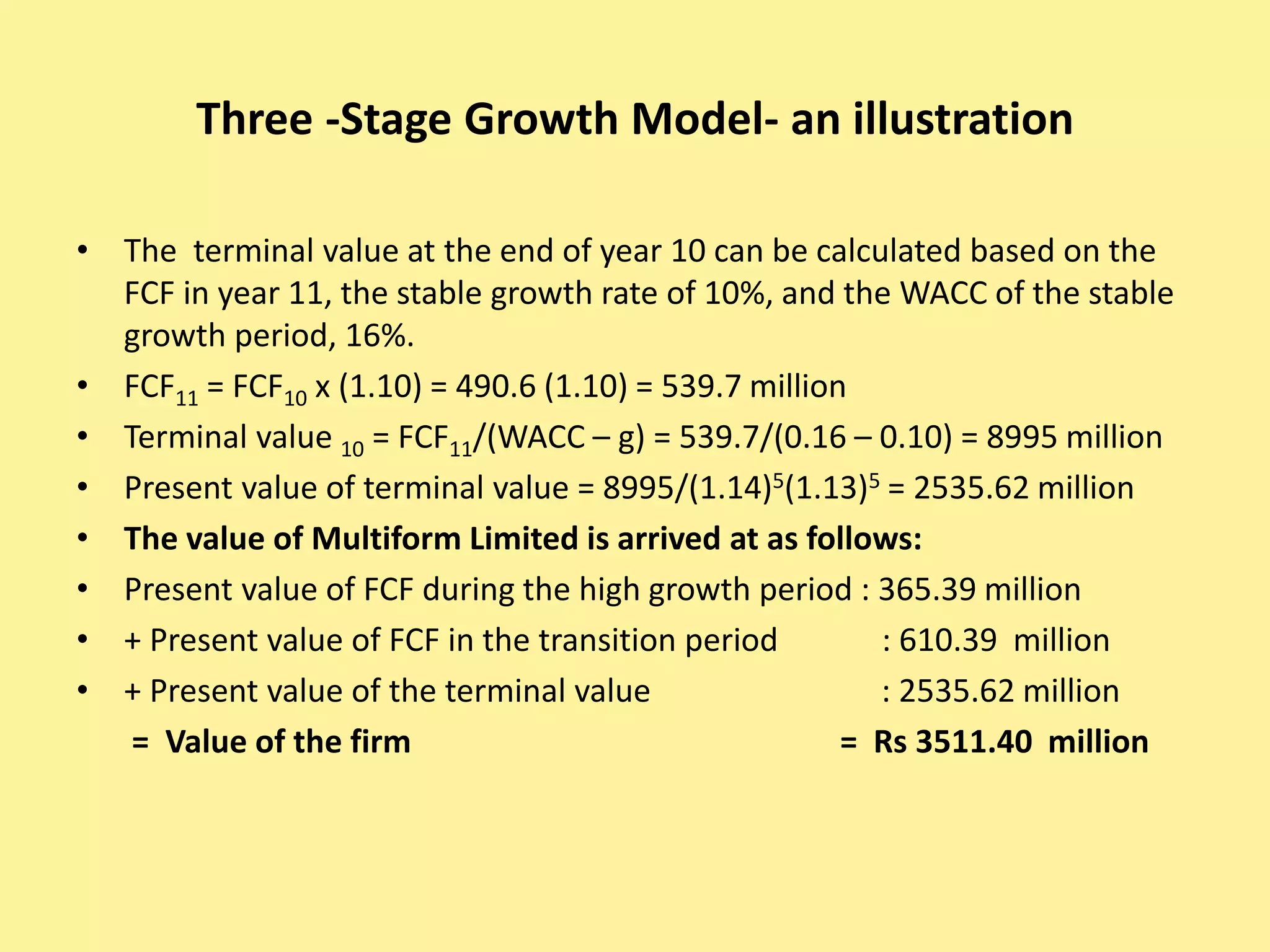

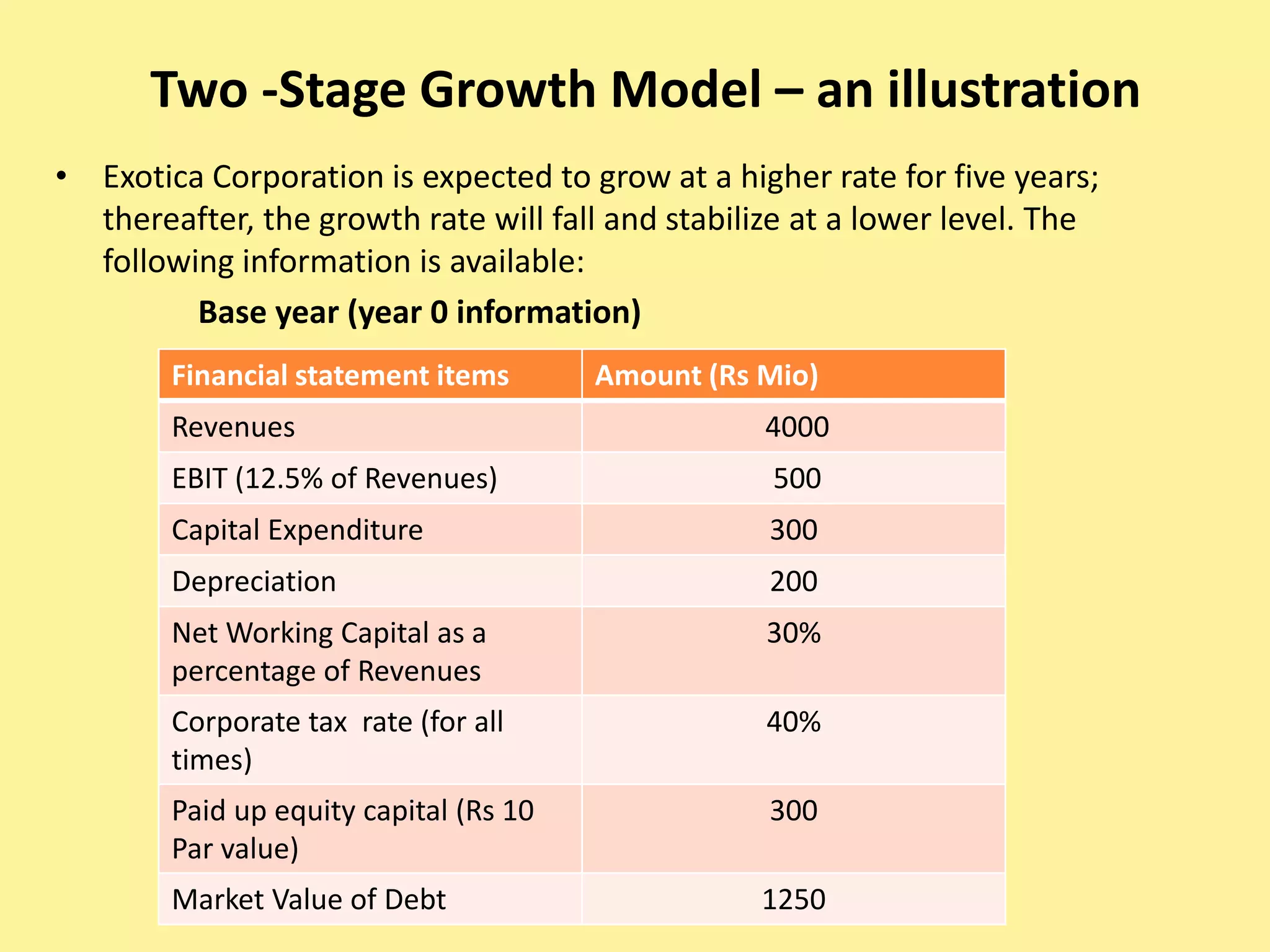

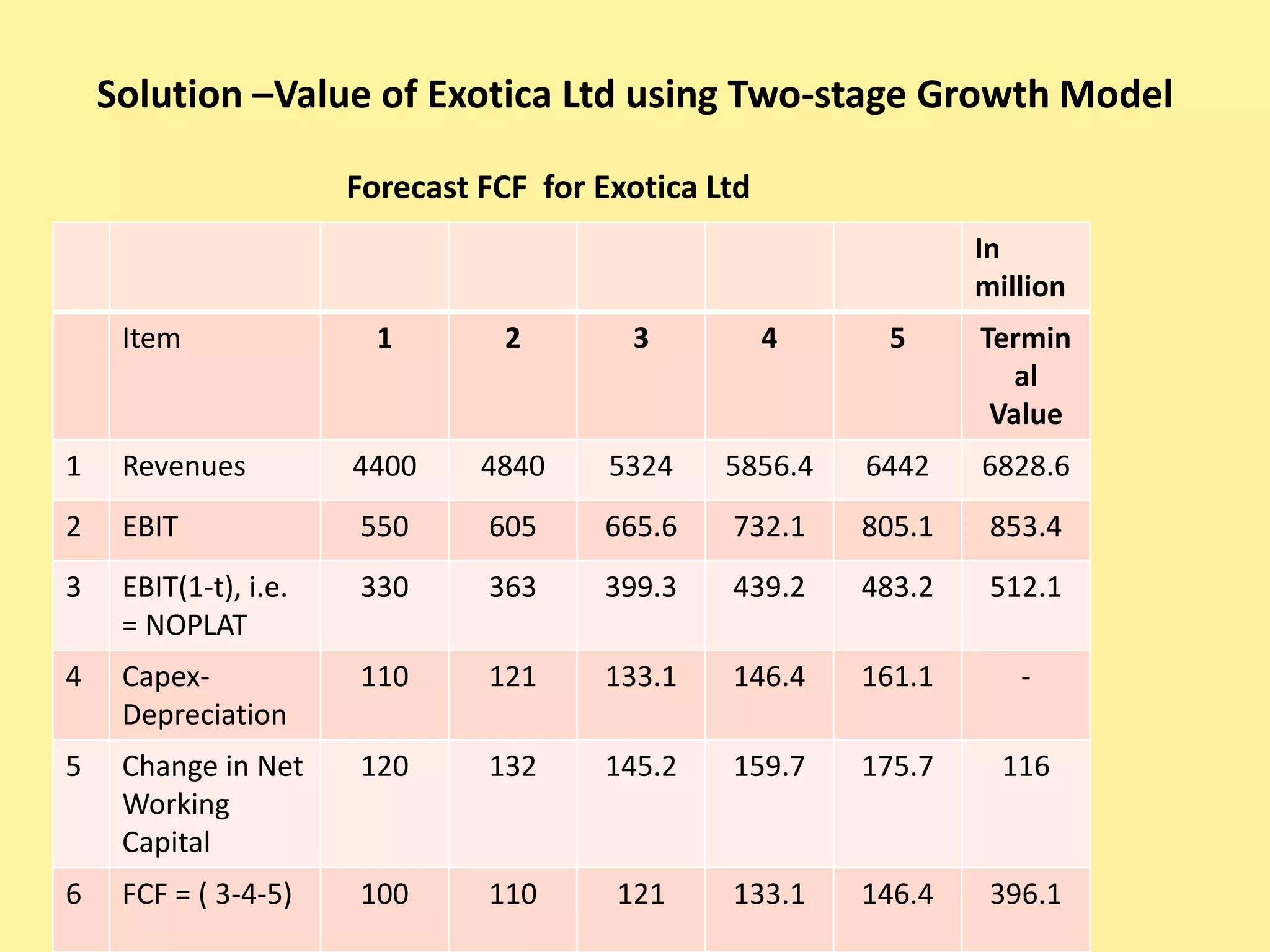

This document discusses two simplified valuation models: the two-stage growth model and three-stage growth model. The two-stage model assumes two periods of growth - an initial high growth period followed by a stable, lower growth forever. The three-stage model assumes an initial high growth period, followed by a transition period where growth declines linearly, and then a stable growth period. Both models calculate value as the present value of forecasted free cash flows during the growth periods and the terminal value. An example application of each model is provided to illustrate the calculation.

![Three -Stage Growth Model- an

illustration

• Weighted Average Cost of Capital (WACC)

computation

• High Growth period: 0.4[ 12+1.583(6)] + 0.6[15(1-0.4)] = 14%

• Transition period : 0.5[11+1.1(6)] + 0.5[14(1-0.4)] = 13%

• Stable growth period: 1.0[10+1(6)] = 16%](https://image.slidesharecdn.com/enterprisedcfvaluation2stageand3-stage-170226180701/75/Enterprise-dcf-valuation-2-stage-and-3-stage-13-2048.jpg)