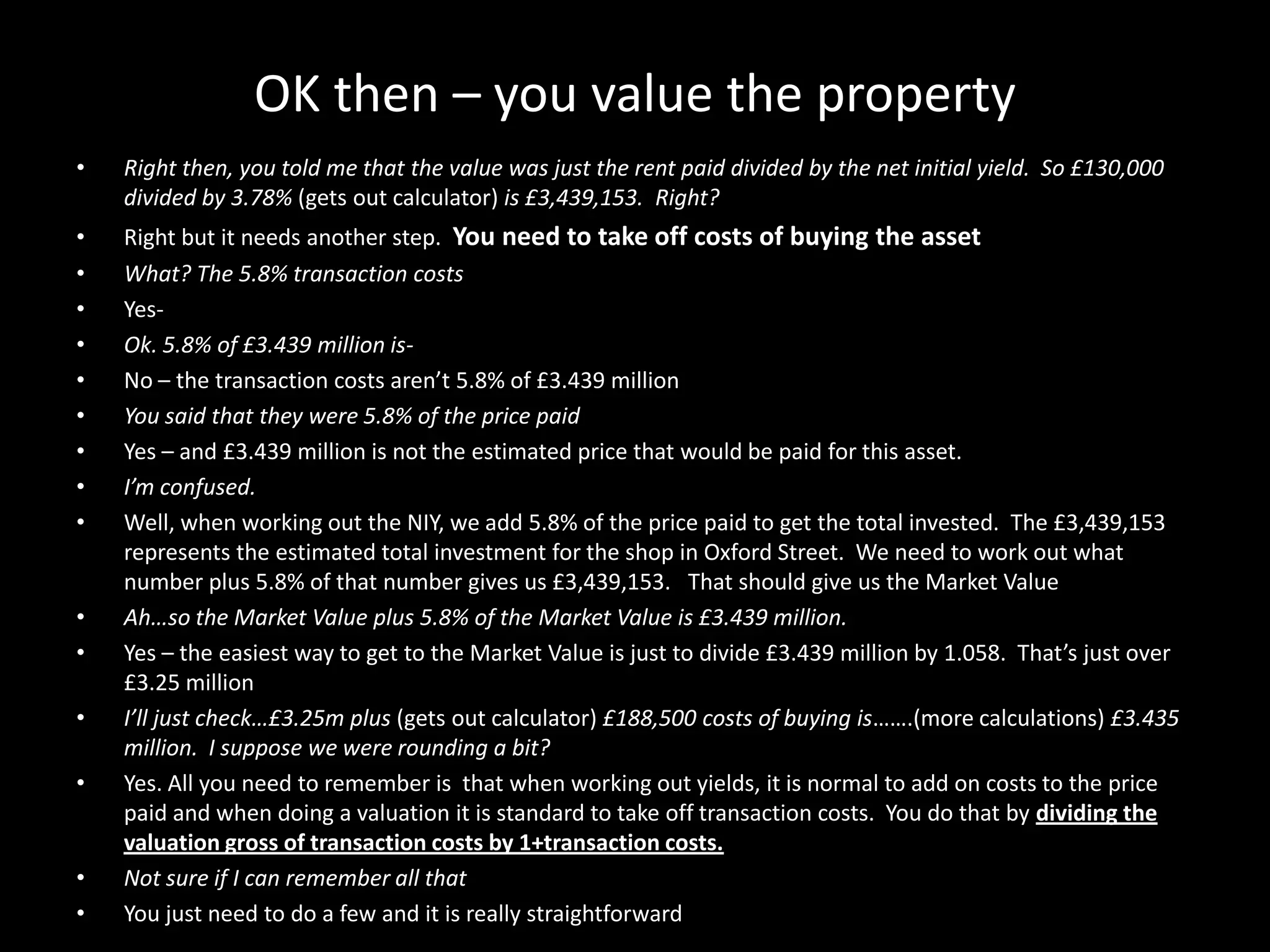

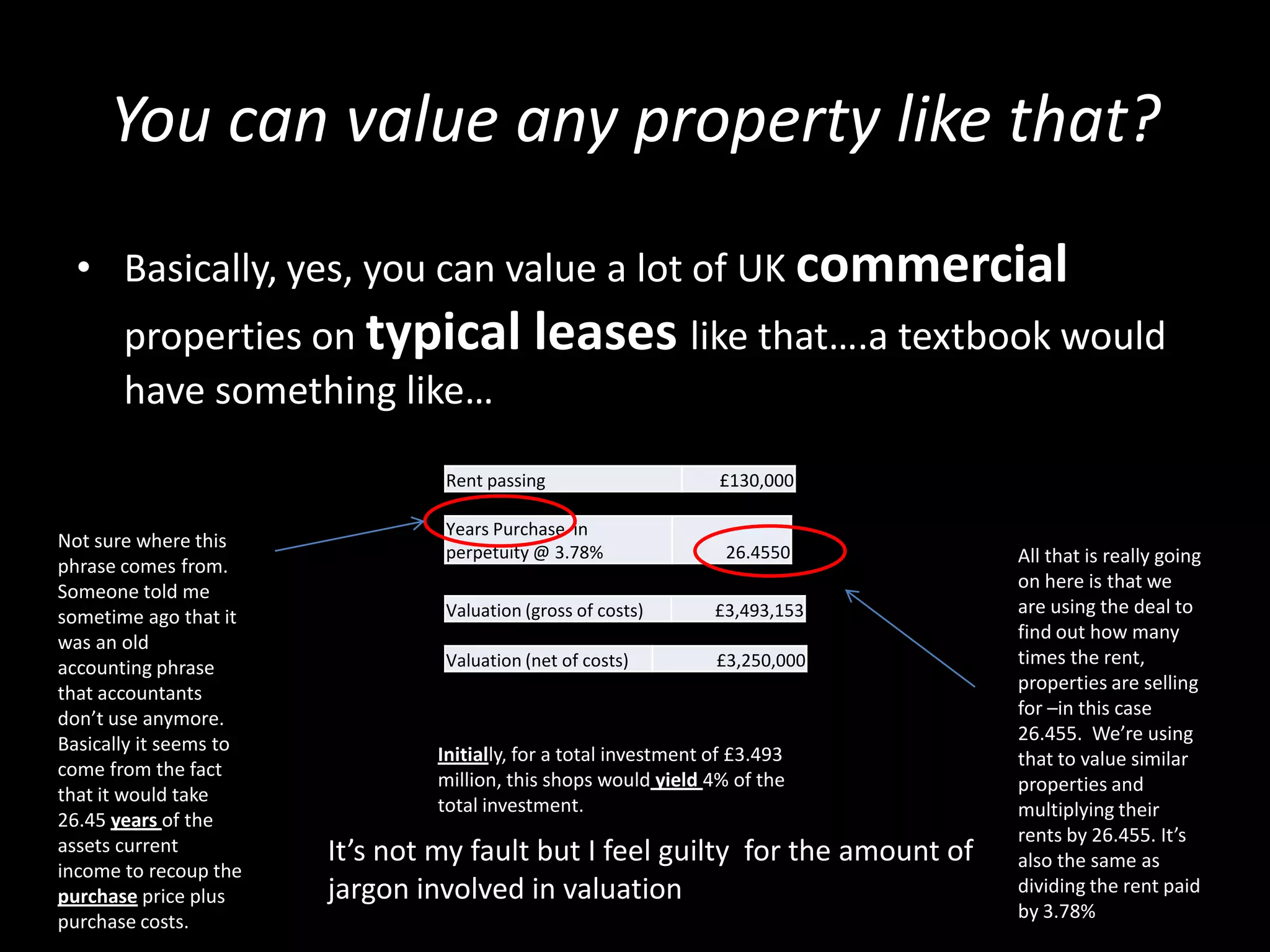

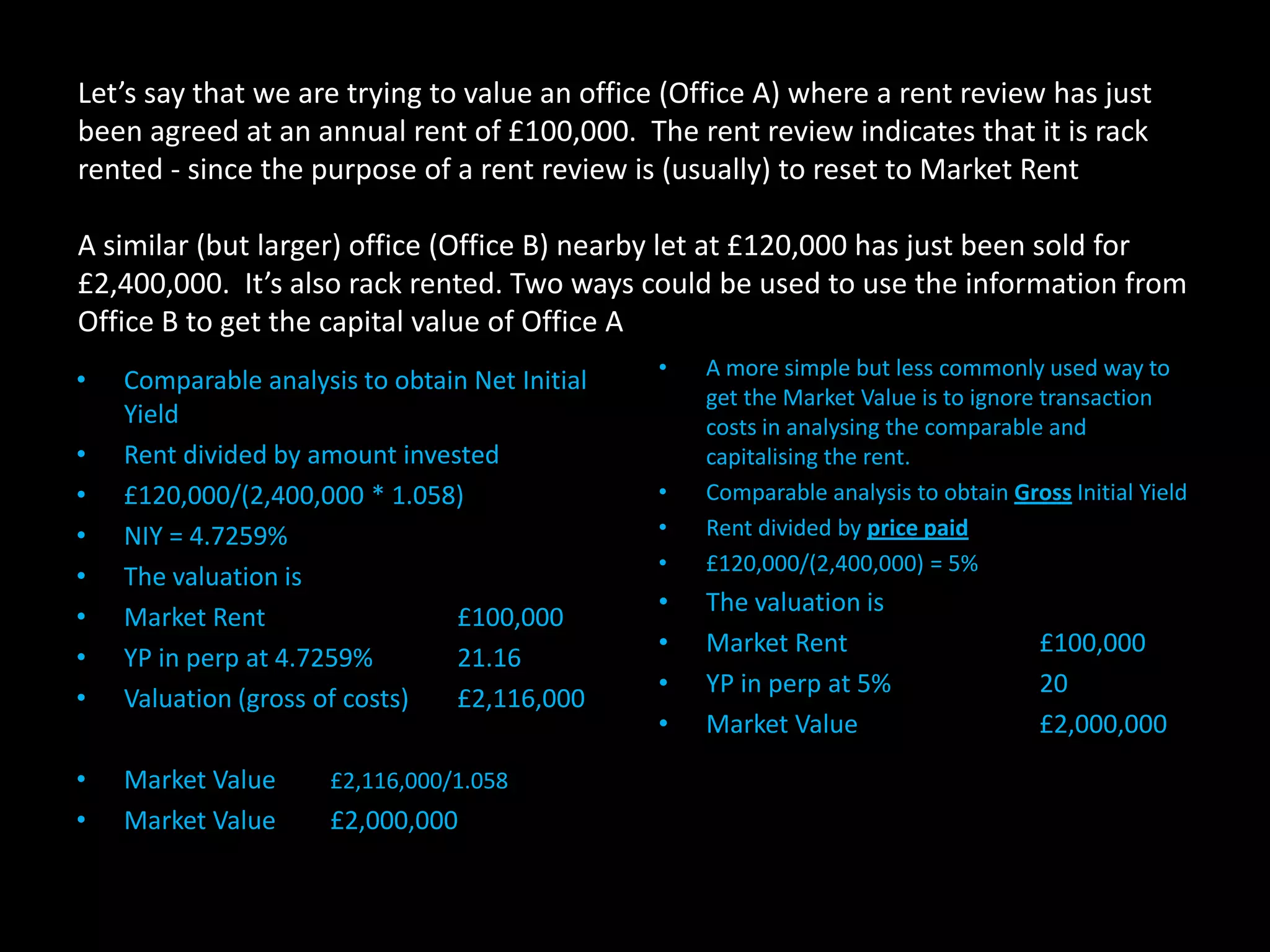

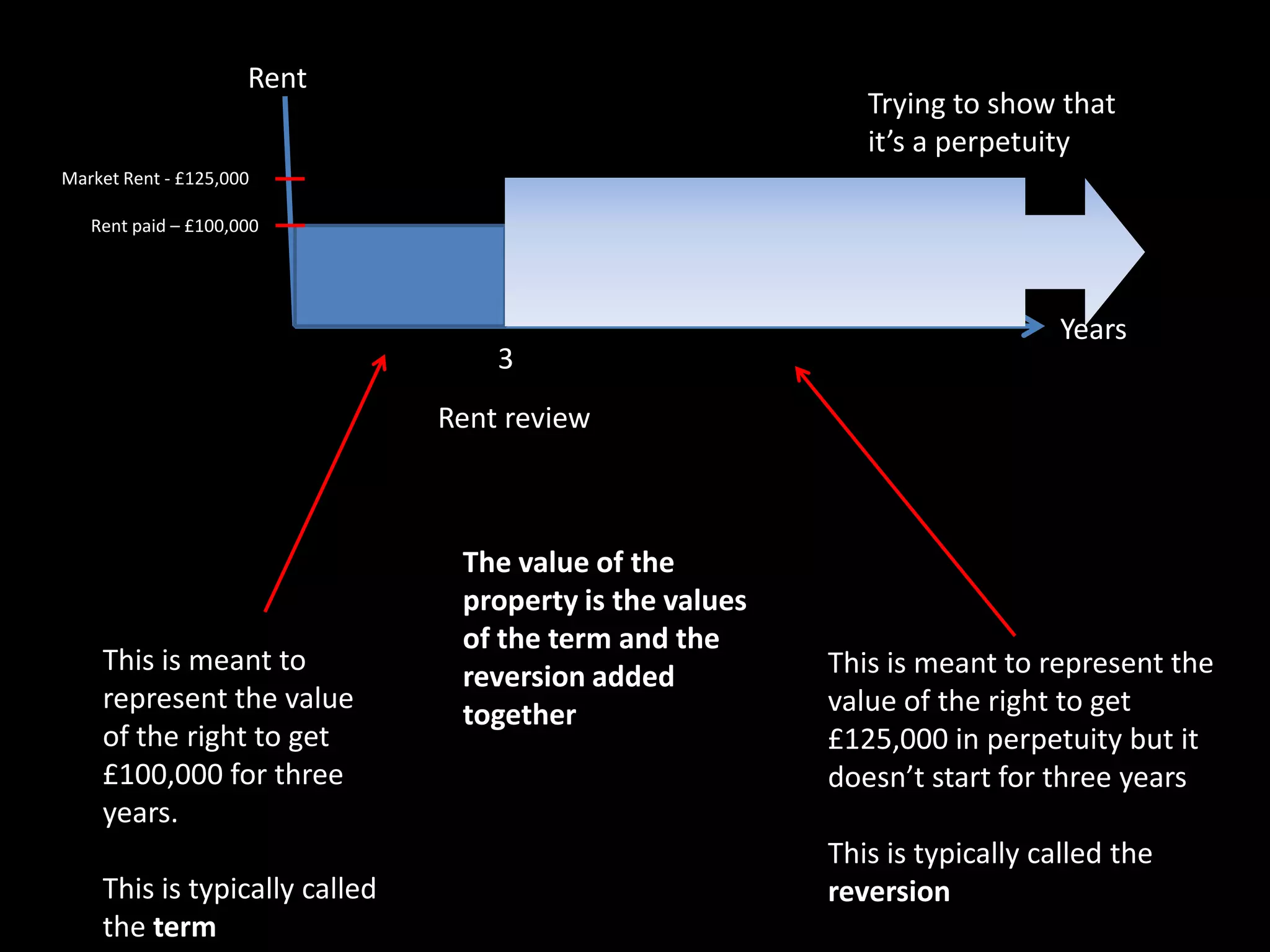

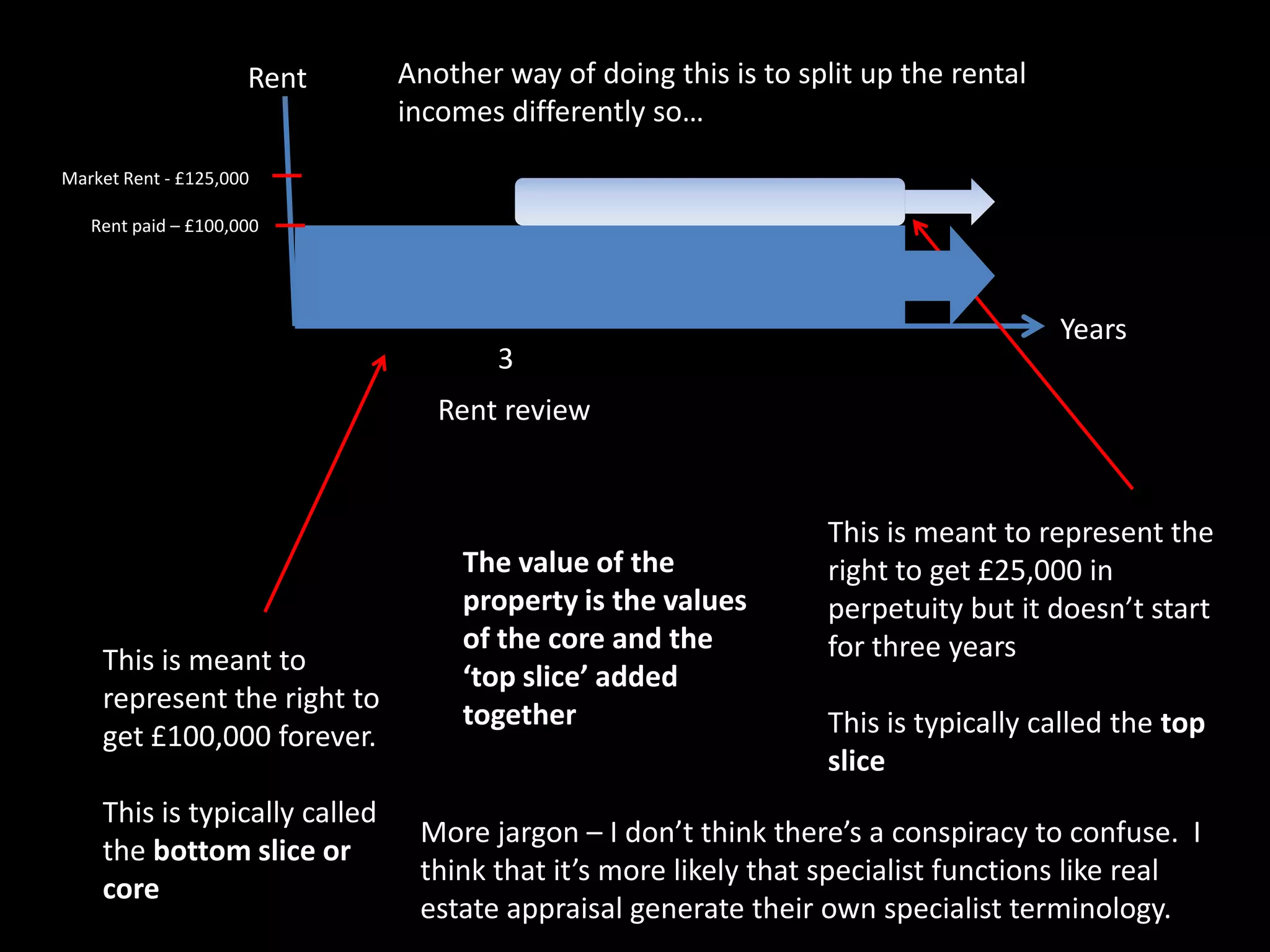

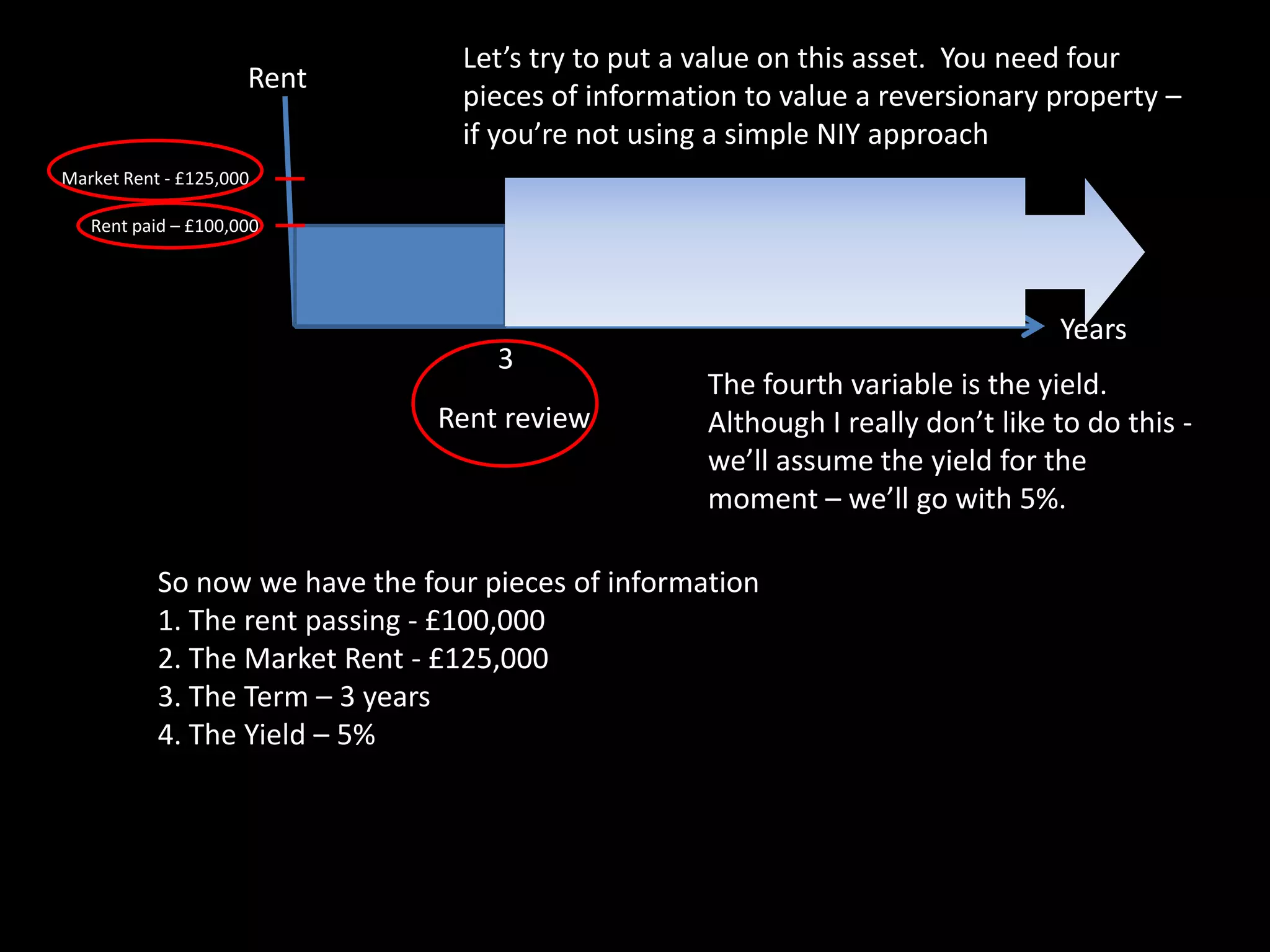

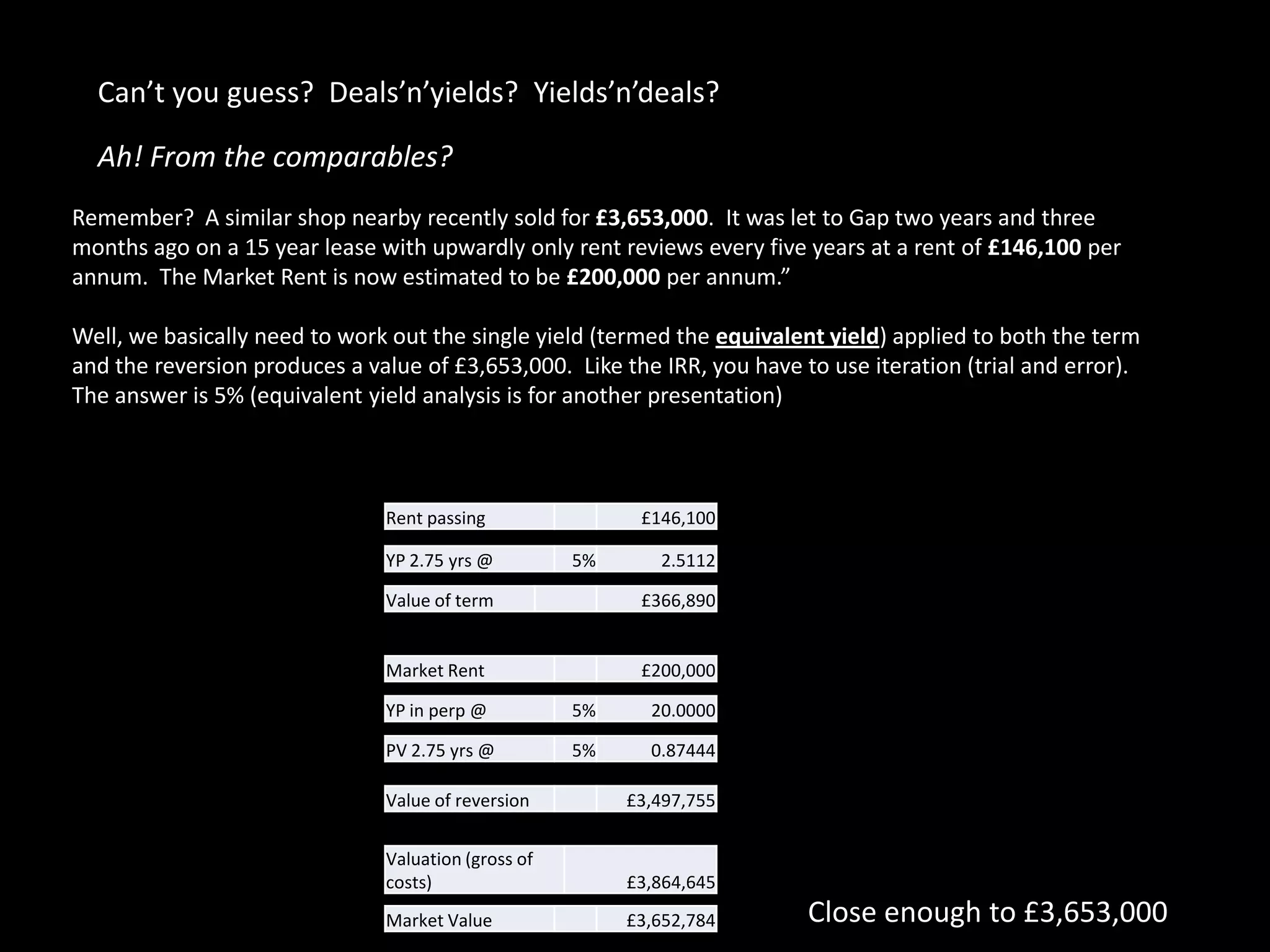

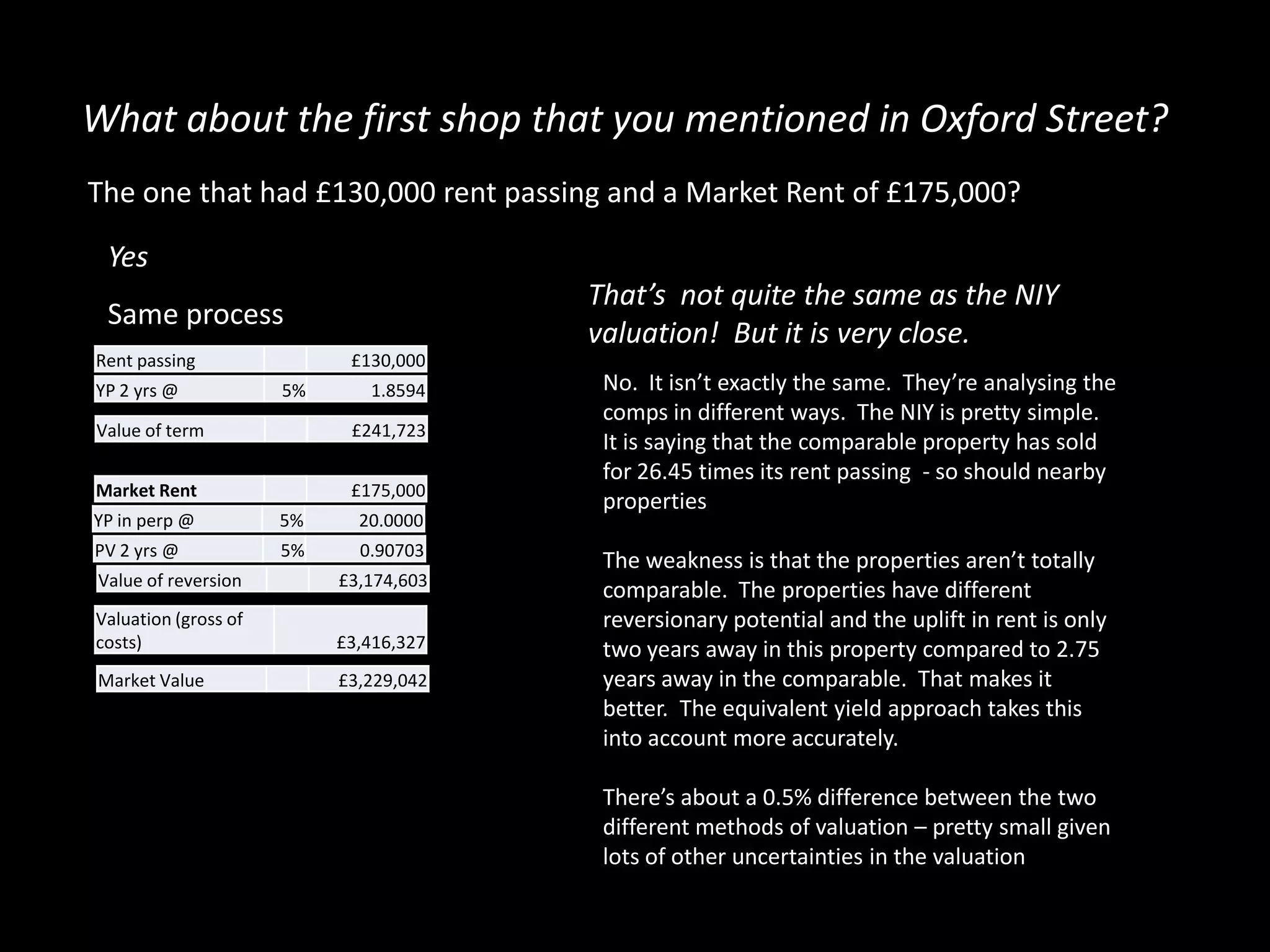

This document provides an introduction to commercial property valuation techniques used in the UK. It discusses the net initial yield approach, which values a property based on its current rent and the net initial yield determined from comparable property sales. An example is provided of a shop valued using this method. The document emphasizes that transaction costs must be accounted for when determining the net initial yield from comparables and when calculating the final valuation amount. Overall, it presents the simple net initial yield approach as a straightforward way to value income-producing commercial real estate.