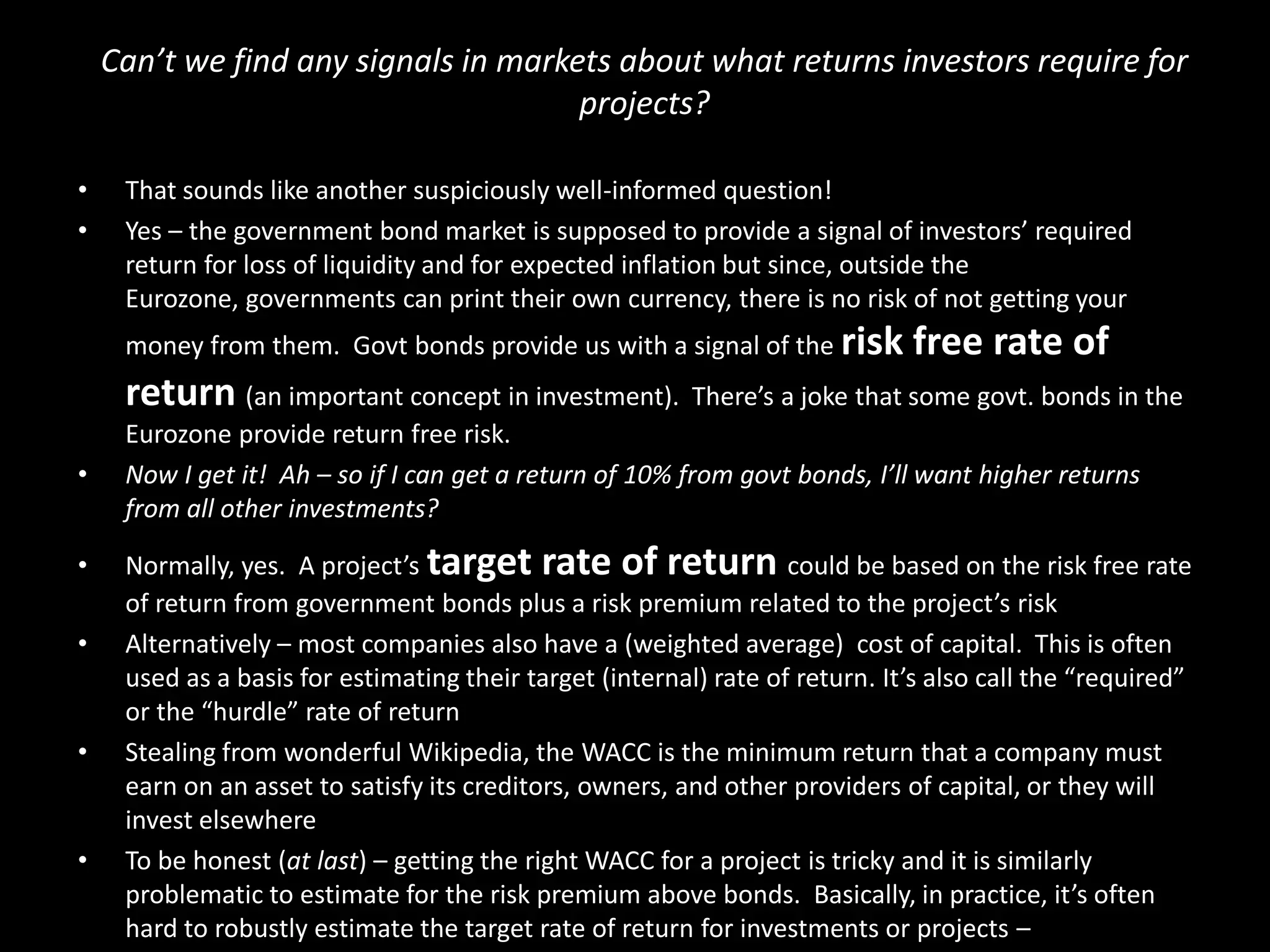

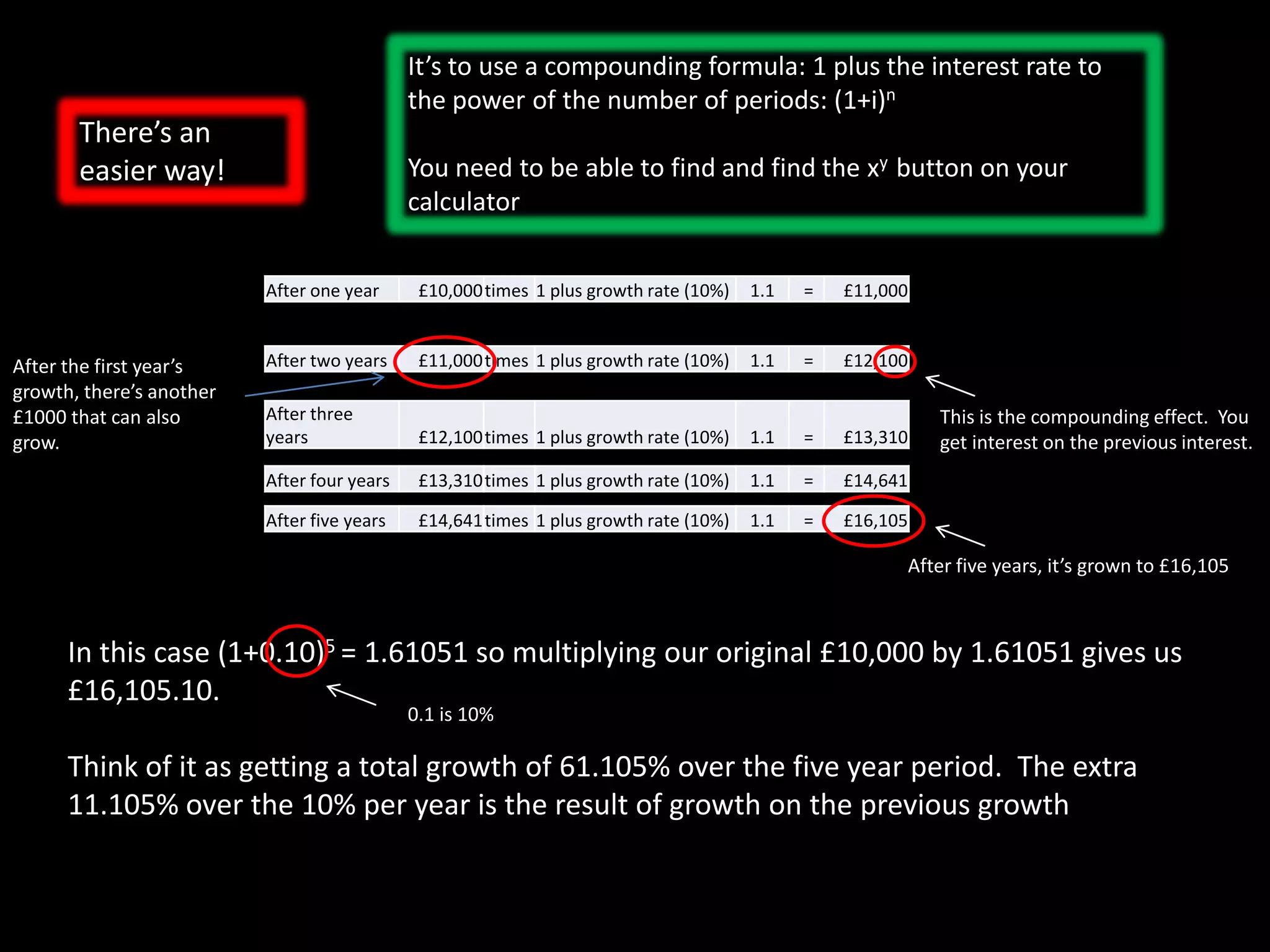

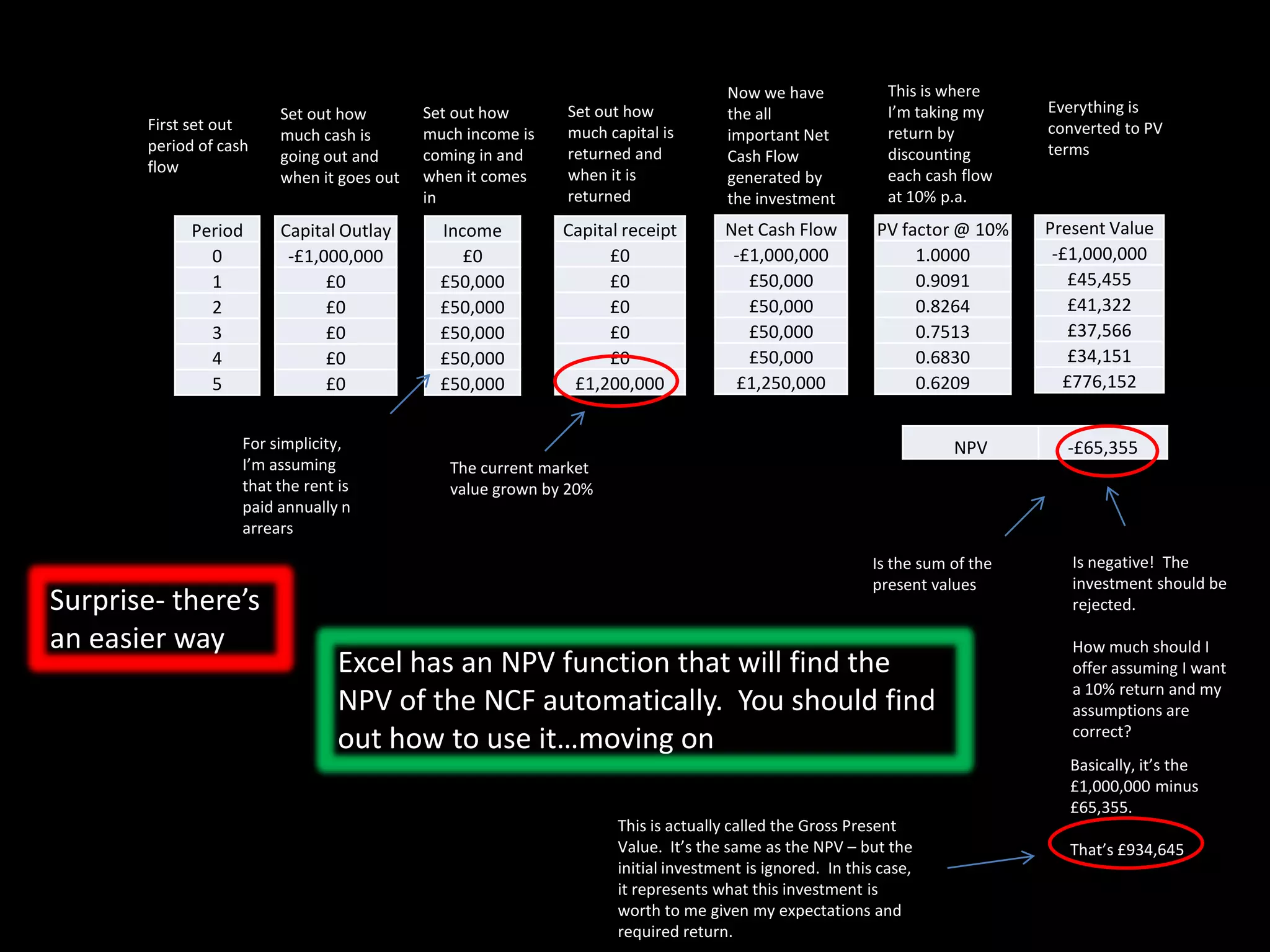

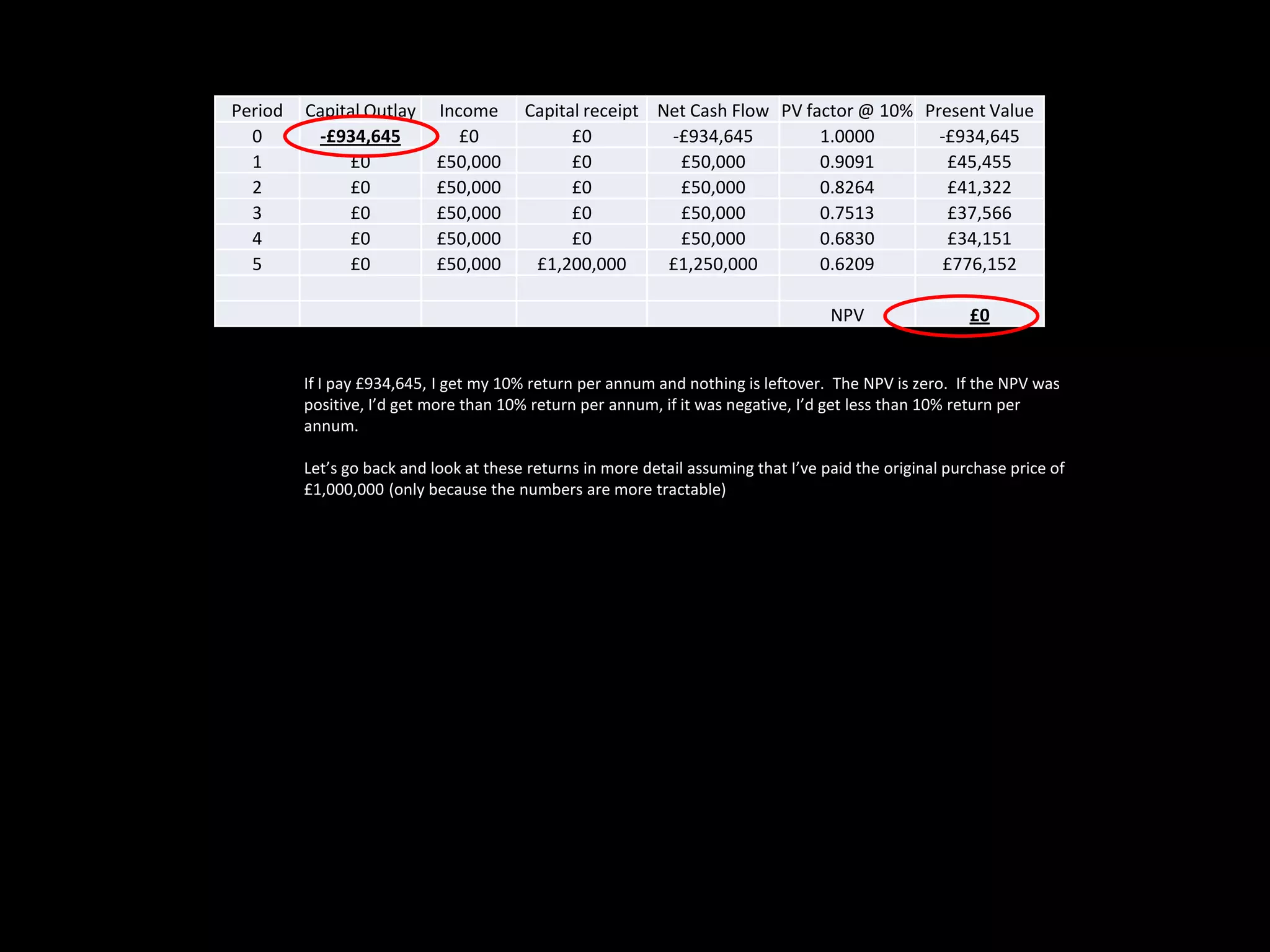

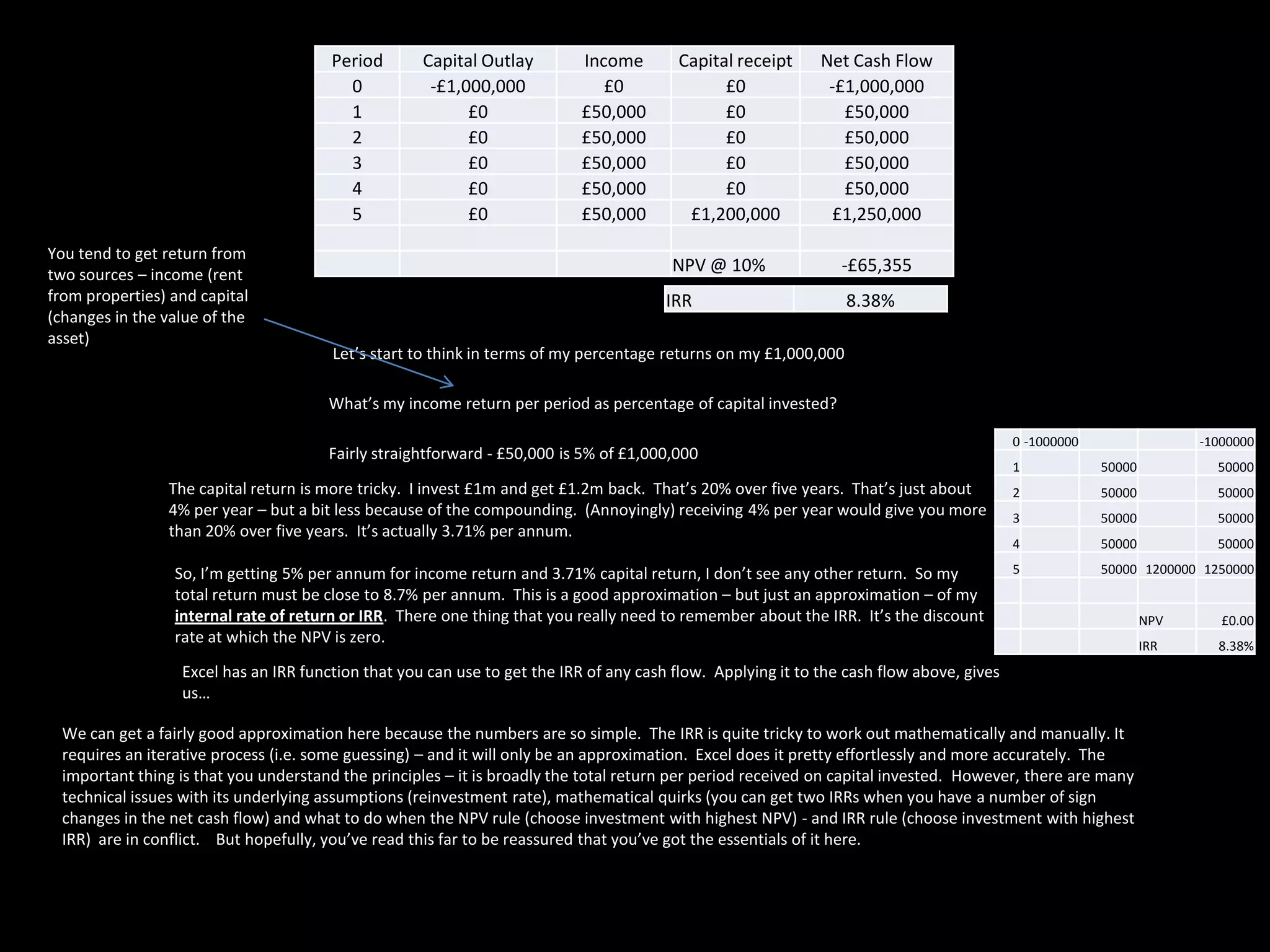

This document provides an introduction to calculating net present value (NPV) for real estate investment projects. NPV is the standard technique used to determine if a project is worth undertaking. The example provided calculates the NPV for a hypothetical investment in a £1,000,000 London property that will be rented to students. The calculation discounts future cash flows like rental income and property sale proceeds at a target 10% annual return. The resulting NPV is negative, indicating the investment should be rejected based on the assumptions. NPV analysis requires estimating cash inflows and outflows over time and discounting them to determine a project's present value.