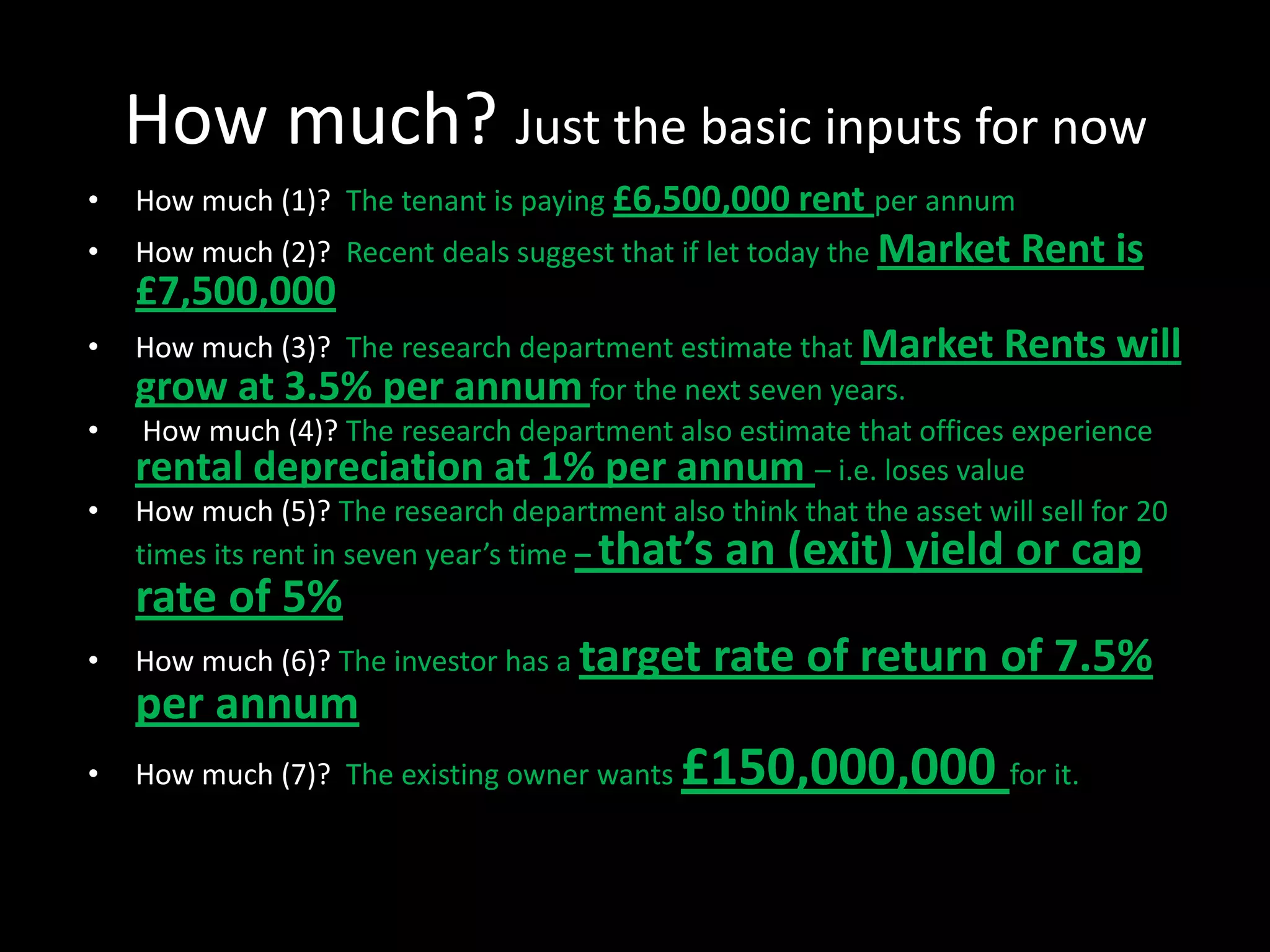

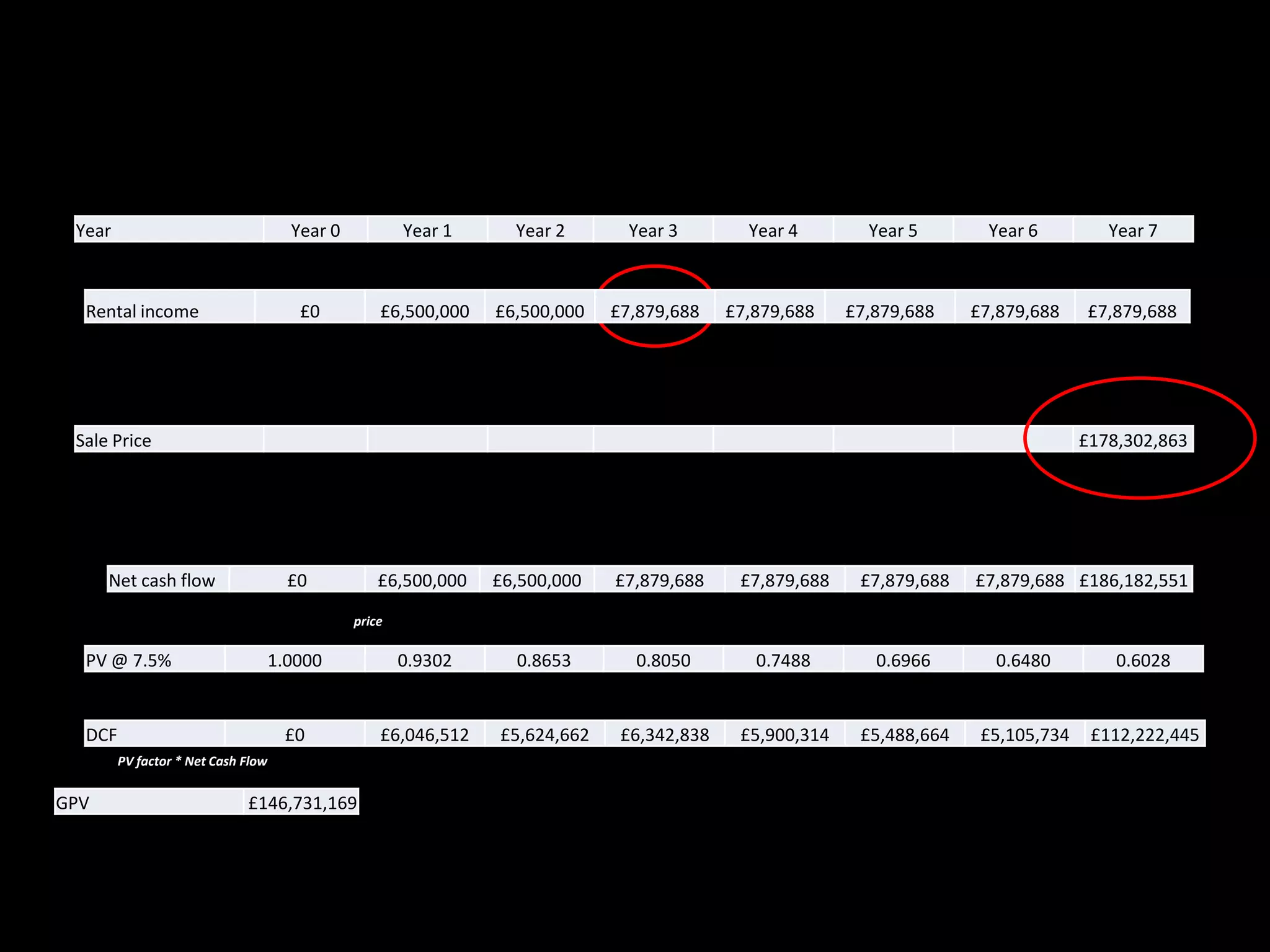

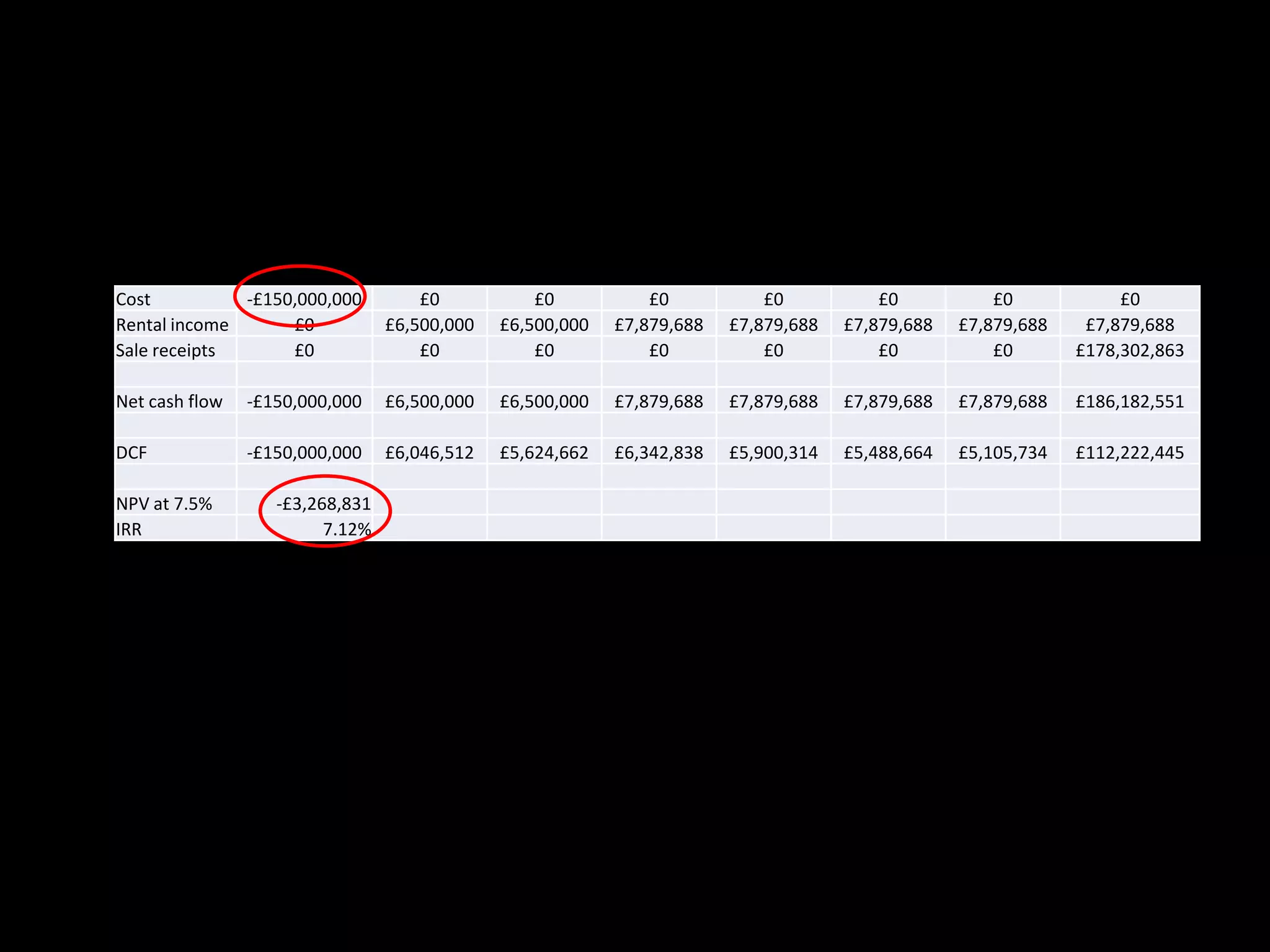

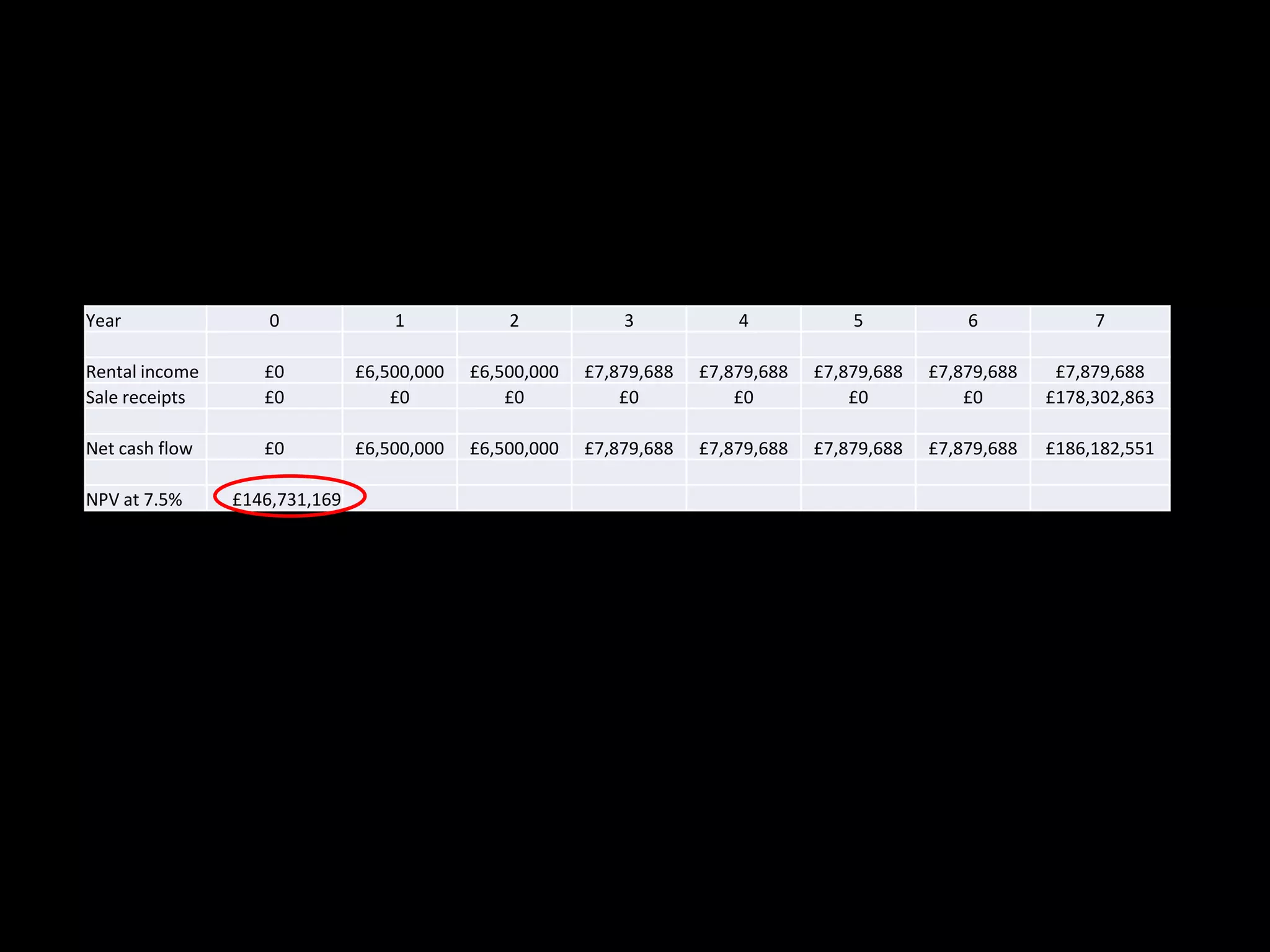

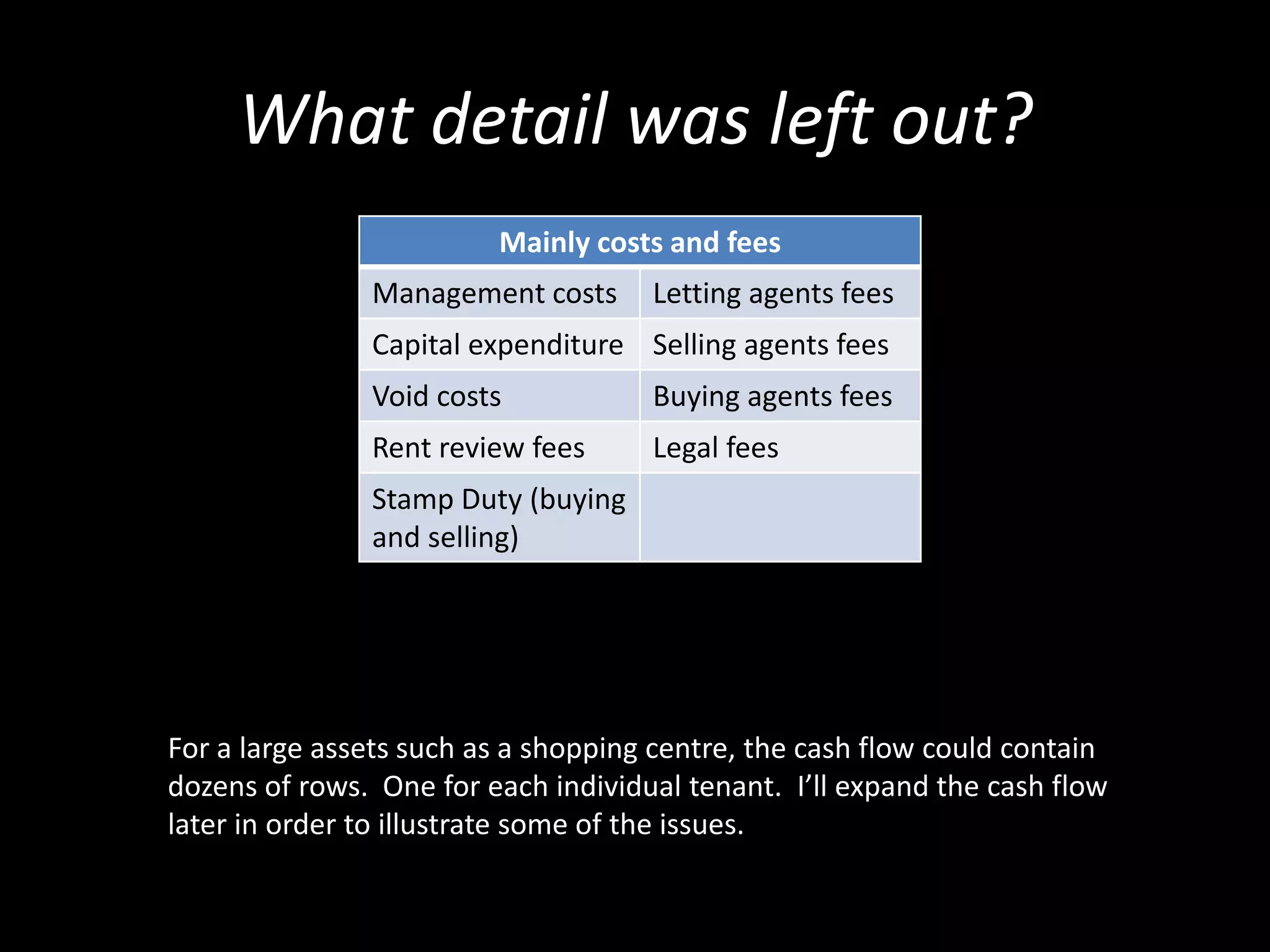

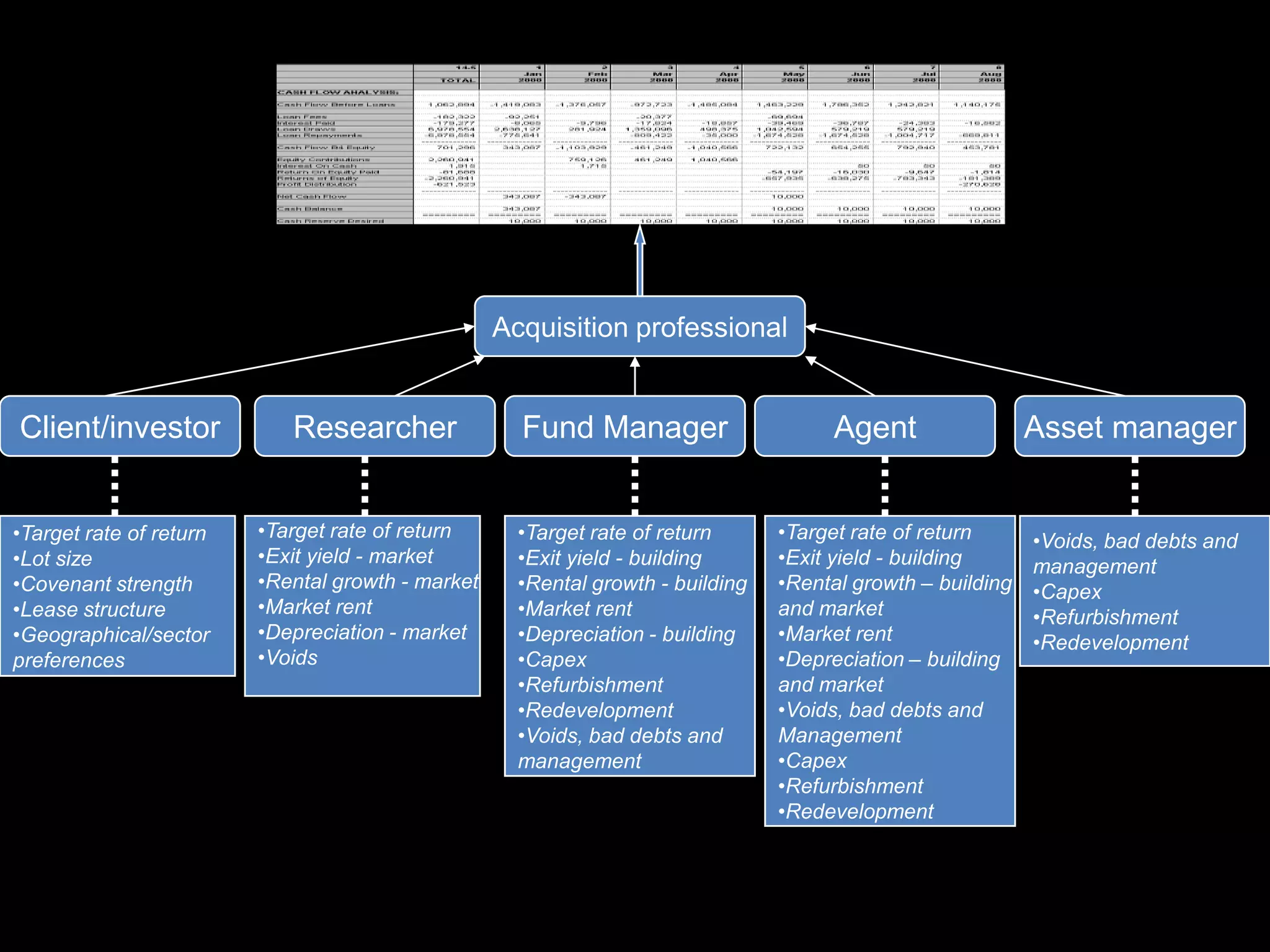

The document discusses calculating the investment value of real estate assets through financial modeling of future cash flows. It provides an example of modeling rental income, sale price, and net cash flows over 7 years for a London office property. The model discounts the cash flows using a target rate of return to calculate the property's gross present value of £146.7 million. Key inputs that must be forecasted are rents, sale prices, depreciation, void costs, and the target rate of return. Additional costs like management fees and capital expenditures were not included in the simplified example but are important considerations in the full analysis.