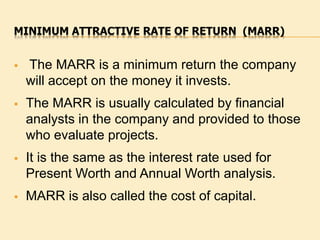

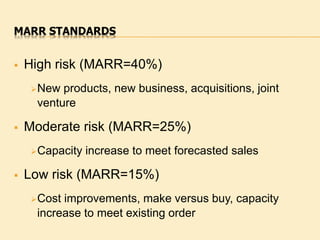

The document discusses the Minimum Attractive Rate of Return (MARR), which is the minimum return a company will accept on an investment. It provides an example calculation of MARR using different funding sources. MARR is used to evaluate projects in capital budgeting, which involves decisions about acquiring and allocating resources for future goods and services. MARR can be calculated in different ways, such as based on a company's cost of debt, cost of equity, or as an opportunity cost in capital rationing situations where funds are limited. The document outlines standards for high, moderate, and low risk MARR levels.