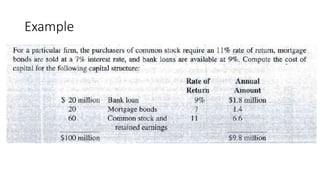

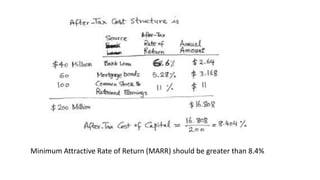

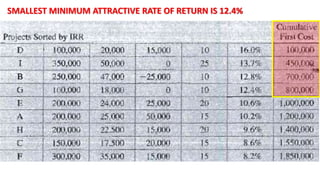

There are four main sources of capital for firms: retained profits, borrowed money, mortgage bonds, and capital stock. A profitable firm generates money from operations equal to retained profits plus depreciation charges, even without making a profit. The minimum attractive rate of return (MARR) should be greater than a firm's cost of capital, which includes the interest rates on borrowed money. Based on an example where the after-tax cost of interest is 8.52%, the MARR in this case should be greater than 8.52%.