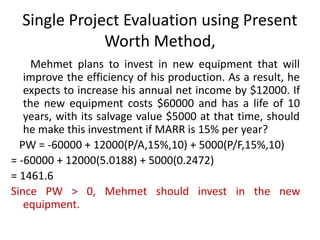

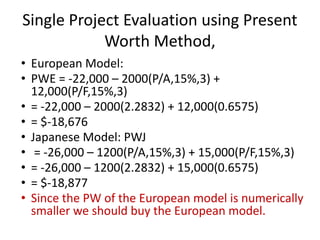

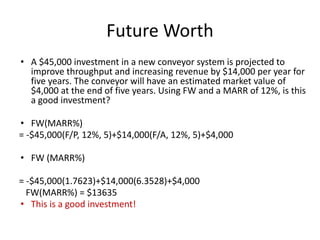

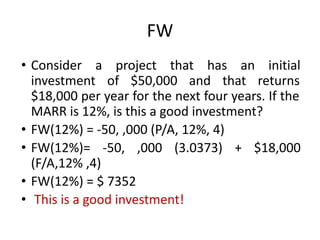

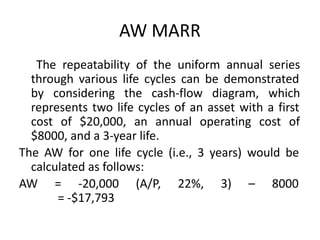

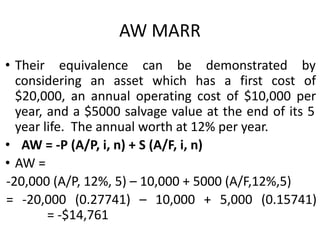

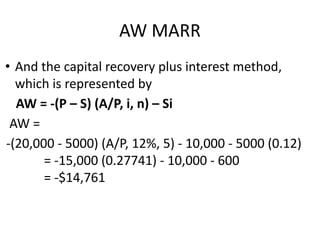

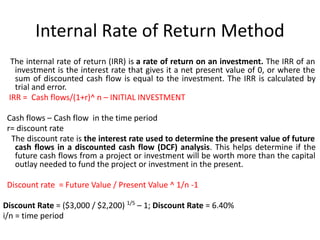

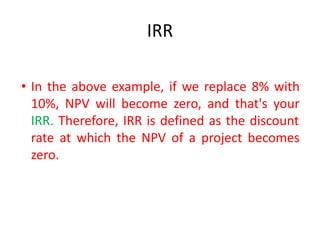

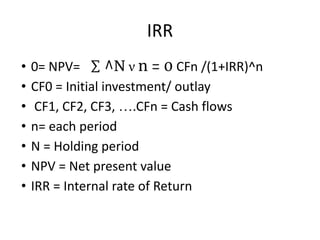

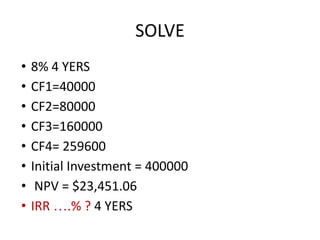

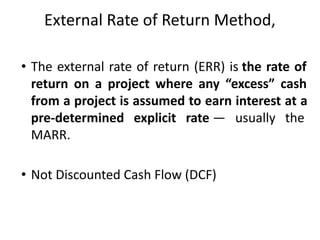

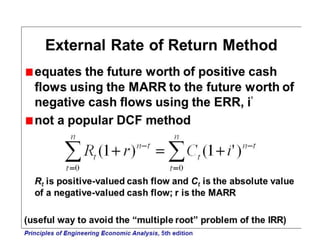

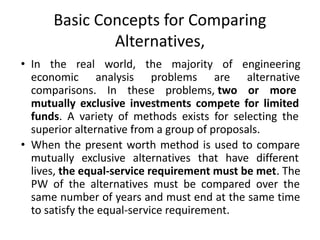

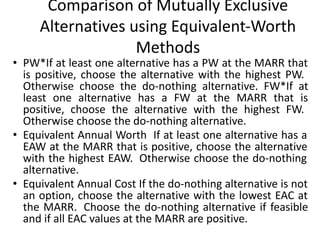

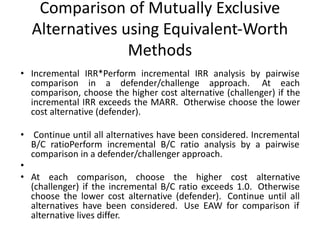

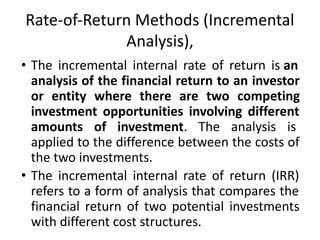

The document discusses various methods for evaluating the economic profitability of projects and investments, including the minimum attractive rate of return (MARR), present worth method, future worth method, annual worth method, internal rate of return method, external rate of return method, and payback period method. It also covers concepts for comparing mutually exclusive alternatives, such as using equivalent worth and rate of return methods, and considerations when useful lives are equal versus unequal among alternatives.