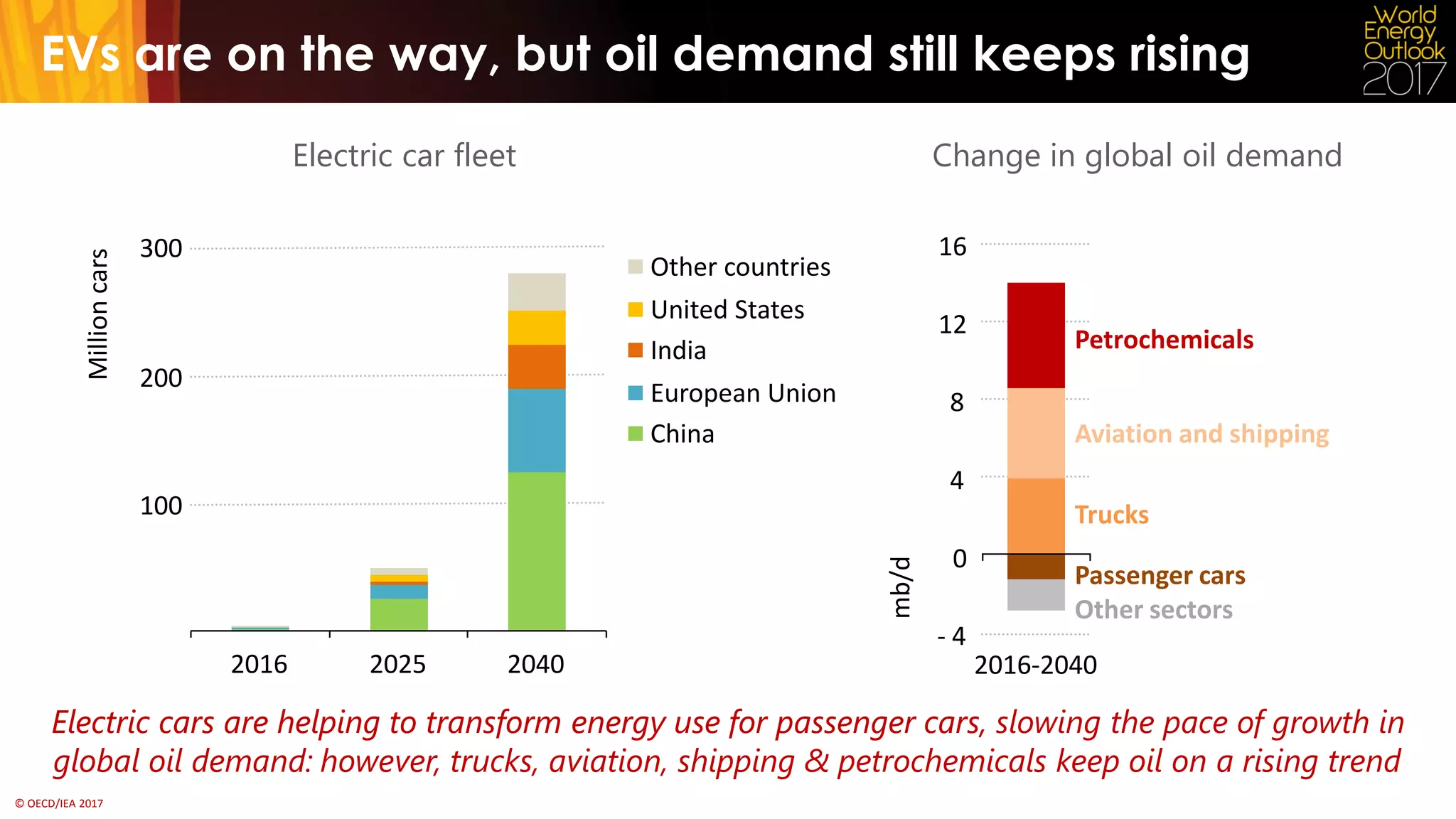

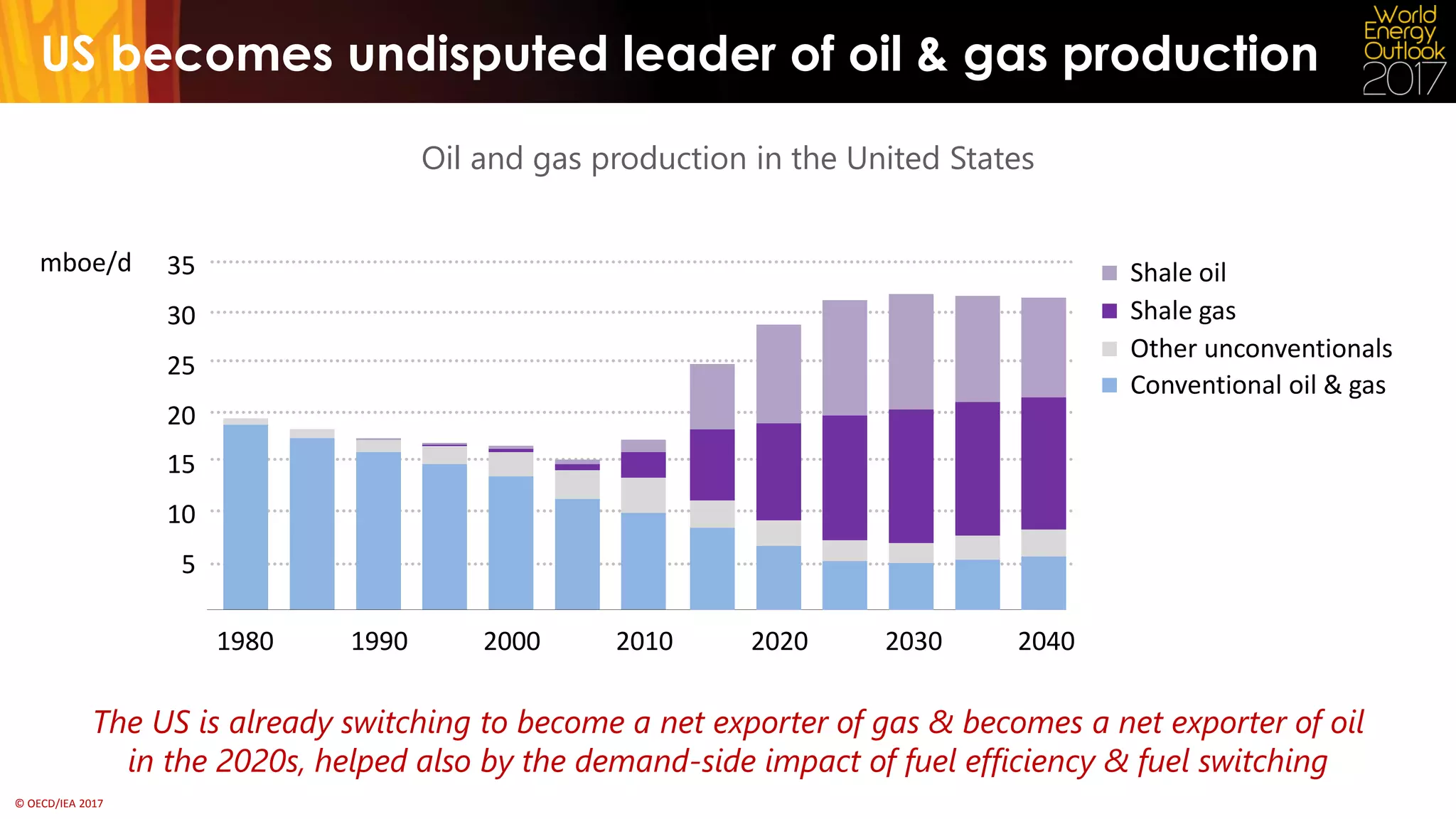

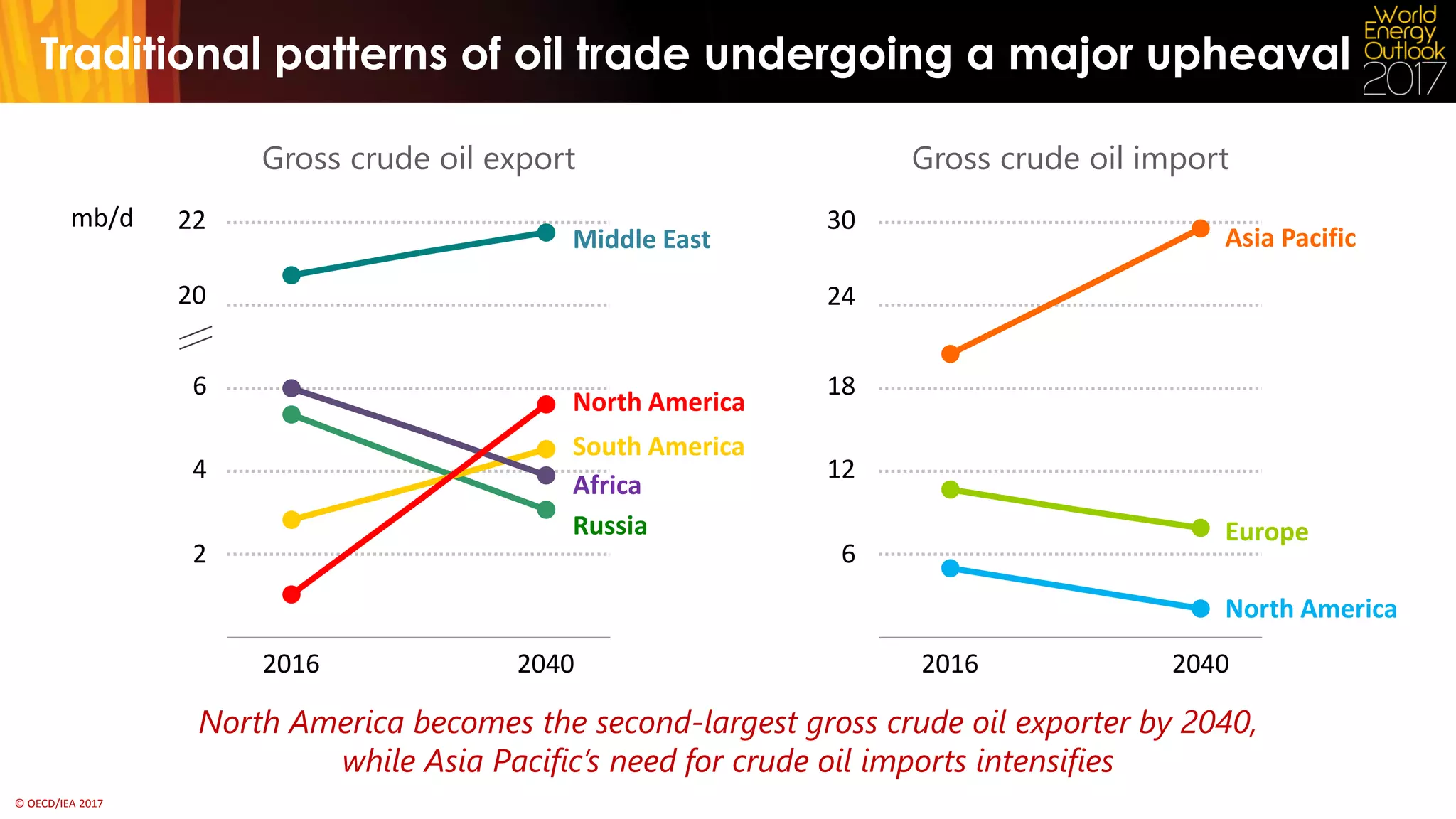

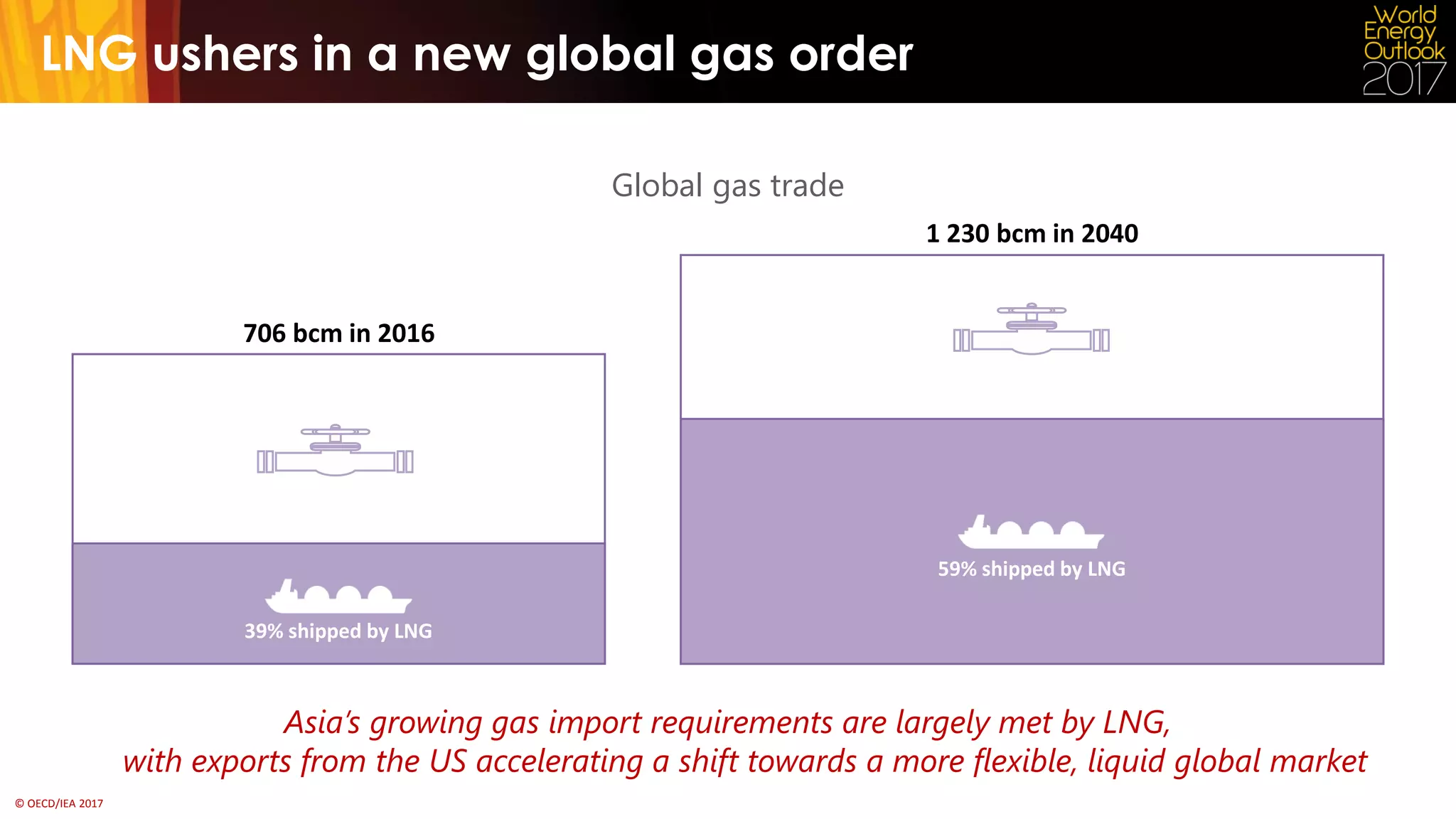

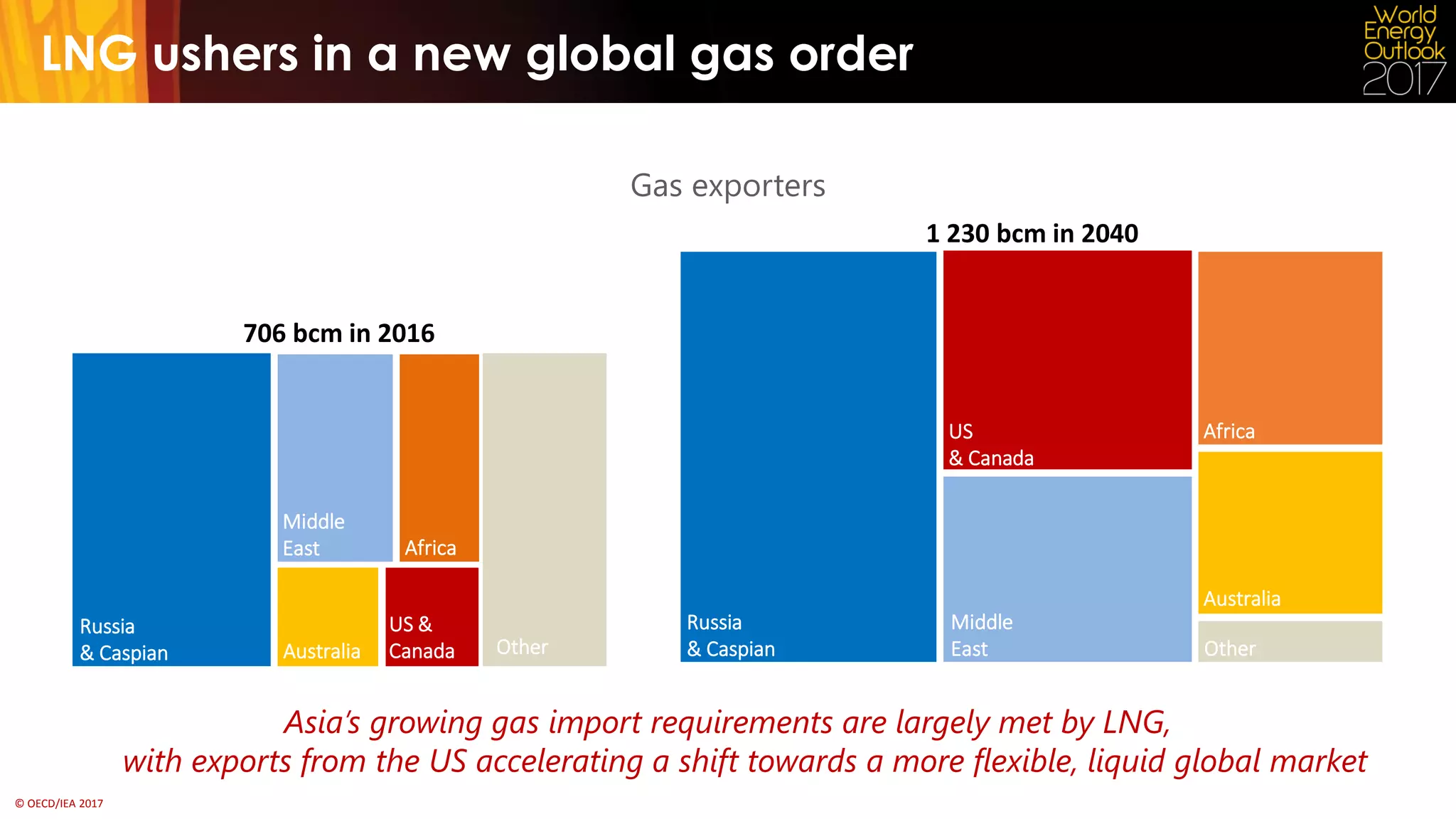

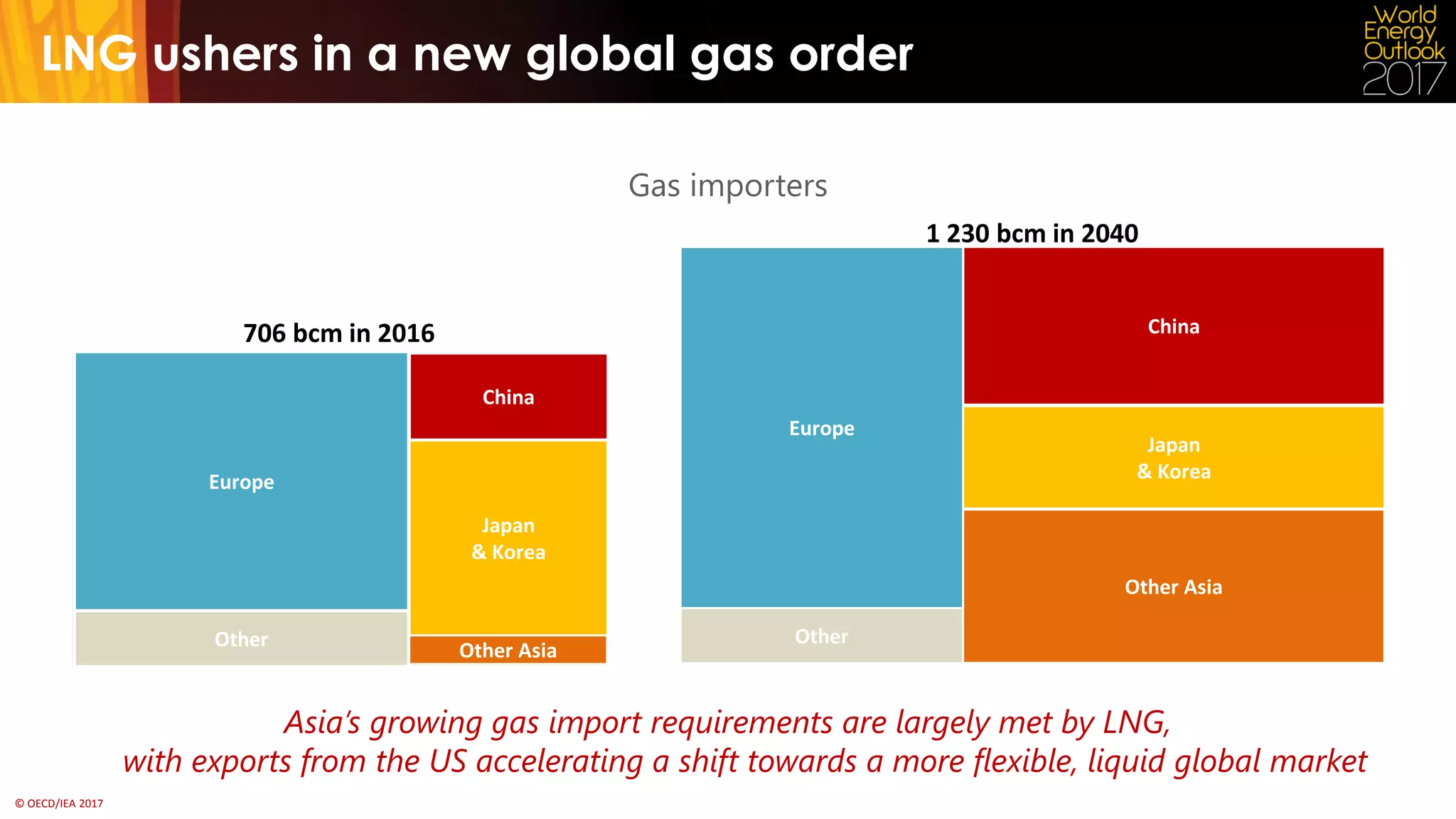

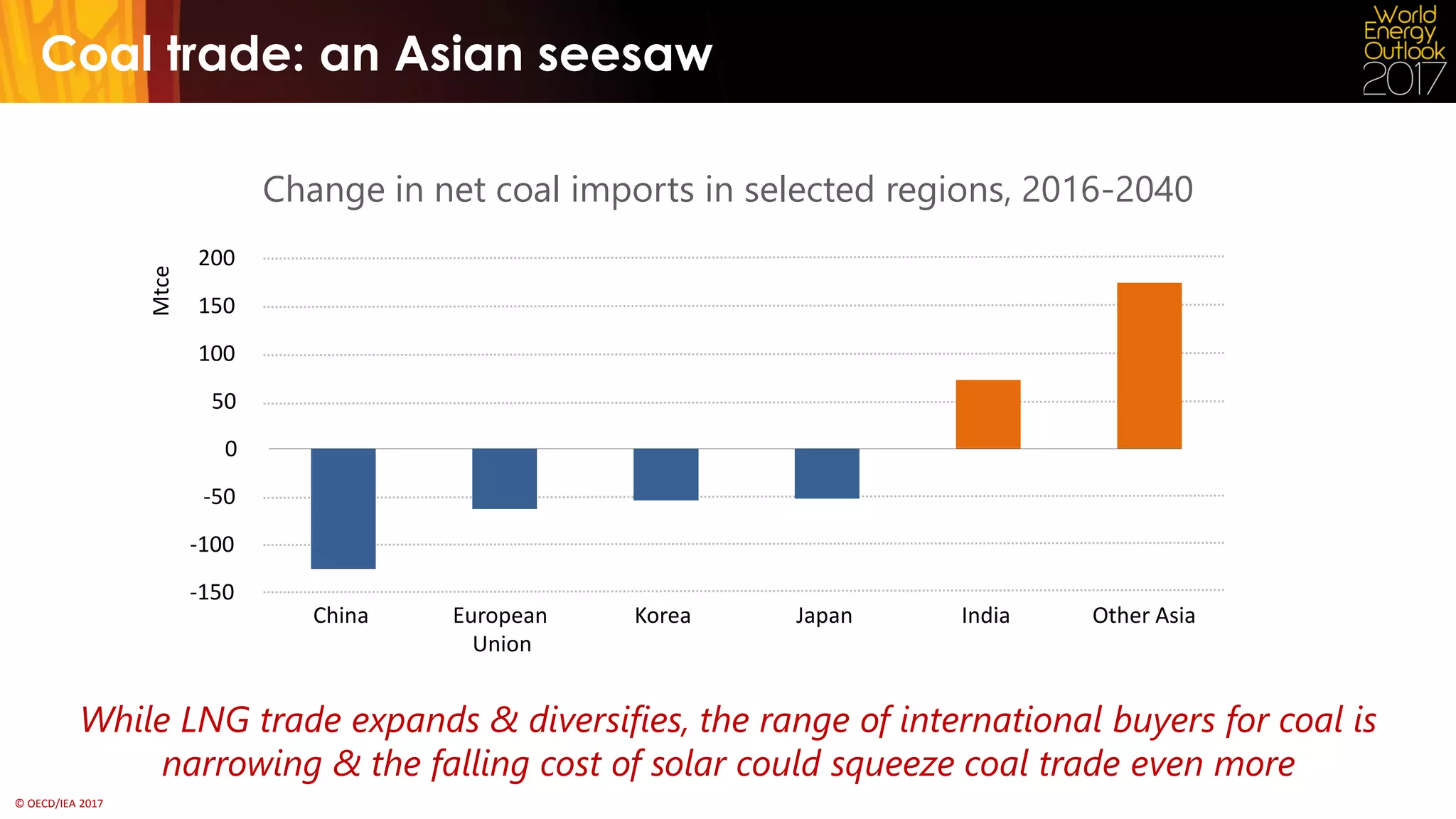

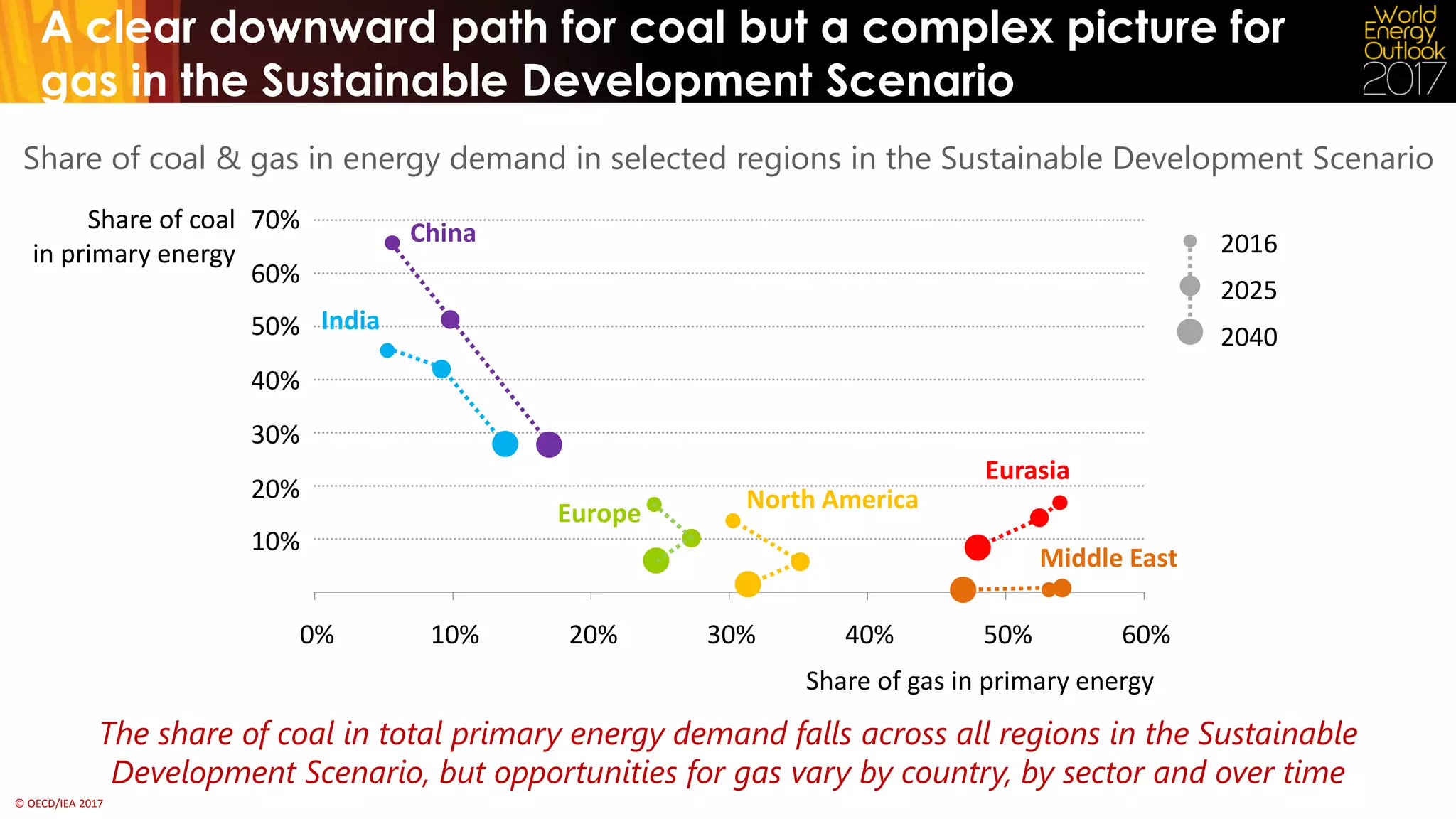

The OECD/IEA report highlights significant upheavals in the global energy landscape, including the U.S. becoming the leading oil and gas producer, the rise of solar PV as a major electricity source, and China's commitment to improving air quality. Electric vehicles are transforming passenger car energy use and mitigating oil demand growth, though sectors like aviation and shipping continue to increase consumption. As global gas trade shifts towards a more flexible market, particularly with LNG, sustainable energy opportunities arise but face challenges such as financing new projects and competing energy sources.