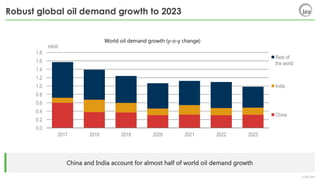

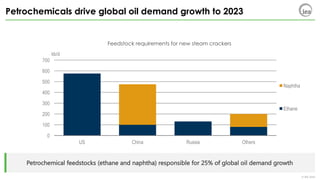

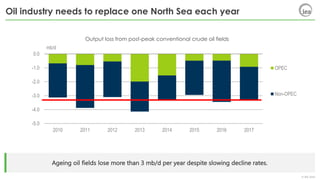

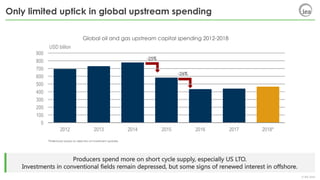

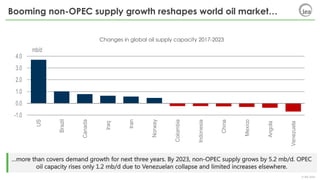

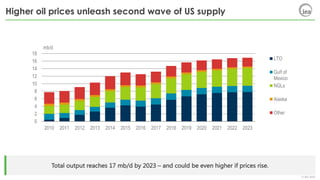

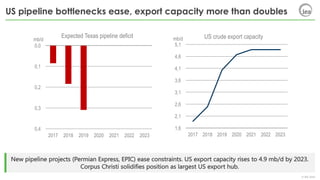

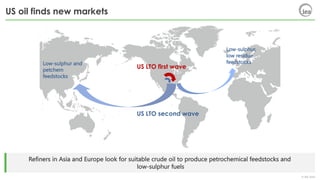

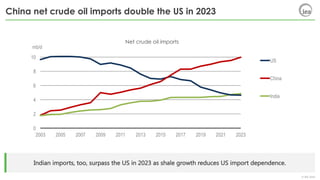

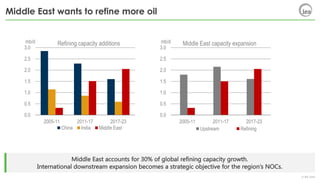

This document summarizes key points from an IEA market report on oil in 2018. It finds that global oil demand will grow robustly to 2023, driven mainly by increasing petrochemical needs. Non-OPEC supply growth, led by the US, Brazil, Canada and Norway, will exceed demand increases through 2020. US crude exports are increasing significantly as new infrastructure alleviates bottlenecks and foreign refiners seek light, low-sulfur oil. However, more upstream investment is still needed to replace over 3 million barrels per day of annual declines from mature fields and ensure future supply security.