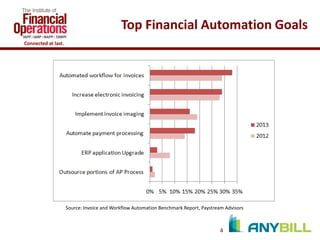

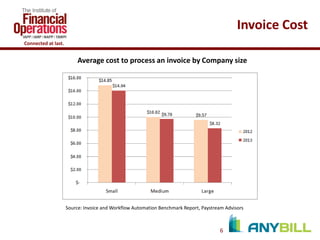

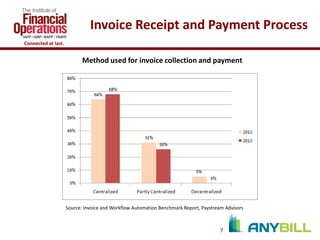

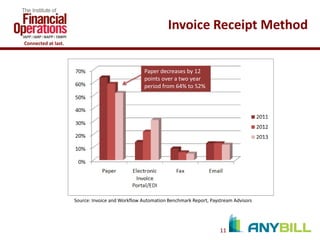

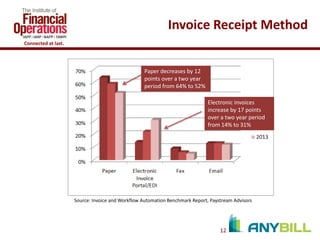

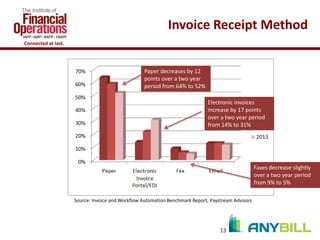

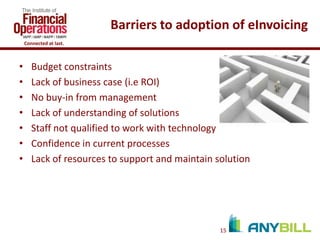

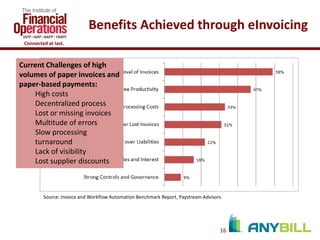

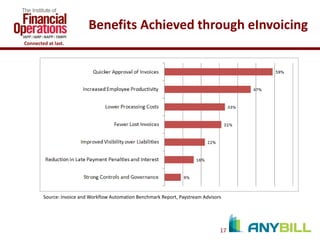

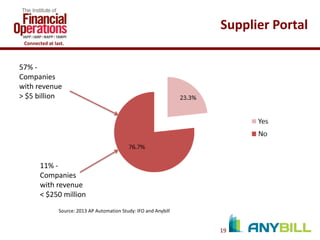

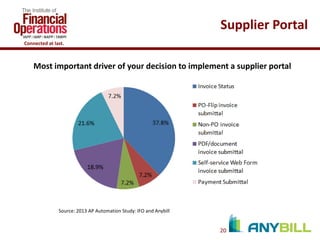

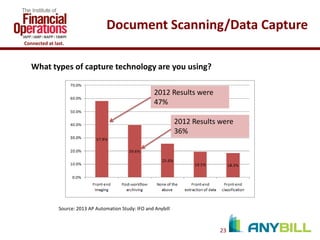

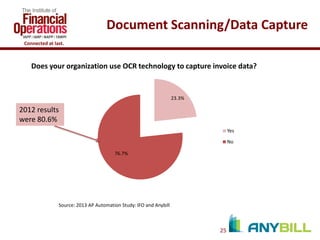

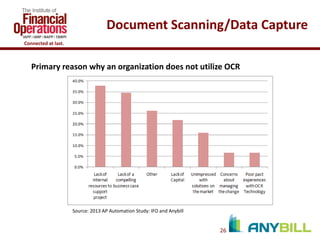

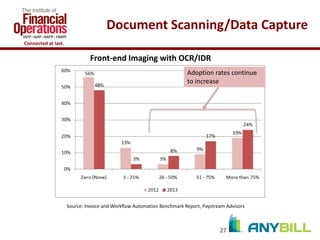

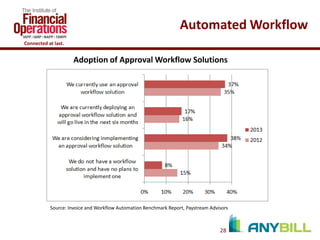

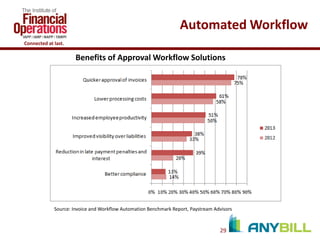

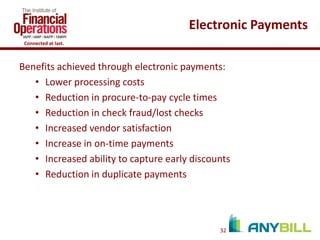

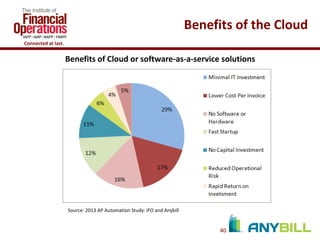

In a recent webinar, experts discussed strategies for improving accounts payable processes through automation, addressing challenges like lost invoices and slow processing. Solutions such as electronic invoicing and automated workflows were highlighted to enhance efficiency and reduce costs. The session emphasized the importance of embracing technology to drive better financial outcomes and streamline operations.