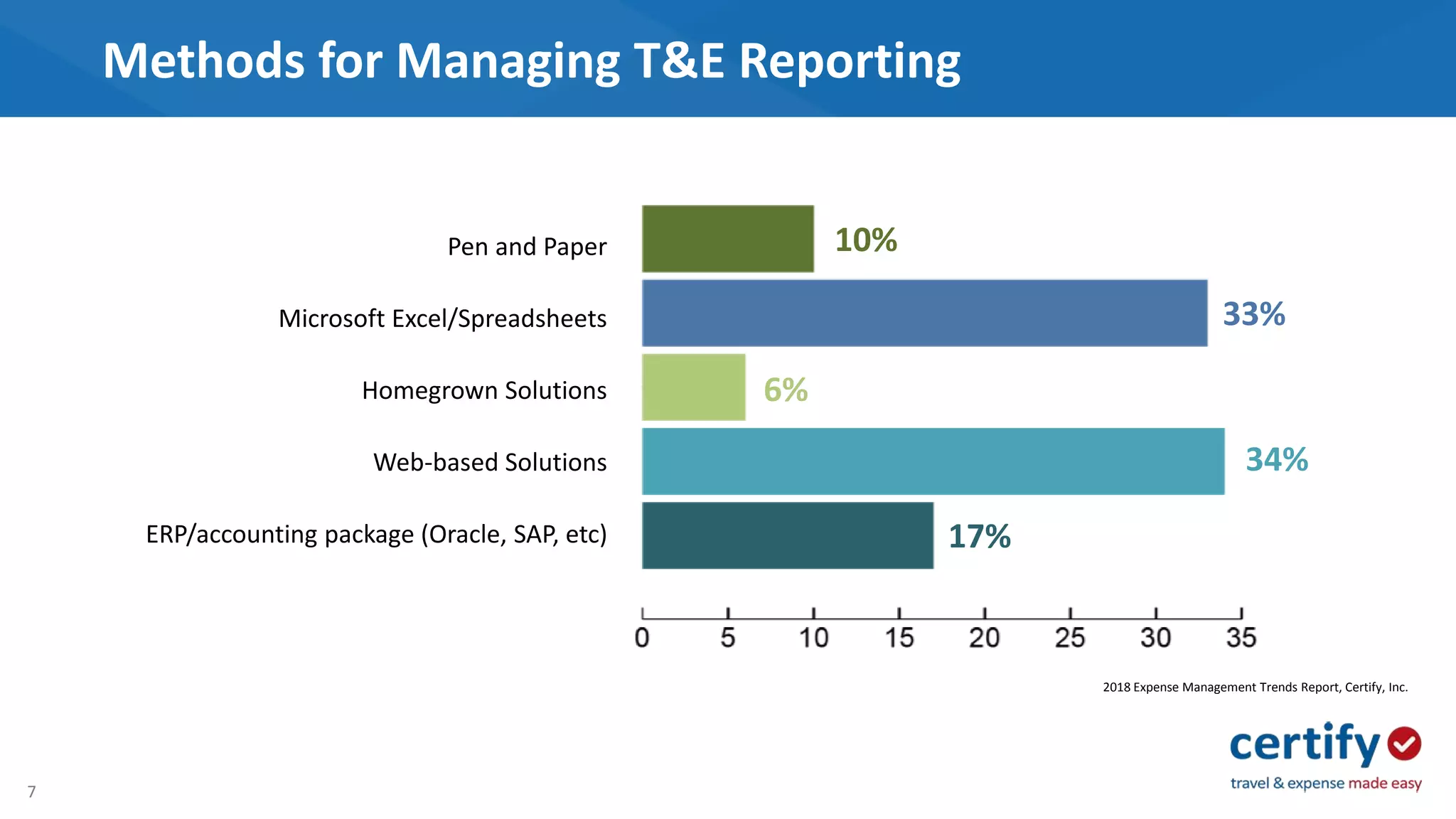

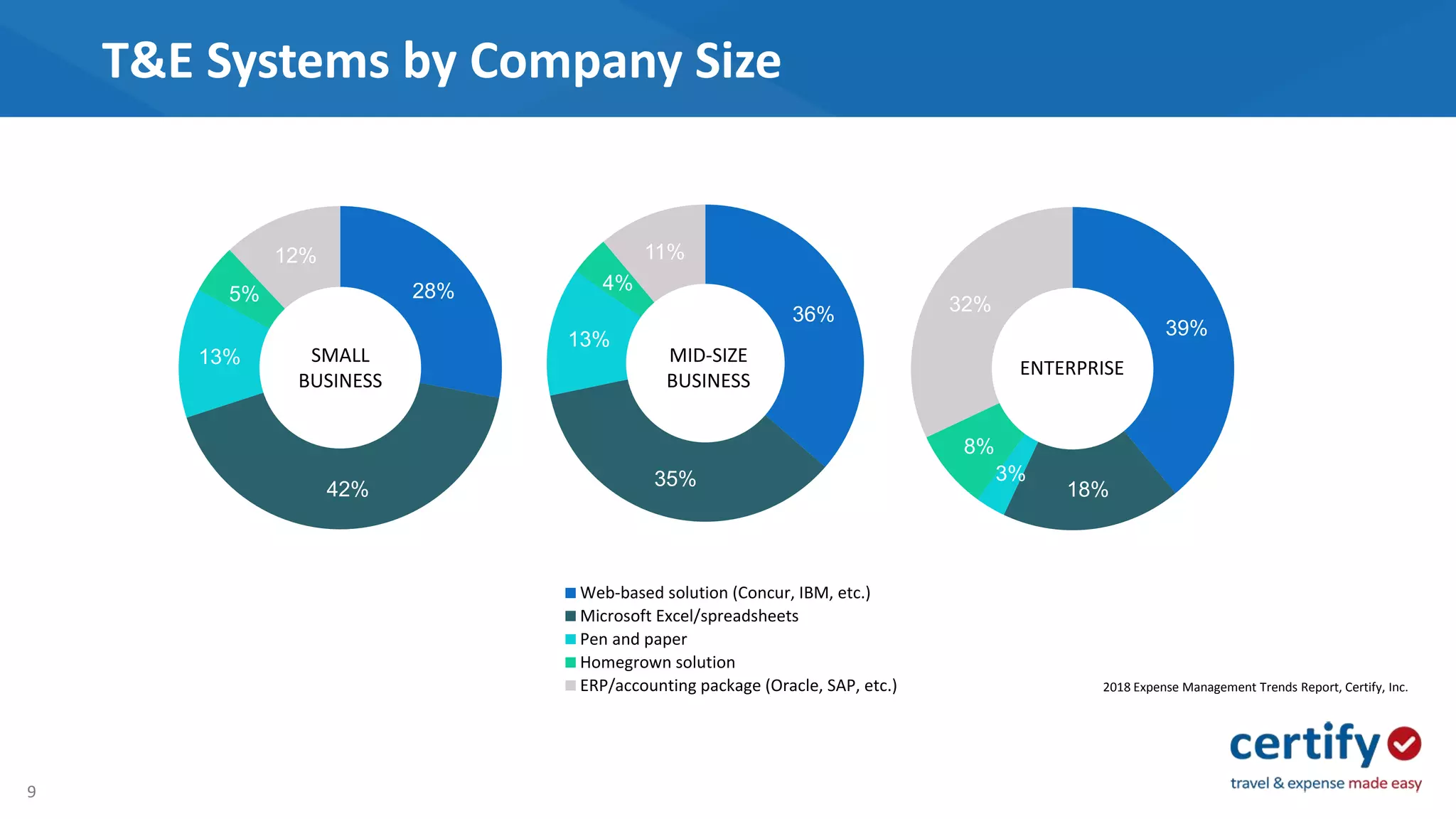

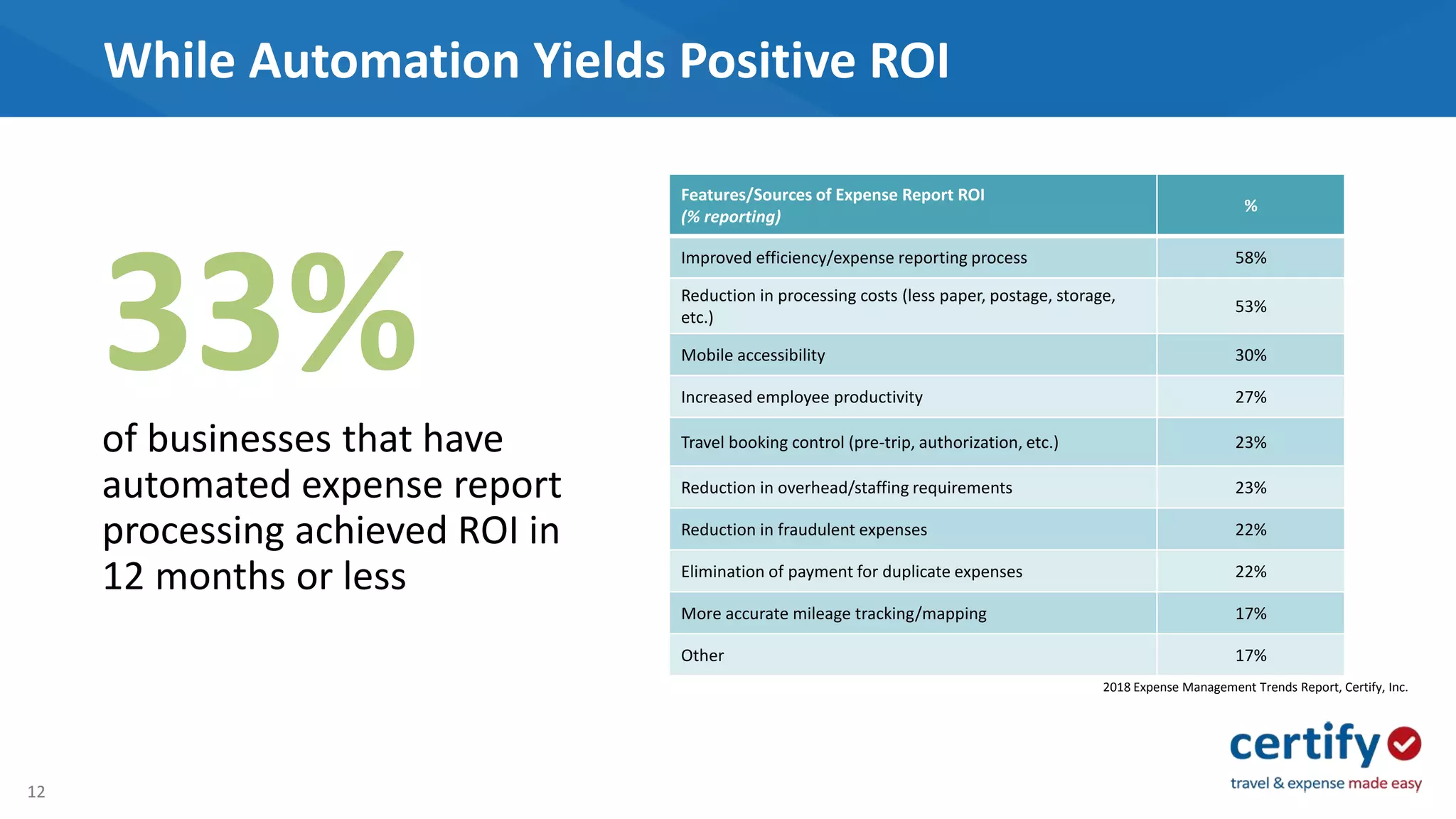

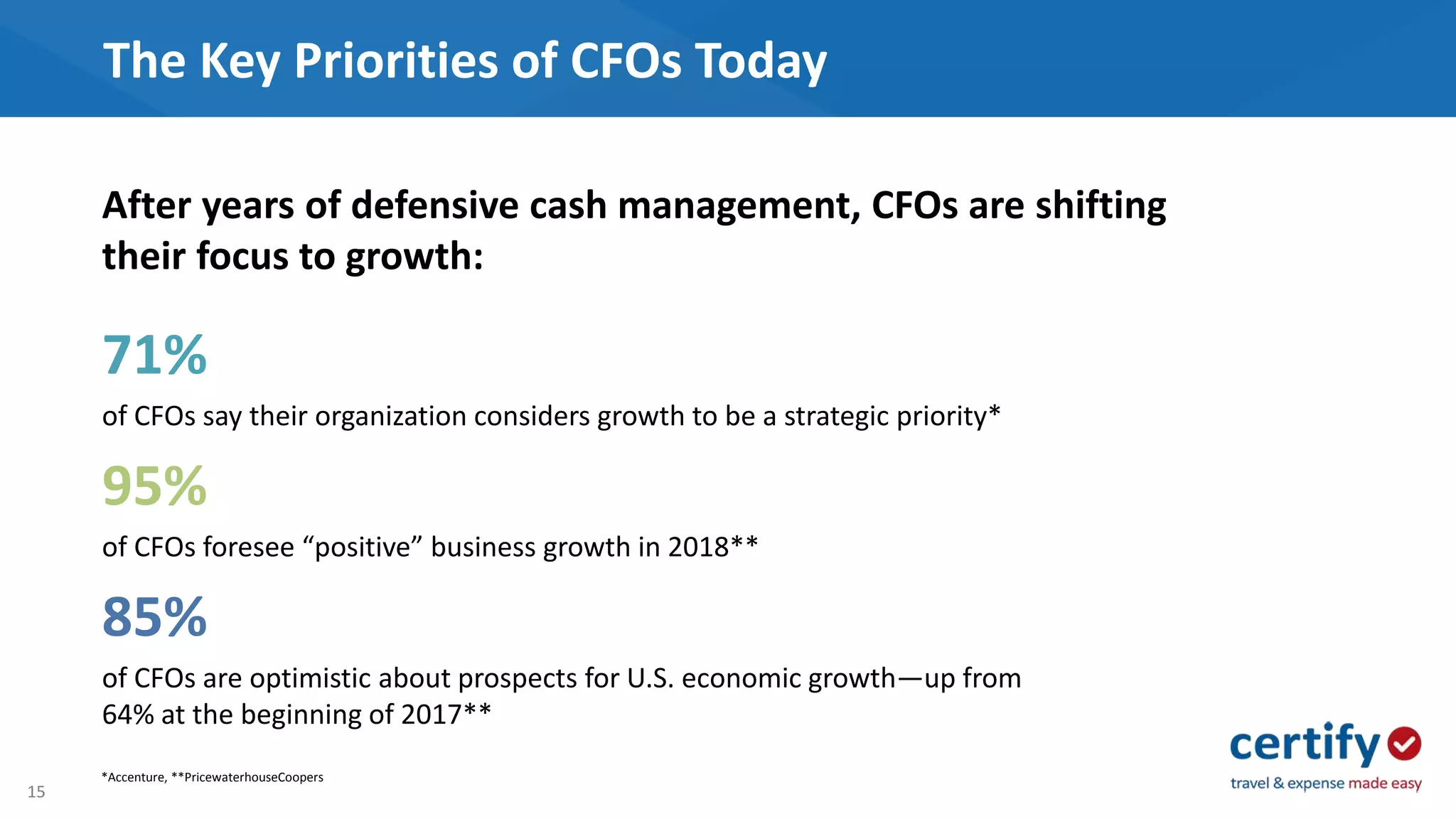

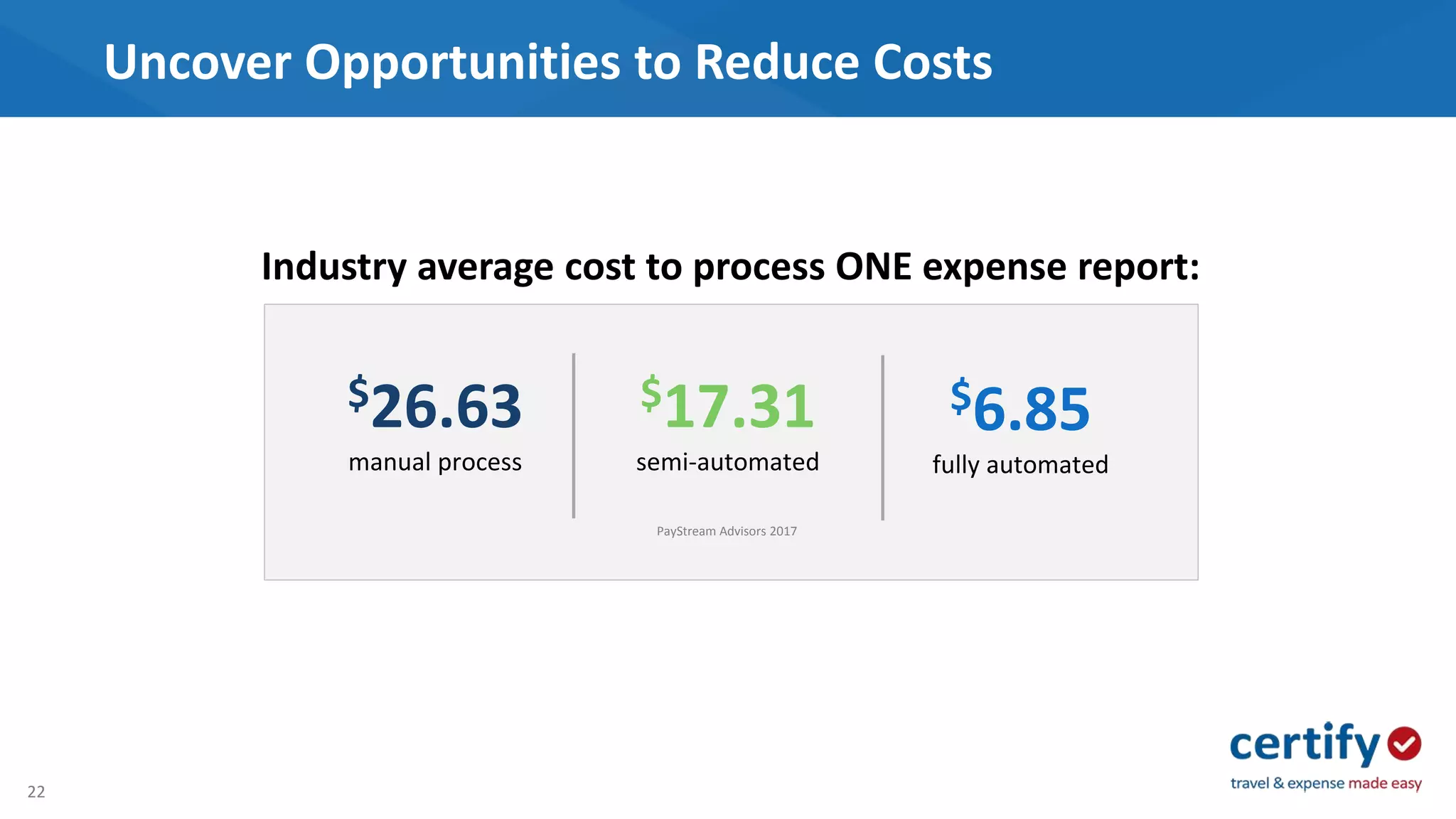

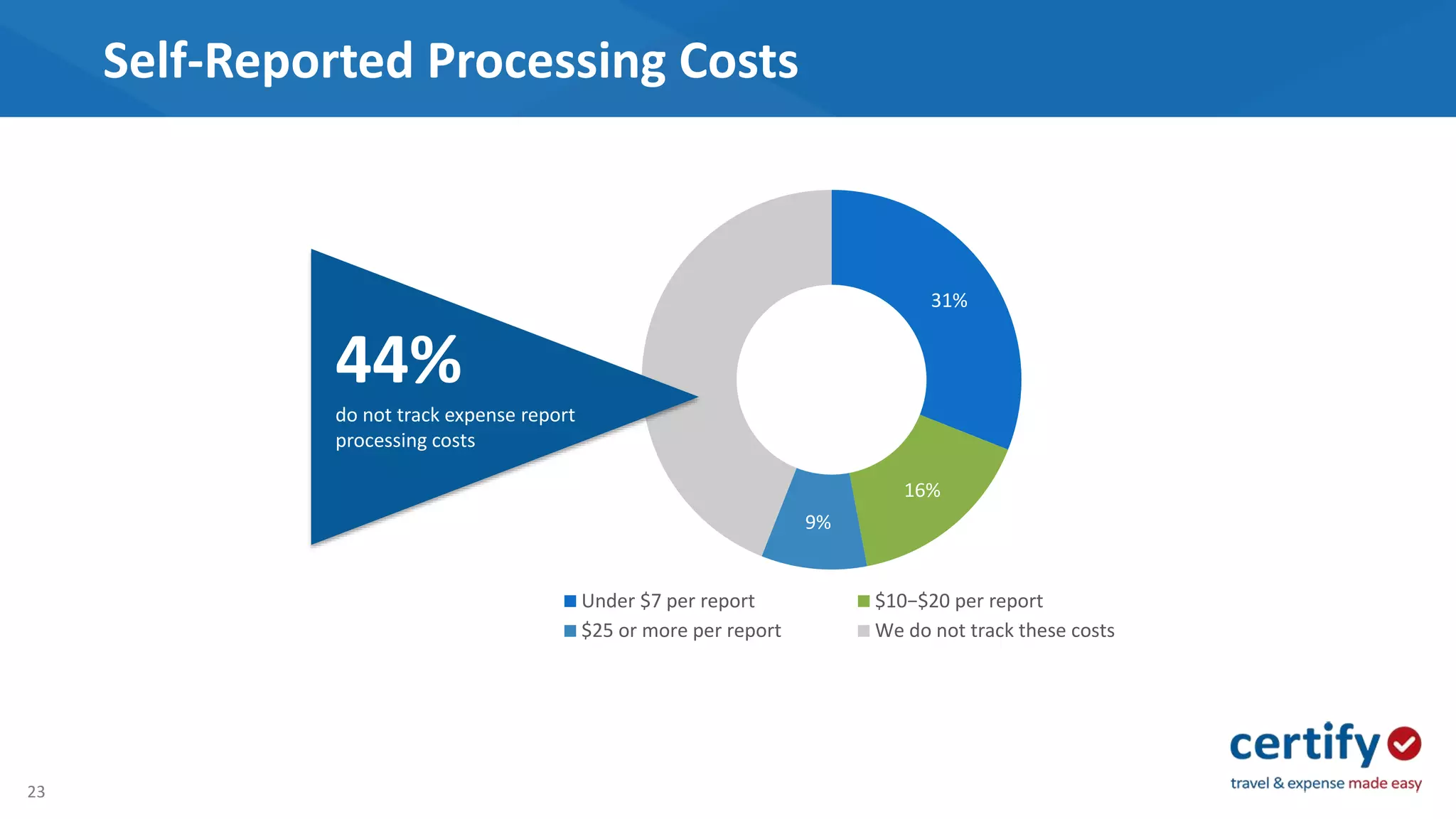

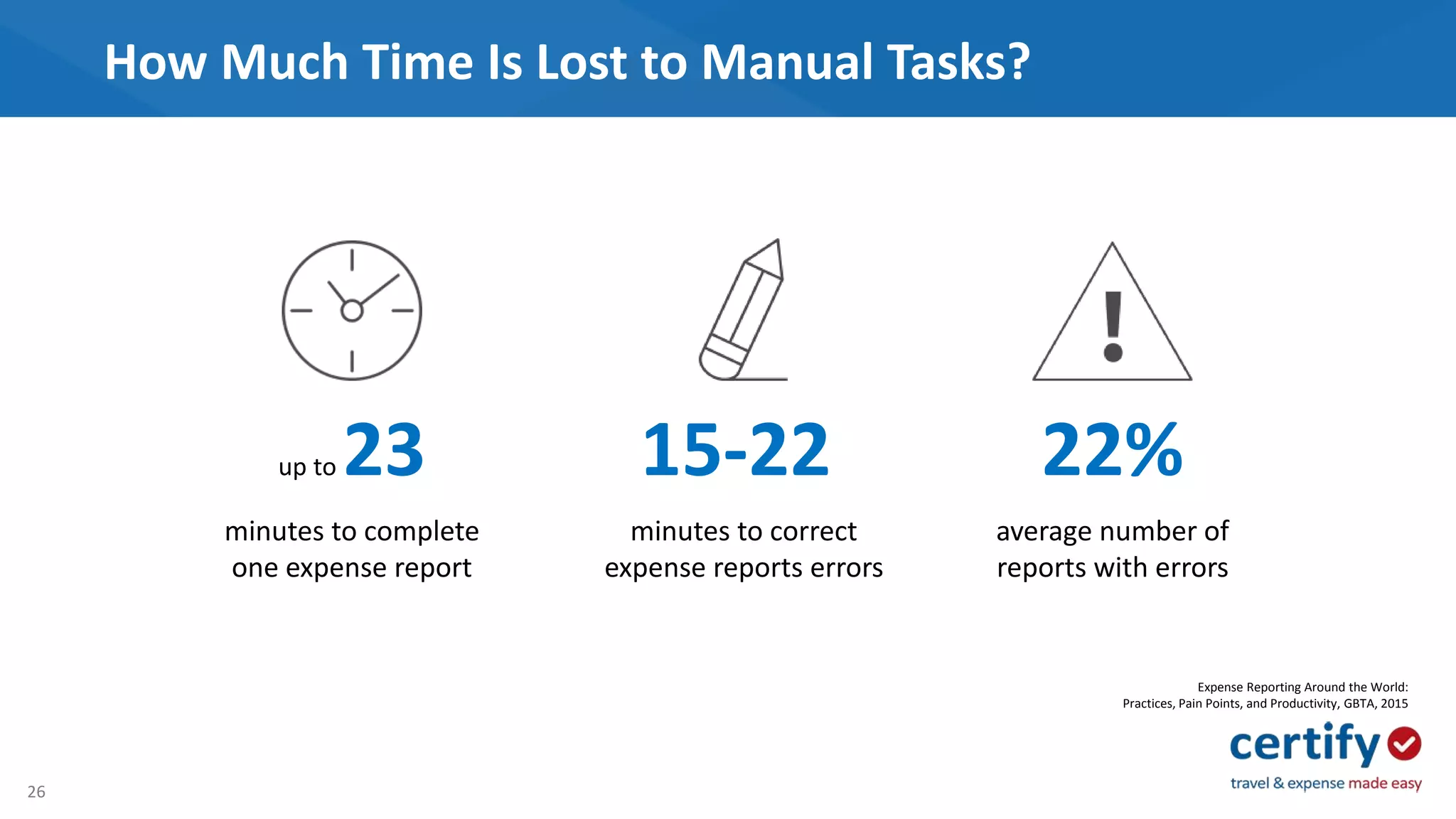

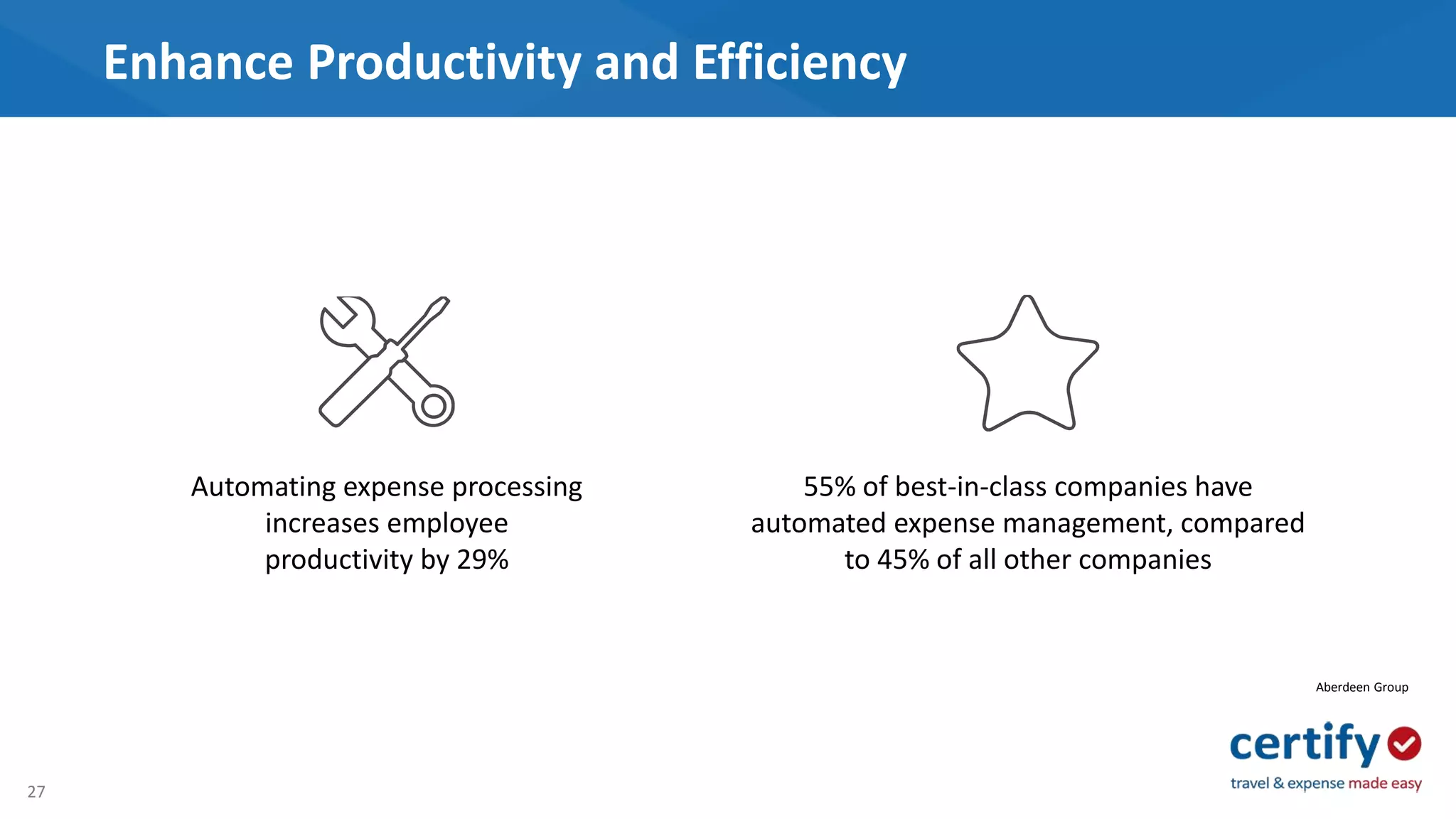

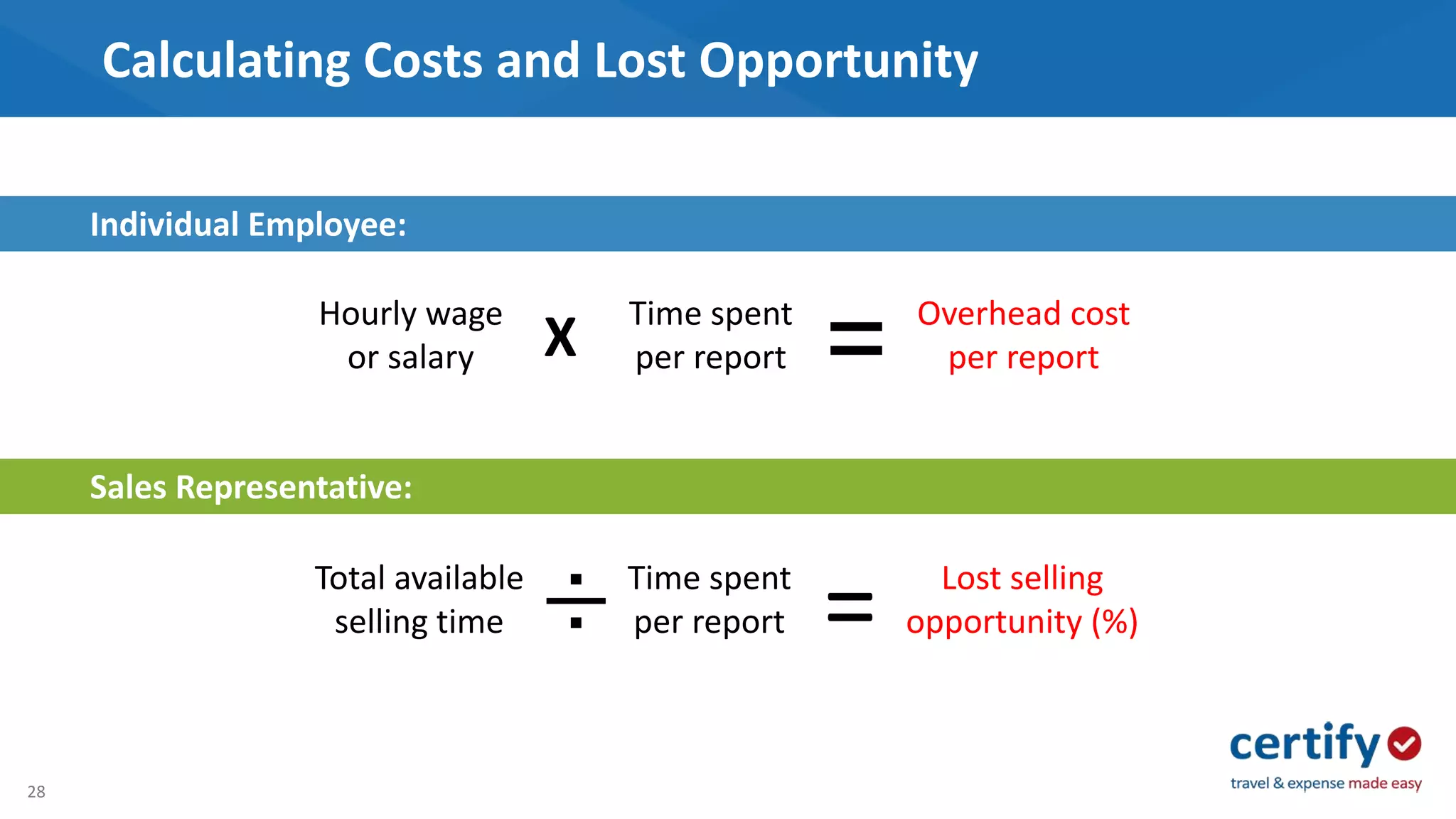

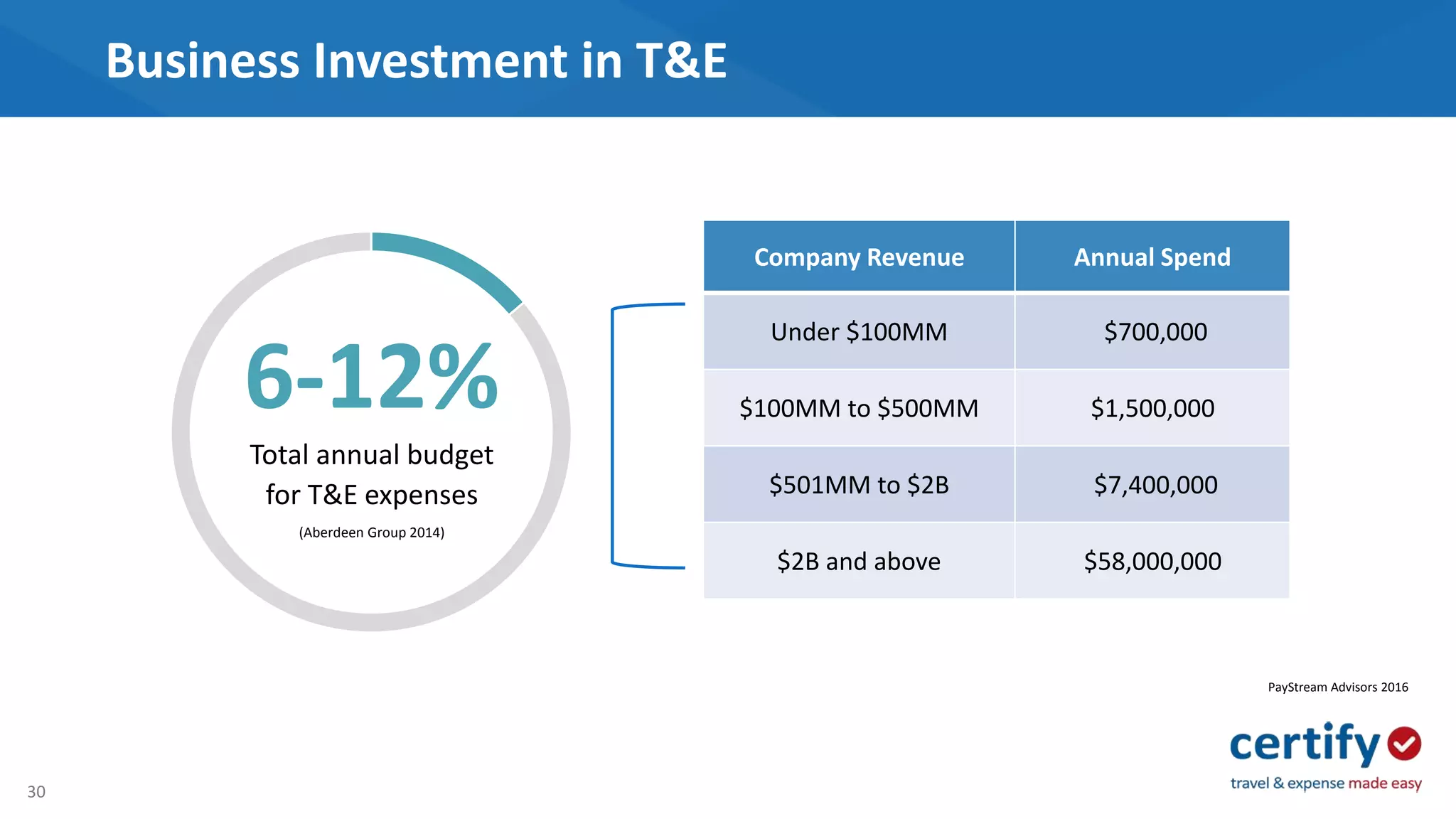

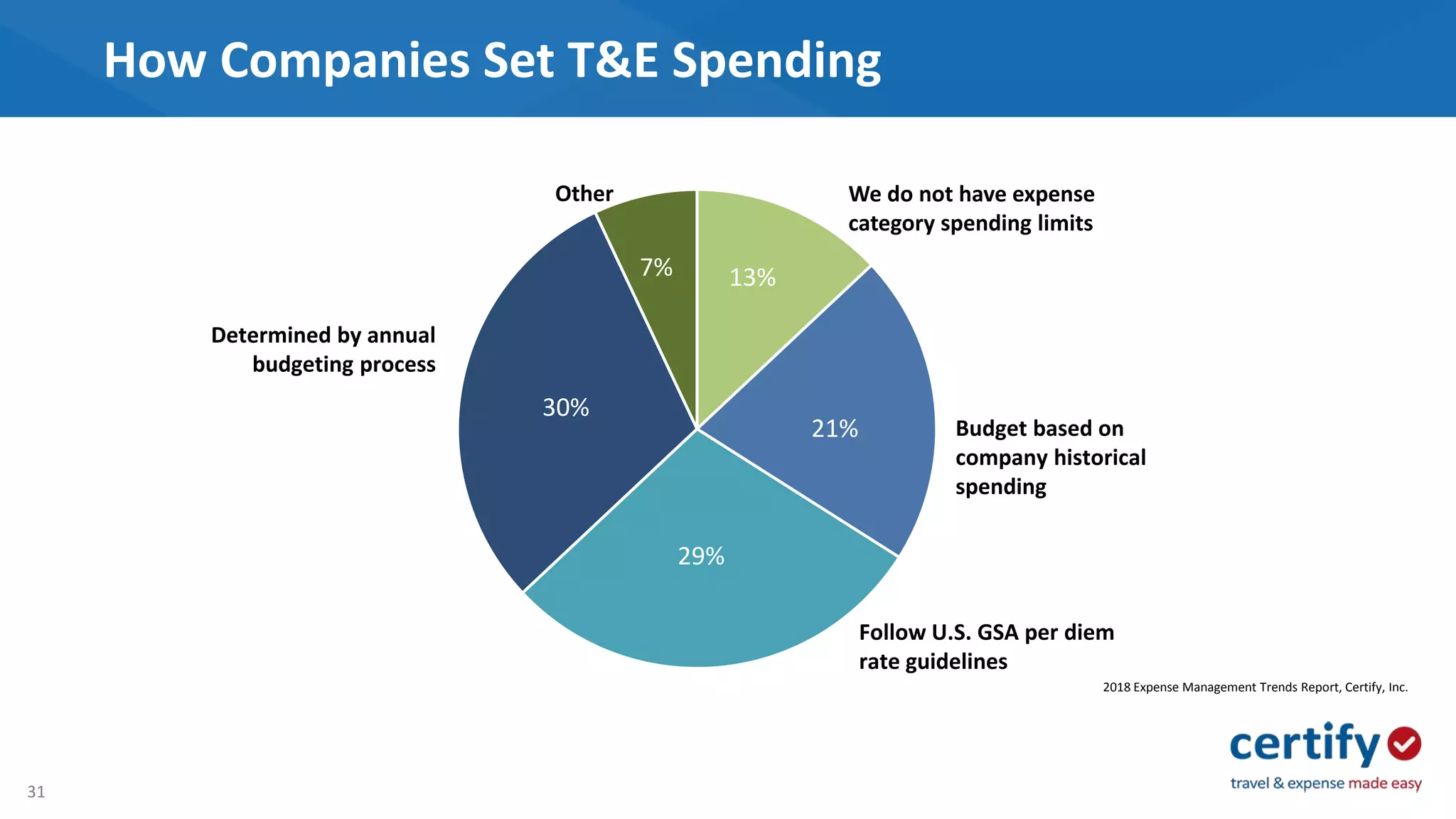

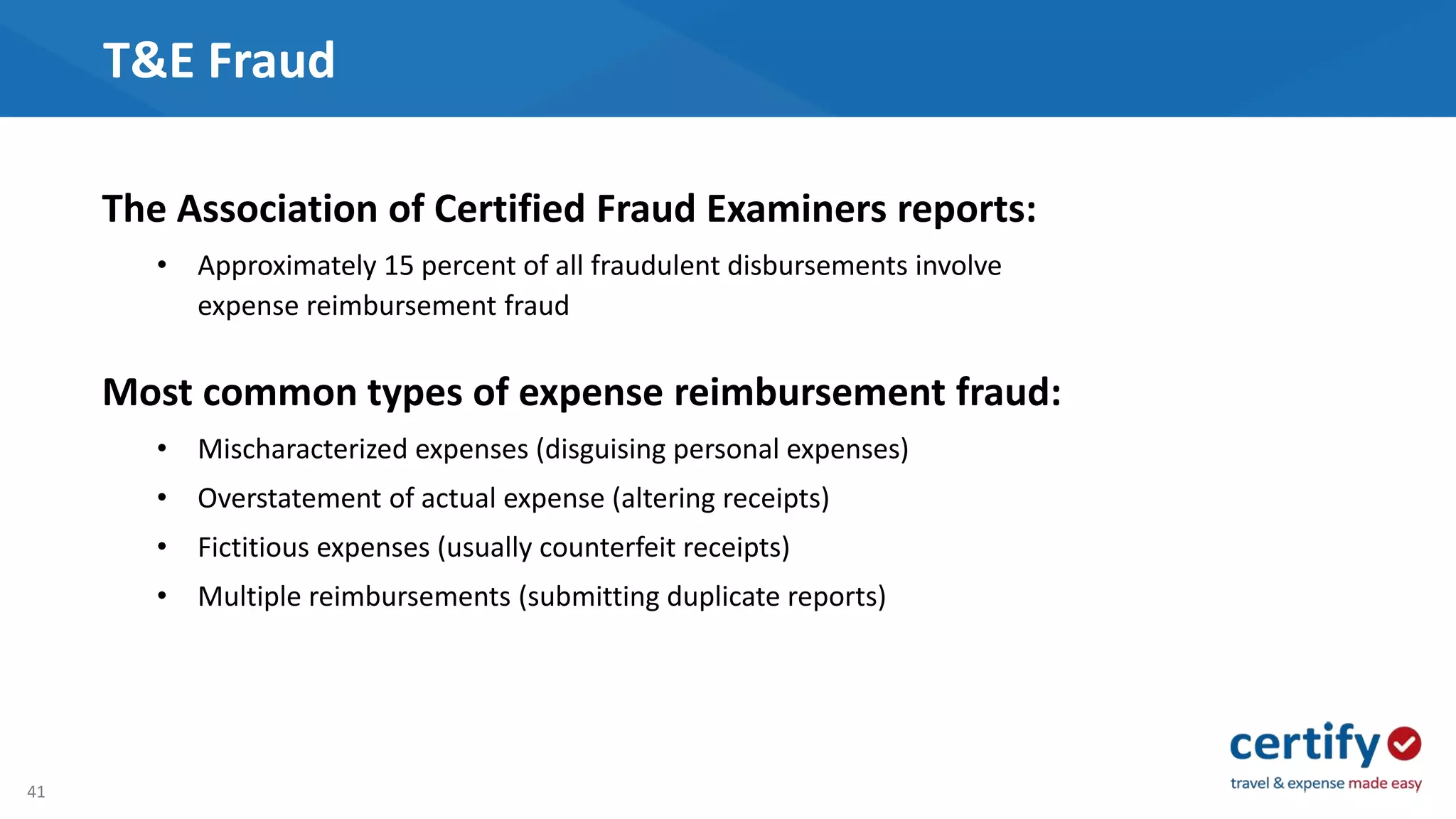

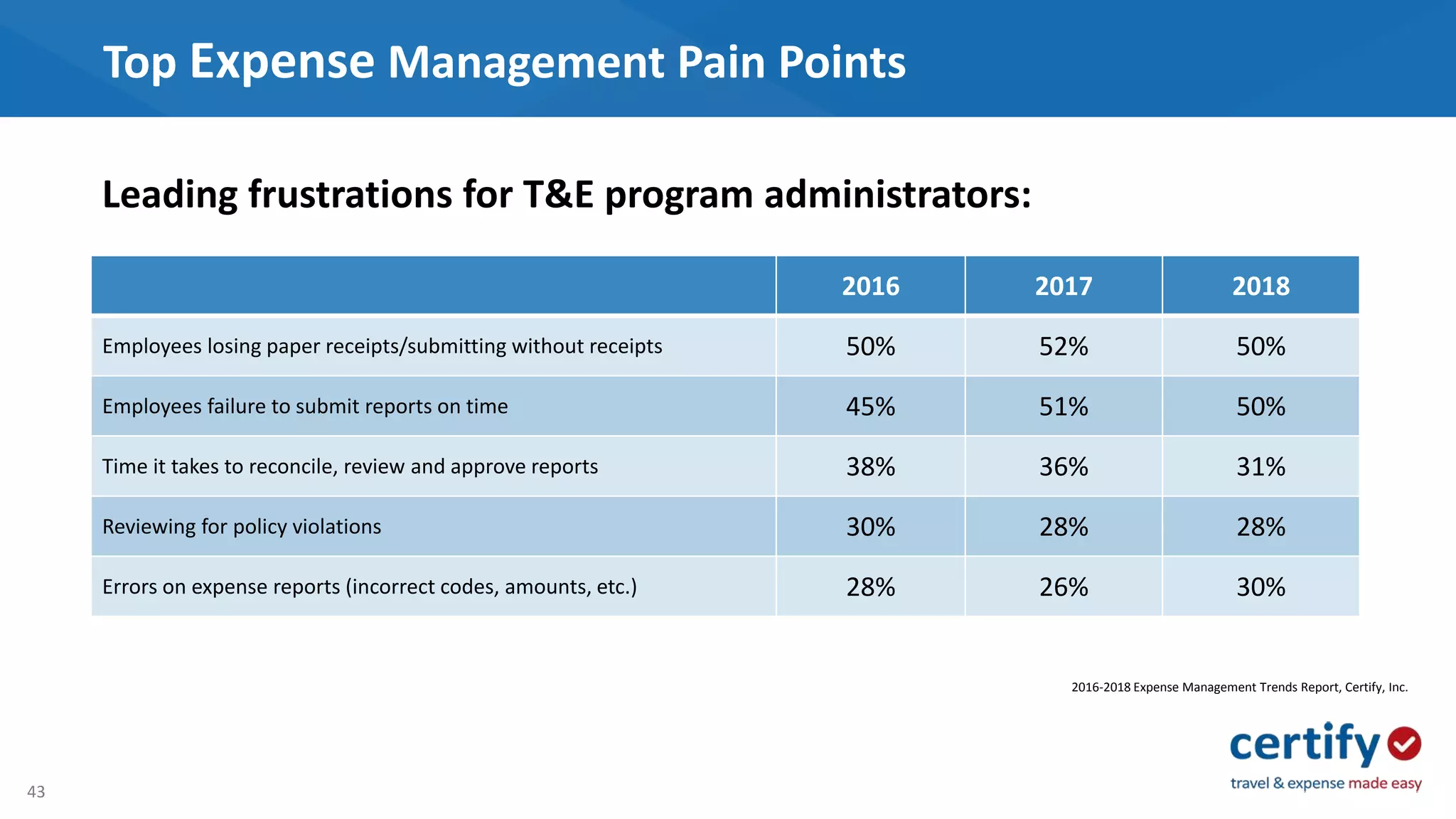

The document discusses the challenges and benefits of automating expense management processes within companies, emphasizing that many organizations still rely on manual systems despite the advantages of automation. Key benefits include reduced costs, improved efficiency, better visibility into spending, enhanced decision-making capabilities, and effective risk mitigation. It also outlines the importance of aligning automation initiatives with CFO priorities to successfully gain their support for implementing such solutions.