https://www.accountantadvocate.com/frs/27799174/building-a-business-case-for-finance-automation

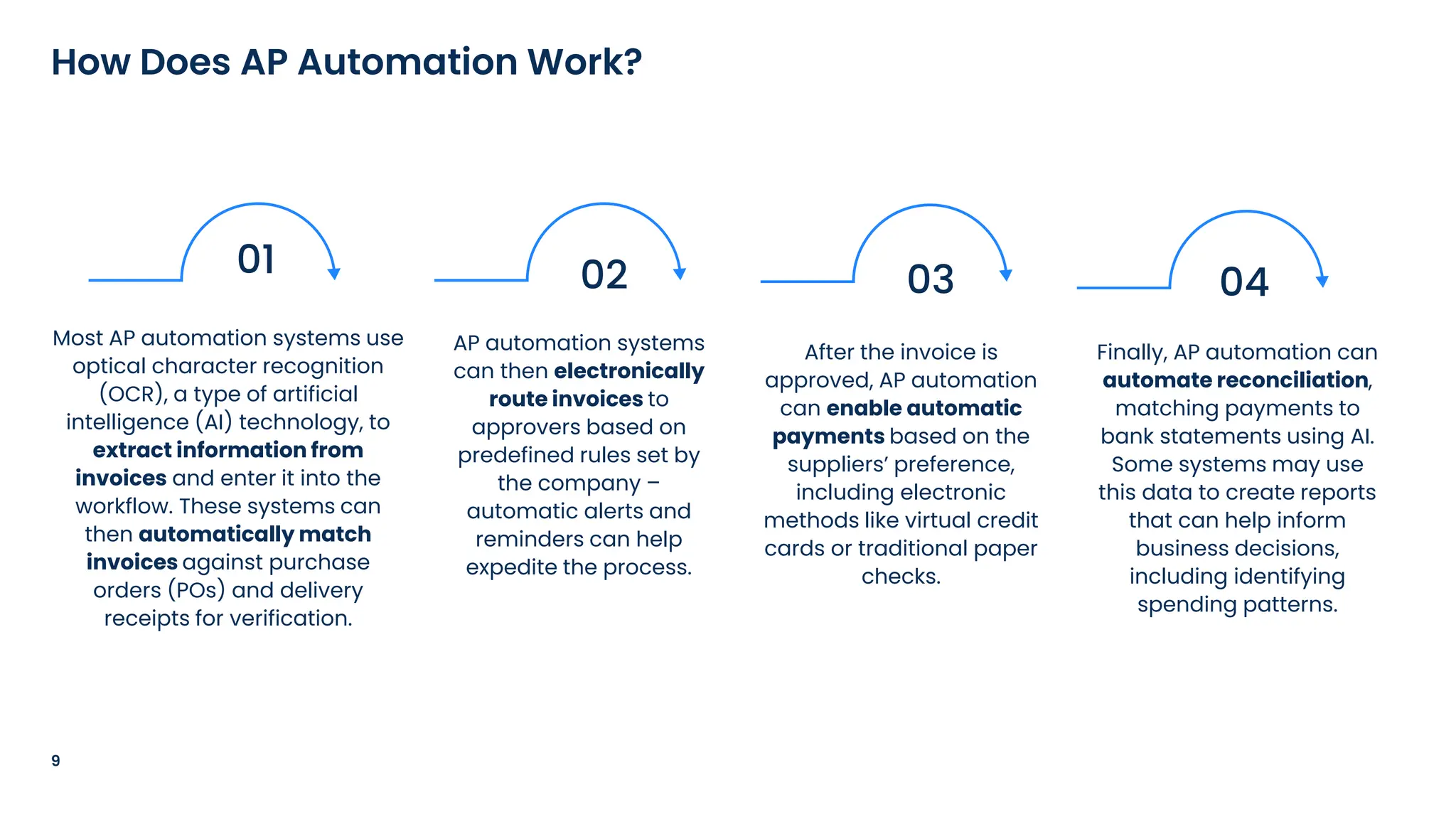

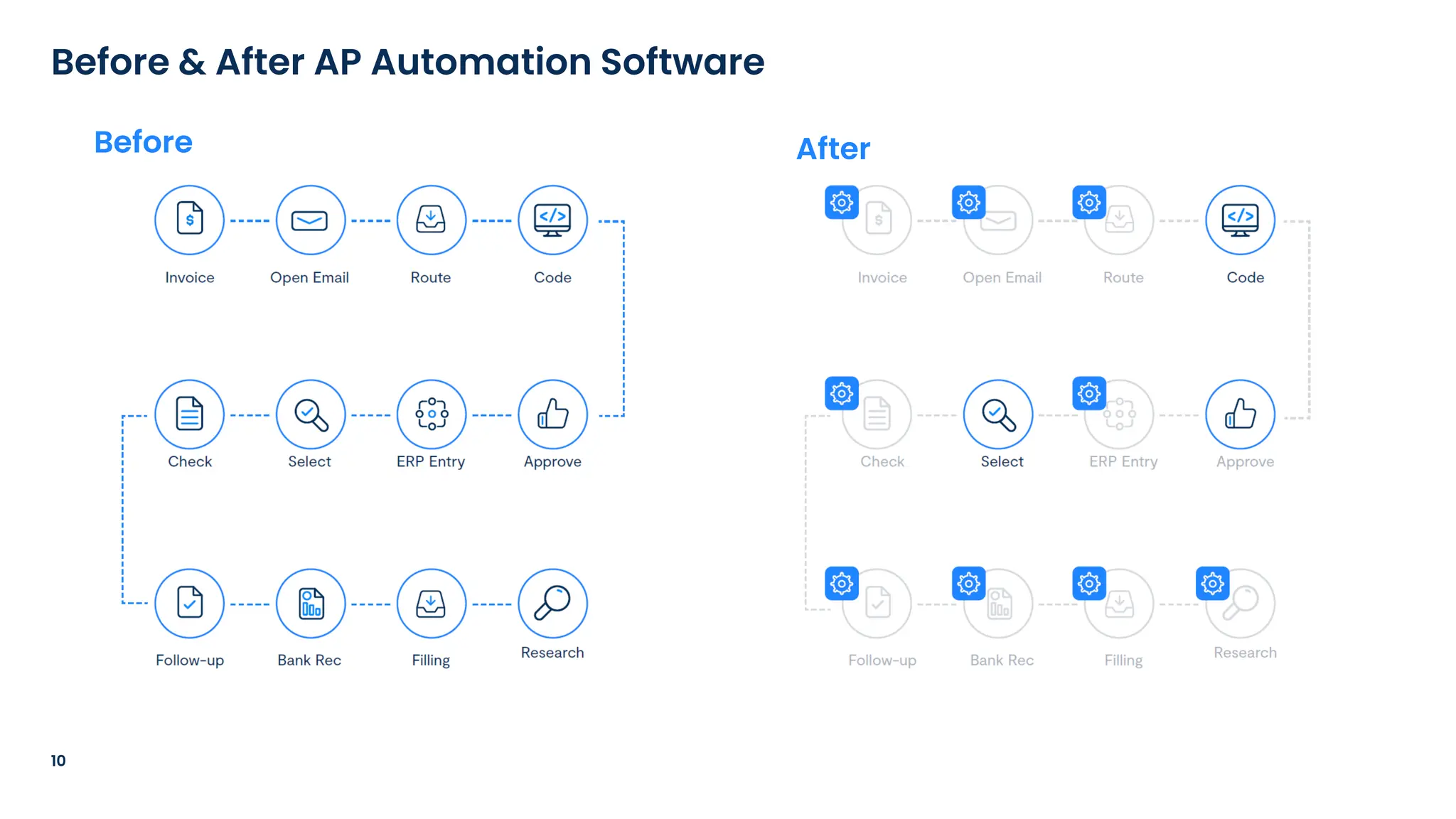

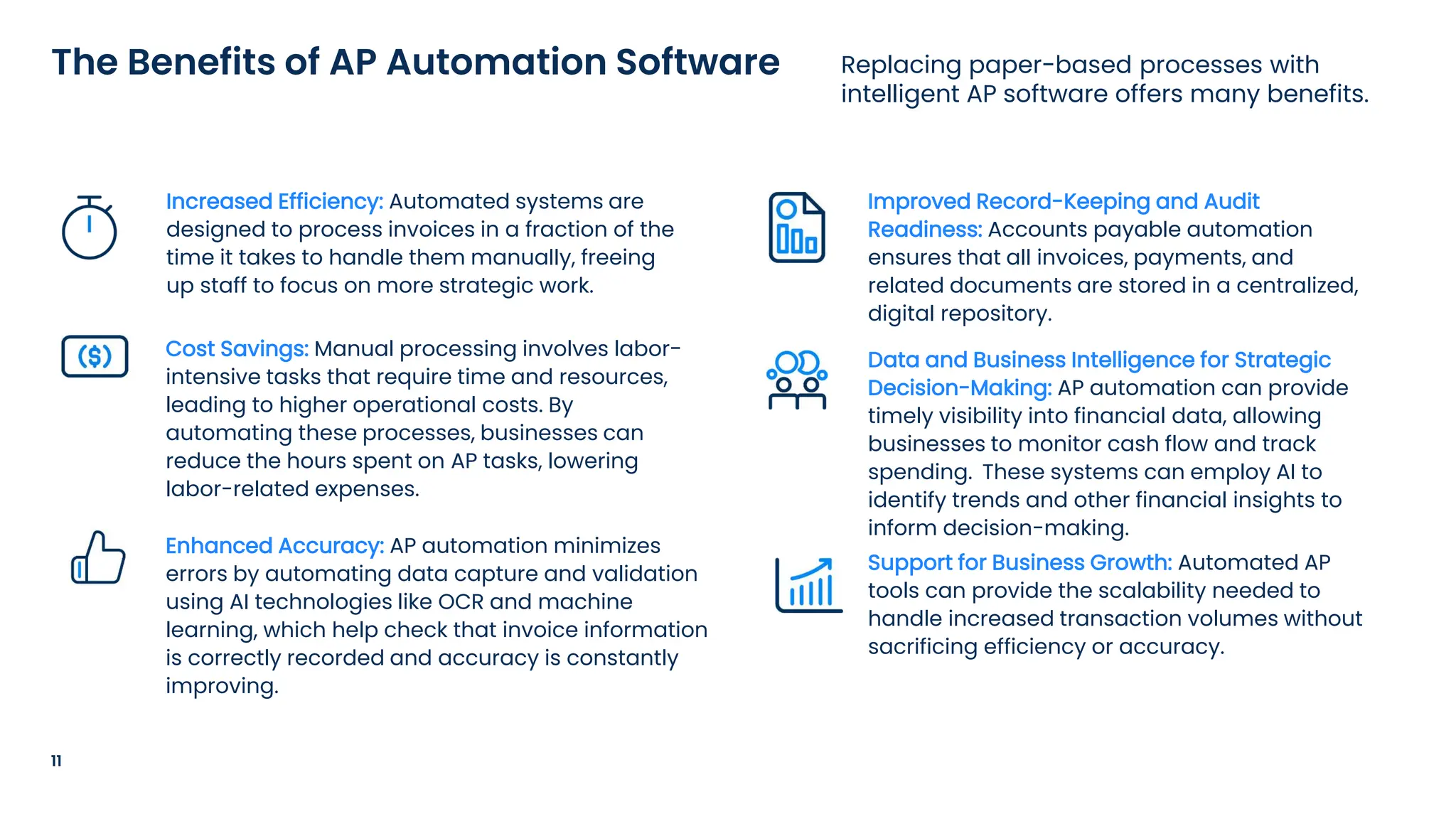

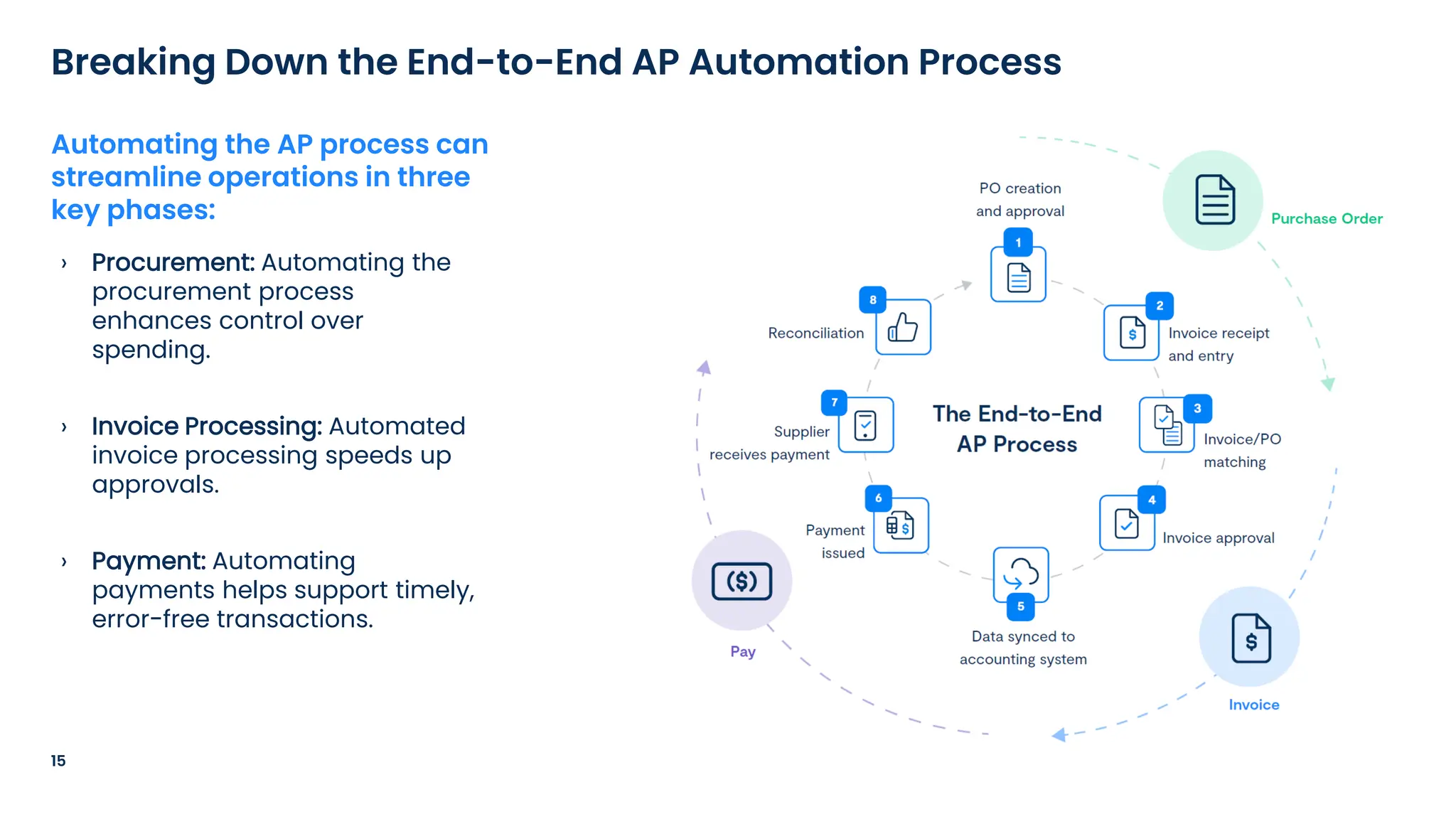

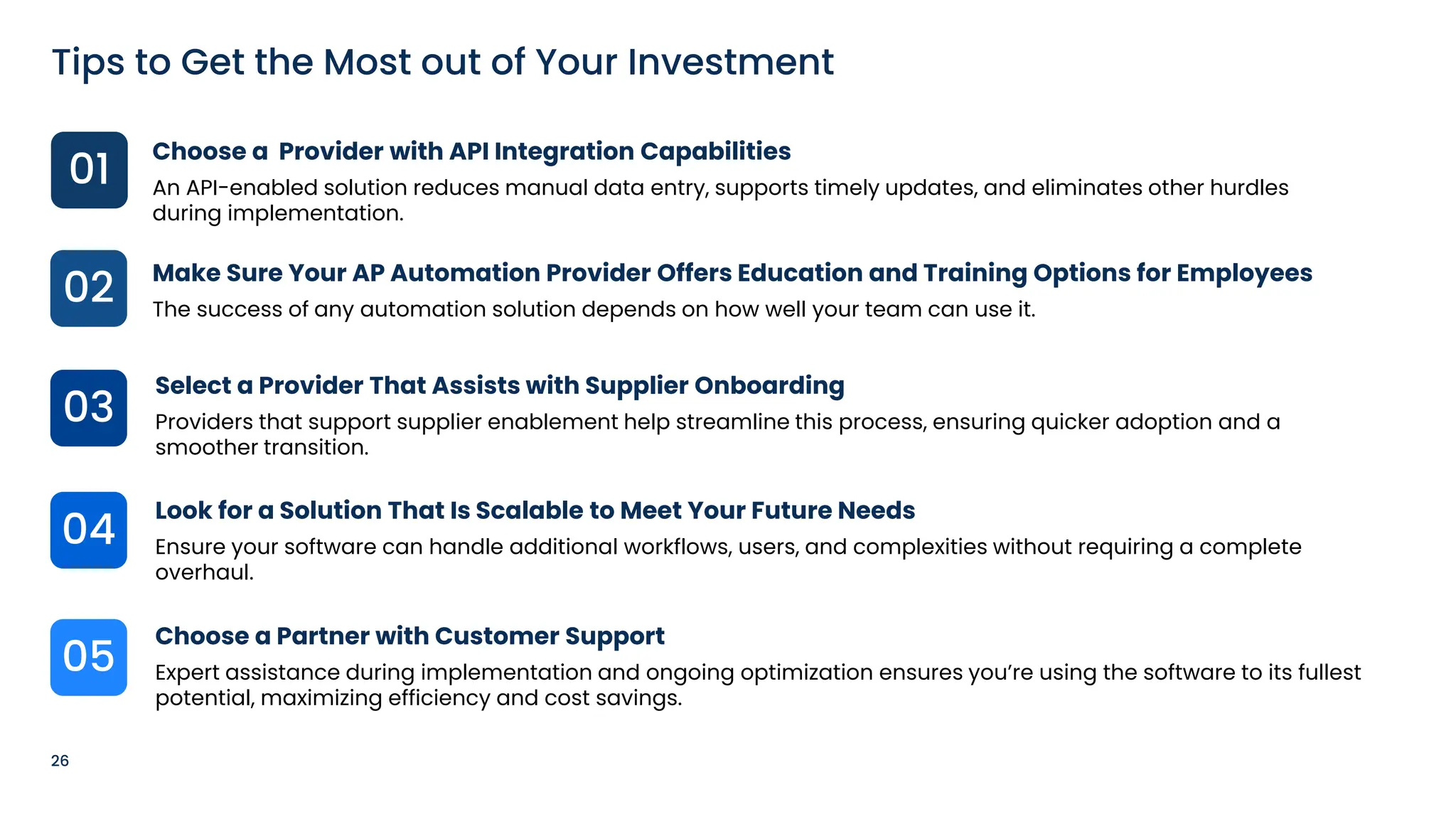

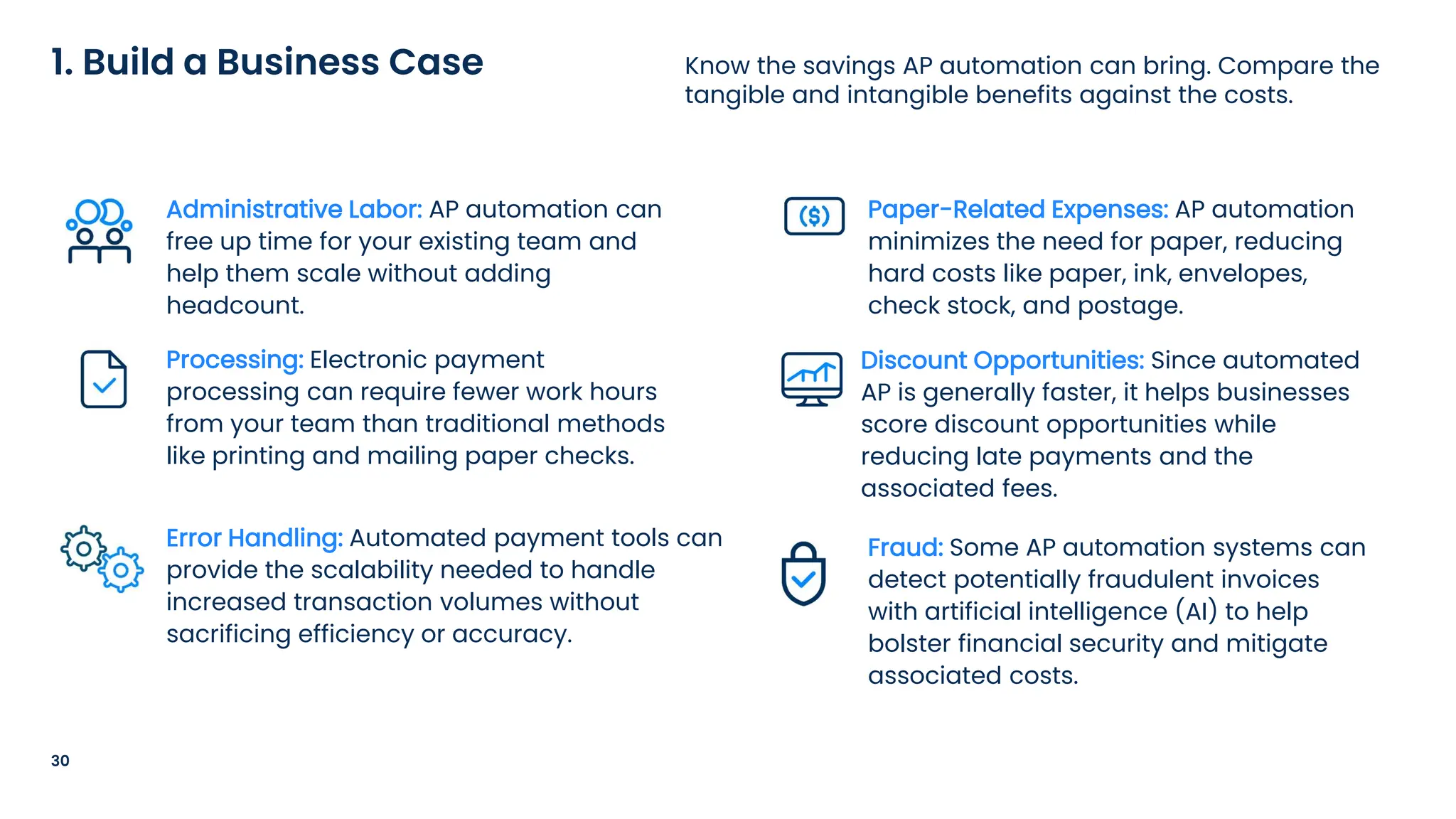

Struggling to get buy-in for finance automation? Learn how to build a compelling business case and streamline your purchase-to-pay process to drive efficiency, reduce costs, and stay ahead of the competition.