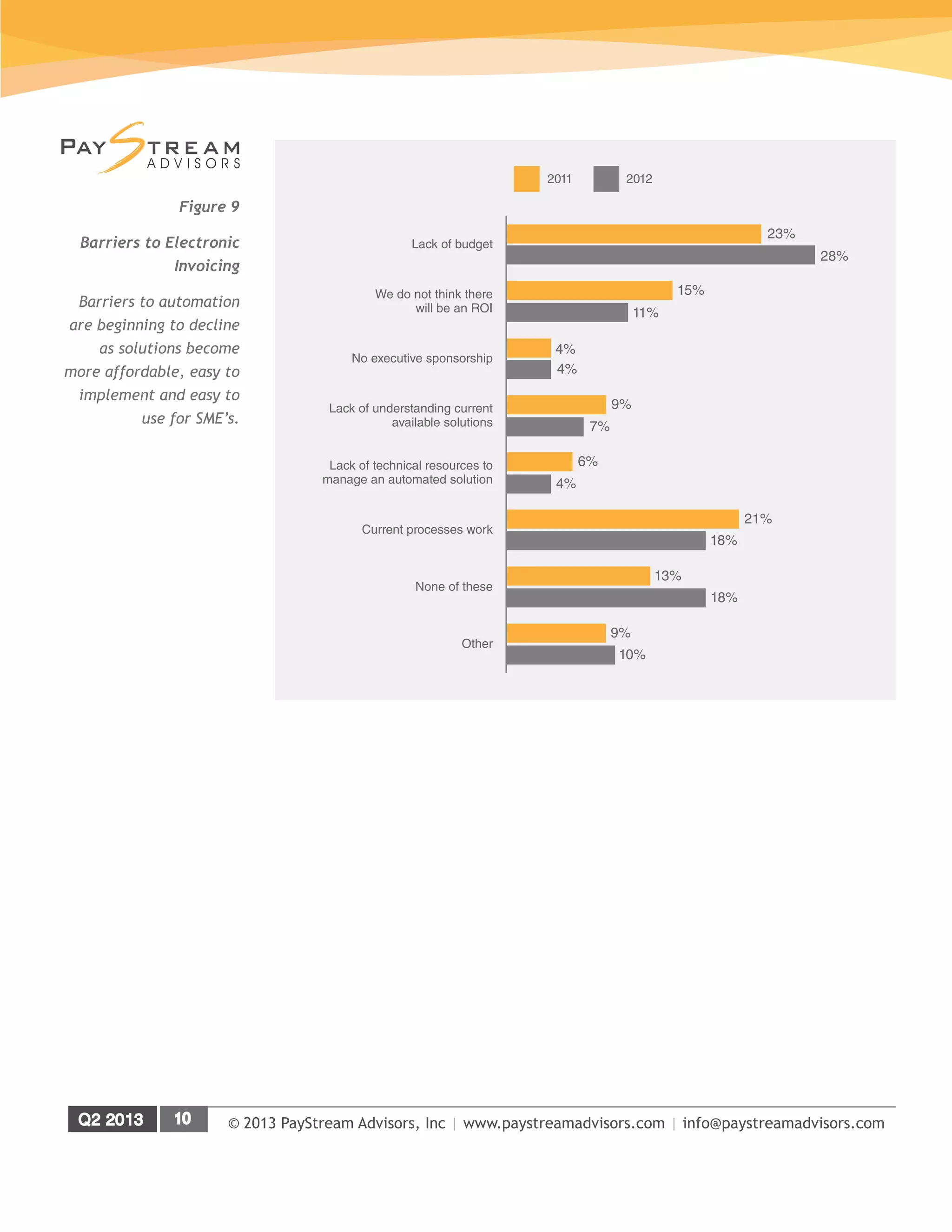

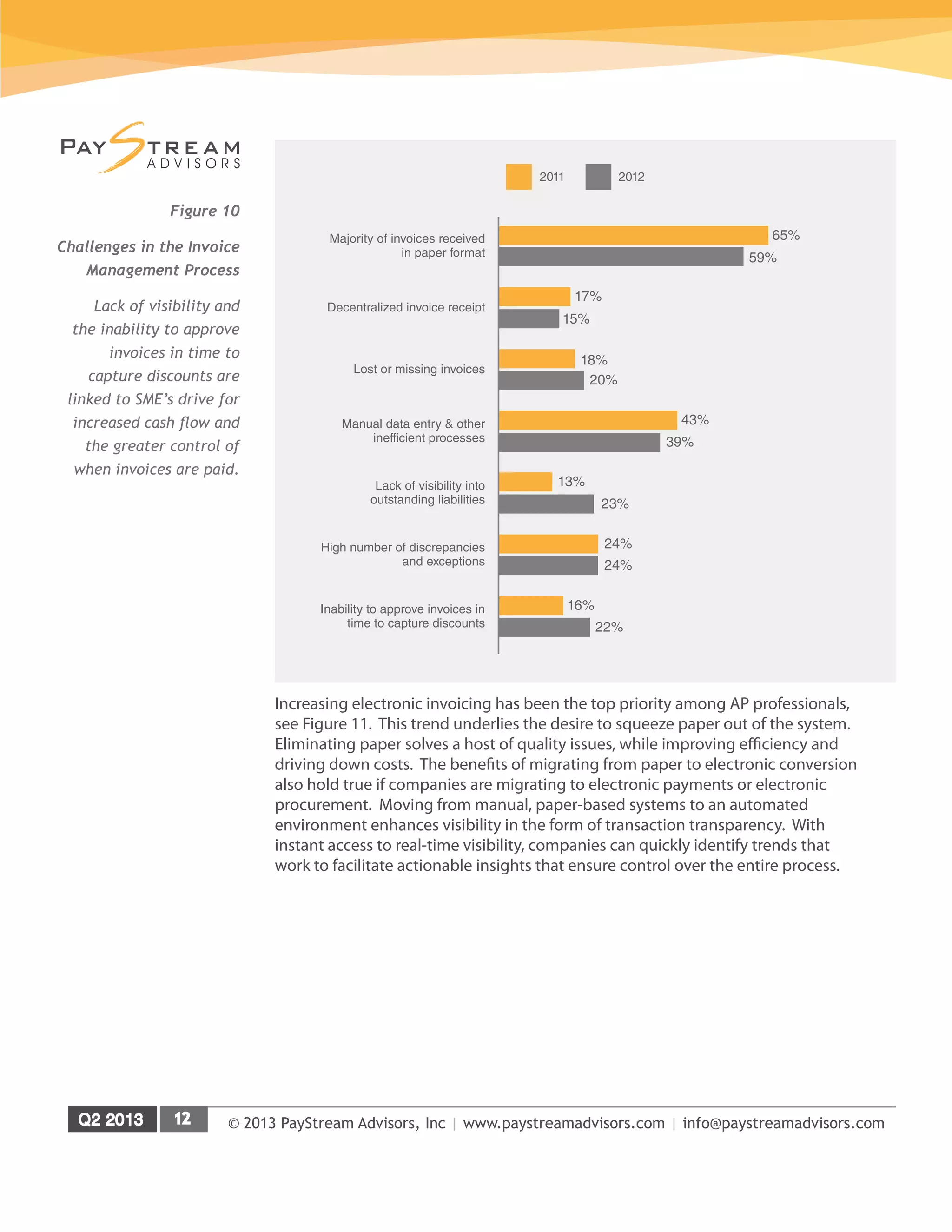

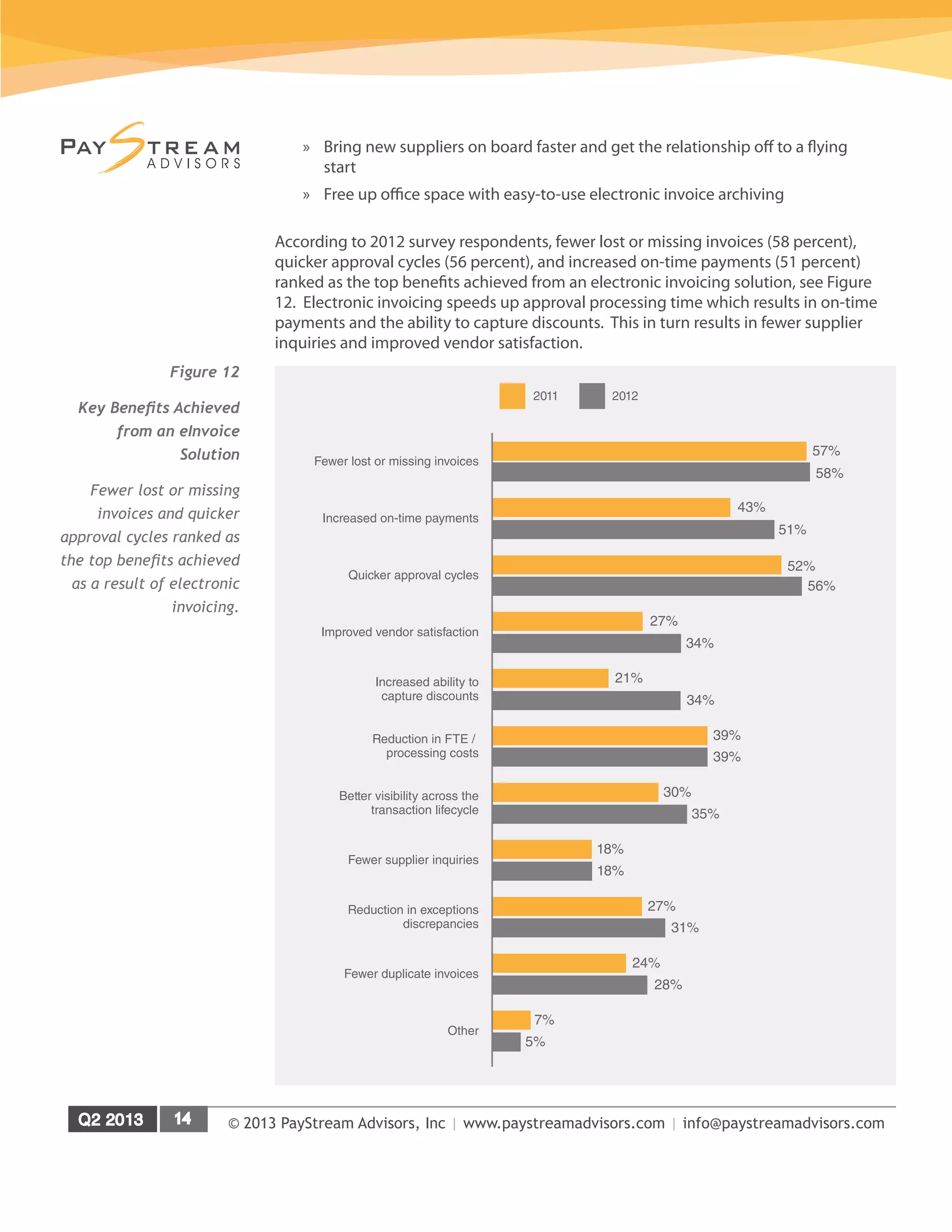

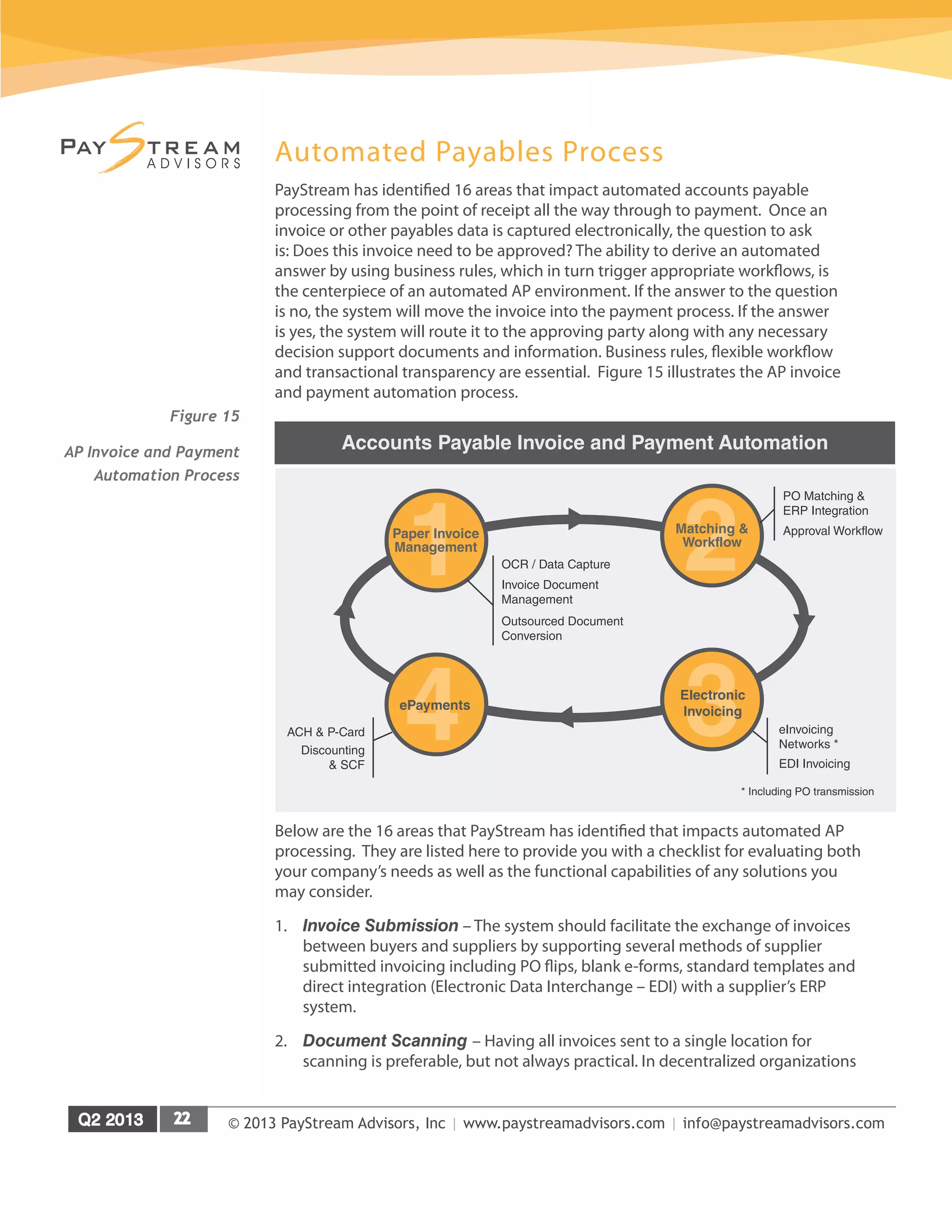

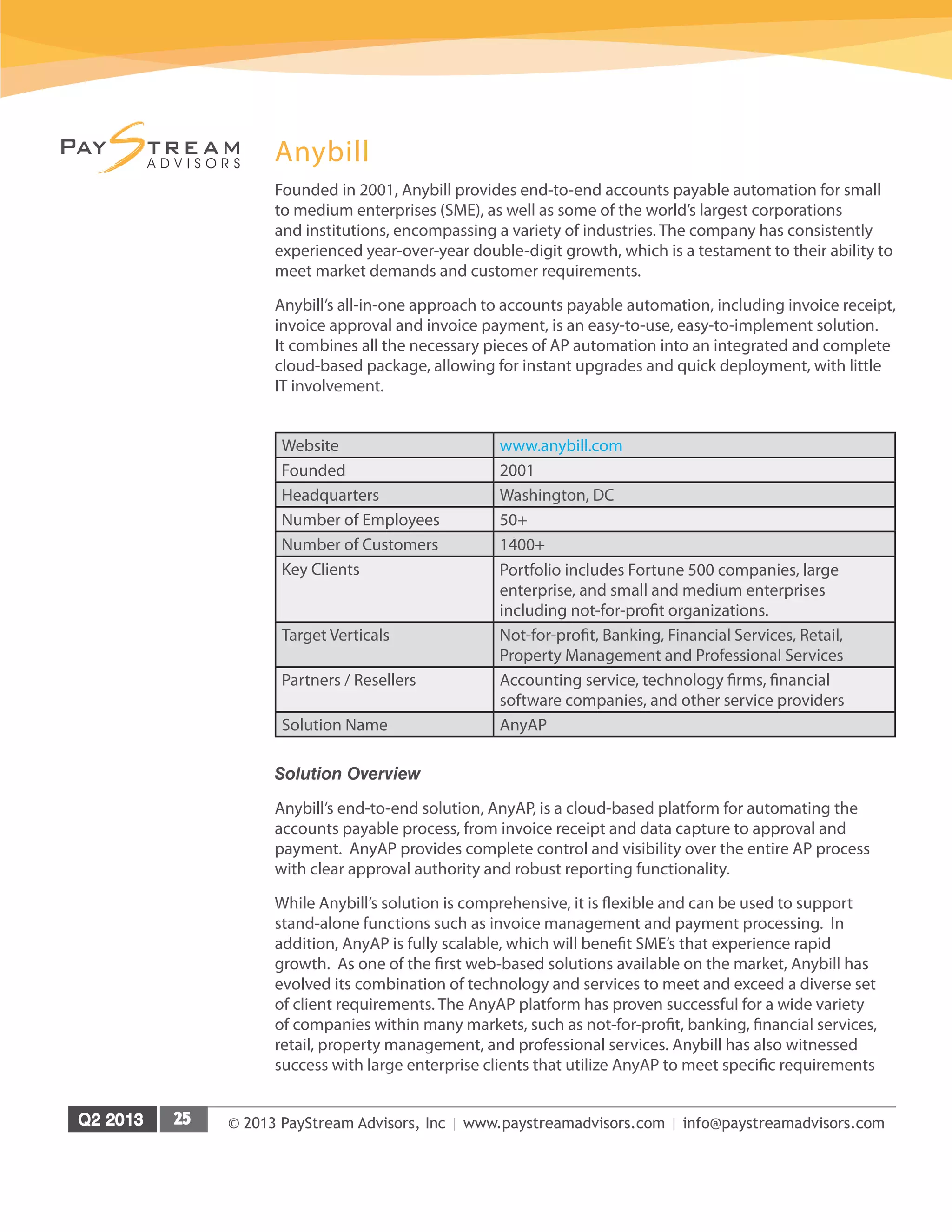

The document discusses the growing trend of accounts payable (AP) automation in small to medium enterprises (SMEs), highlighting the challenges they face with manual processes and the benefits of adopting electronic invoicing and automated workflows. It provides insights from a research report that includes statistics on adoption rates, barriers to automation, and successful case studies, emphasizing the potential for cost savings and improved supplier relationships. The report concludes that while SMEs are increasingly investing in AP automation technology, budget constraints and reliance on paper-based systems still hinder widespread adoption.