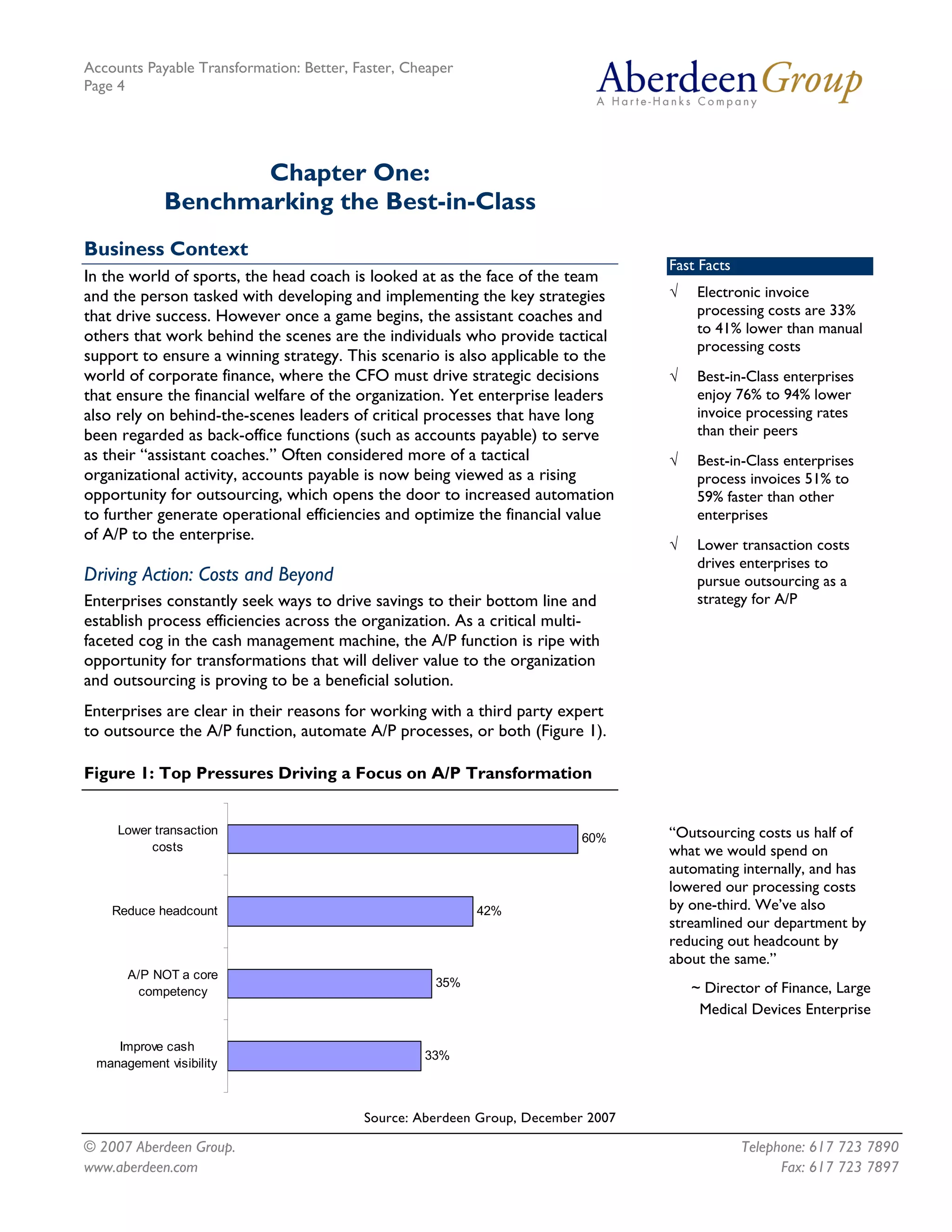

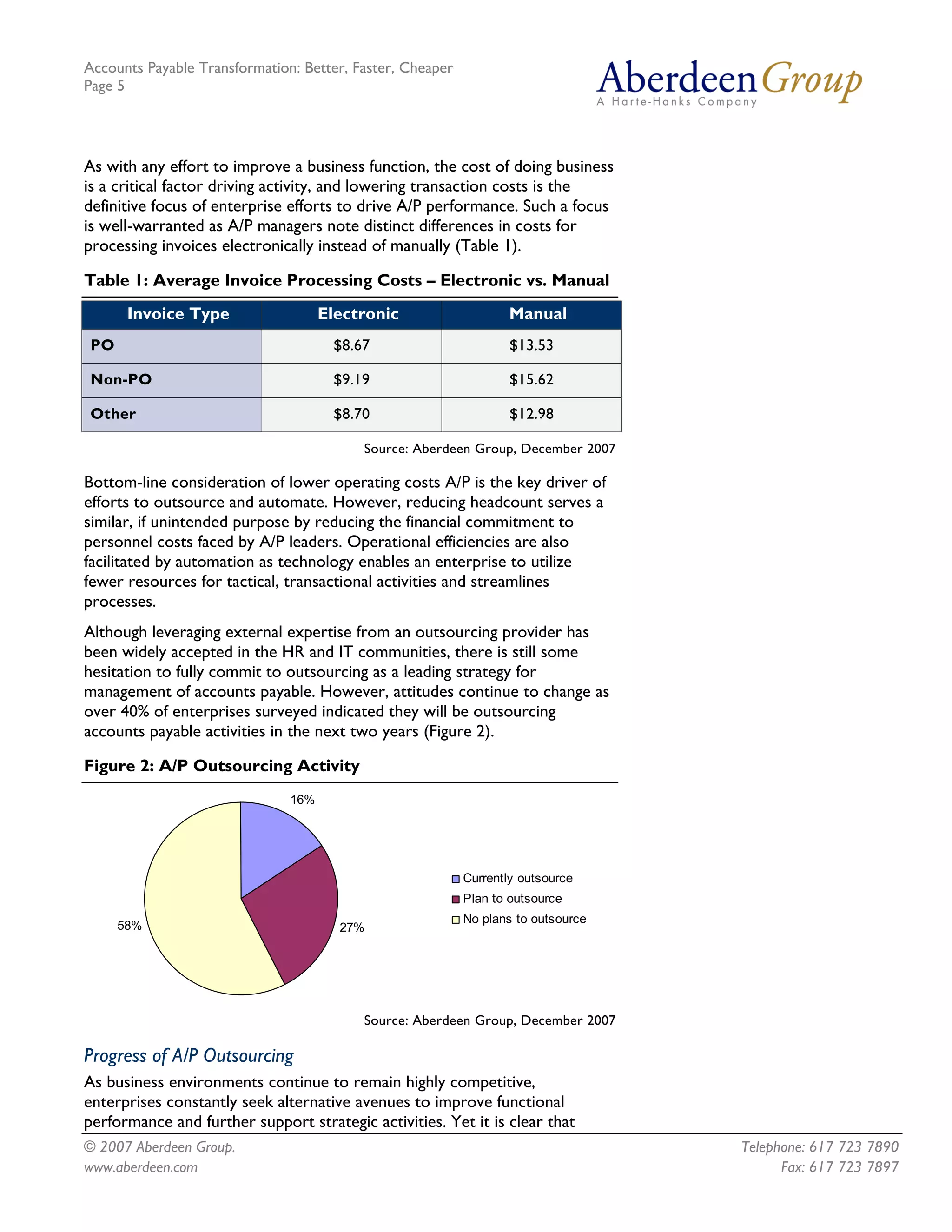

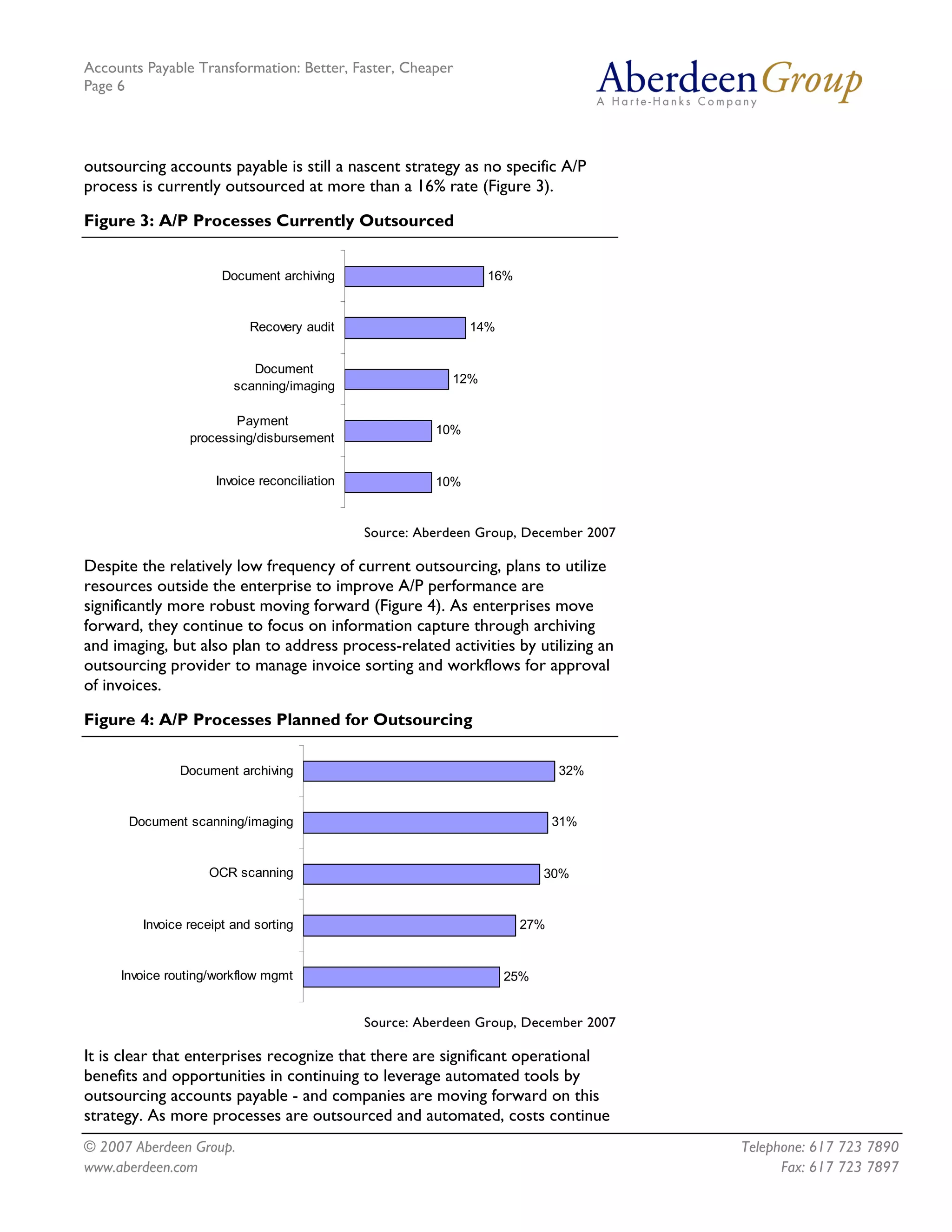

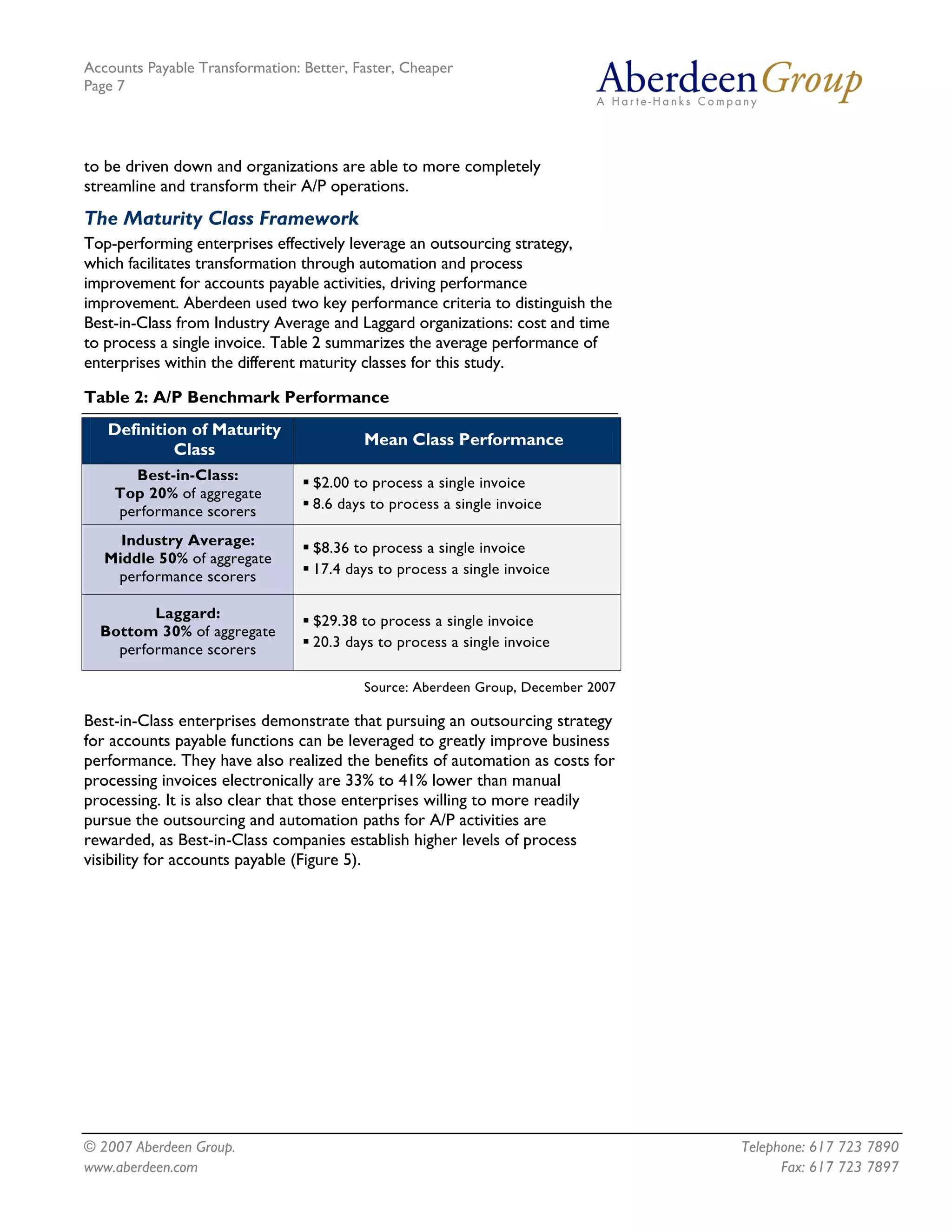

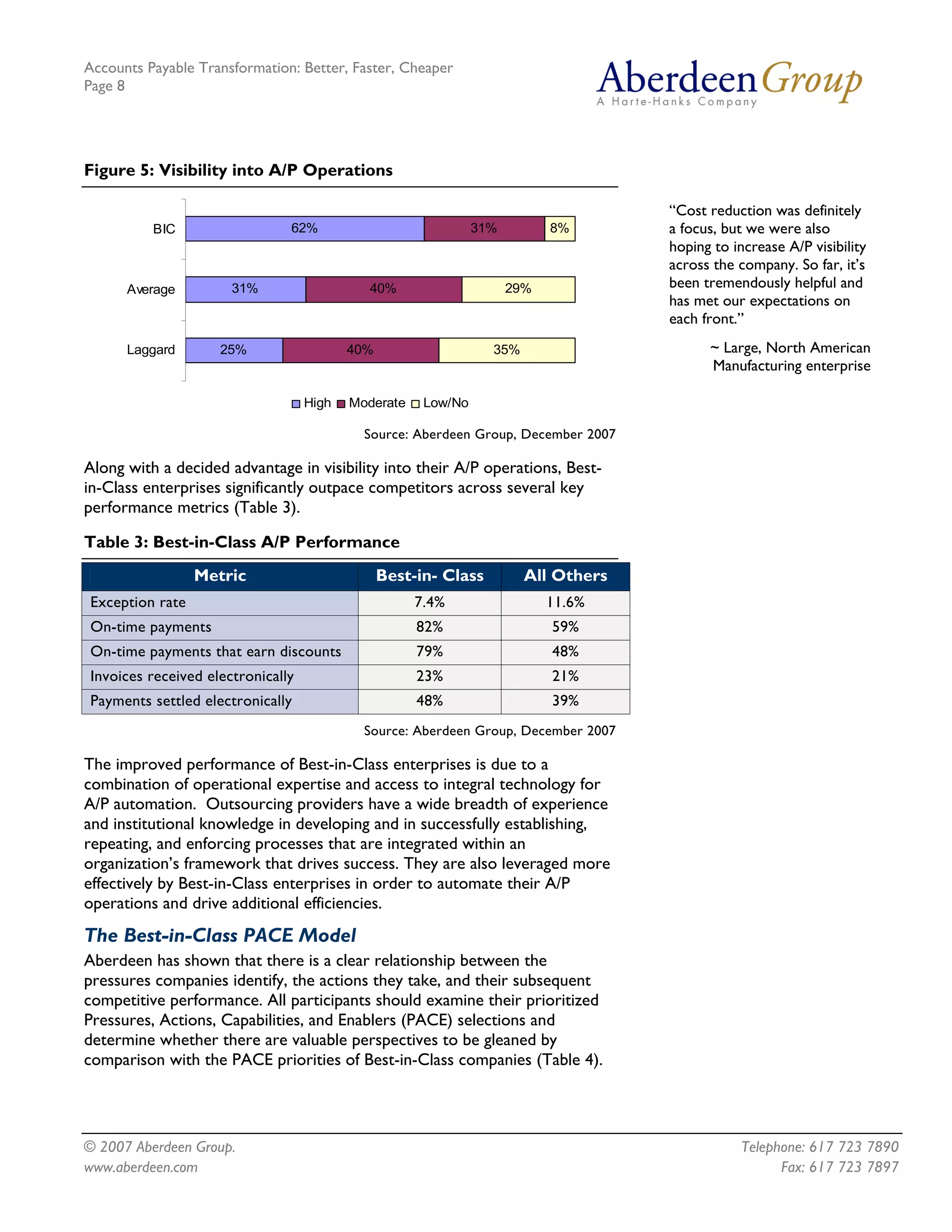

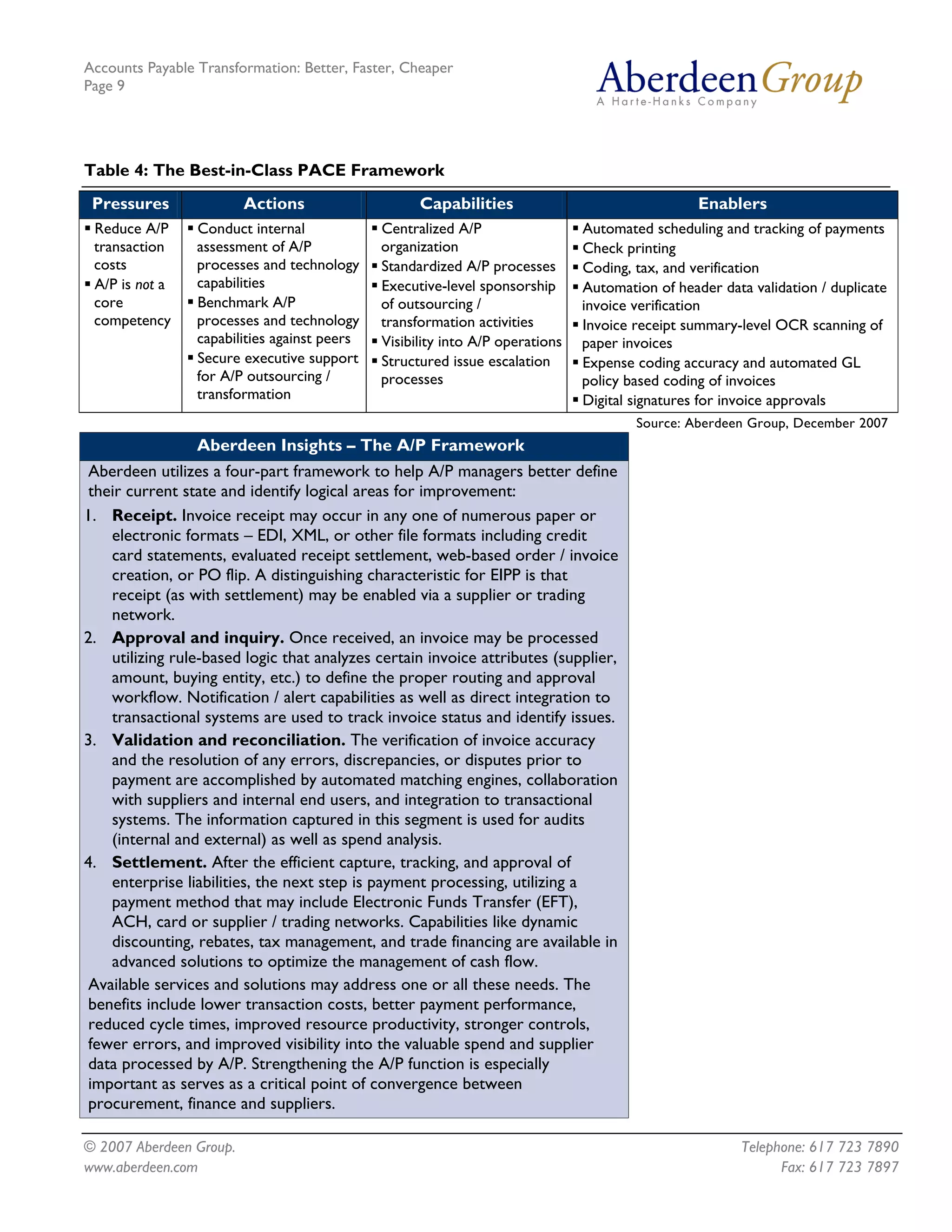

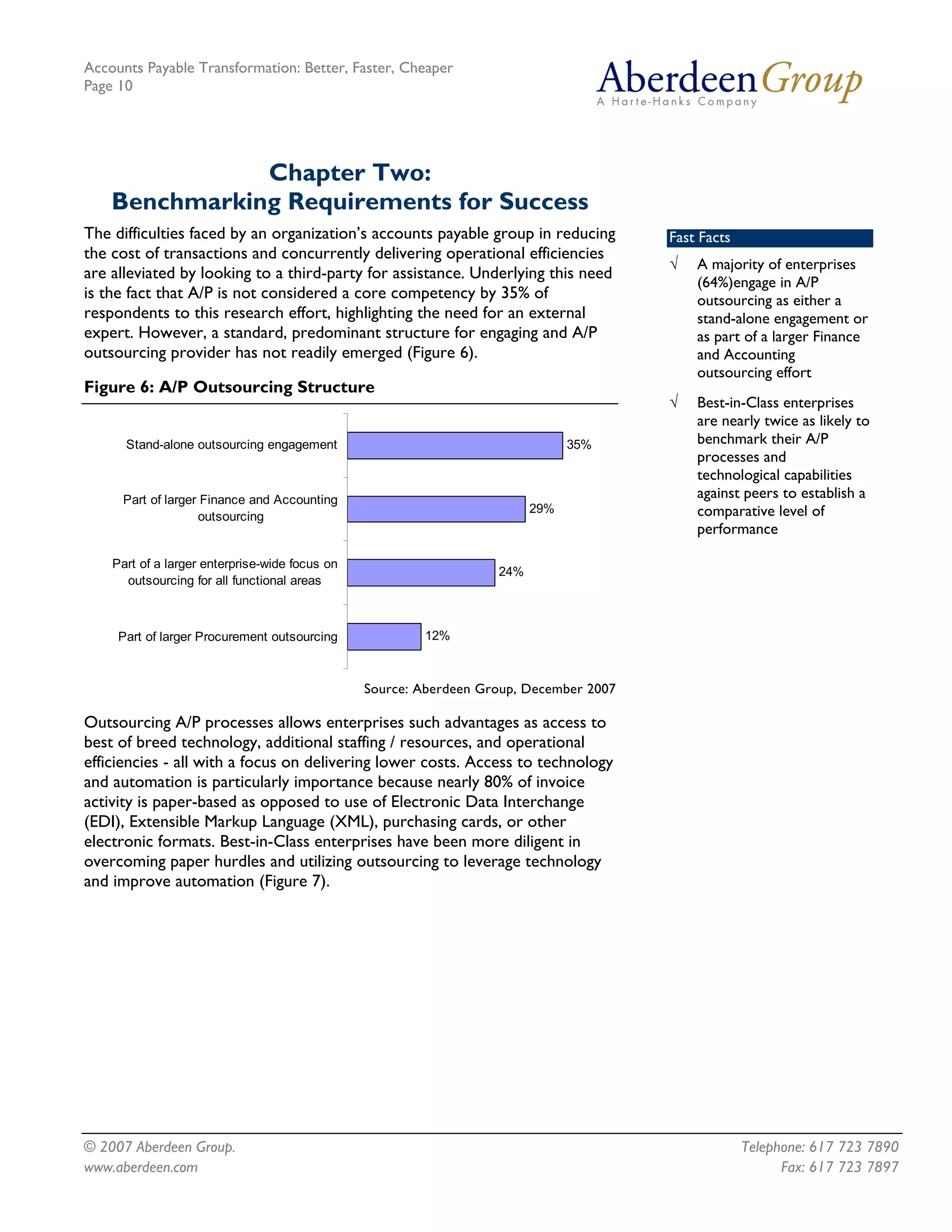

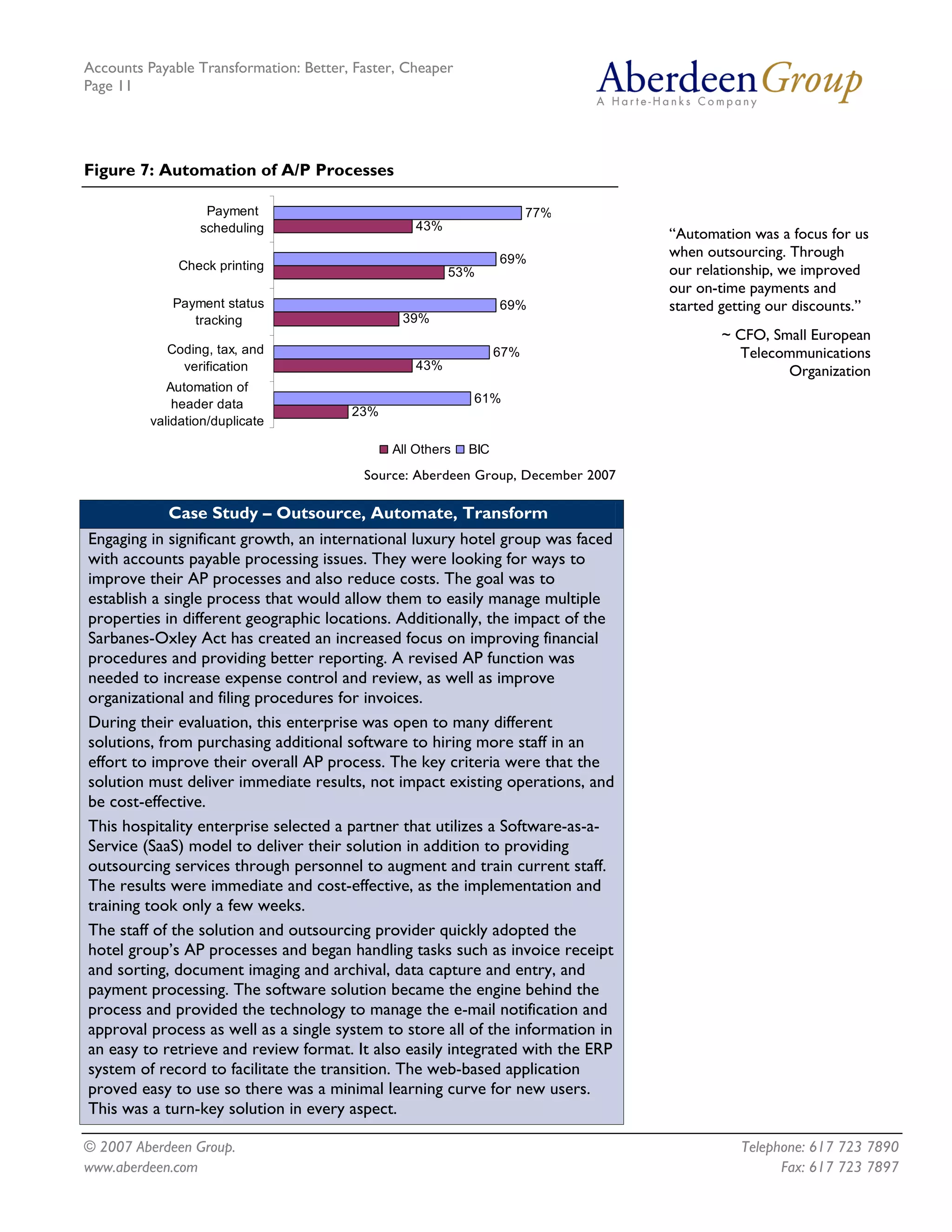

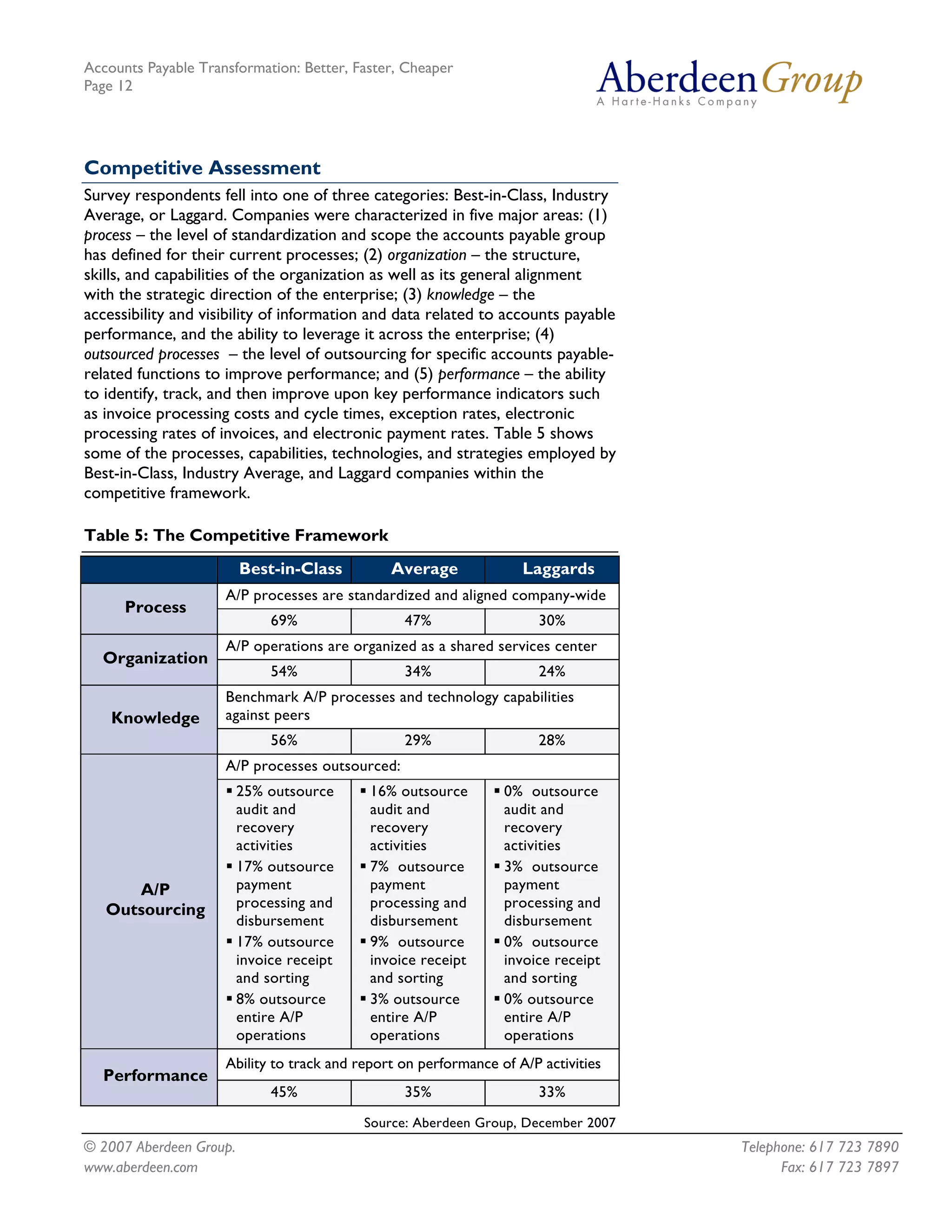

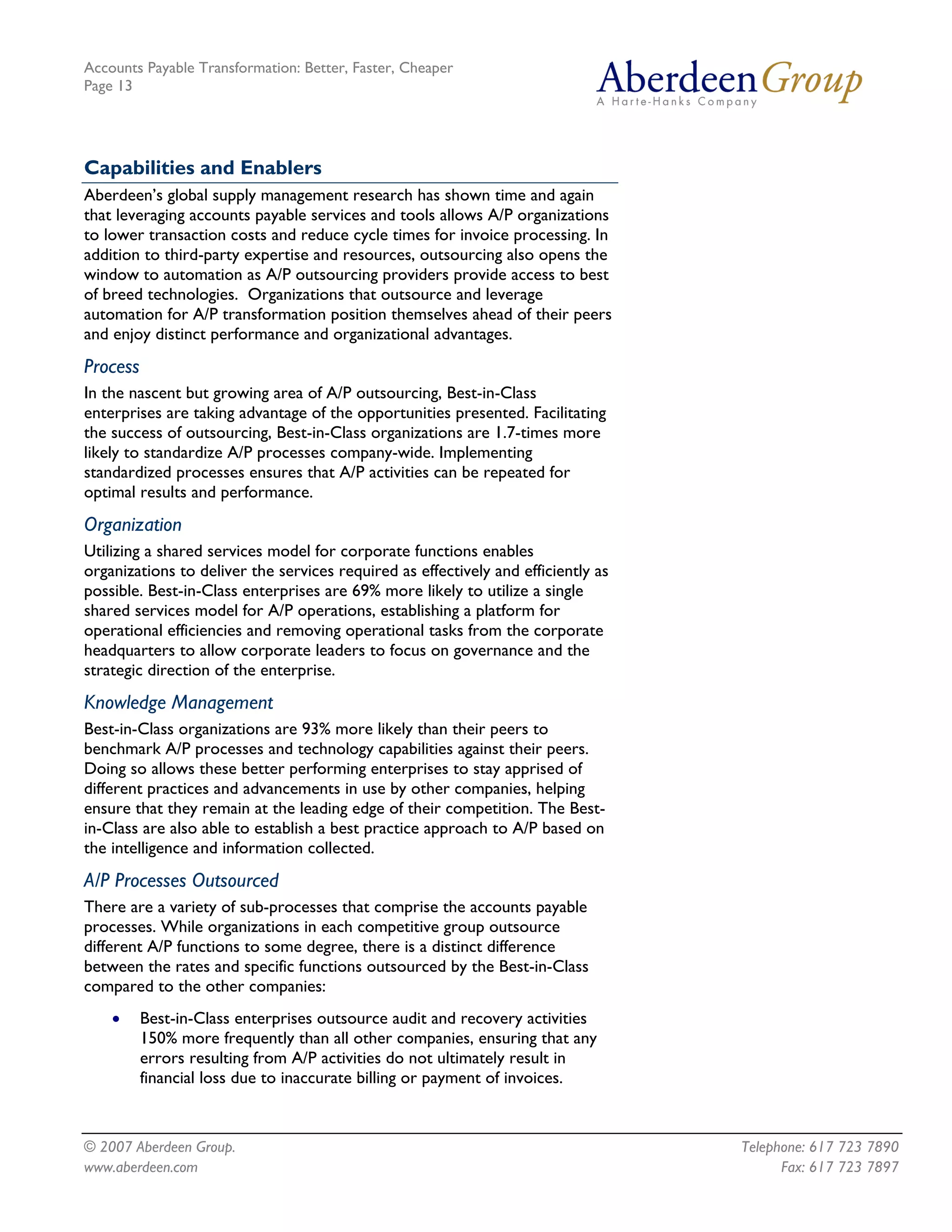

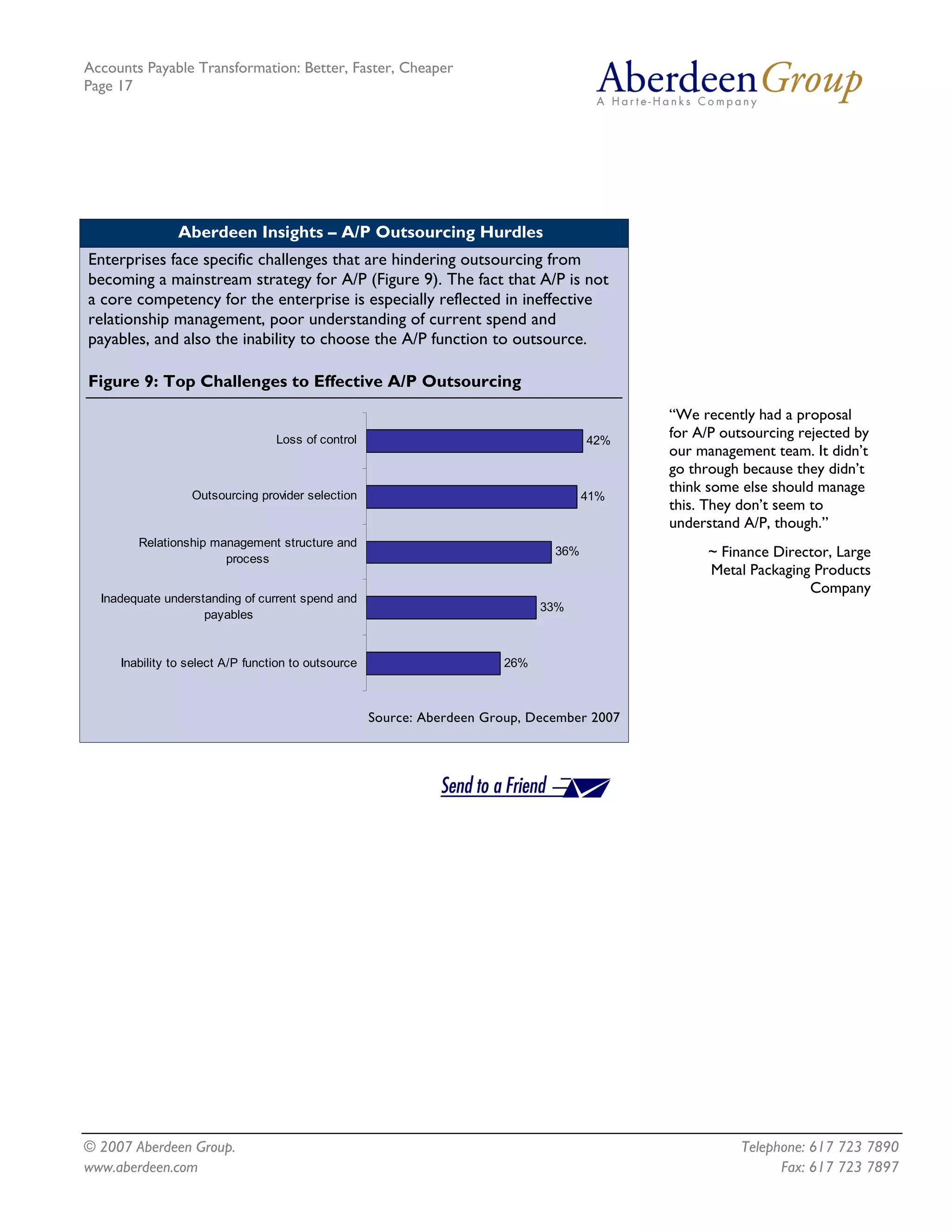

The document discusses accounts payable (A/P) transformation through outsourcing and automation. It finds that enterprises that outsource and automate their A/P functions experience 88% lower invoice processing costs, 52% faster invoice processing times, and 66% higher on-time payment rates compared to others. These "Best-in-Class" enterprises are more likely to standardize A/P operations, utilize shared services centers, and benchmark their processes. The document provides recommendations for enterprises to evaluate their A/P competencies, gain executive support, and implement a shared services center model to achieve better A/P performance.