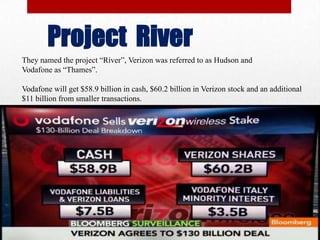

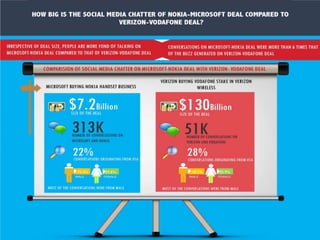

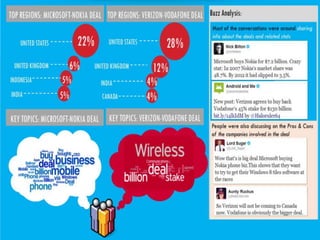

Under two separate deals, Microsoft acquired Nokia's devices and services division to strengthen its position in smartphones, while Verizon and Vodafone parted ways to enhance their own products and services. The Verizon-Vodafone deal will see Verizon acquire Vodafone's 45% stake in their joint U.S. venture Verizon Wireless for $130 billion, allowing Verizon full access to profits from the largest U.S. mobile operator. The Microsoft-Nokia deal involves Microsoft purchasing Nokia's handset business and licensing its patents for $7.2 billion in an effort to improve its mobile offerings, but faces challenges in reviving the declining Nokia brand.