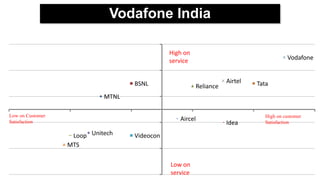

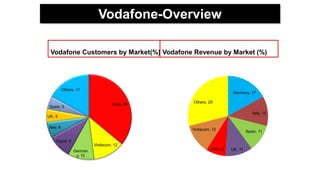

Vodafone acquired a majority stake in Hutchison Essar in 2007 and fully acquired the company in 2011. It has since grown to become one of the largest mobile operators in India, serving over 15% of the country's subscribers. Vodafone focuses on offering strong network coverage and quality customer service while facing competition from other major players like Airtel and Reliance. It performs market research to understand Indian consumers and tailor its brand and offerings accordingly.