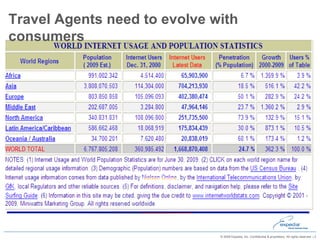

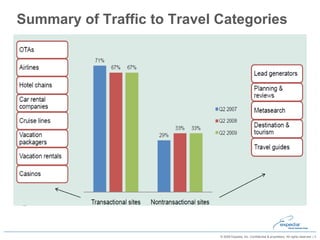

This document discusses the effects of the internet on travel and how consumers, intermediaries, and suppliers have adapted. Some key points:

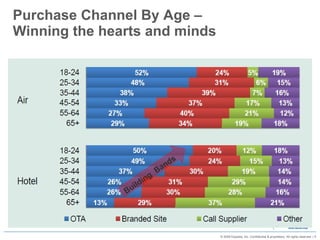

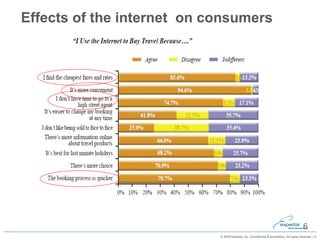

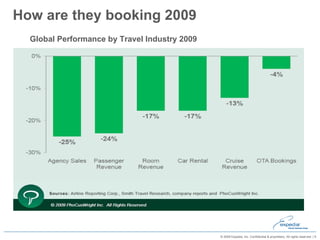

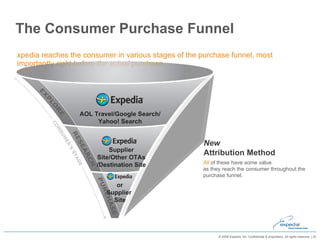

- The internet has changed how people search for and book travel, with many now booking directly online rather than through travel agents.

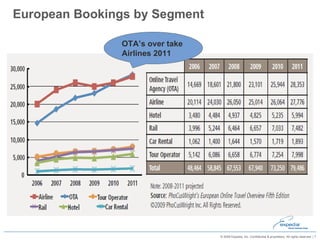

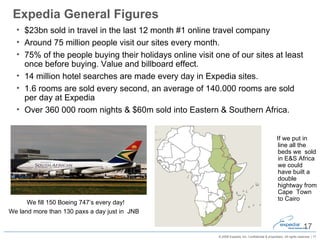

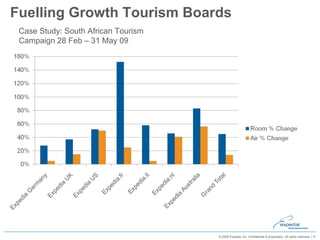

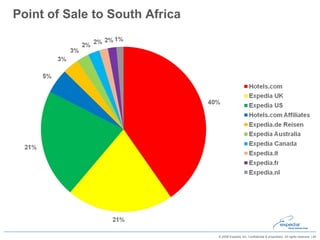

- Online travel agencies like Expedia have seen significant growth and now compete directly with airlines and hotels for bookings.

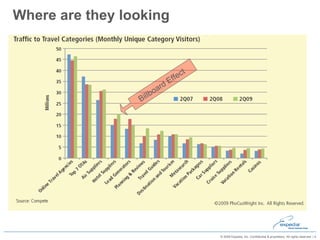

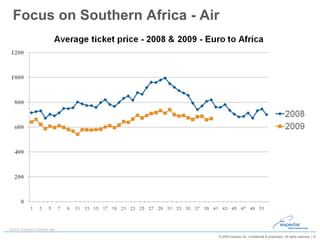

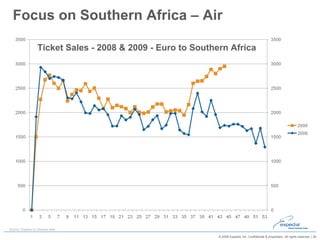

- Travel suppliers have had to develop an online presence to reach customers searching and booking online. Working with sites like Expedia gives suppliers global distribution and access to their customer base.

- Data shows a "billboard effect" where being listed on Expedia and other sites drives additional direct bookings to the supplier's own

![Thank You & Questions ? [email_address] www.joinexpedia.com](https://image.slidesharecdn.com/vodacombusiness-091202225546-phpapp01/85/Expedia-51-320.jpg)