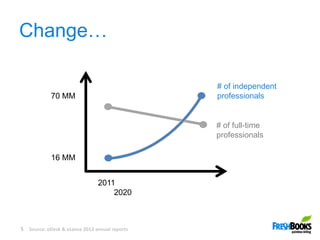

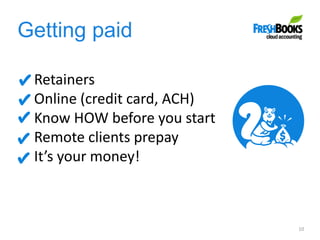

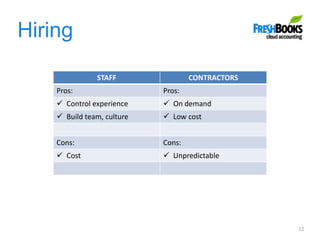

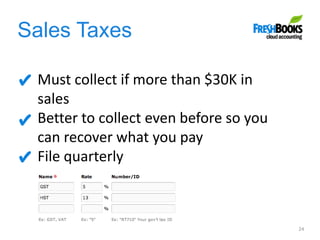

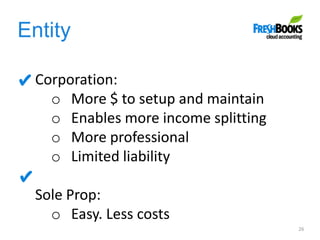

The document discusses financial management for freelancers, highlighting FreshBooks as a leading cloud accounting platform. It covers essential topics such as making and spending money, accounting basics, funding strategies, and the importance of having a clear financial plan. The presentation emphasizes valuable pricing strategies, invoicing, and best practices in managing expenses and financial documentation.