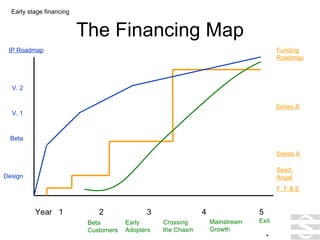

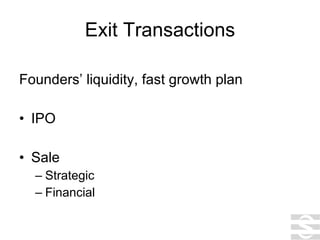

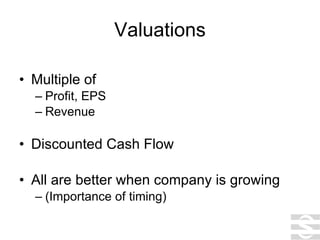

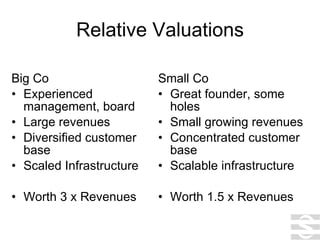

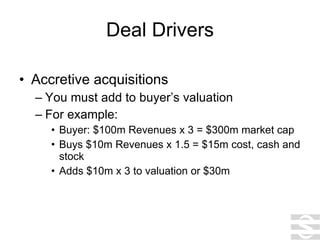

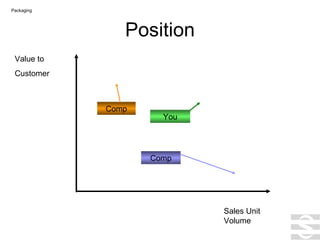

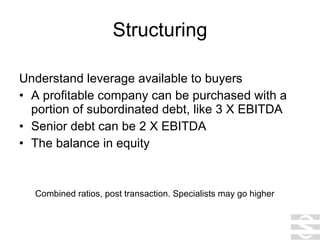

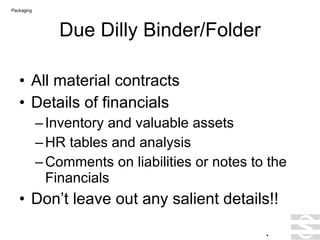

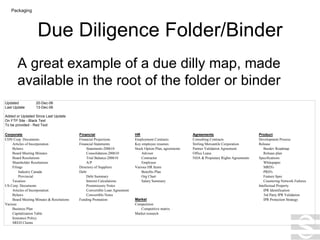

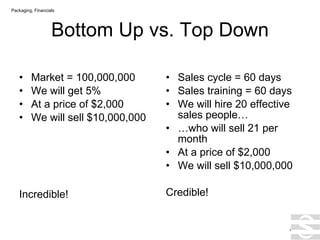

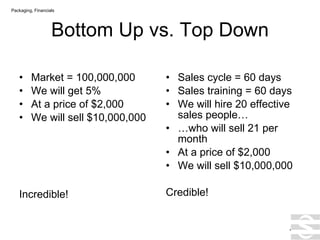

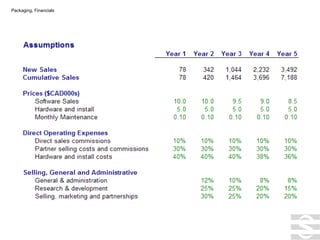

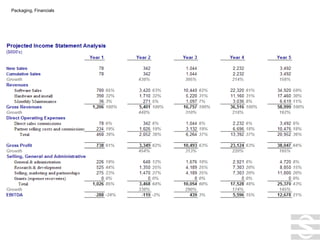

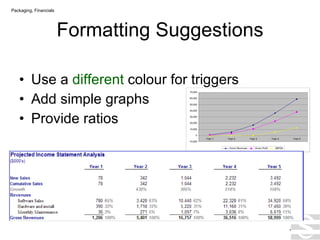

The document provides information about Stirling Mercantile, a corporate finance advisory firm. It discusses goals for building a business, exit strategies, and considerations for planning an exit from the outset. Key points include planning for an exit, understanding potential buyers and service providers, positioning value, structuring a deal, due diligence, and financial modeling best practices.