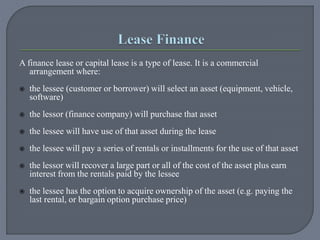

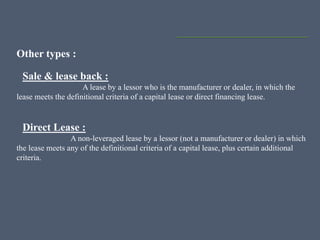

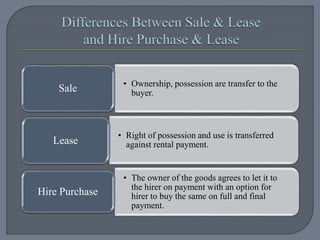

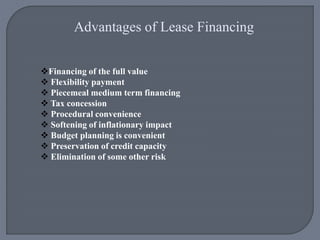

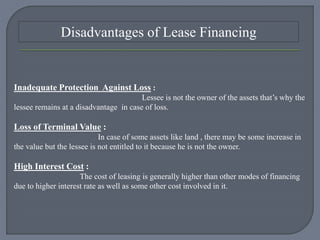

This document discusses leasing and different types of leases. It defines leasing as a method of financing where the lessor retains ownership of an asset while allowing the lessee to use it by paying rentals over time. There are two main types of leases: finance/capital leases where the lessee selects an asset and pays rentals to cover its full cost, and operating leases for assets used for less than their full economic life. Real estate leasing involves renting property through a rental agreement or lease. The document also outlines advantages like financing flexibility and tax benefits, and disadvantages such as inadequate protection for the lessee and higher interest costs compared to other financing modes.