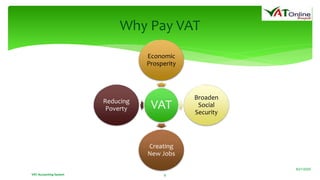

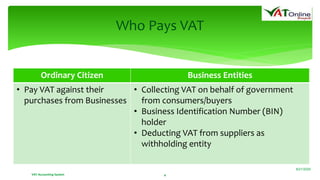

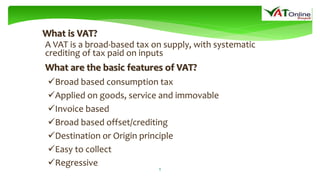

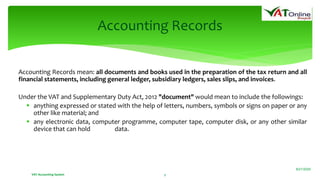

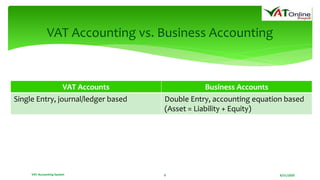

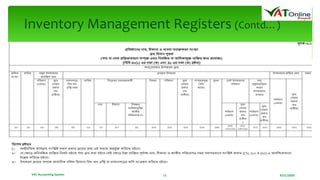

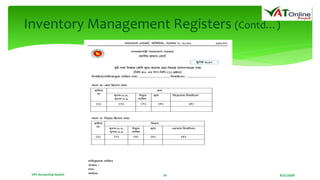

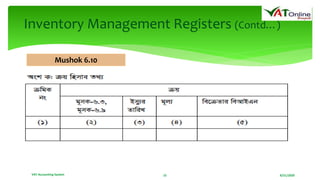

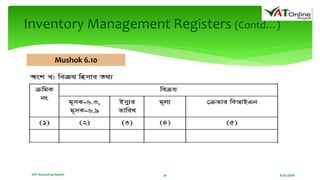

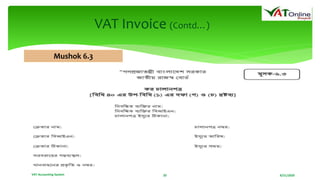

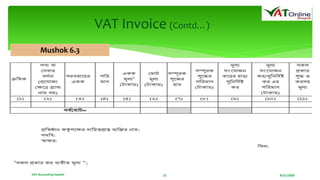

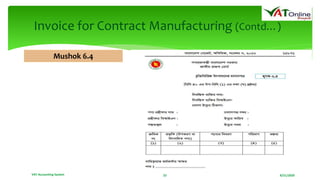

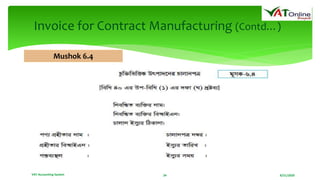

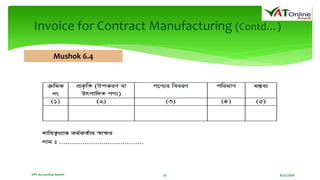

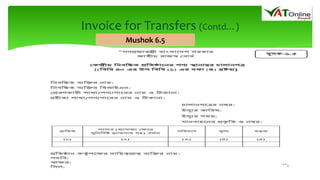

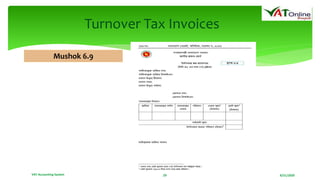

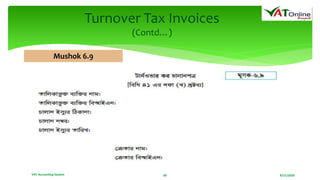

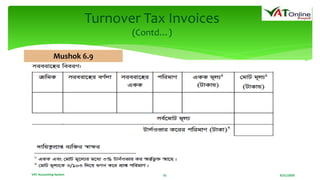

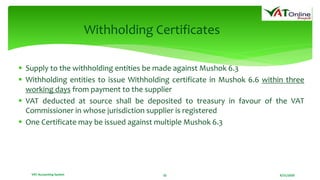

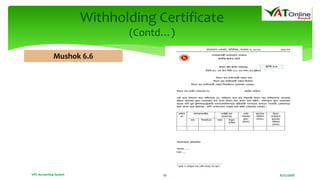

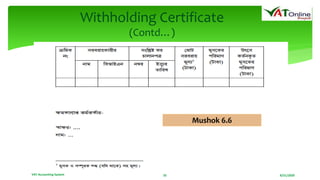

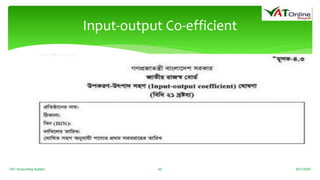

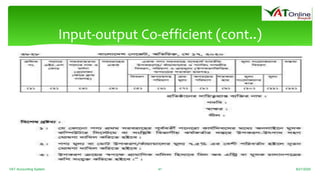

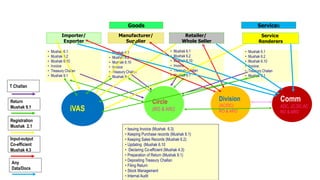

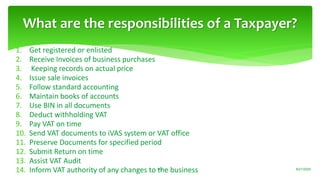

The document provides an overview of VAT accounting systems in Bangladesh. It discusses key aspects of VAT accounting including why VAT is paid, who pays VAT, what VAT is, maintaining proper accounting records, inventory management registers, VAT and turnover tax invoices, withholding certificates, credit and debit notes, input-output coefficients, and the responsibilities of taxpayers. The goal is to educate taxpayers on proper VAT accounting procedures and compliance with VAT laws and regulations in Bangladesh.