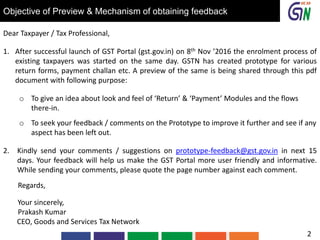

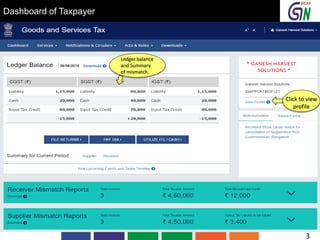

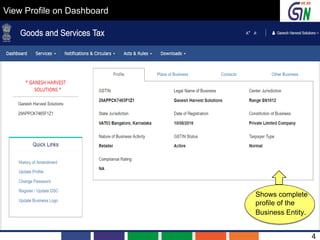

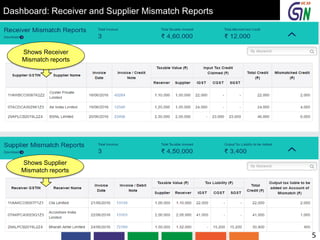

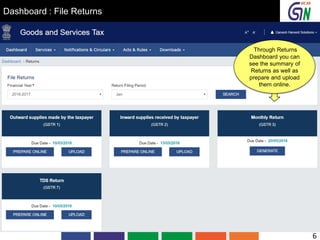

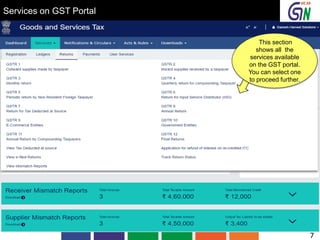

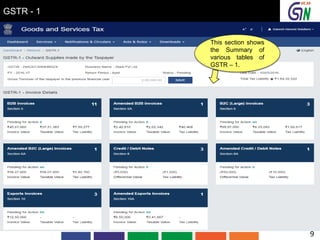

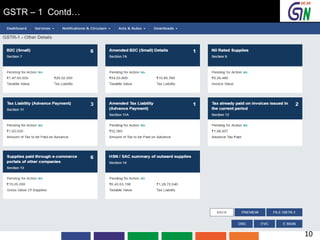

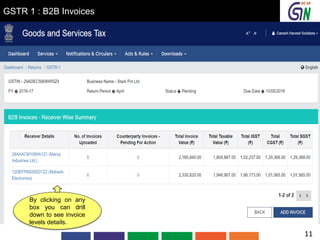

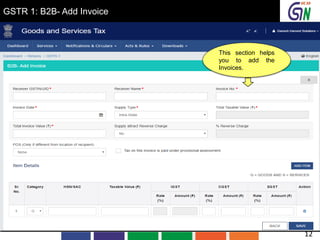

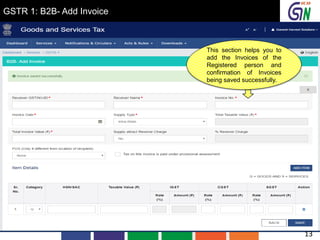

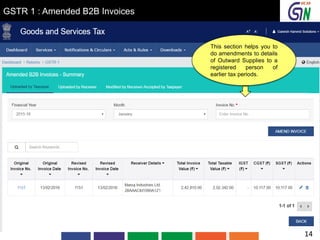

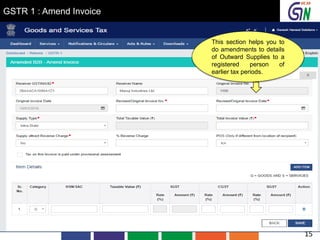

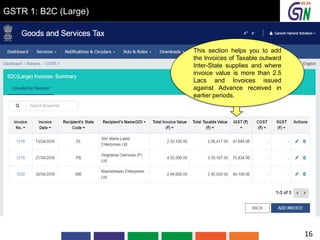

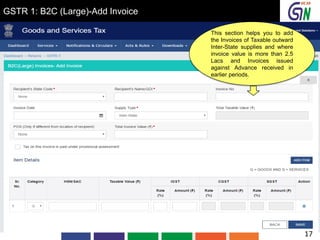

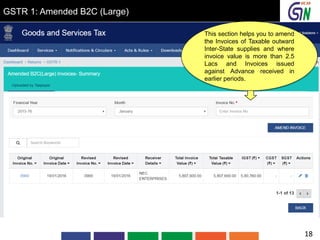

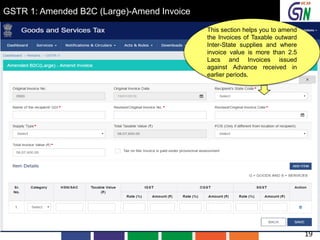

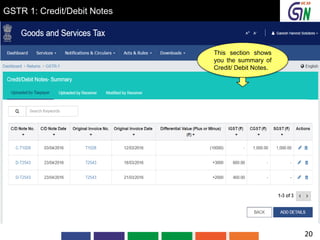

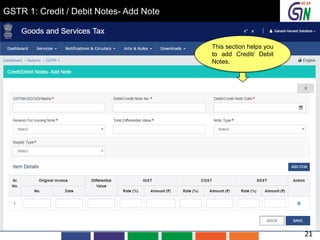

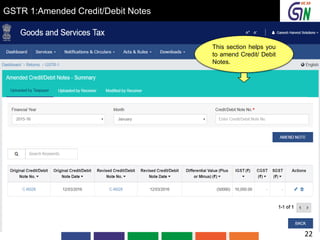

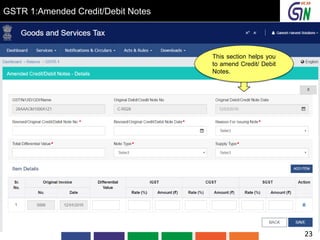

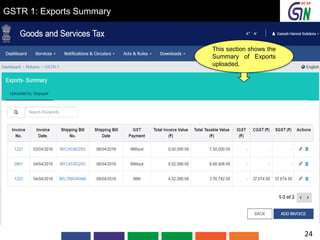

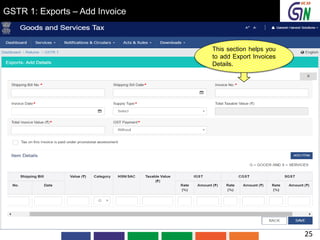

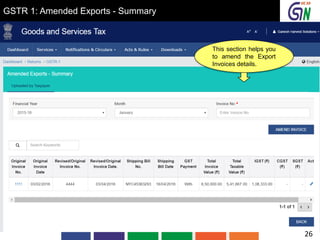

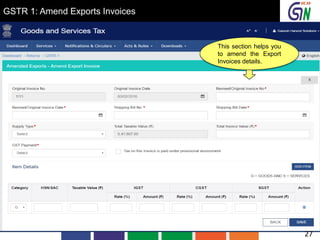

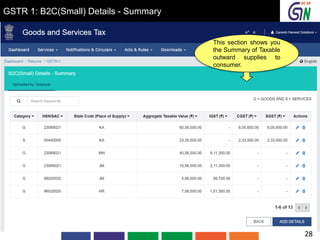

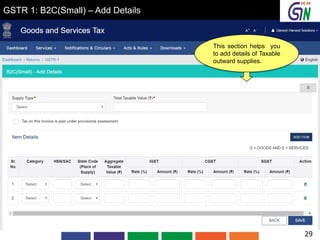

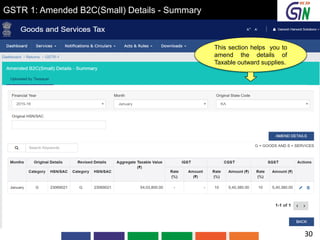

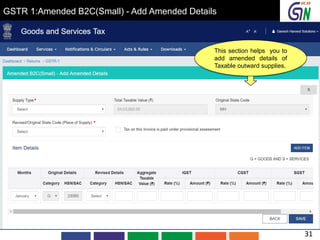

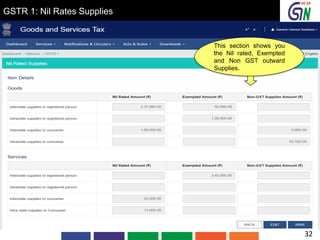

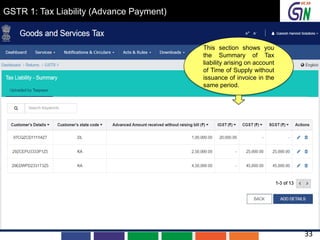

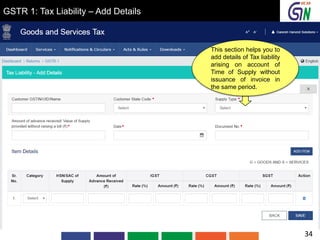

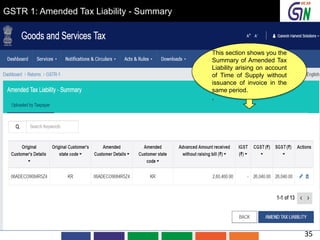

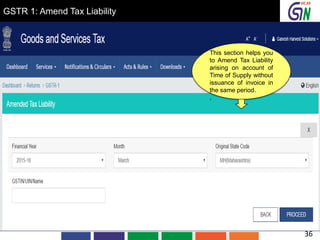

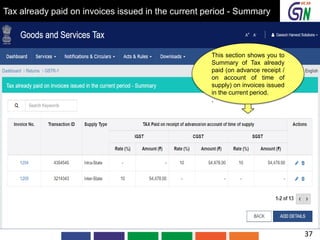

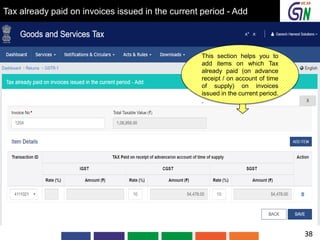

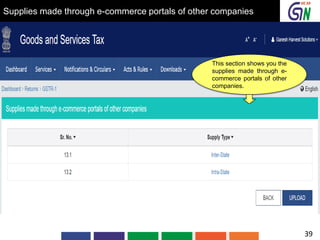

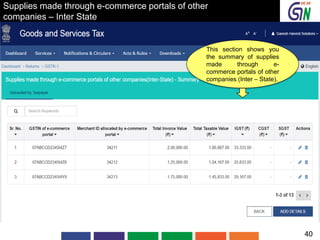

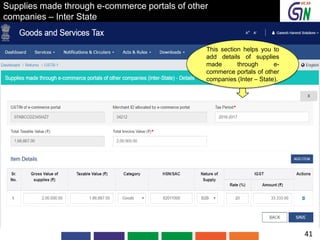

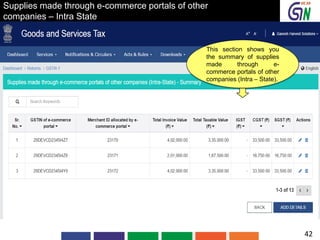

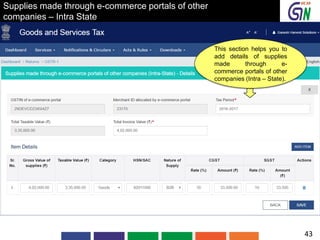

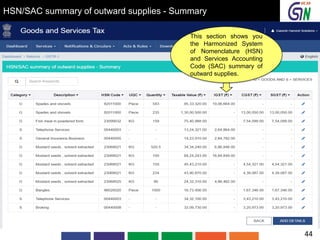

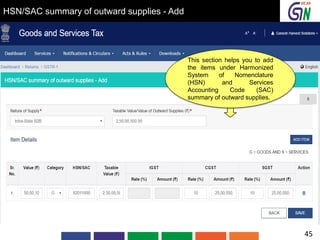

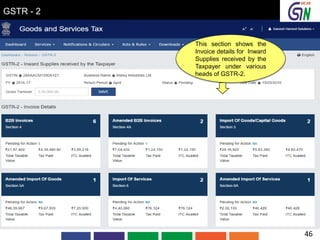

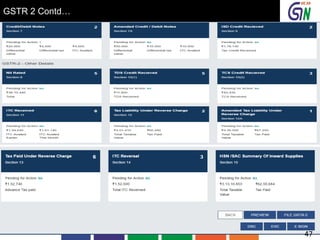

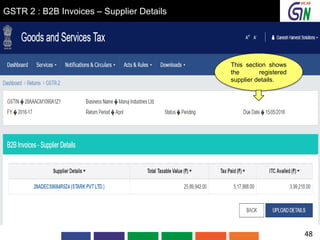

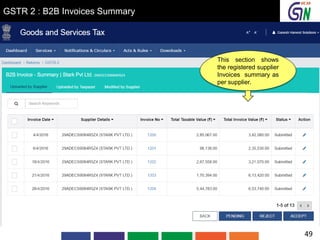

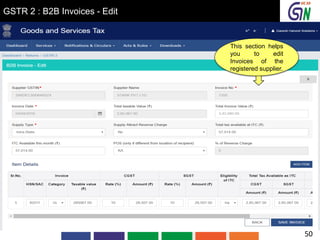

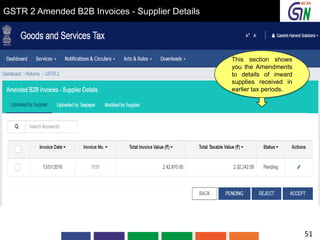

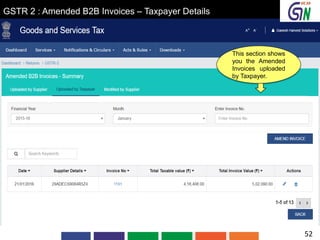

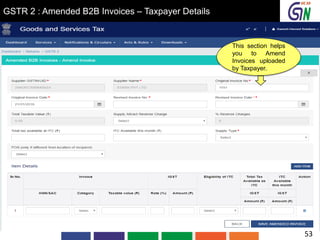

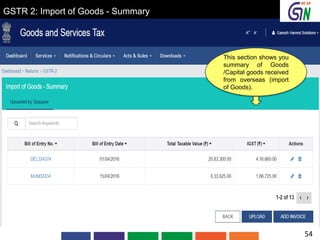

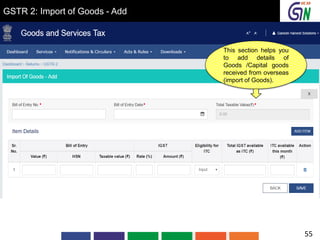

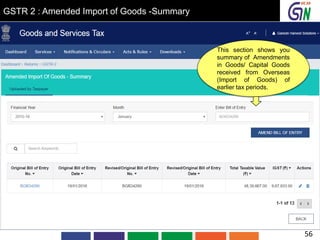

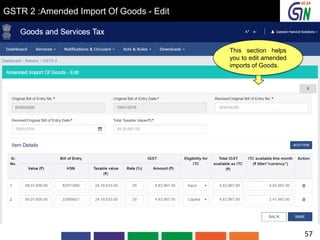

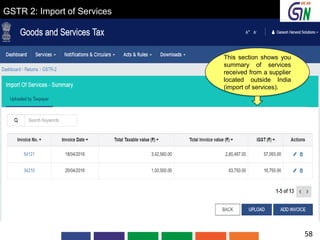

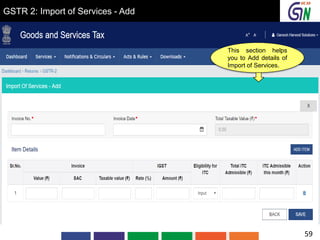

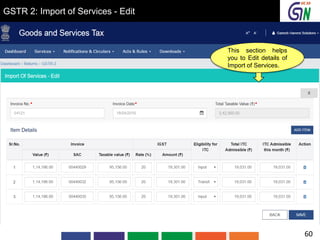

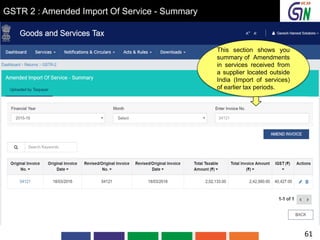

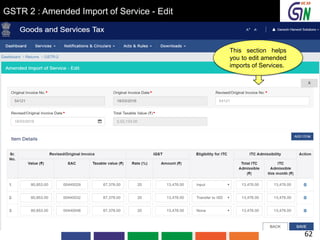

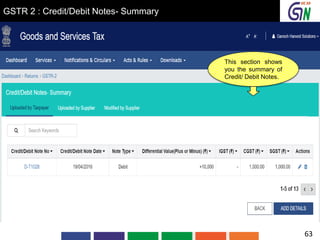

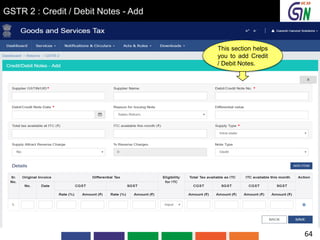

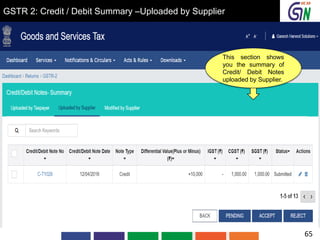

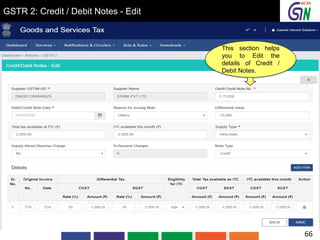

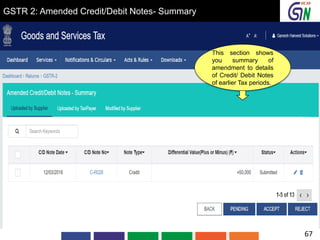

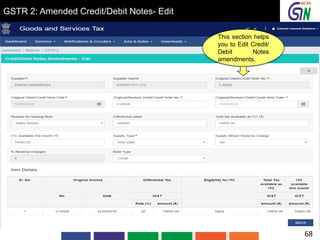

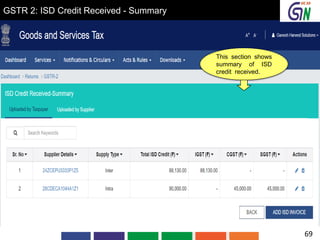

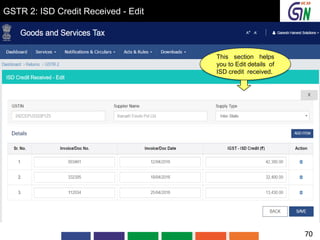

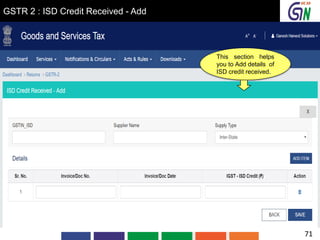

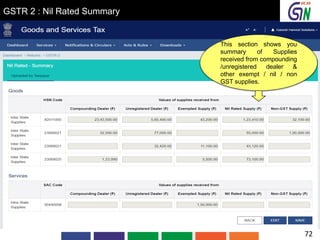

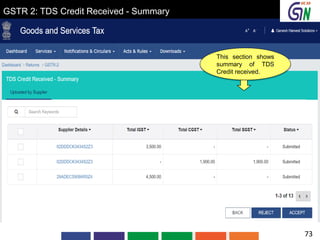

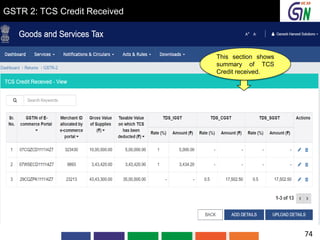

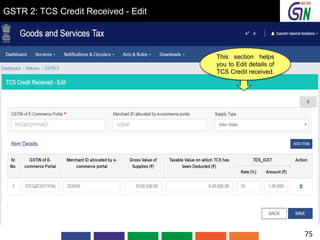

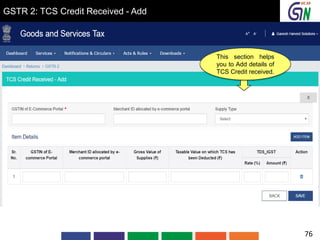

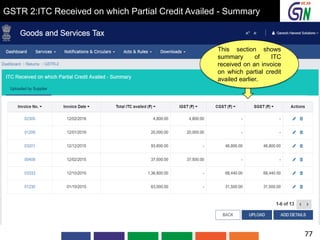

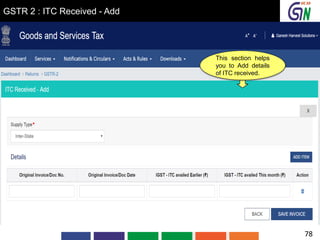

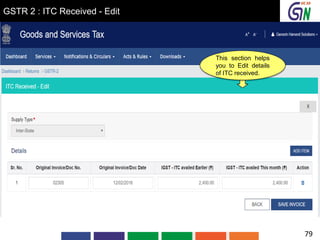

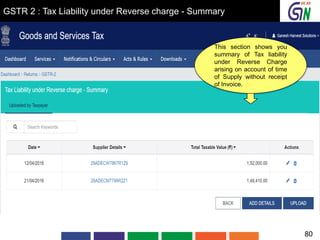

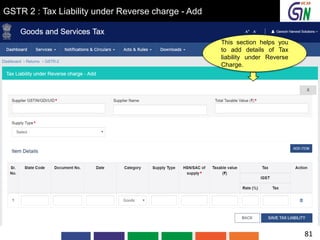

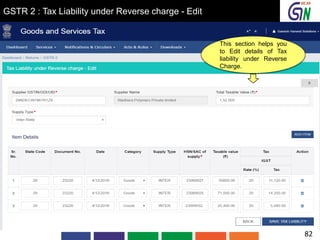

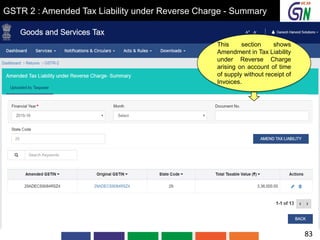

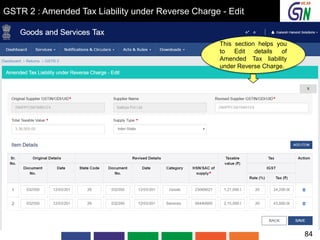

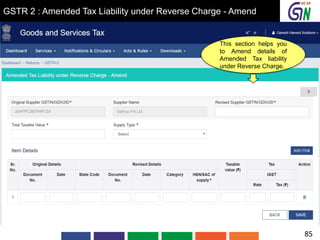

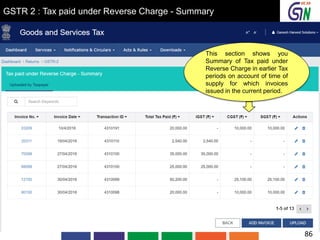

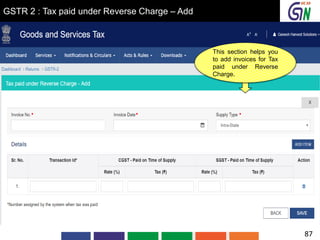

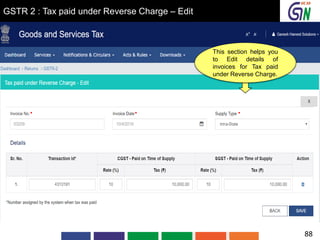

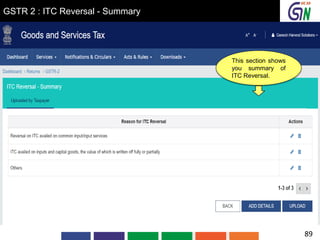

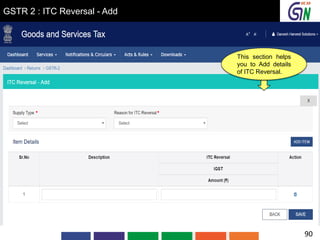

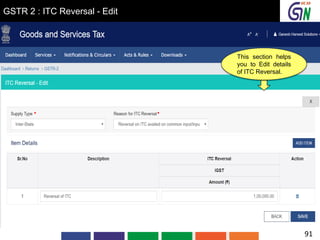

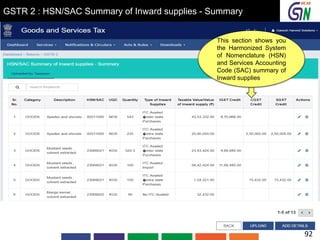

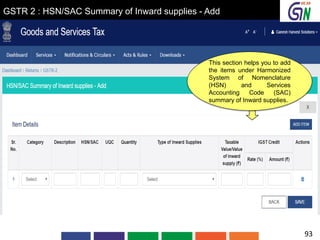

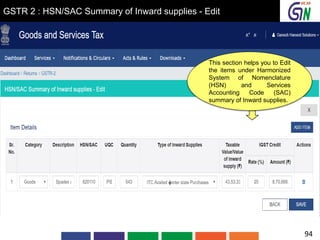

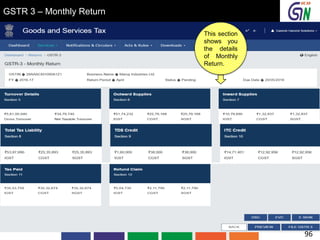

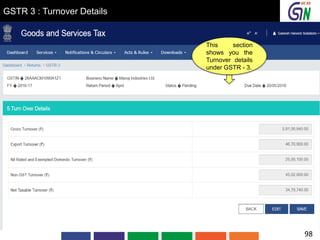

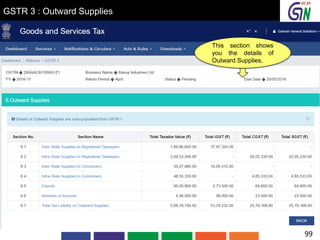

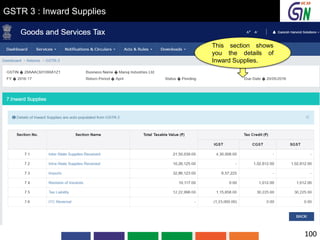

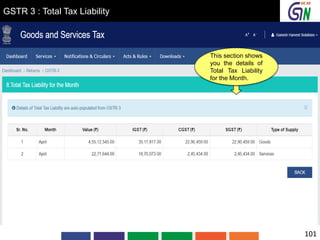

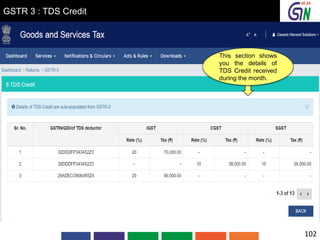

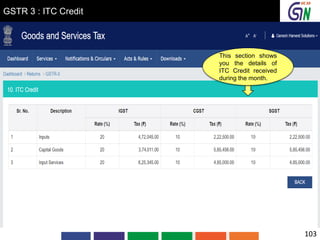

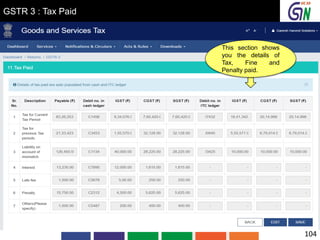

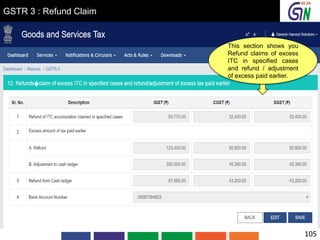

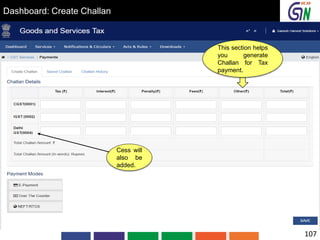

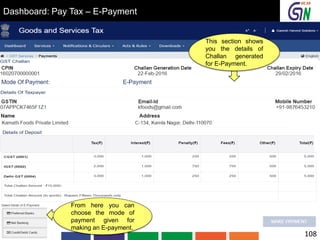

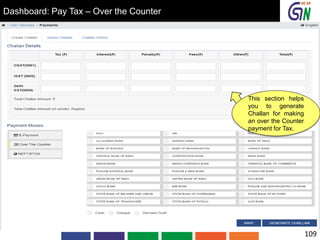

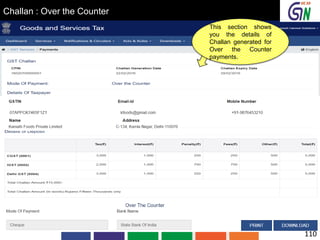

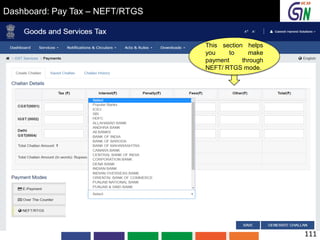

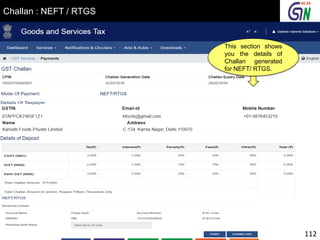

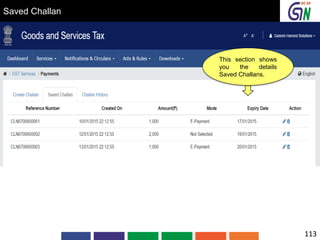

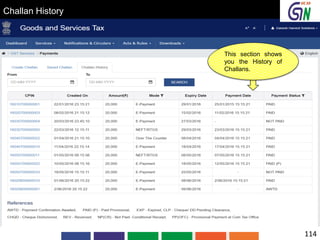

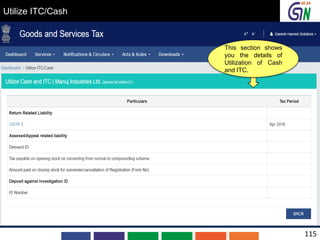

The document provides a preview of the return and payment modules of the Goods and Services Tax (GST) portal. It includes prototypes of various return forms and payment challans to give taxpayers an idea of how these sections will look and function. Feedback is sought within 15 days on ways to improve the prototypes and ensure all necessary aspects are included. The summaries then describe the different sections and functionalities within the return filing (GSTR-1 and GSTR-2) and monthly return (GSTR-3) modules of the portal.