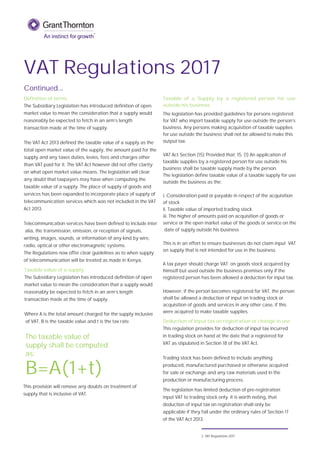

The VAT Regulations 2017, announced by the Cabinet Secretary for National Treasury, aim to clarify and streamline the VAT Act and improve compliance since their first draft in 2014. Key updates include definitions for taxable values, guidelines for electronic tax invoices, and clear documentation requirements for exports. The regulations also address VAT refunds and deductions on supplies, enhancing the overall framework for VAT administration in Kenya.