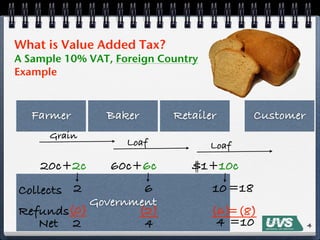

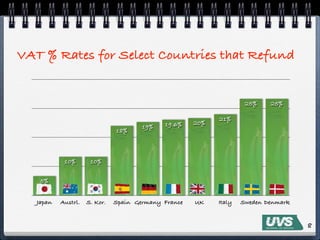

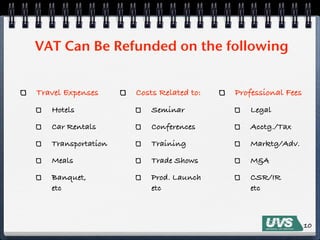

The document discusses Value Added Tax (VAT) as a recoverable tax on goods and services in various countries, highlighting the potential for significant refunds that companies often overlook. It outlines the requirements for VAT recovery, includes examples of refundable expenses, and emphasizes the importance of proper documentation. A proactive VAT recovery company offers services to maximize VAT recovery for businesses at a contingent fee basis.