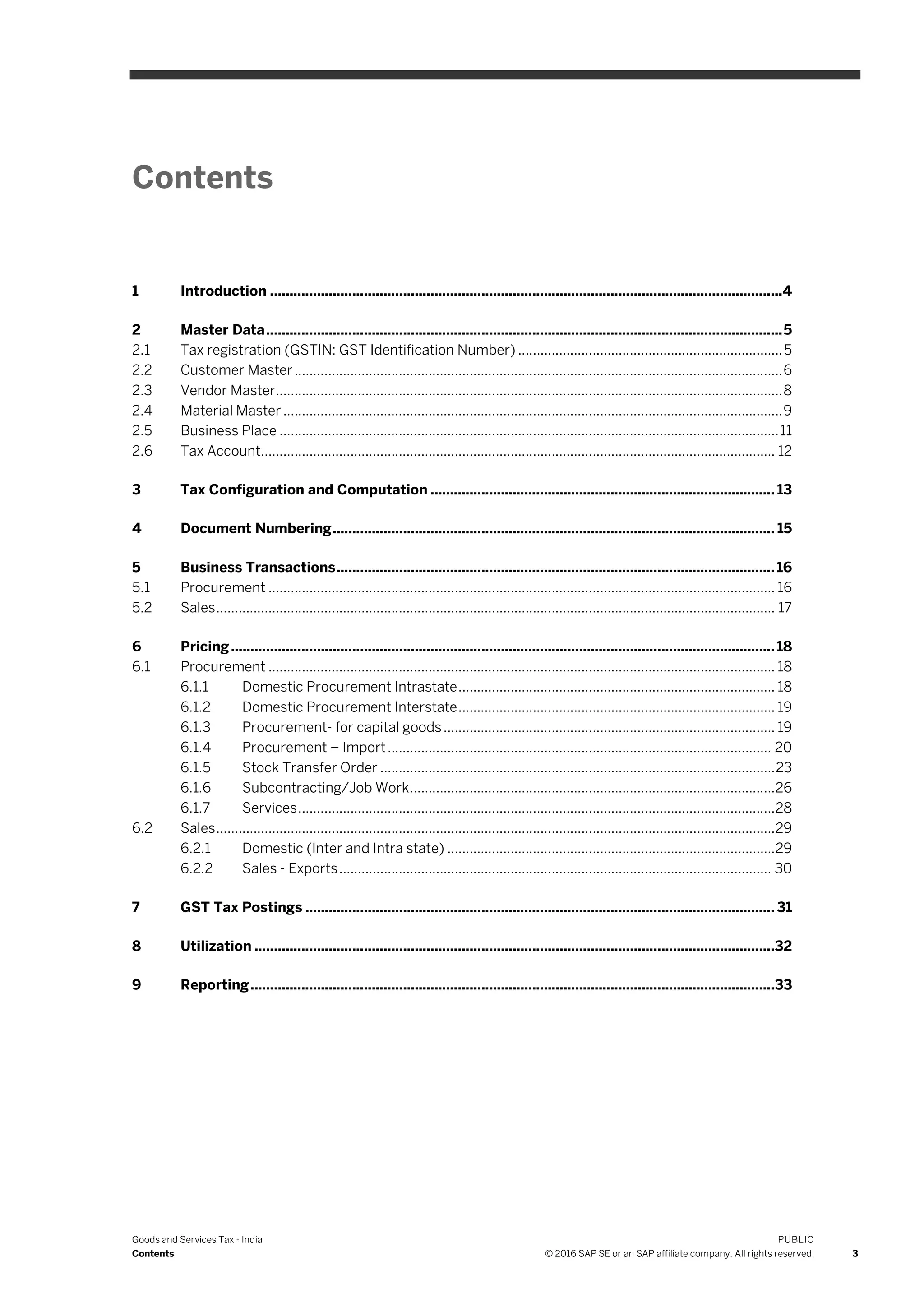

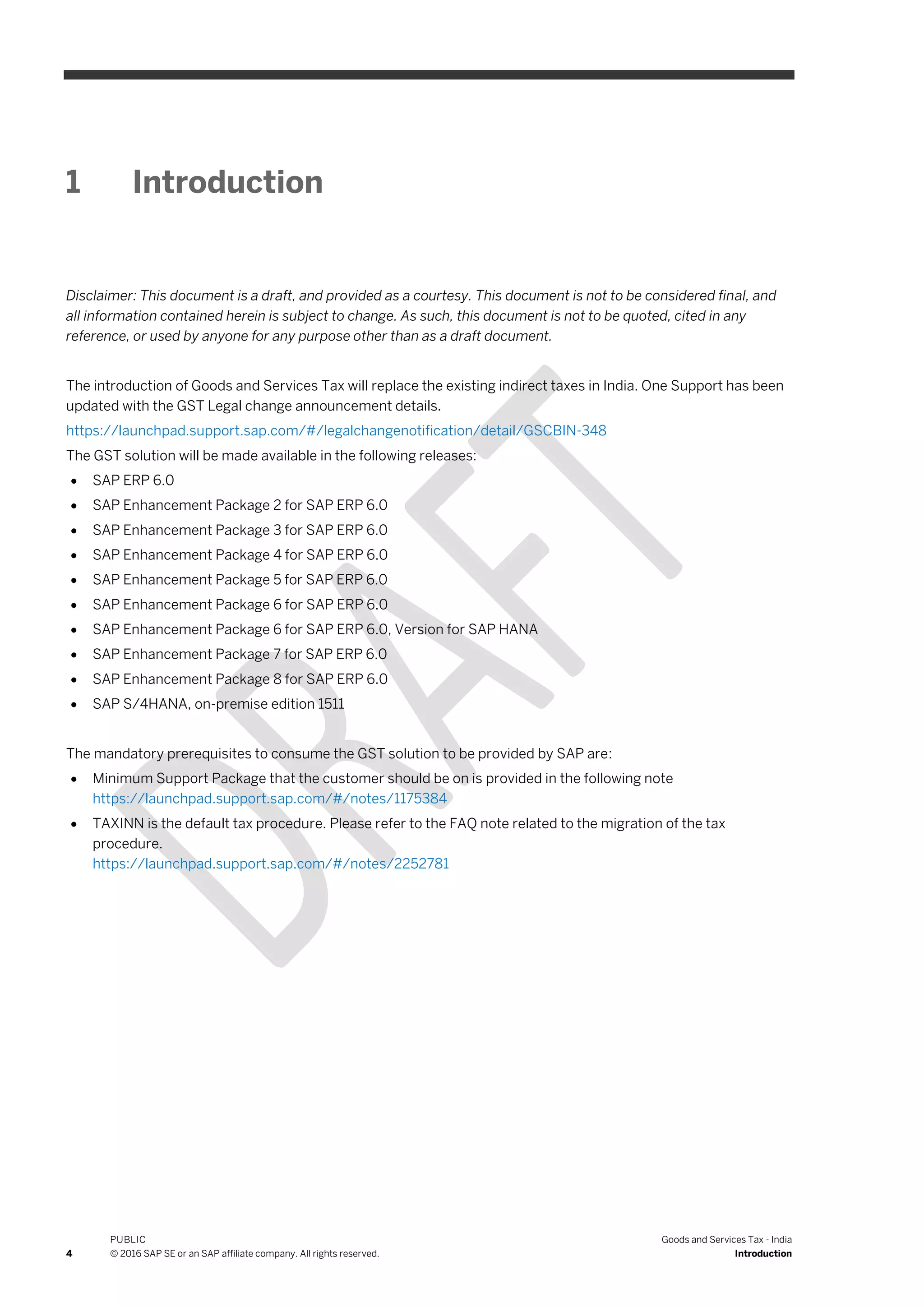

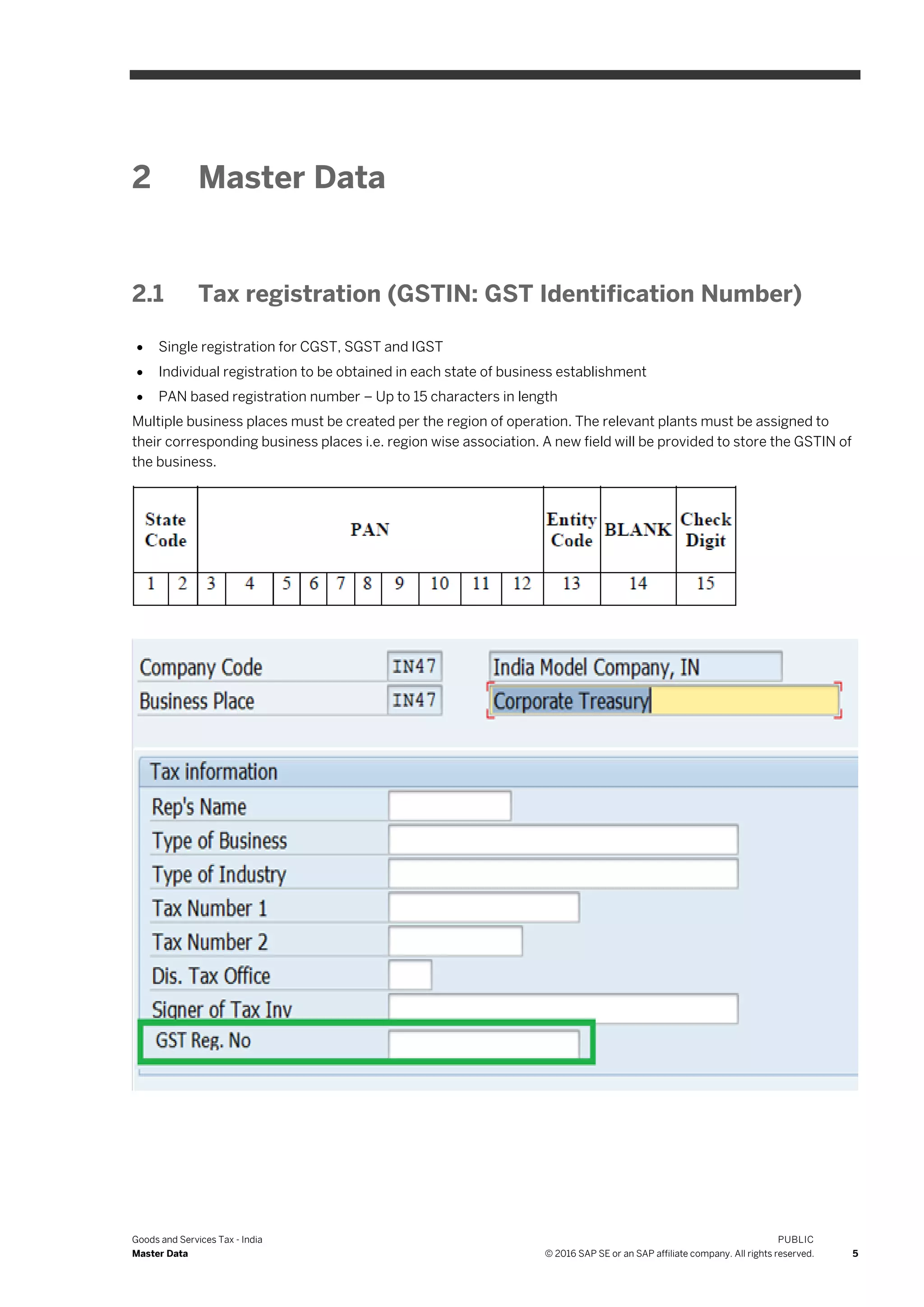

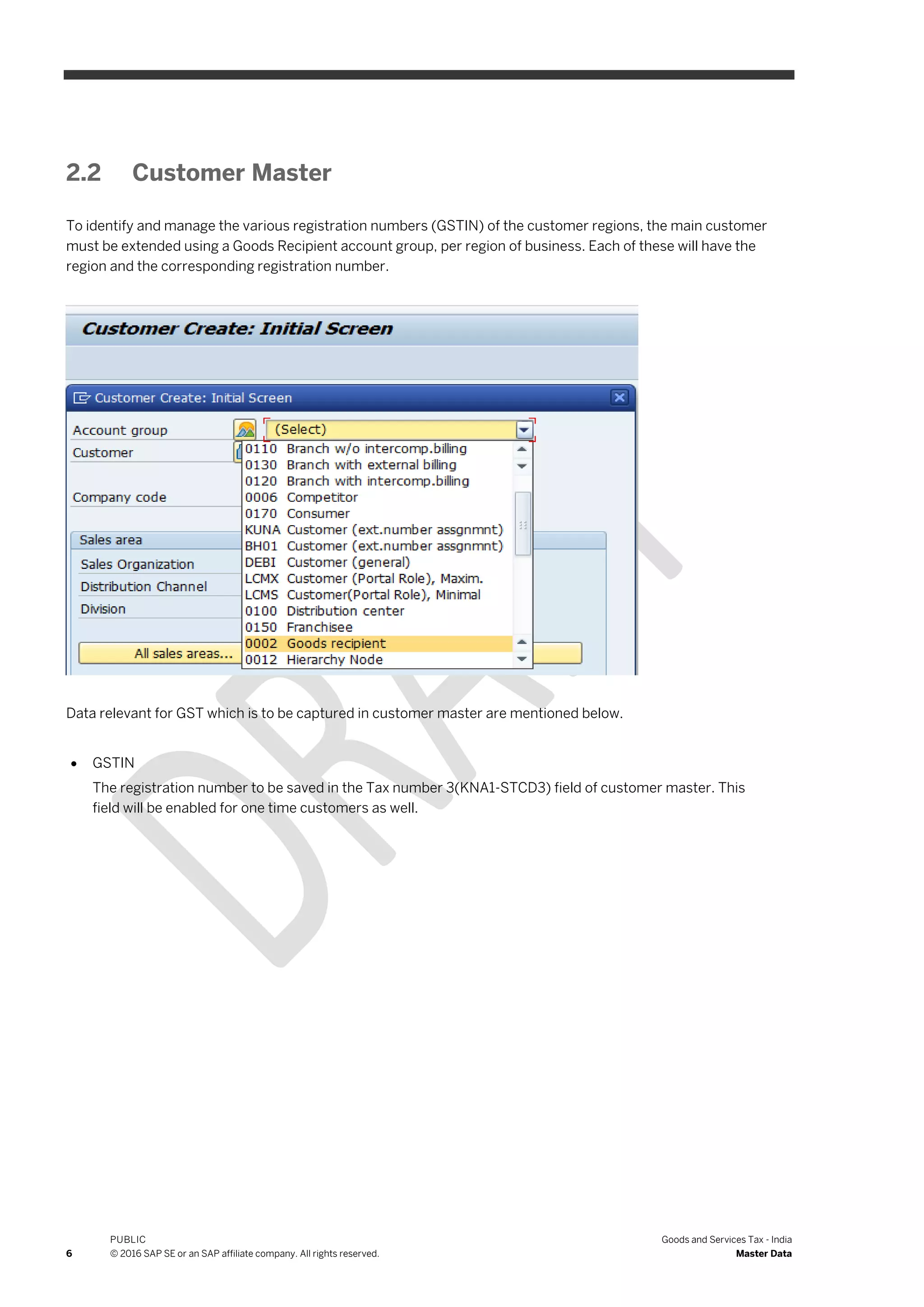

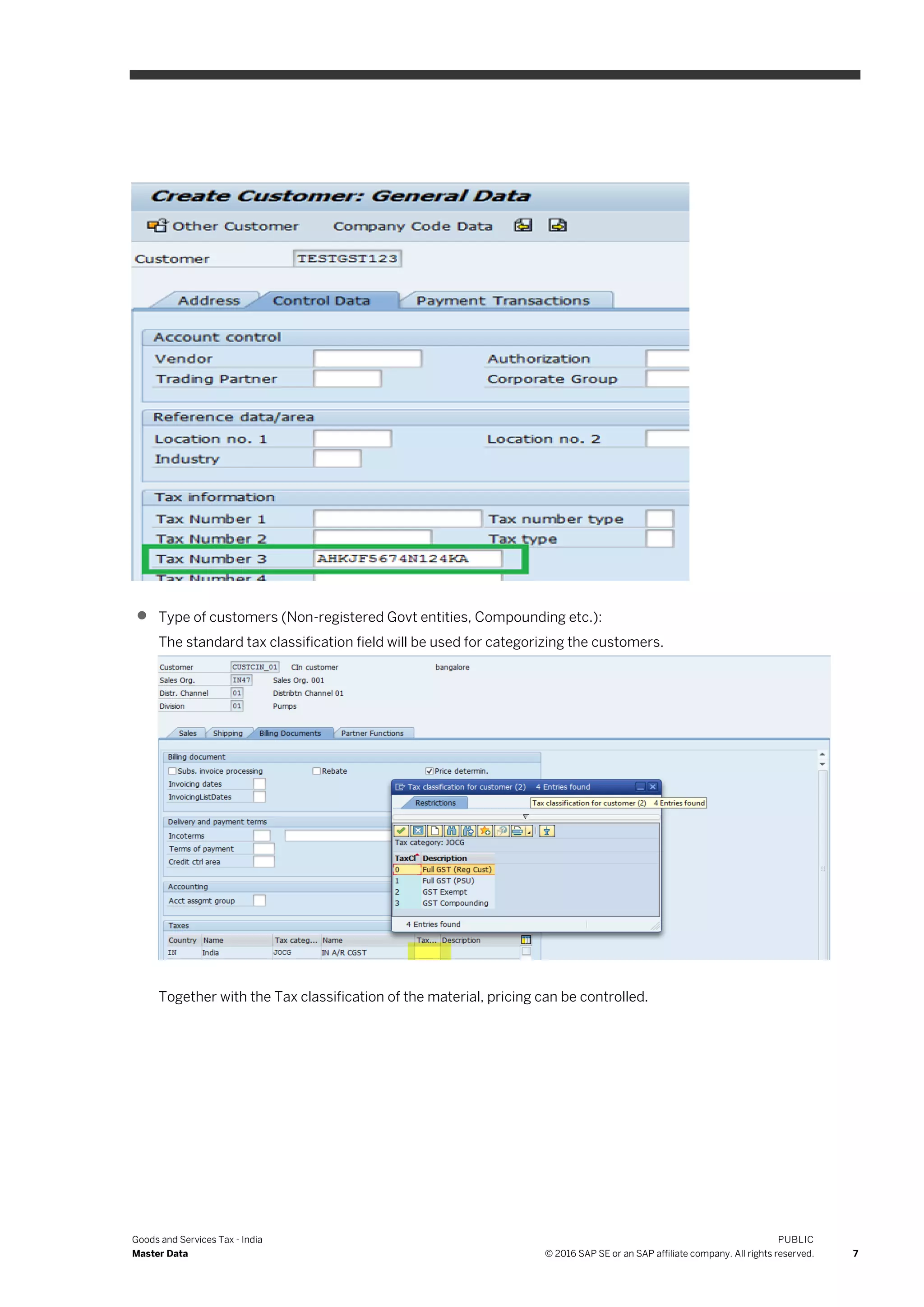

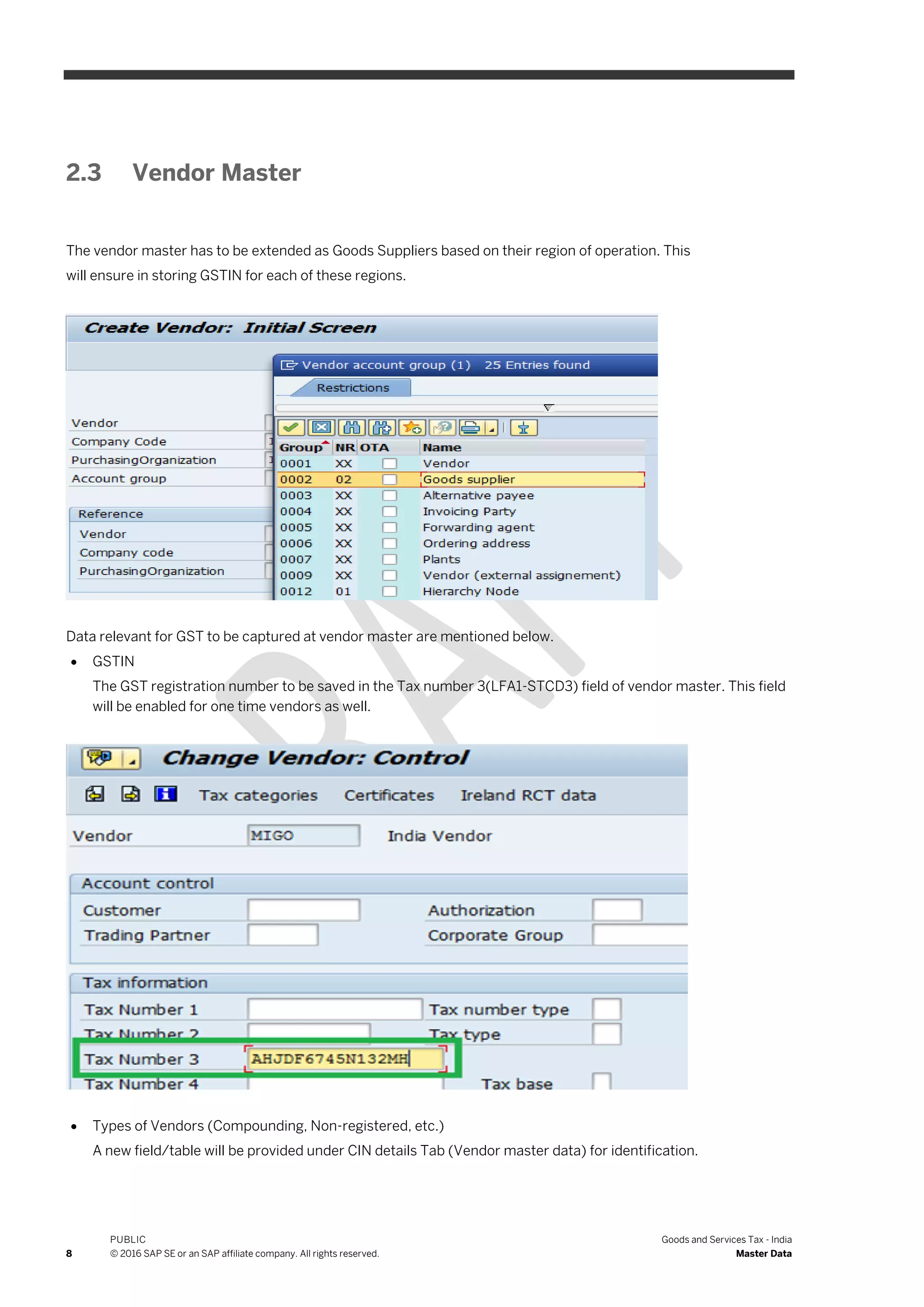

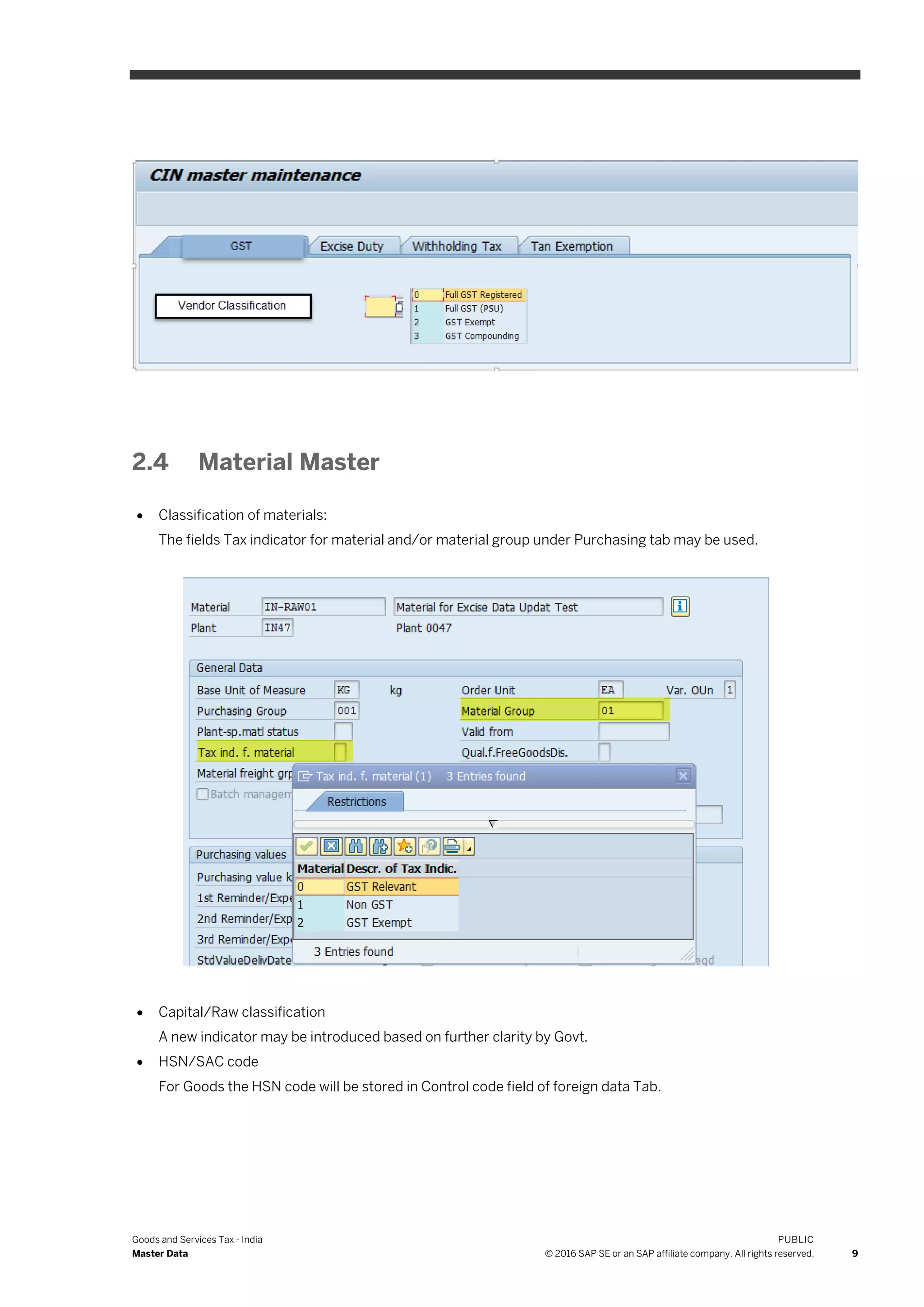

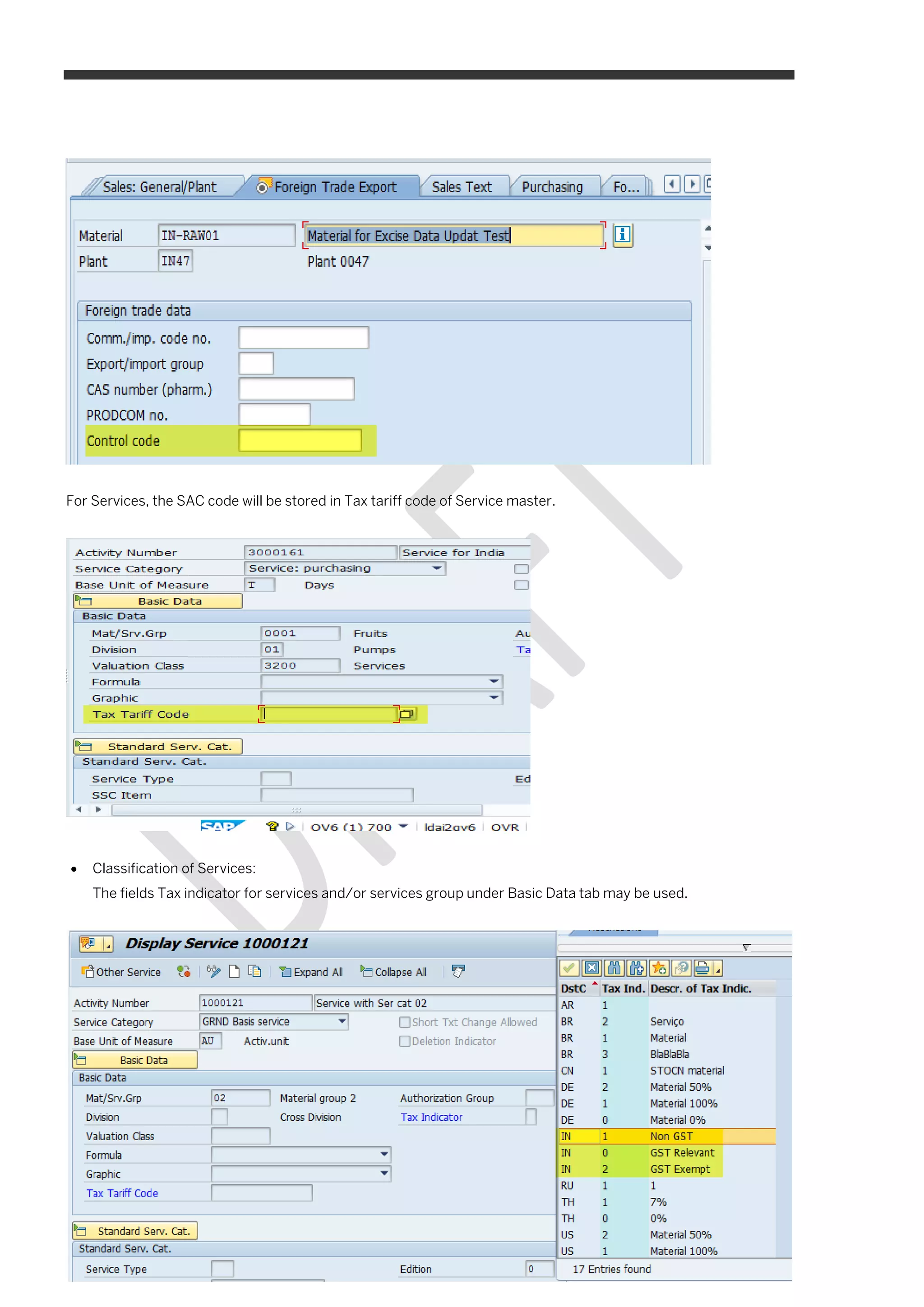

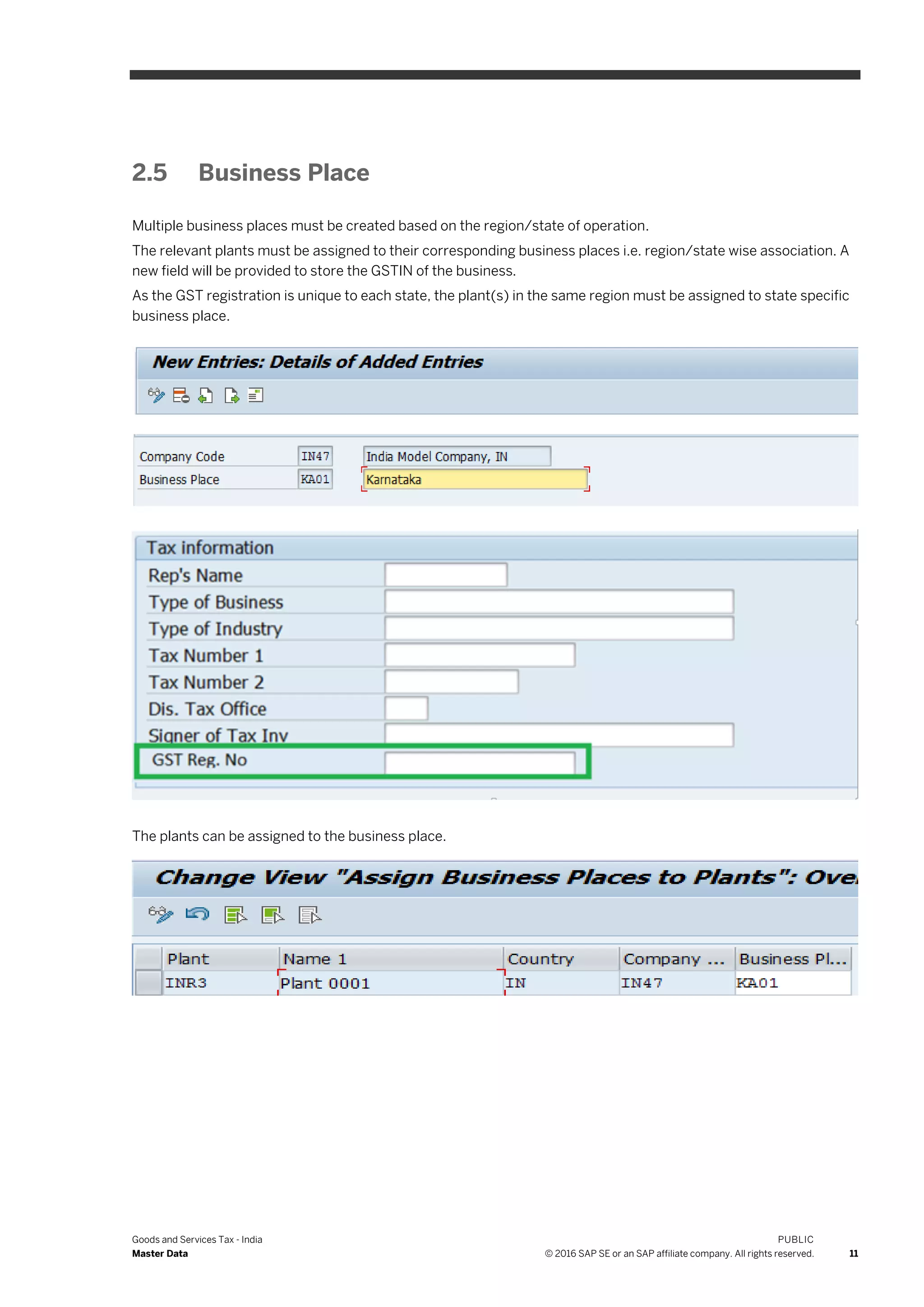

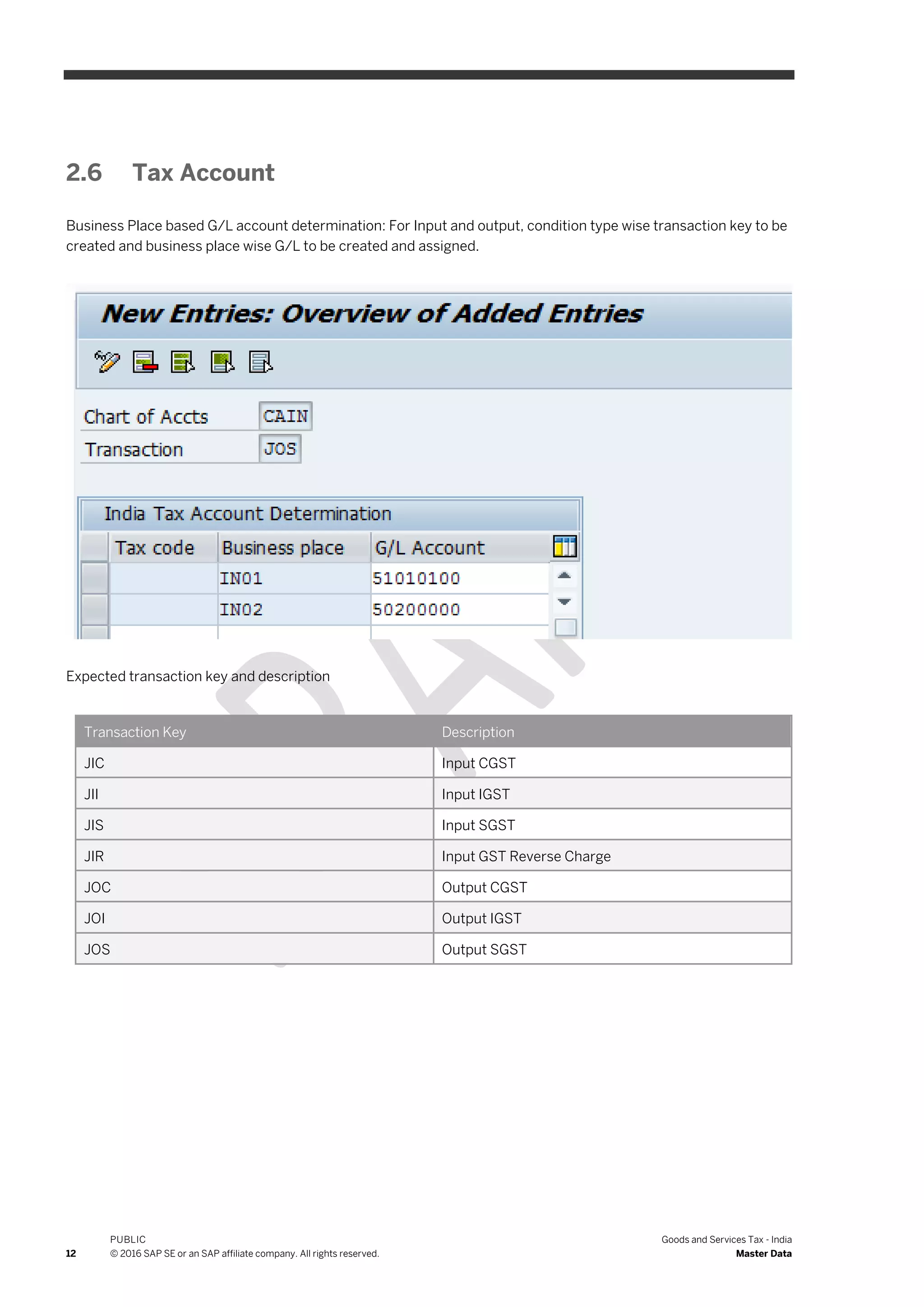

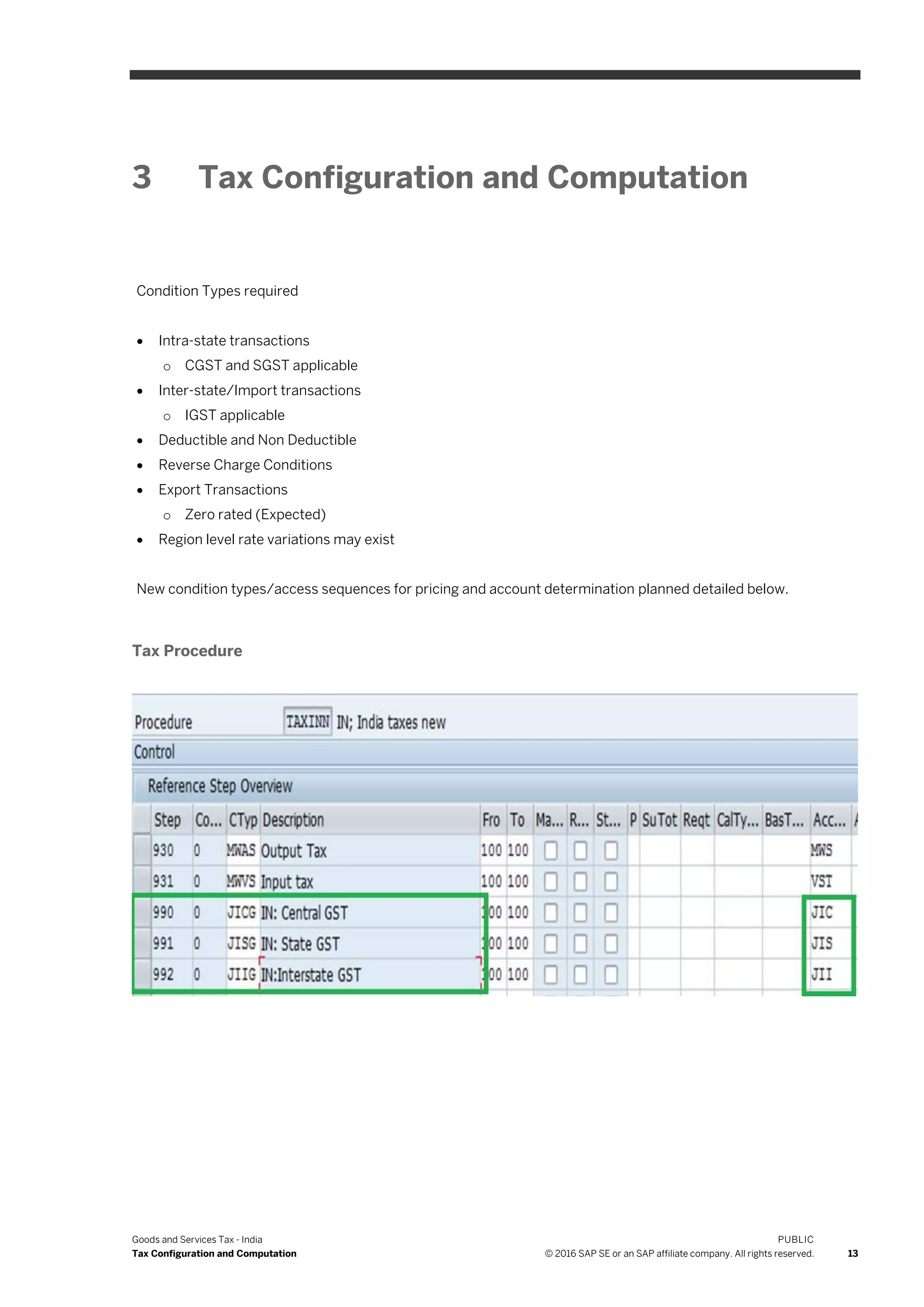

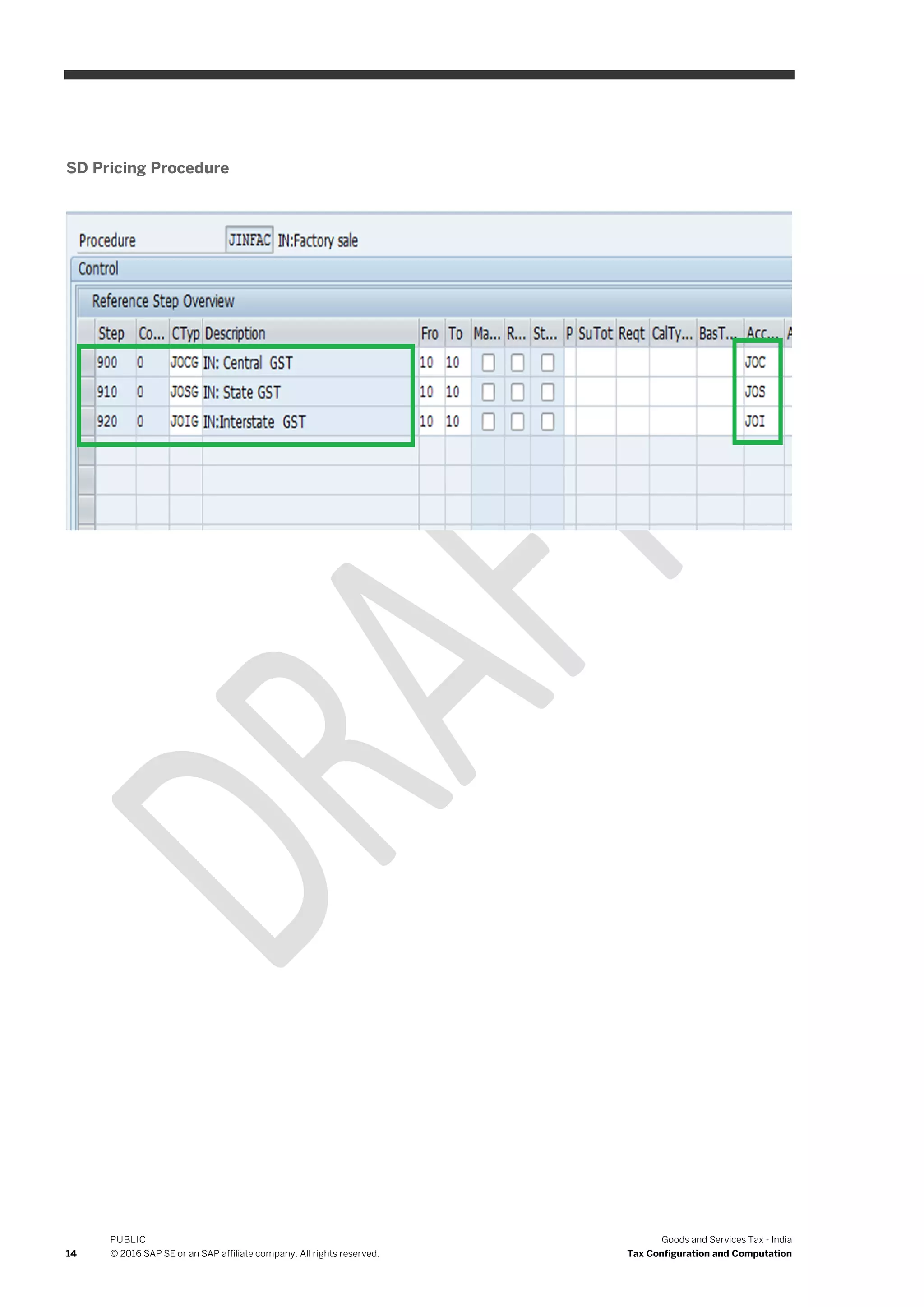

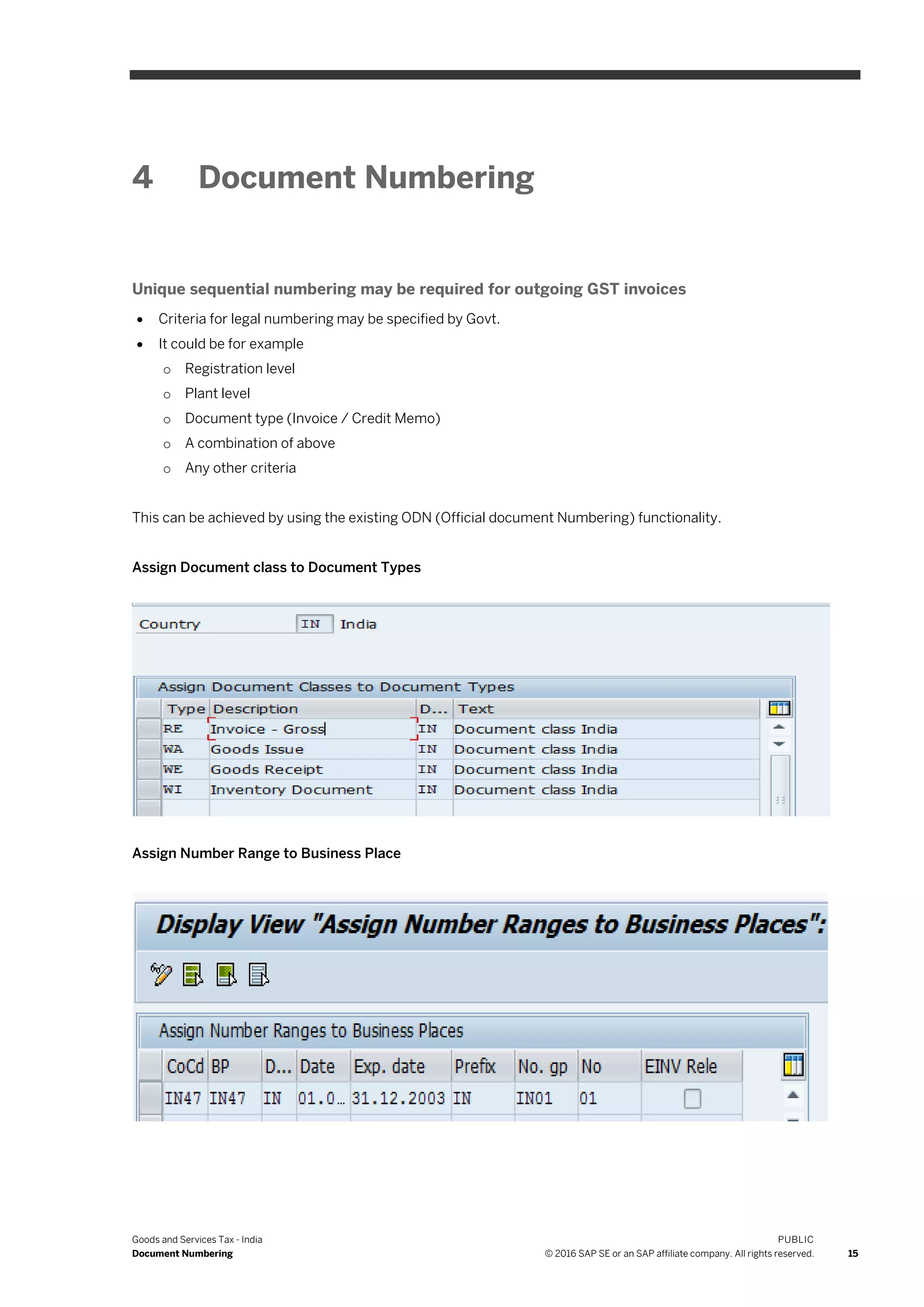

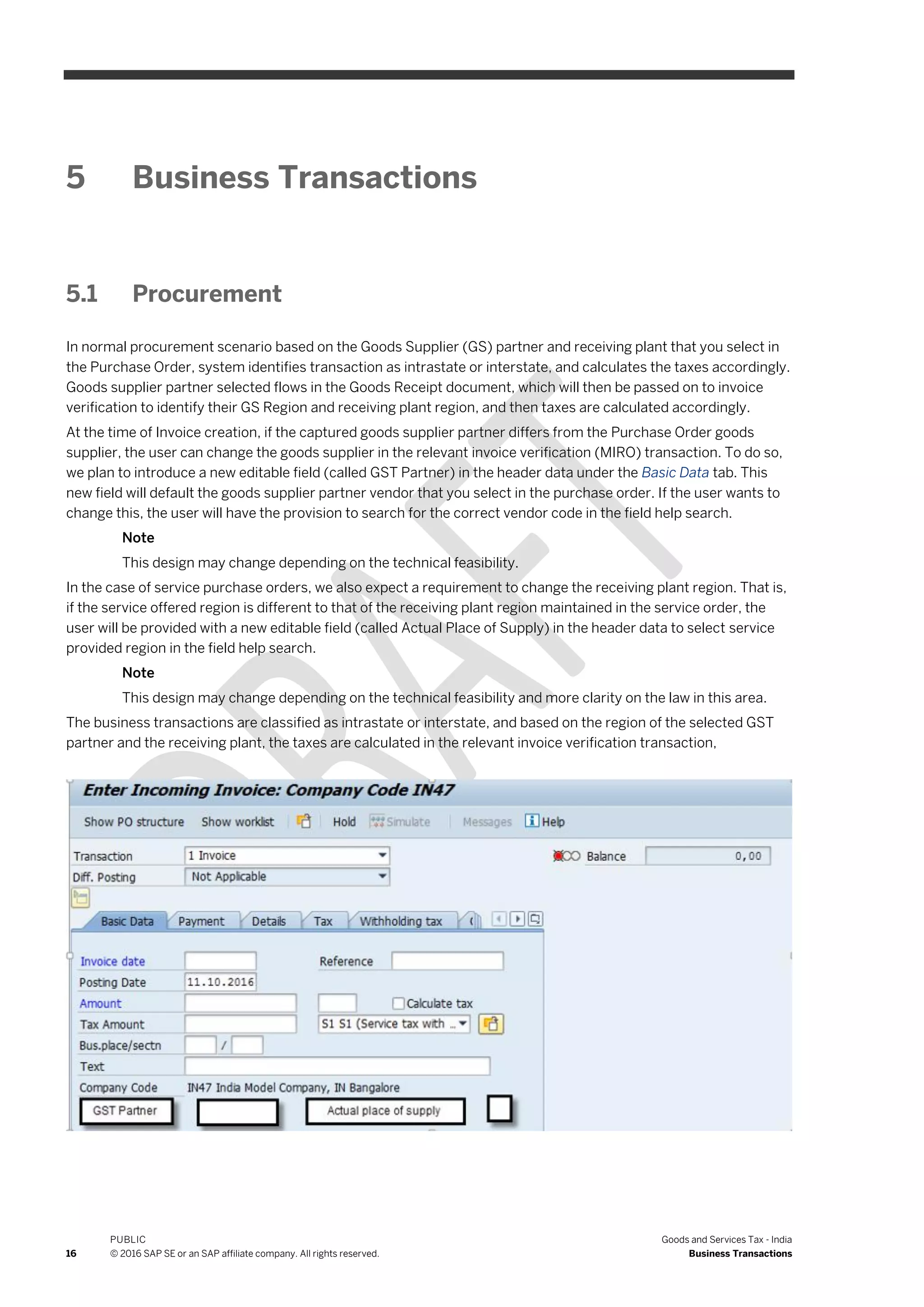

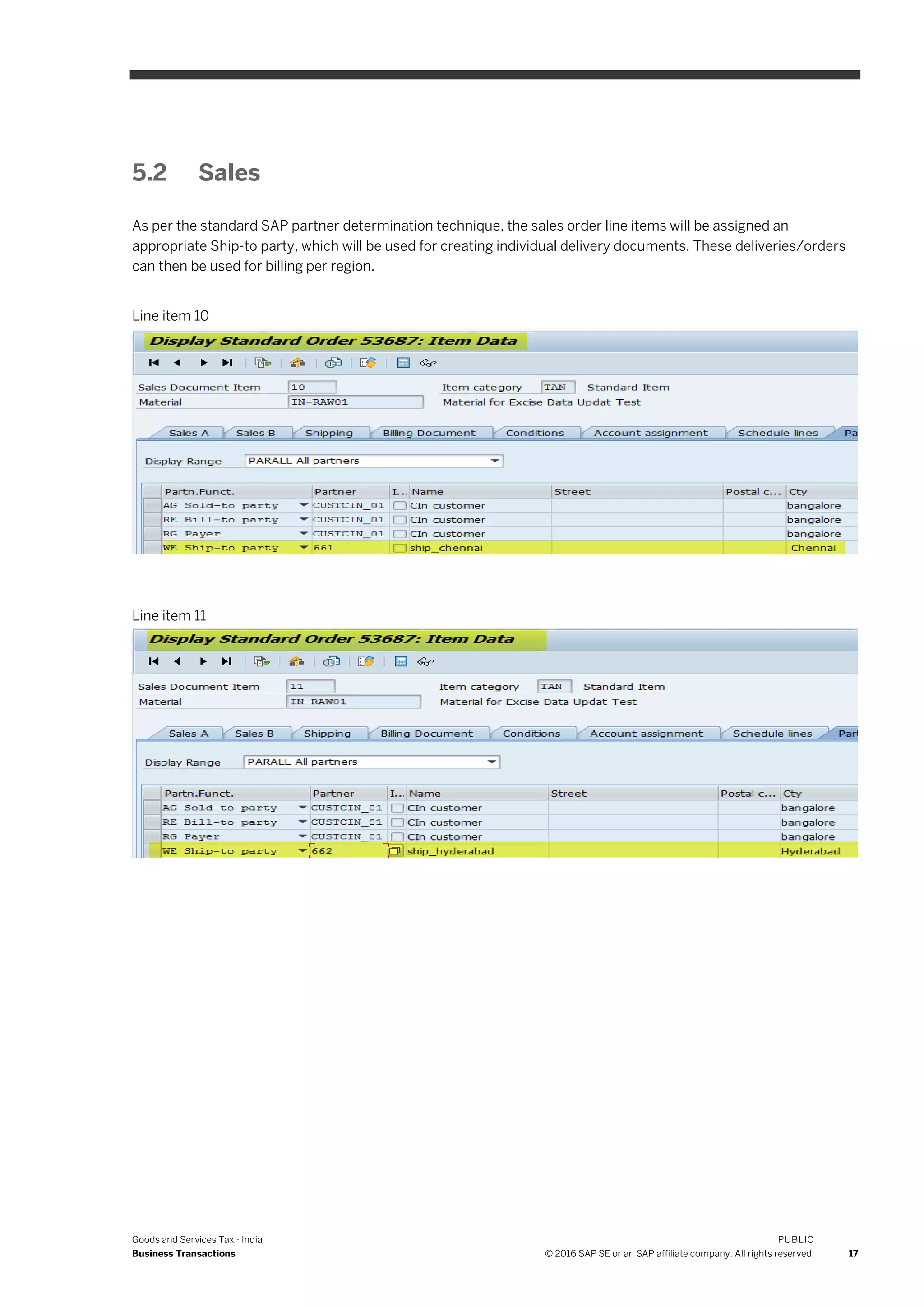

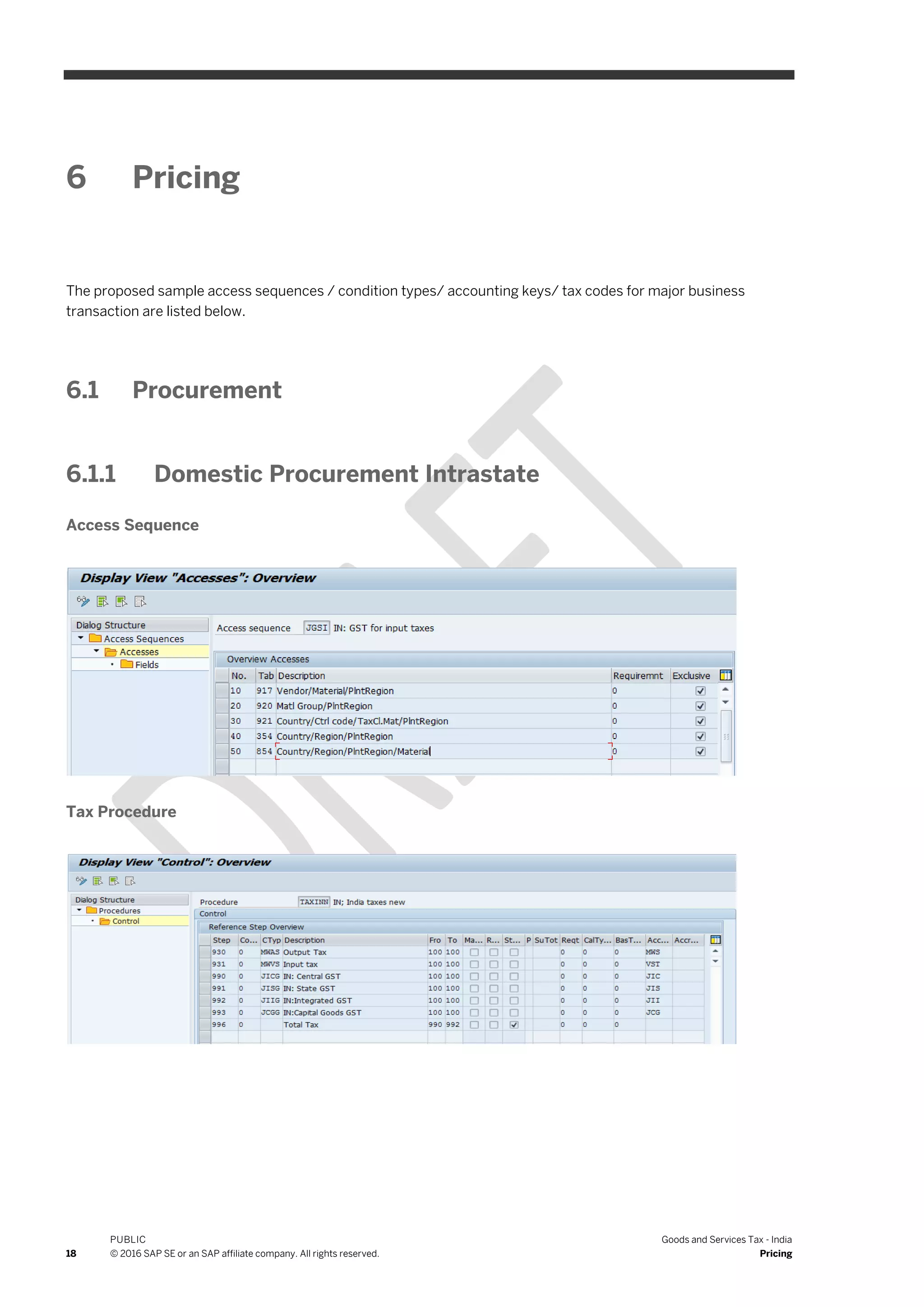

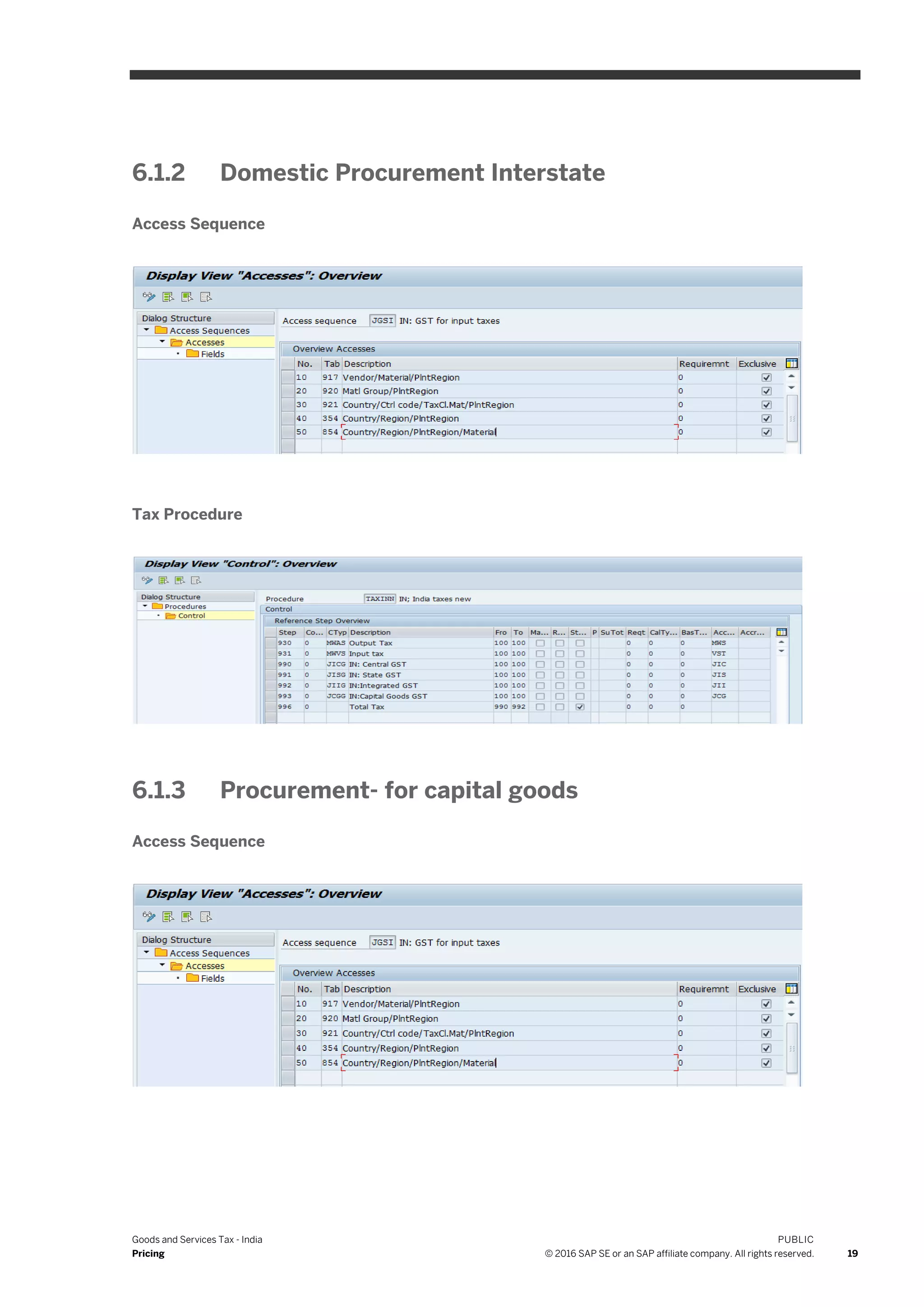

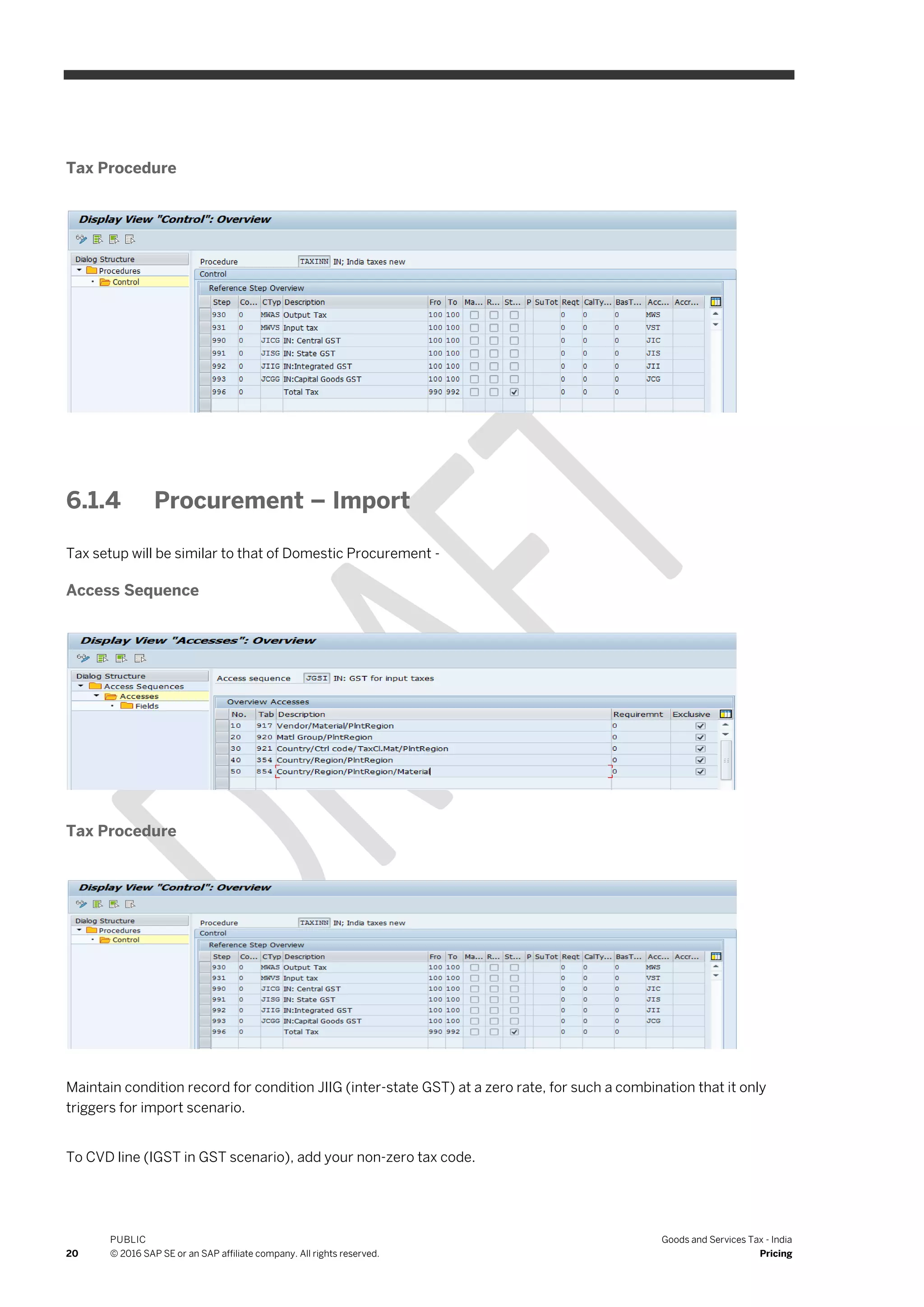

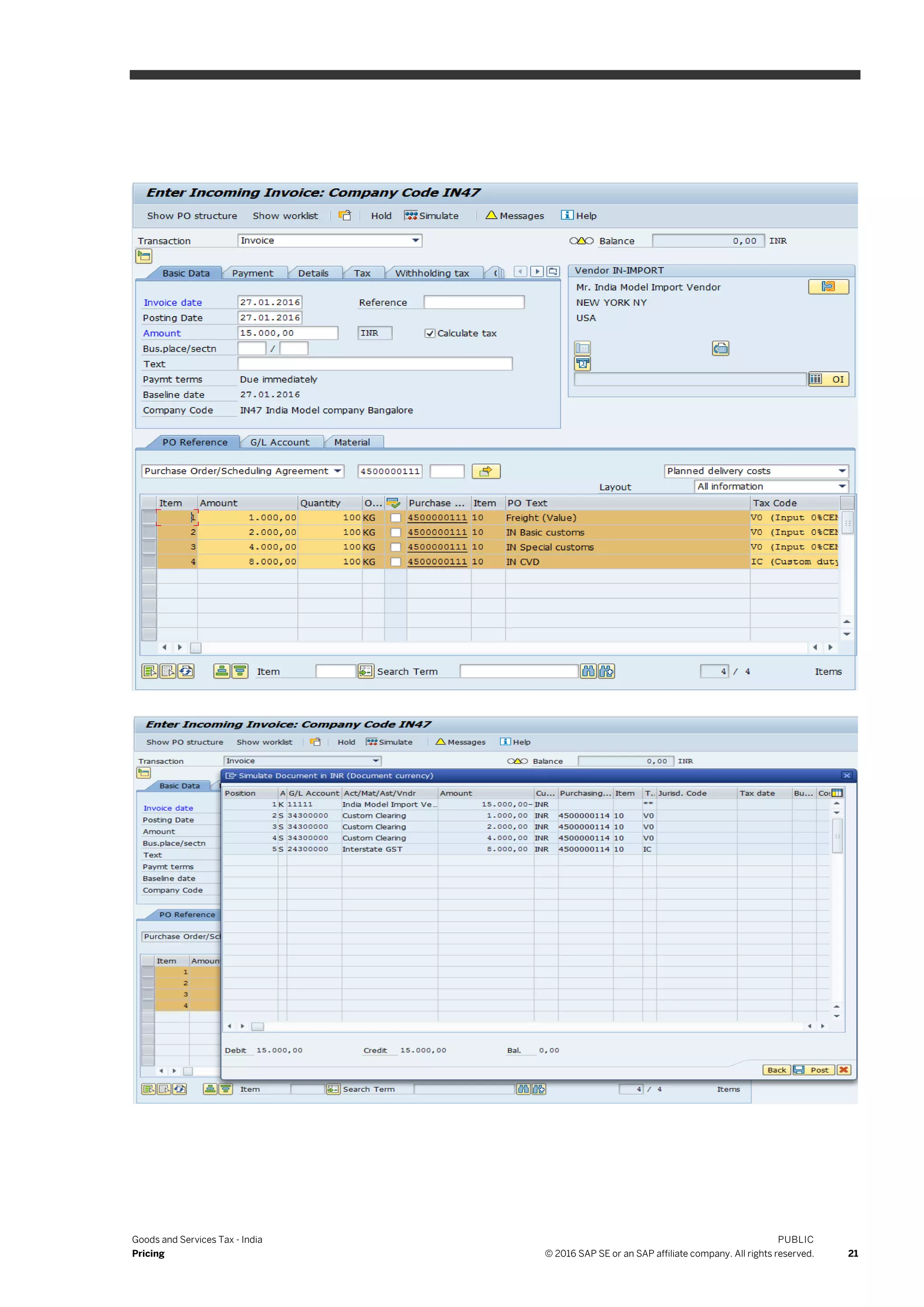

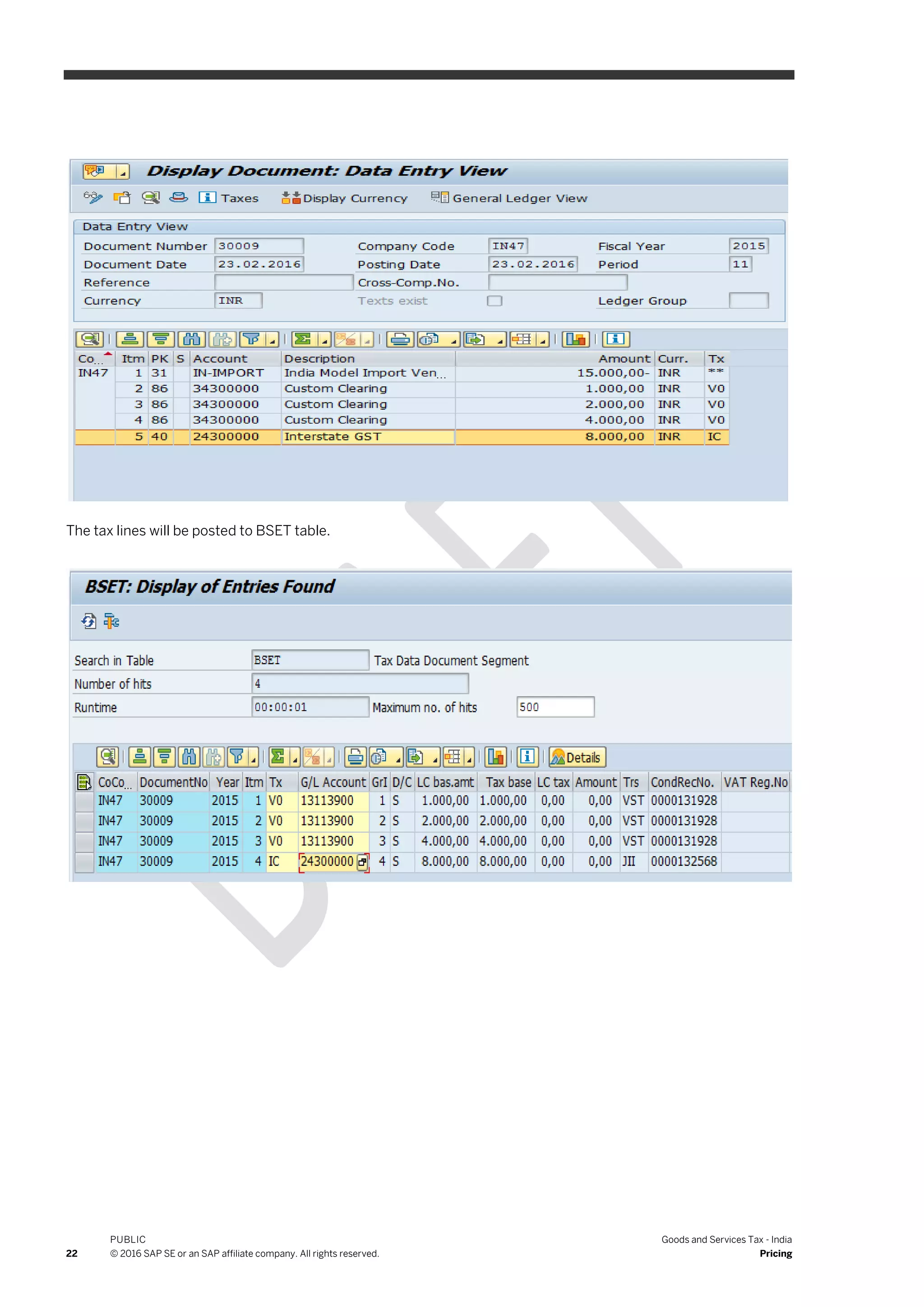

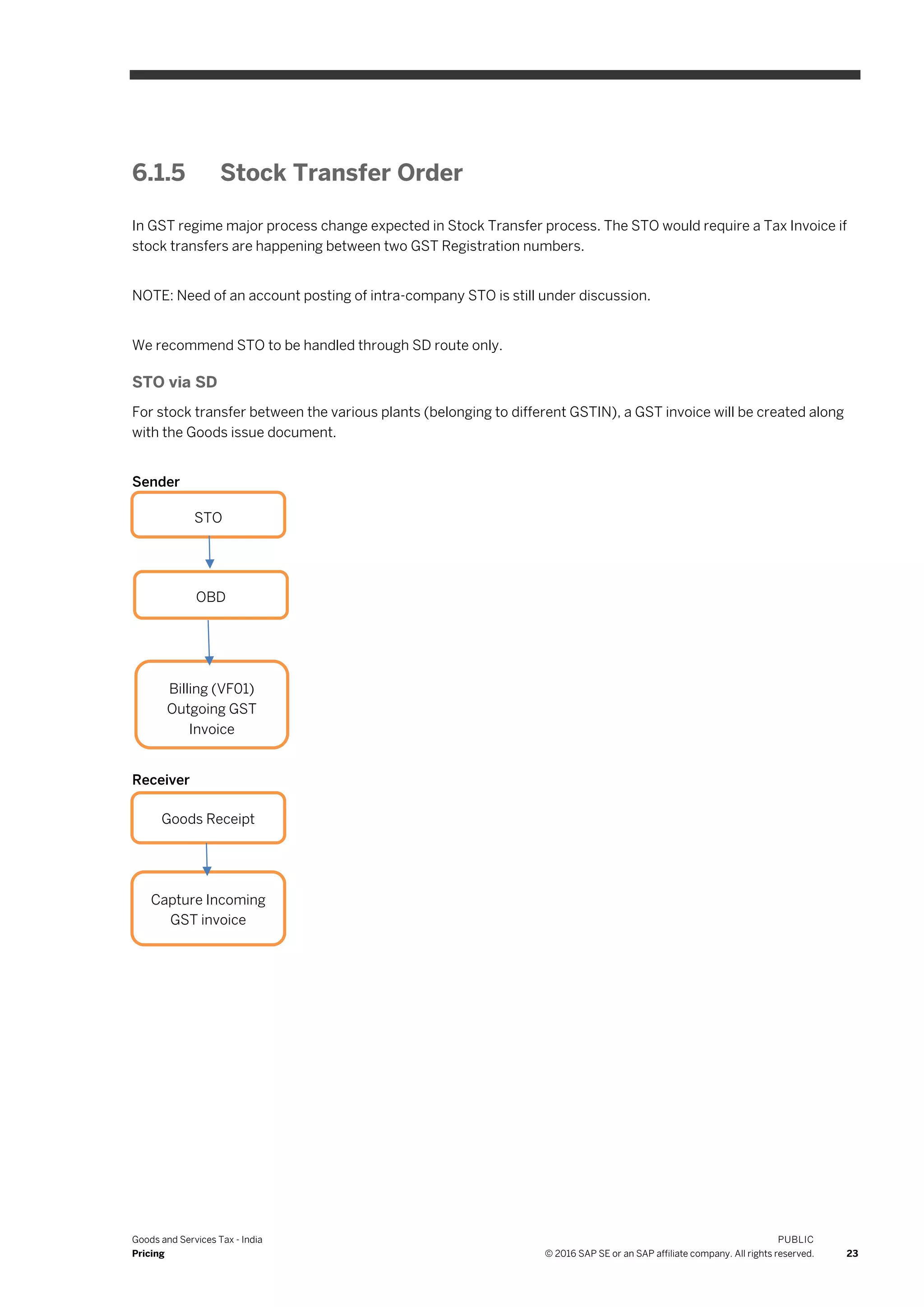

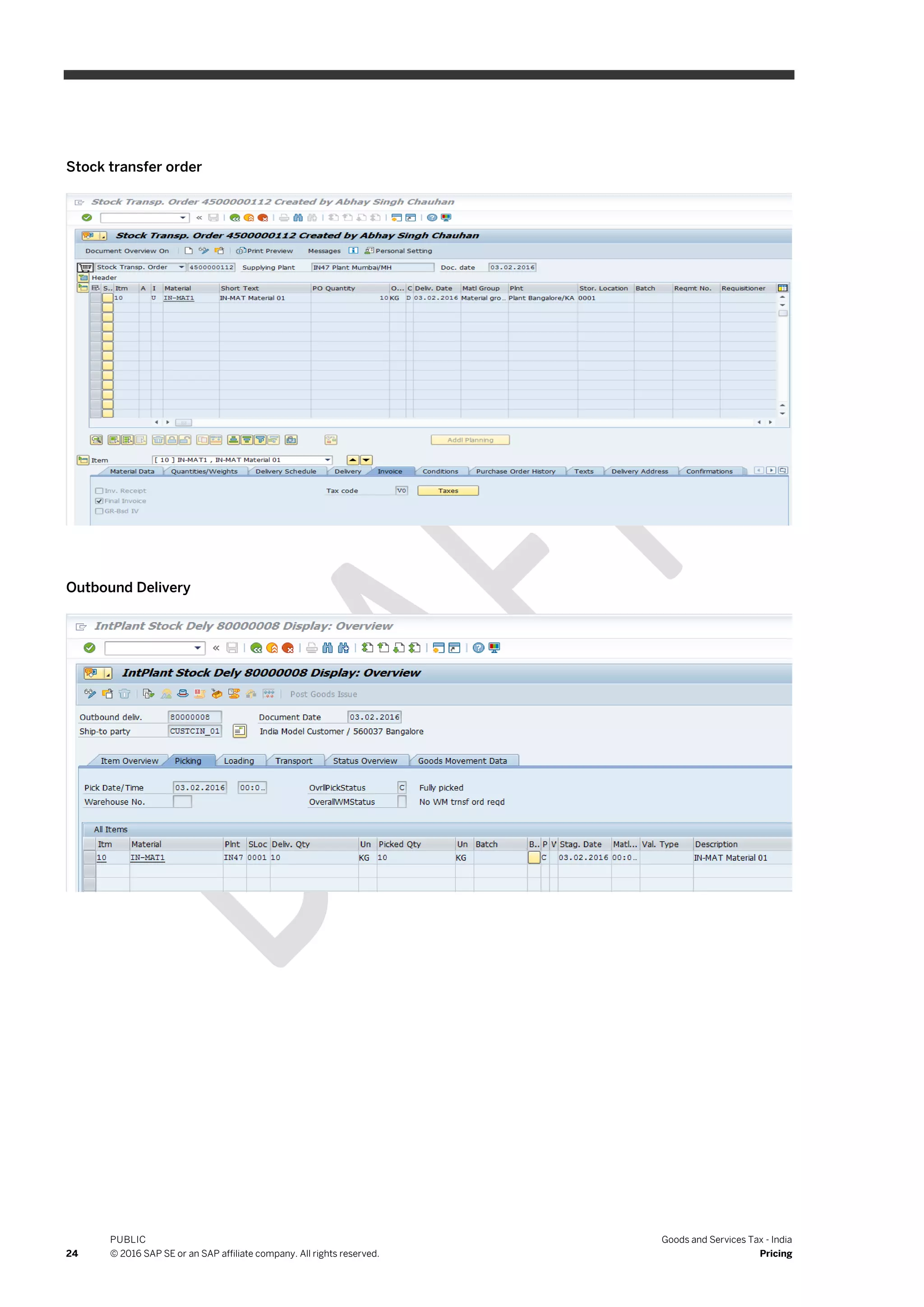

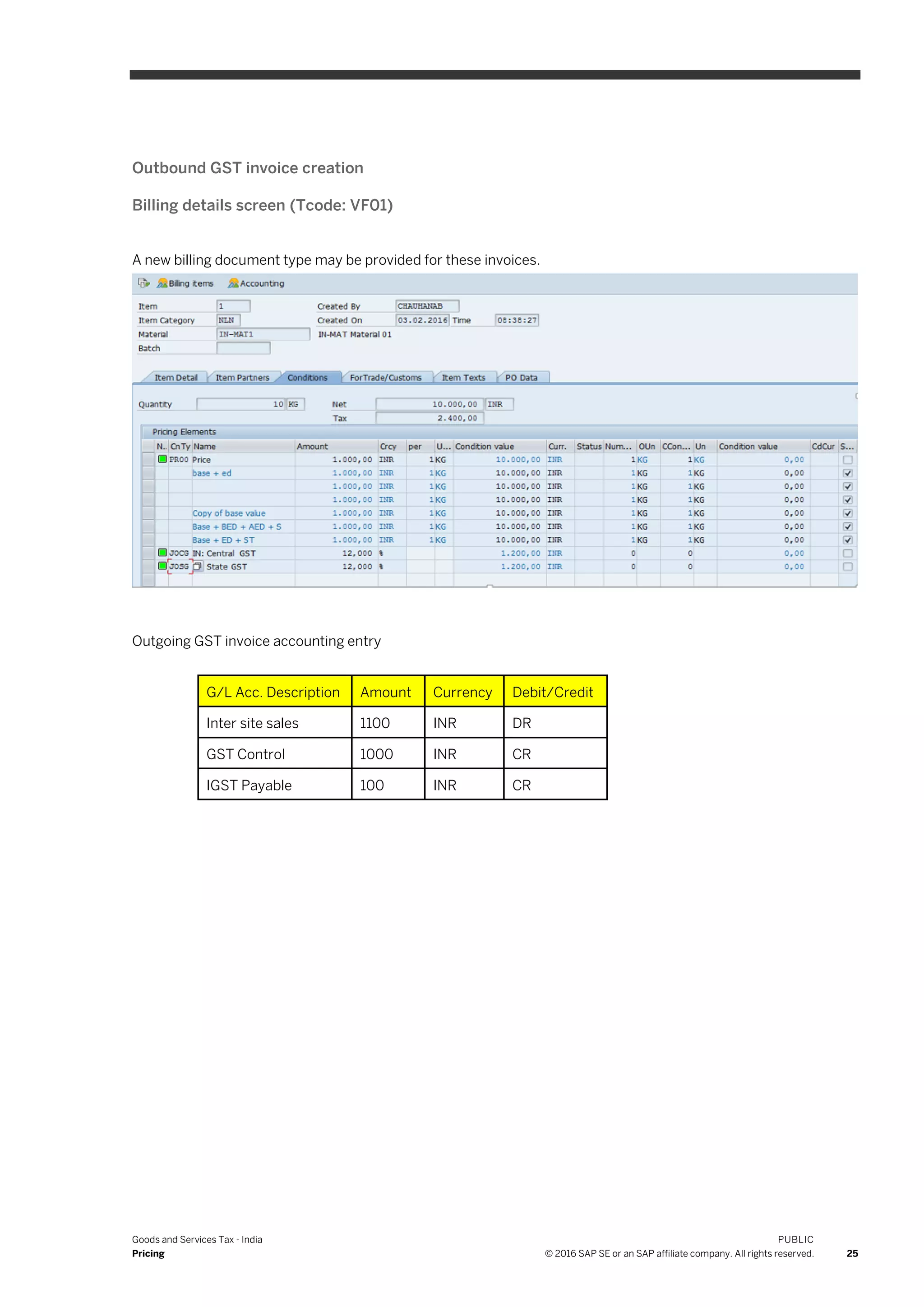

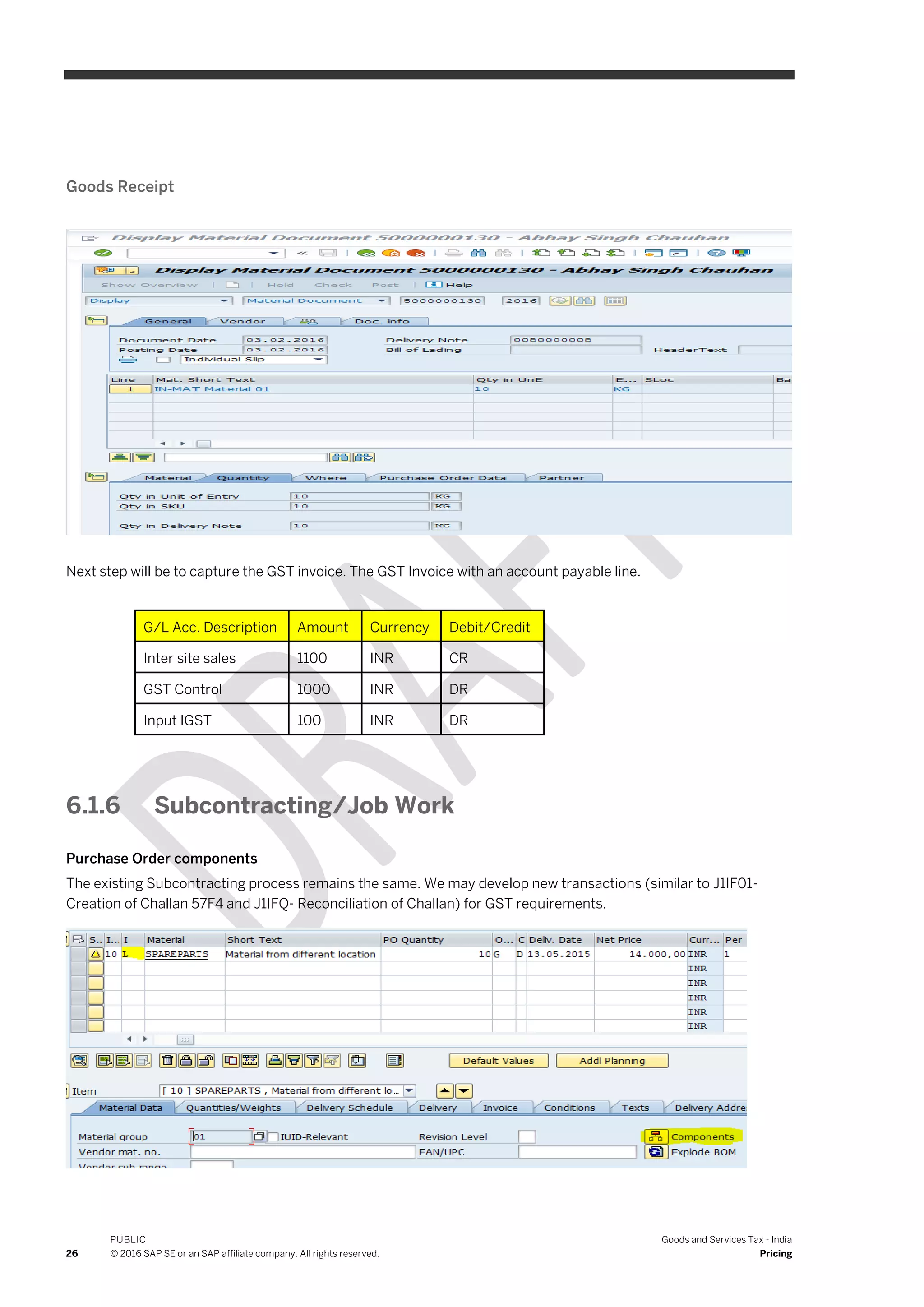

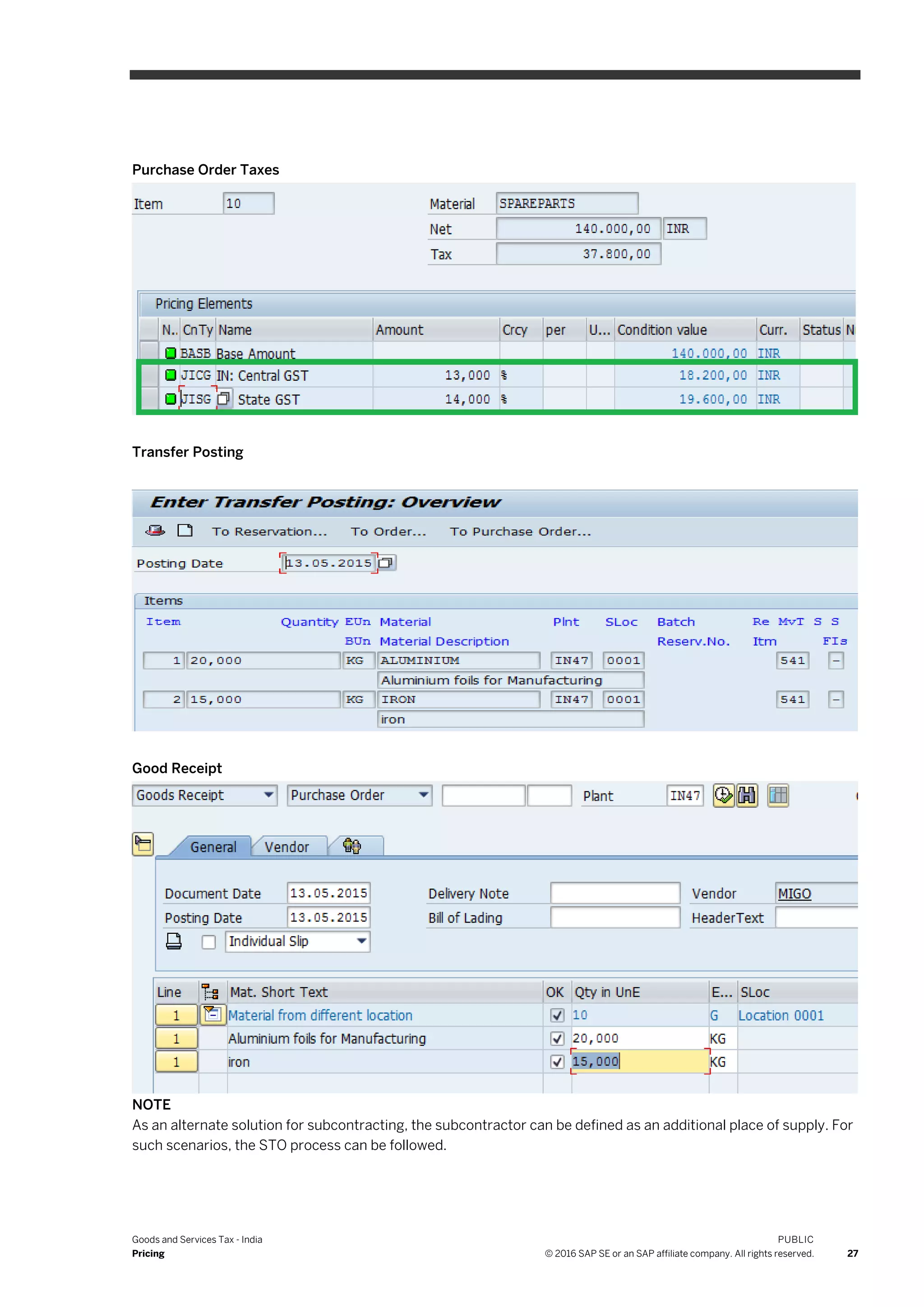

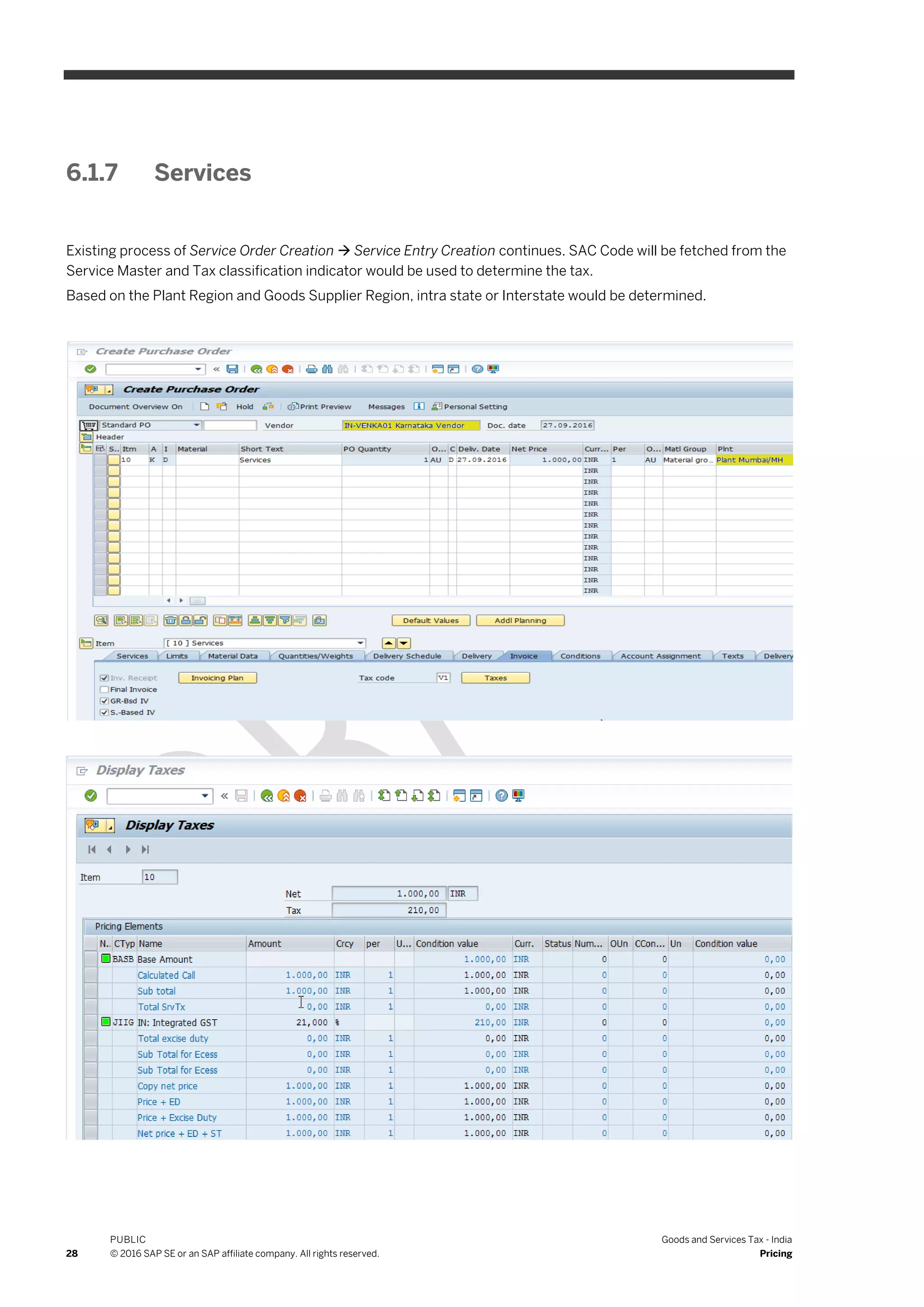

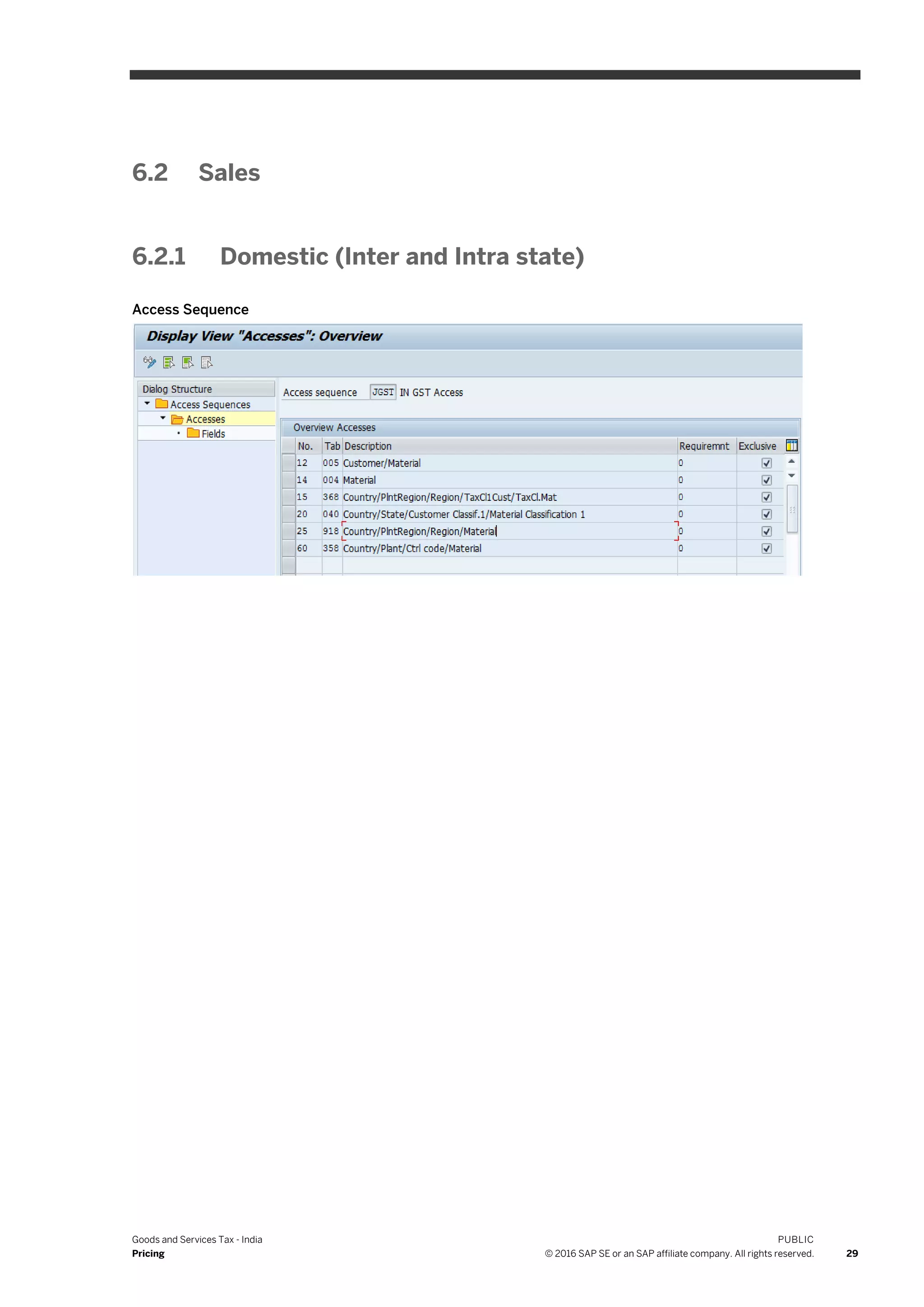

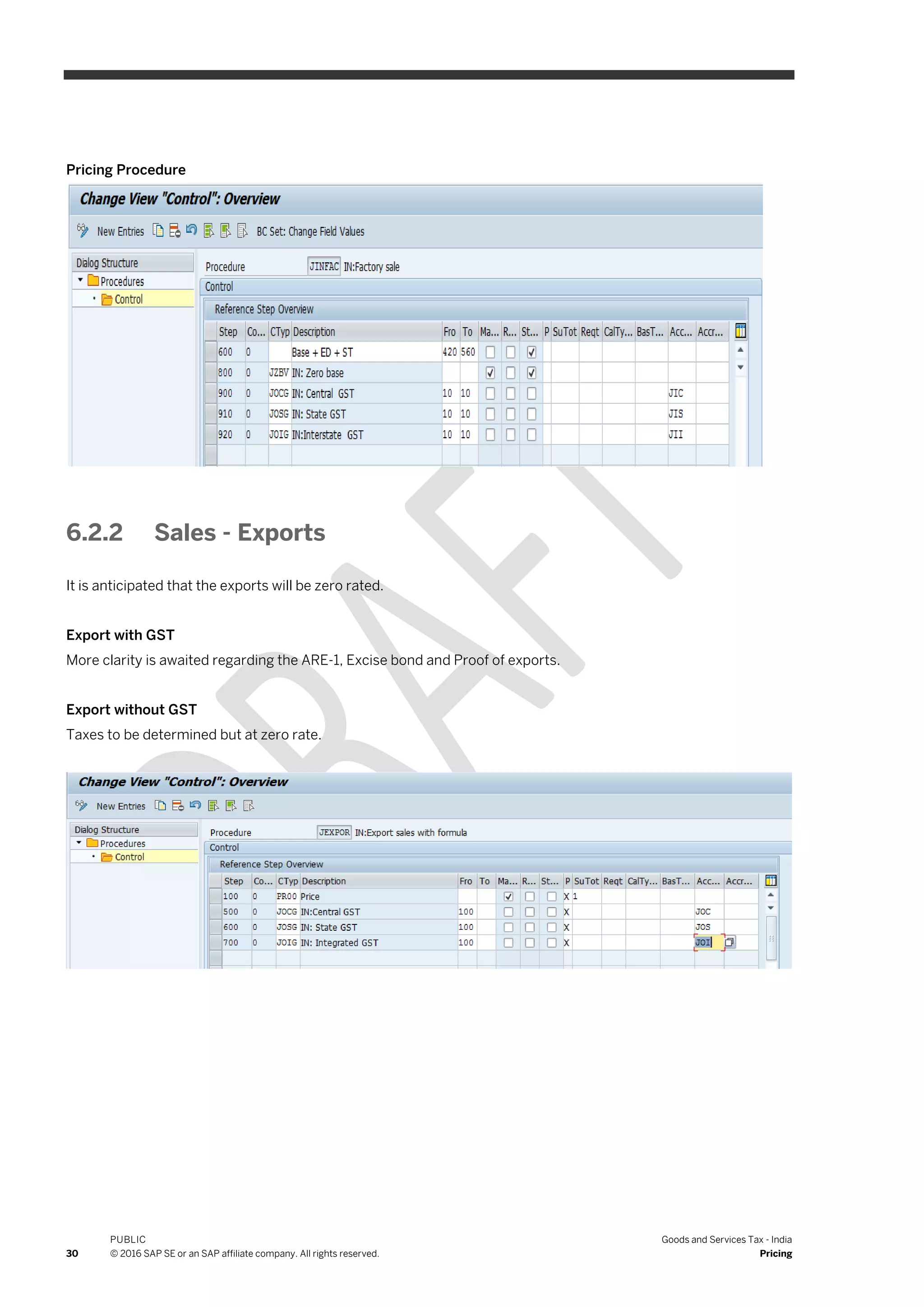

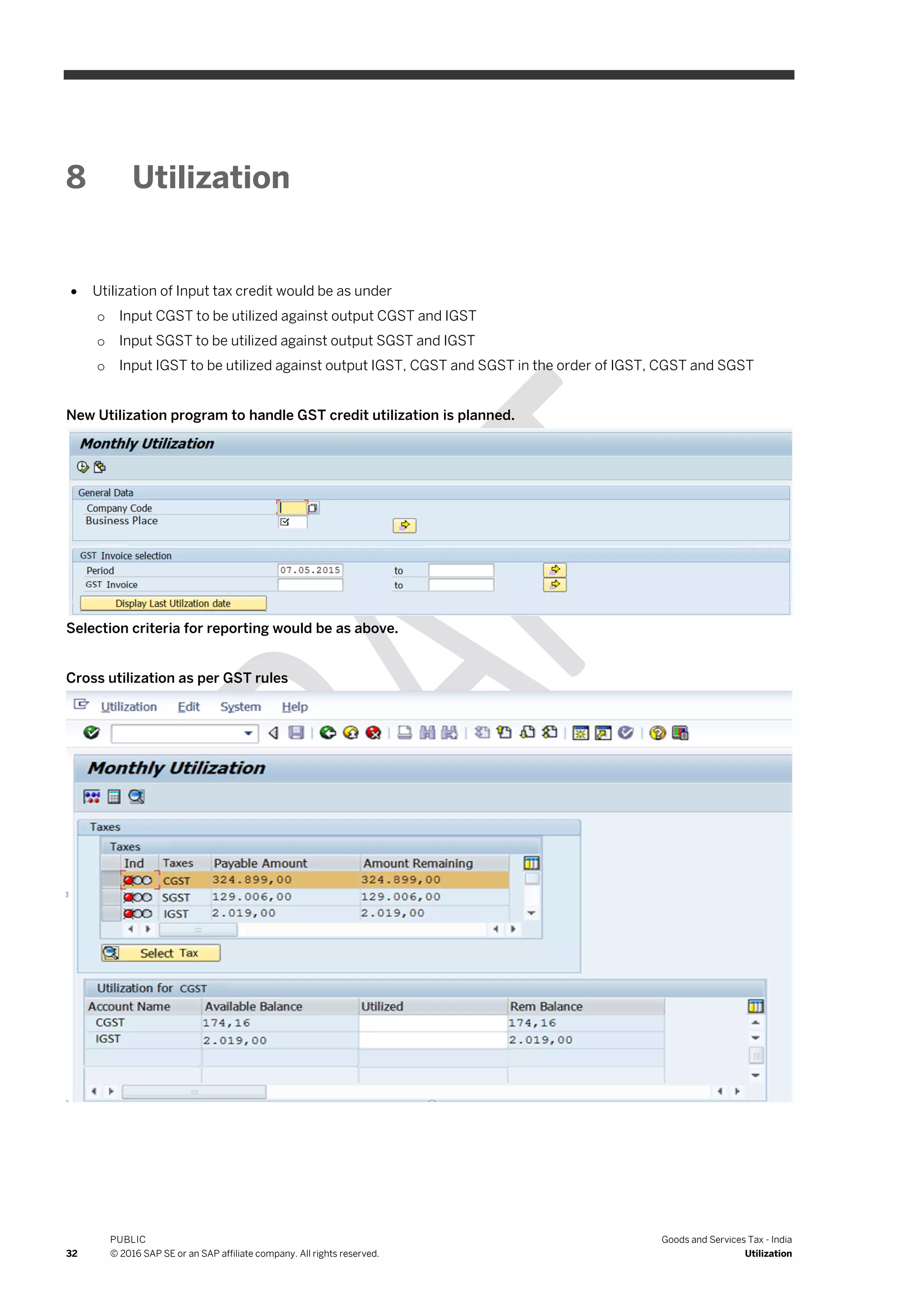

This document provides an overview of how SAP solutions can be configured for Goods and Services Tax (GST) compliance in India. It discusses master data setup, tax configuration, document numbering, business transactions for procurement, sales, and pricing. Key areas covered include tax registration numbers, classification of customers, vendors, materials and services, configuration of tax condition types for intra-state, inter-state, import and export transactions, and pricing procedures.