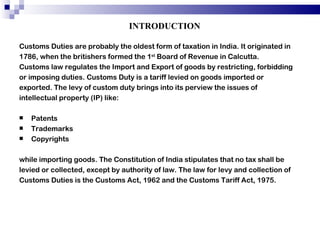

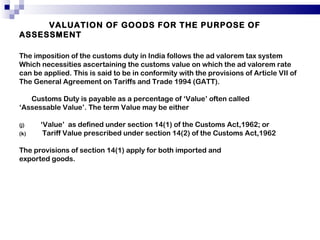

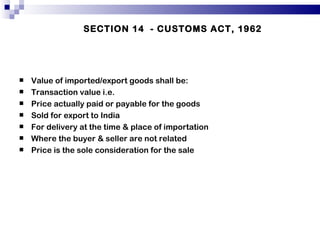

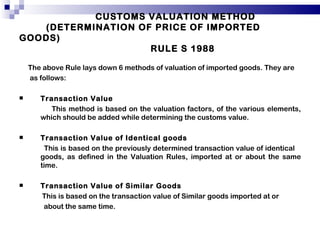

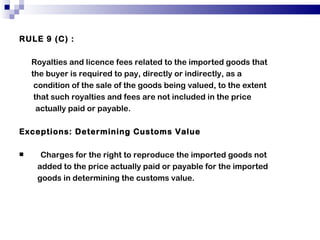

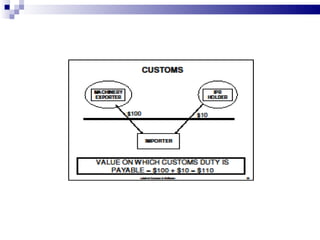

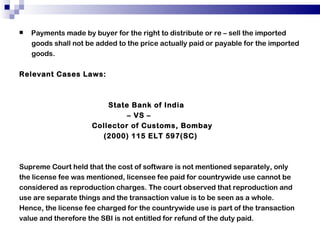

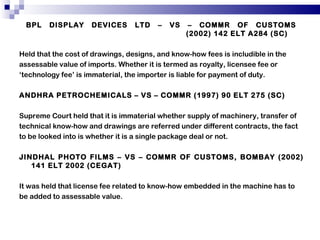

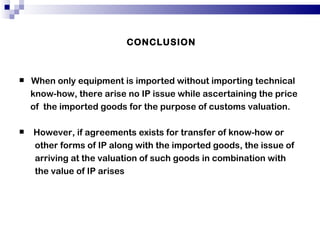

Customs duties are levied on imported and exported goods in India according to the Customs Act of 1962. The duty is assessed based on the transaction value or assessable value of the goods, which is generally the price paid or payable. However, for goods imported with intellectual property, the value of the IP in the form of patents, trademarks, copyrights, or technical know-how must be included in the assessable value to determine the applicable customs duty. Indian courts have ruled that fees for licenses, designs, technology transfers are to be included in the goods' value even if listed separately. When goods are imported with associated intellectual property, valuing them and the IP together can complicate determining the customs duty.