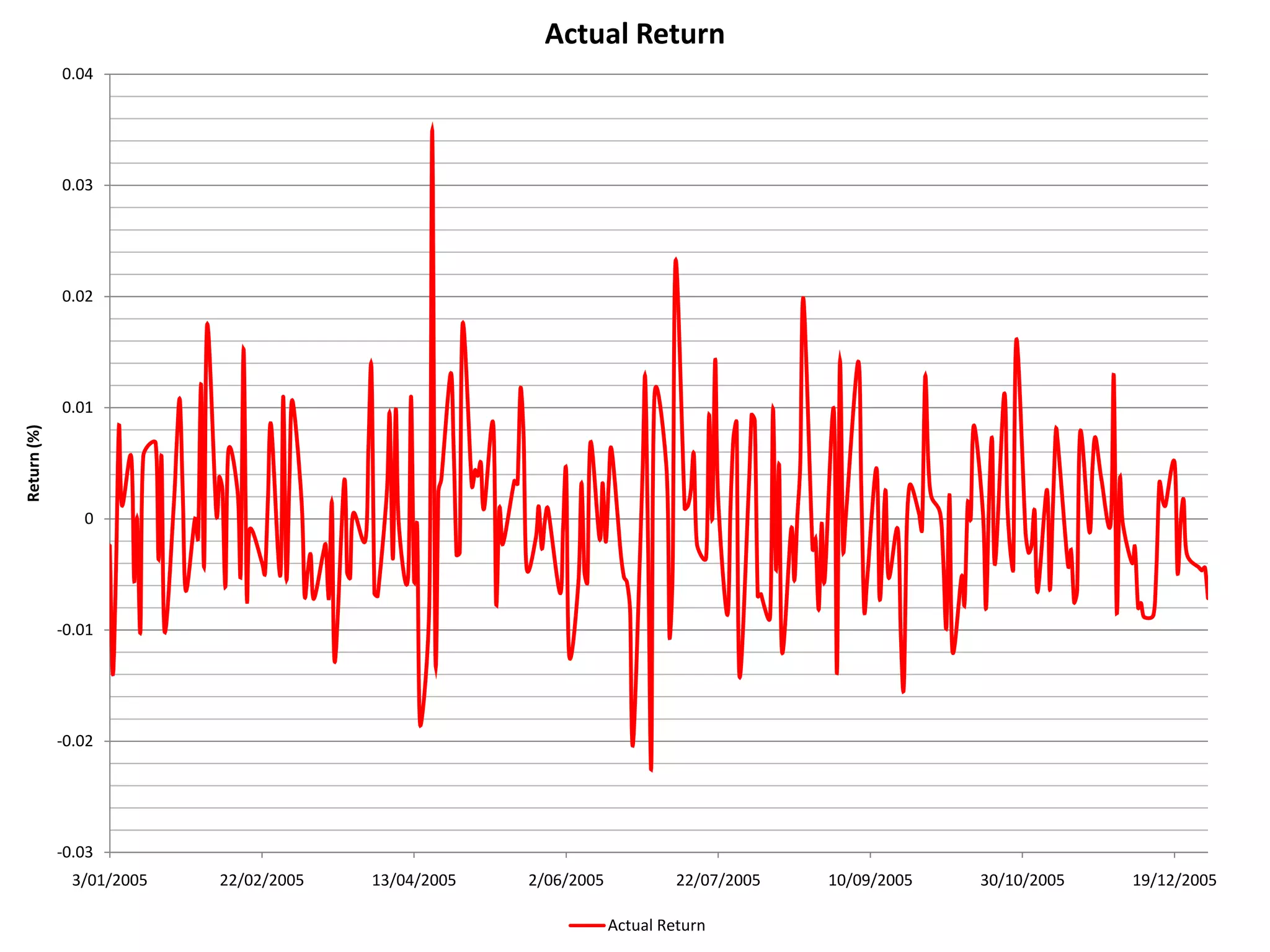

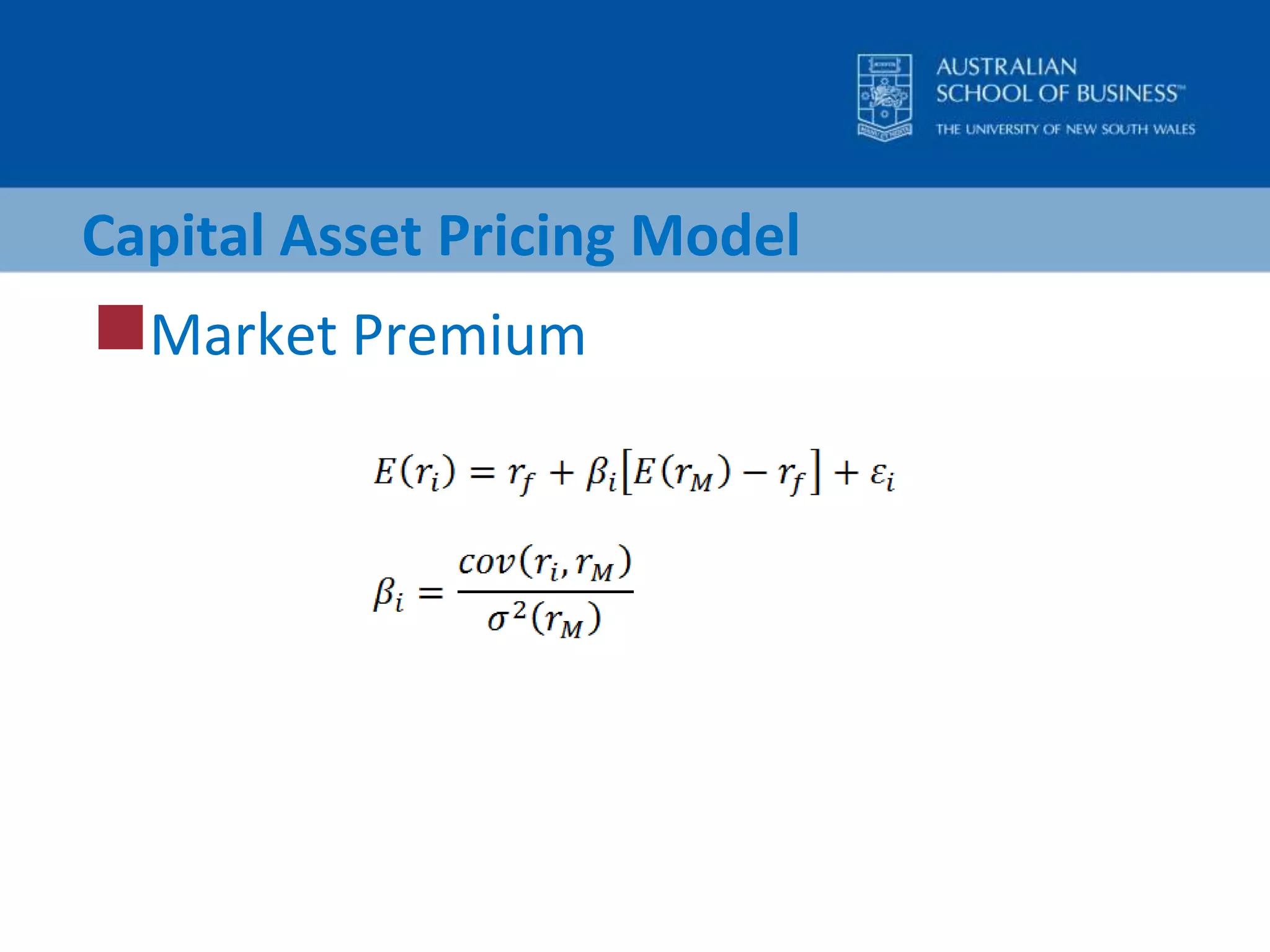

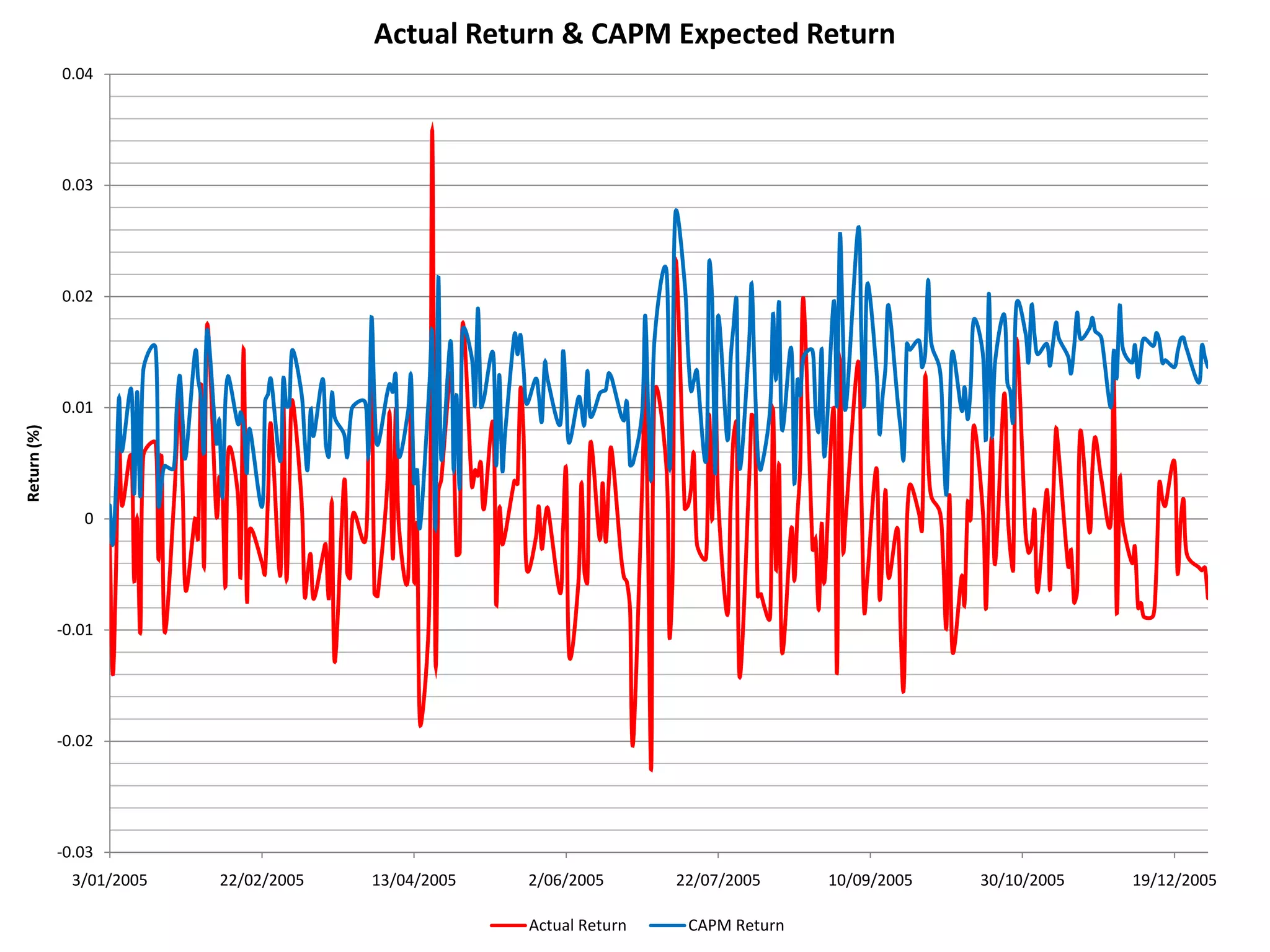

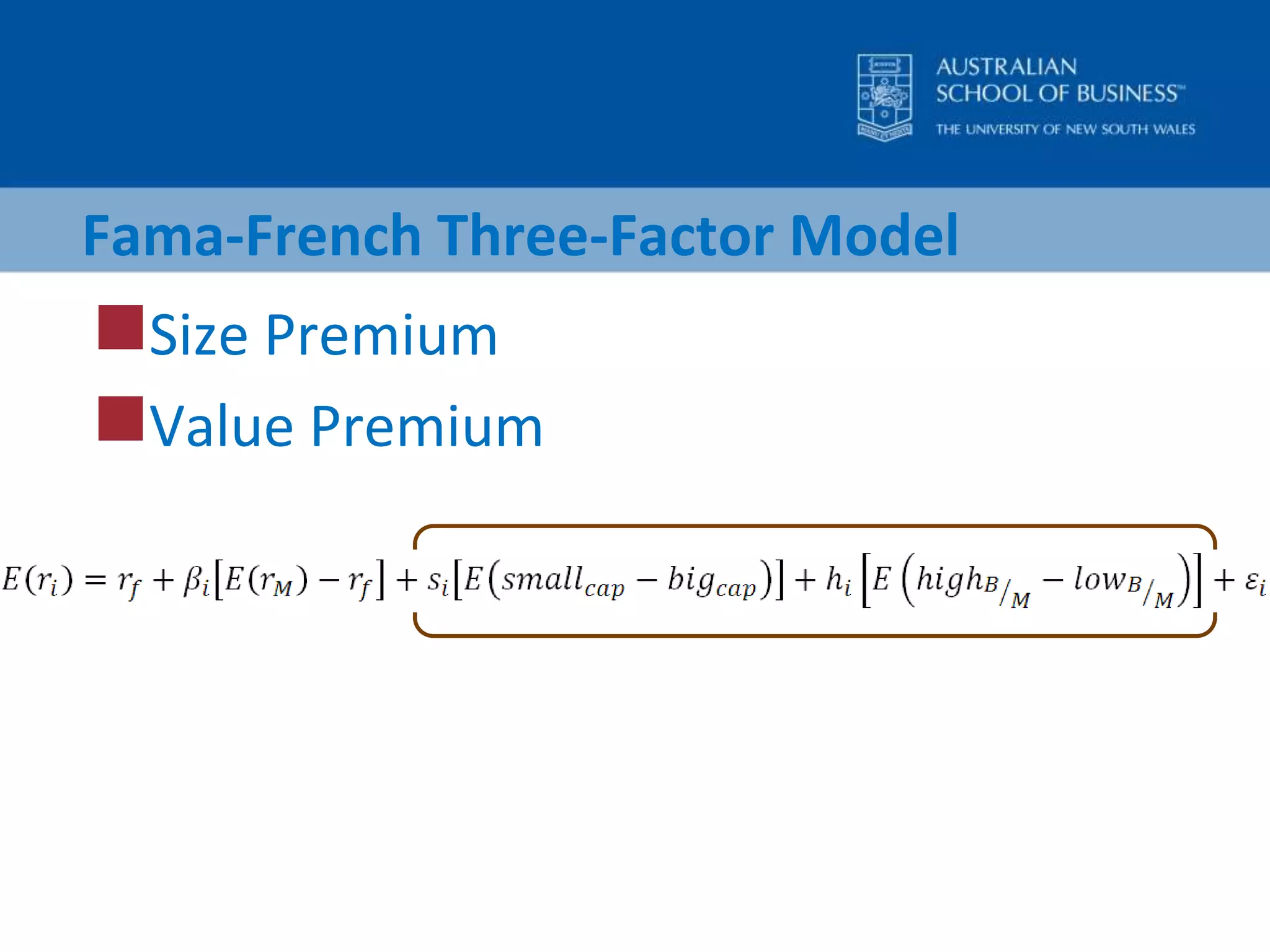

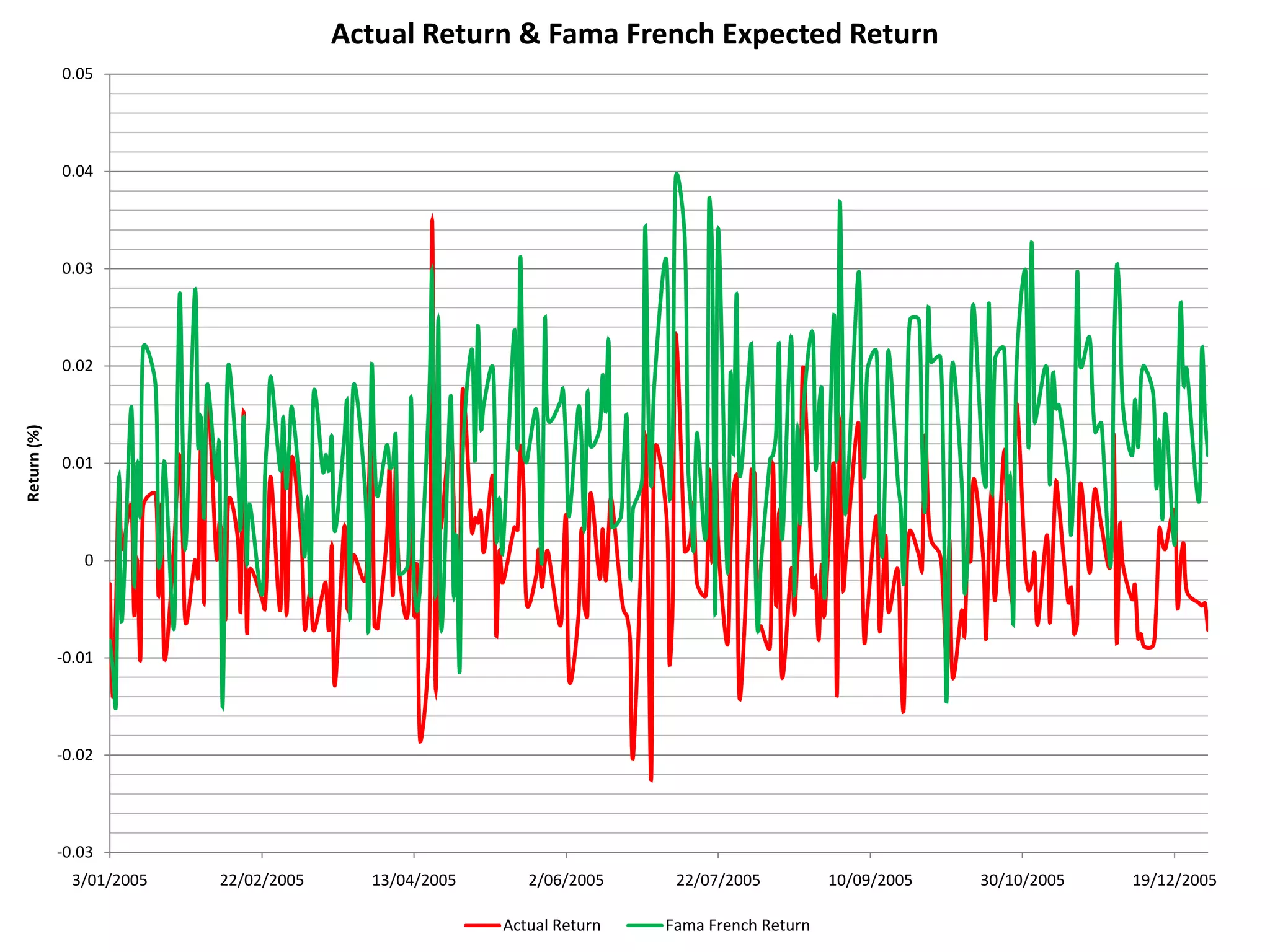

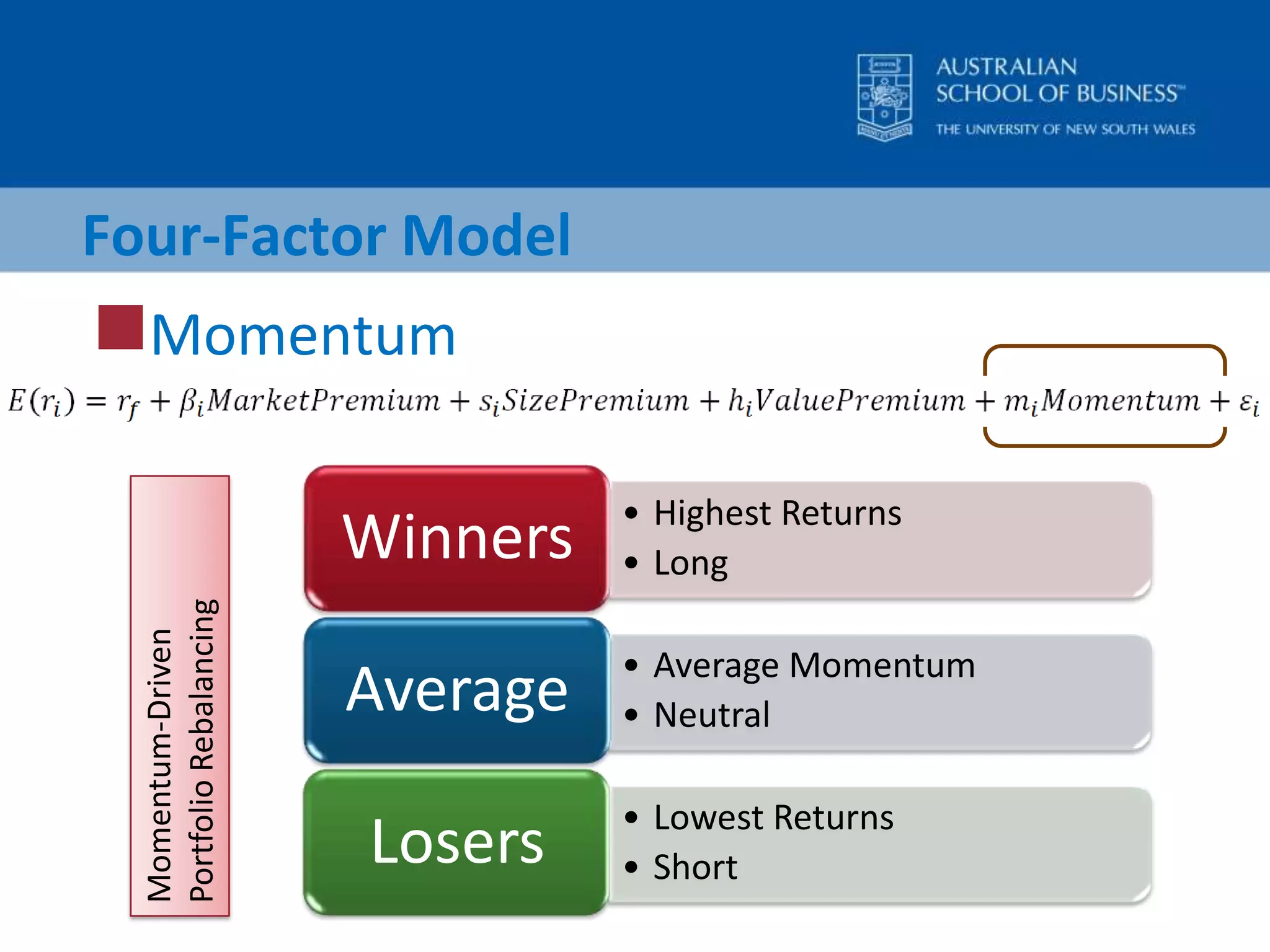

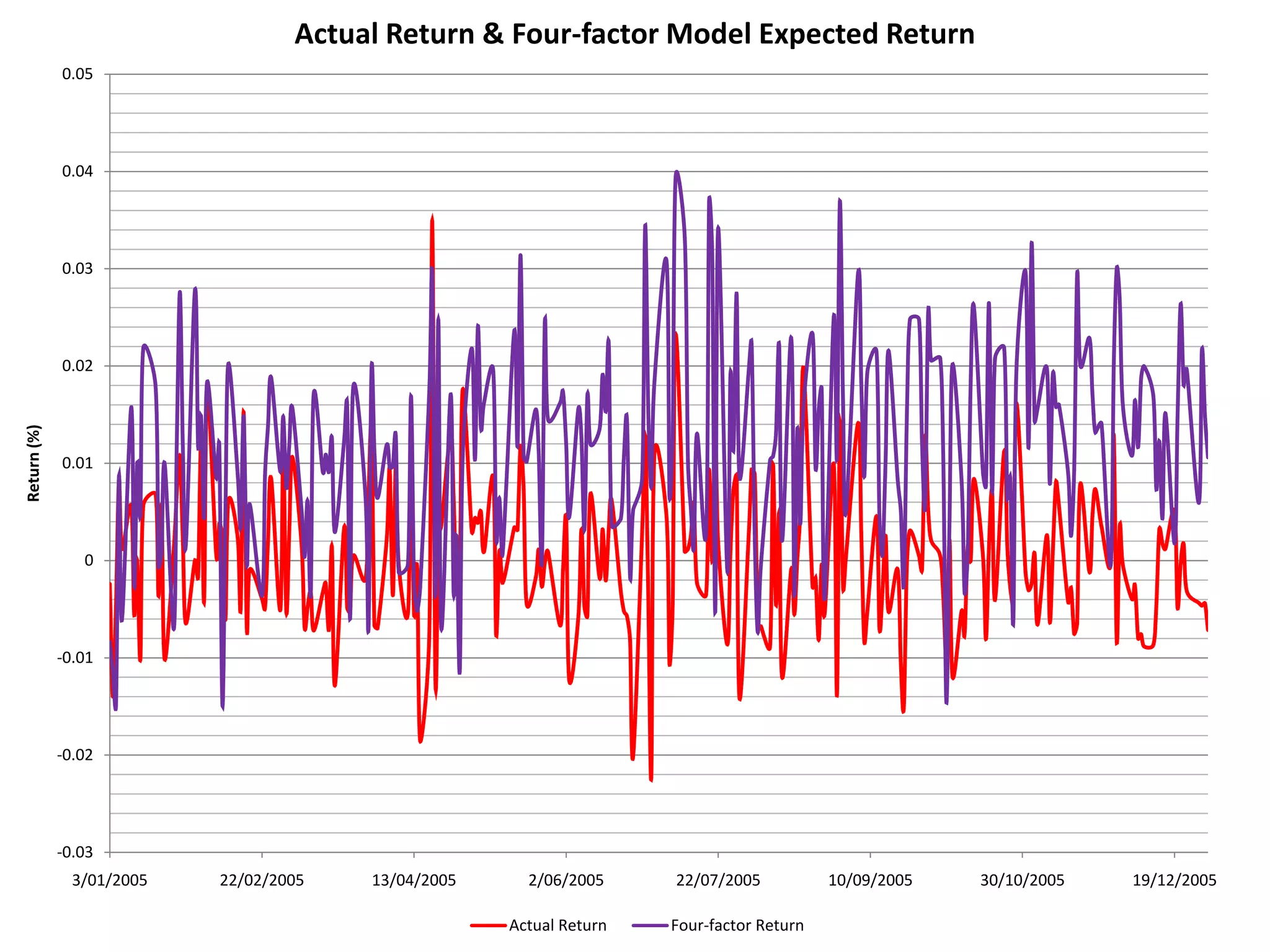

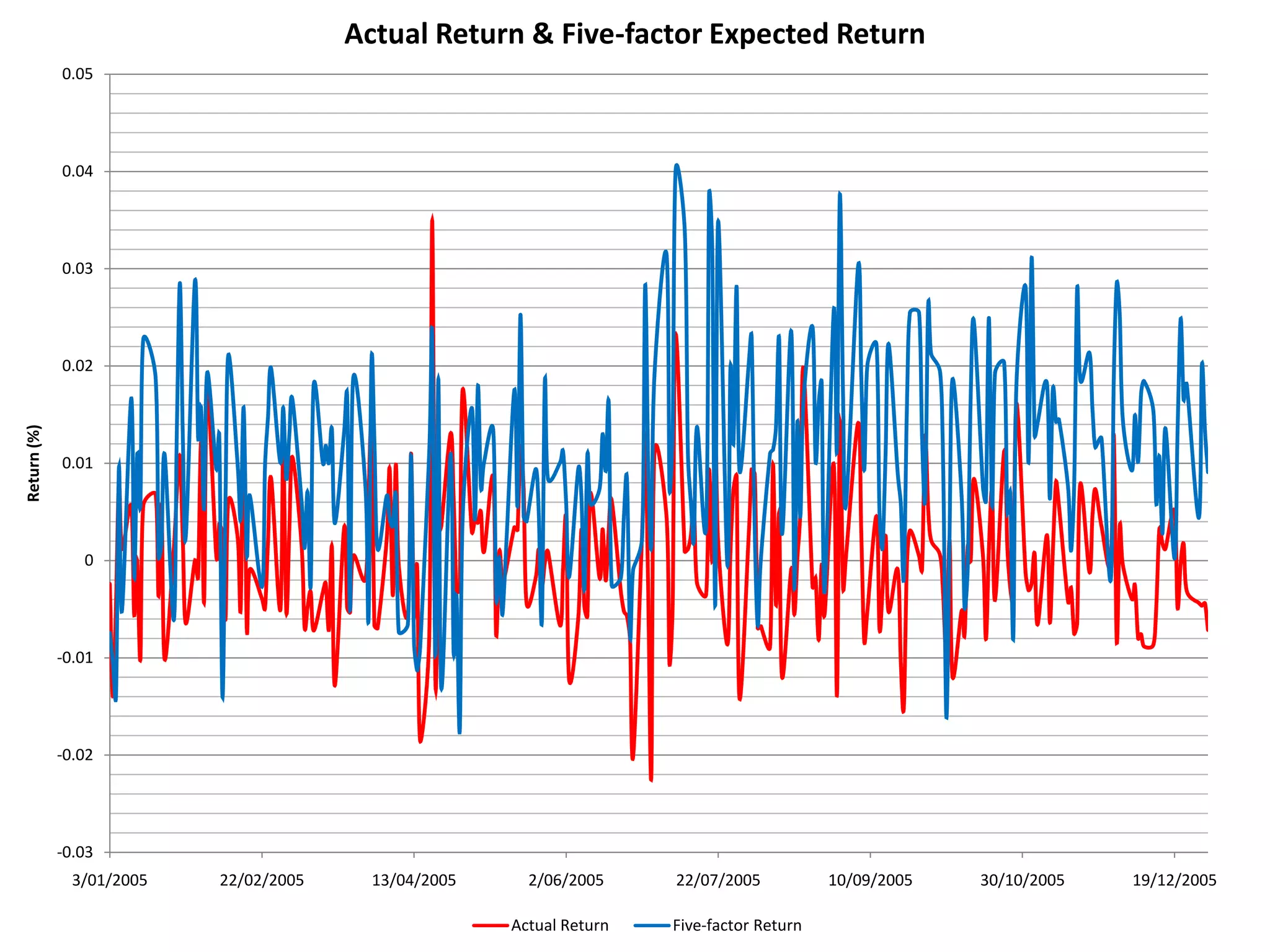

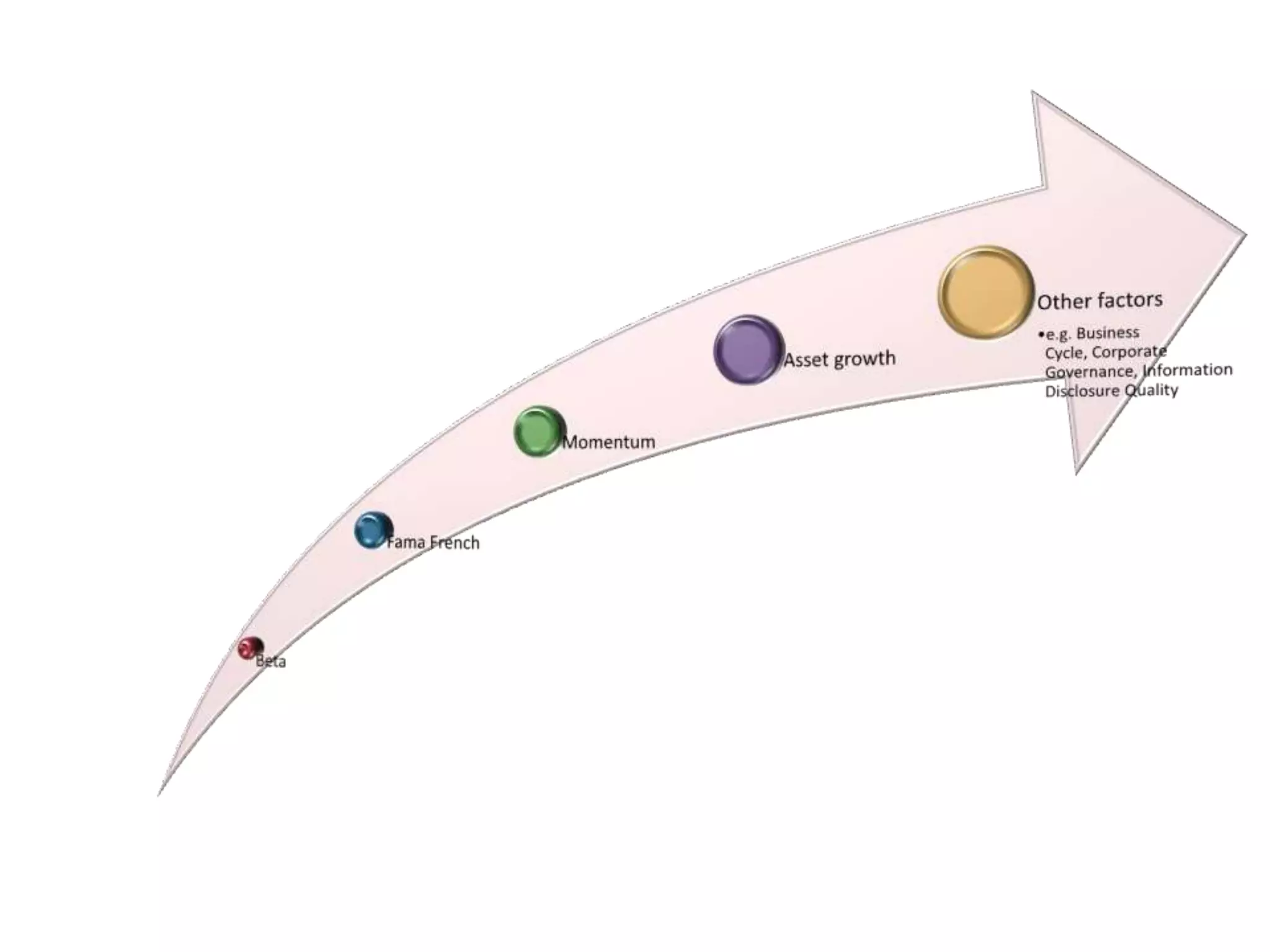

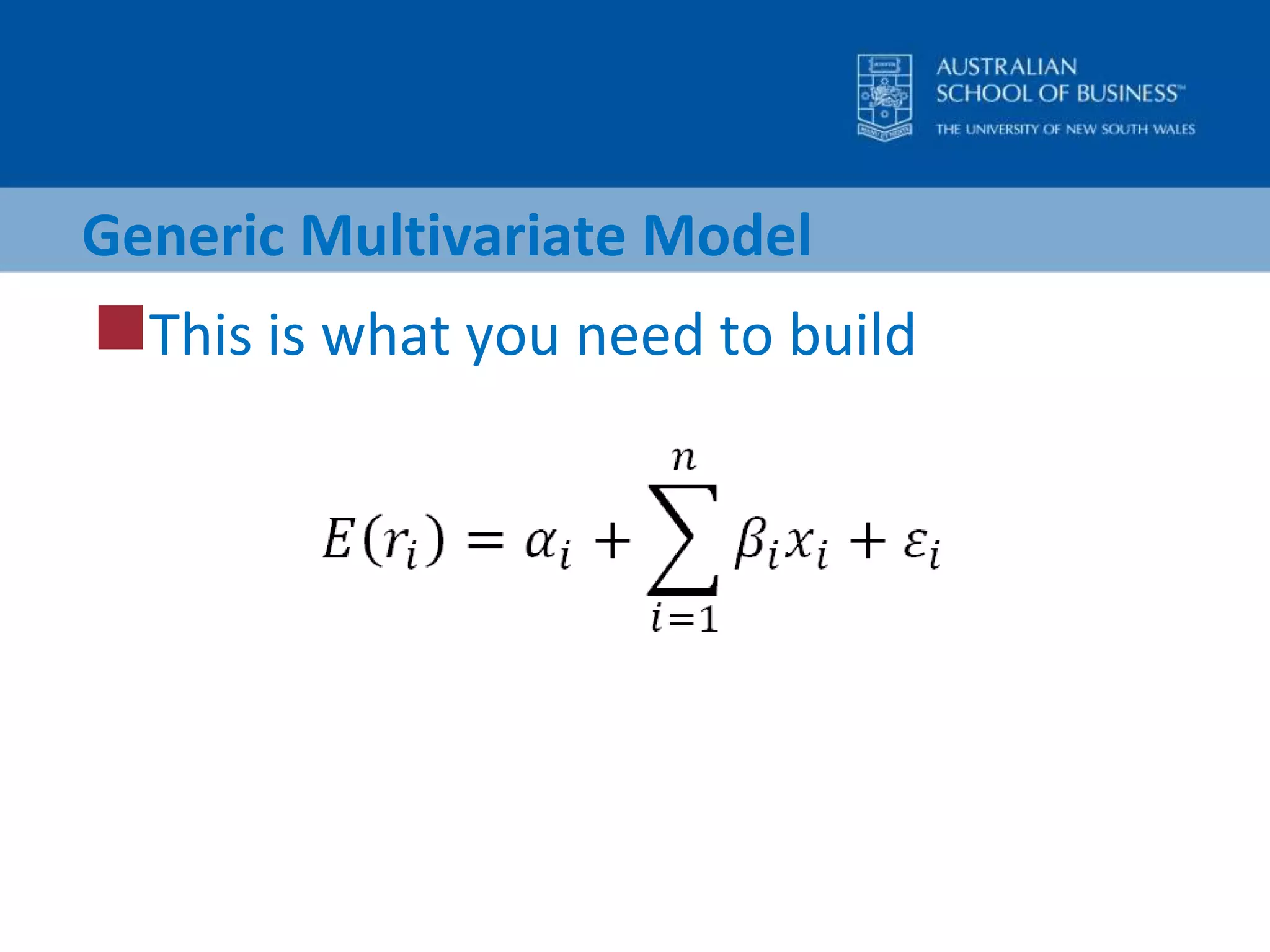

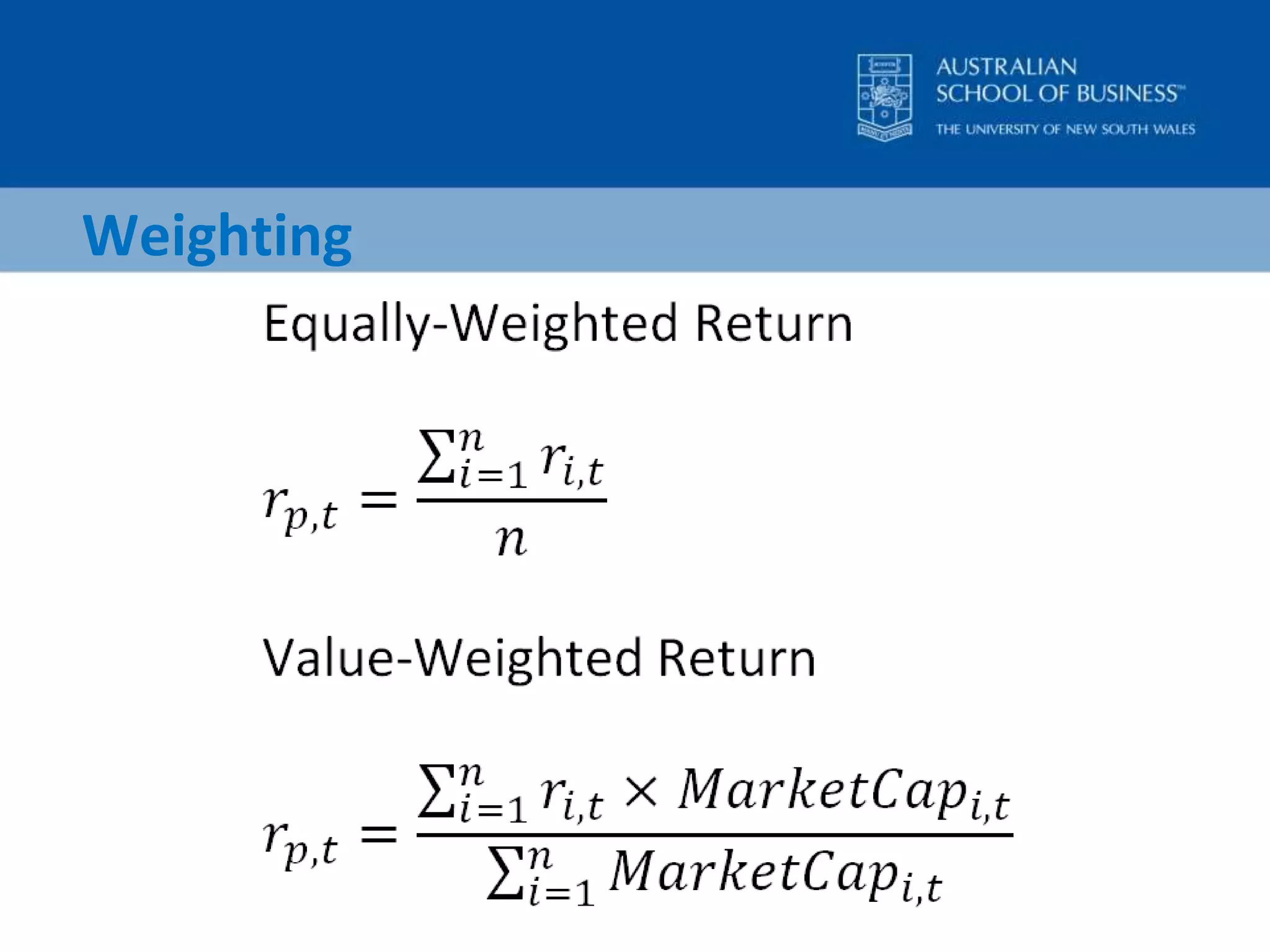

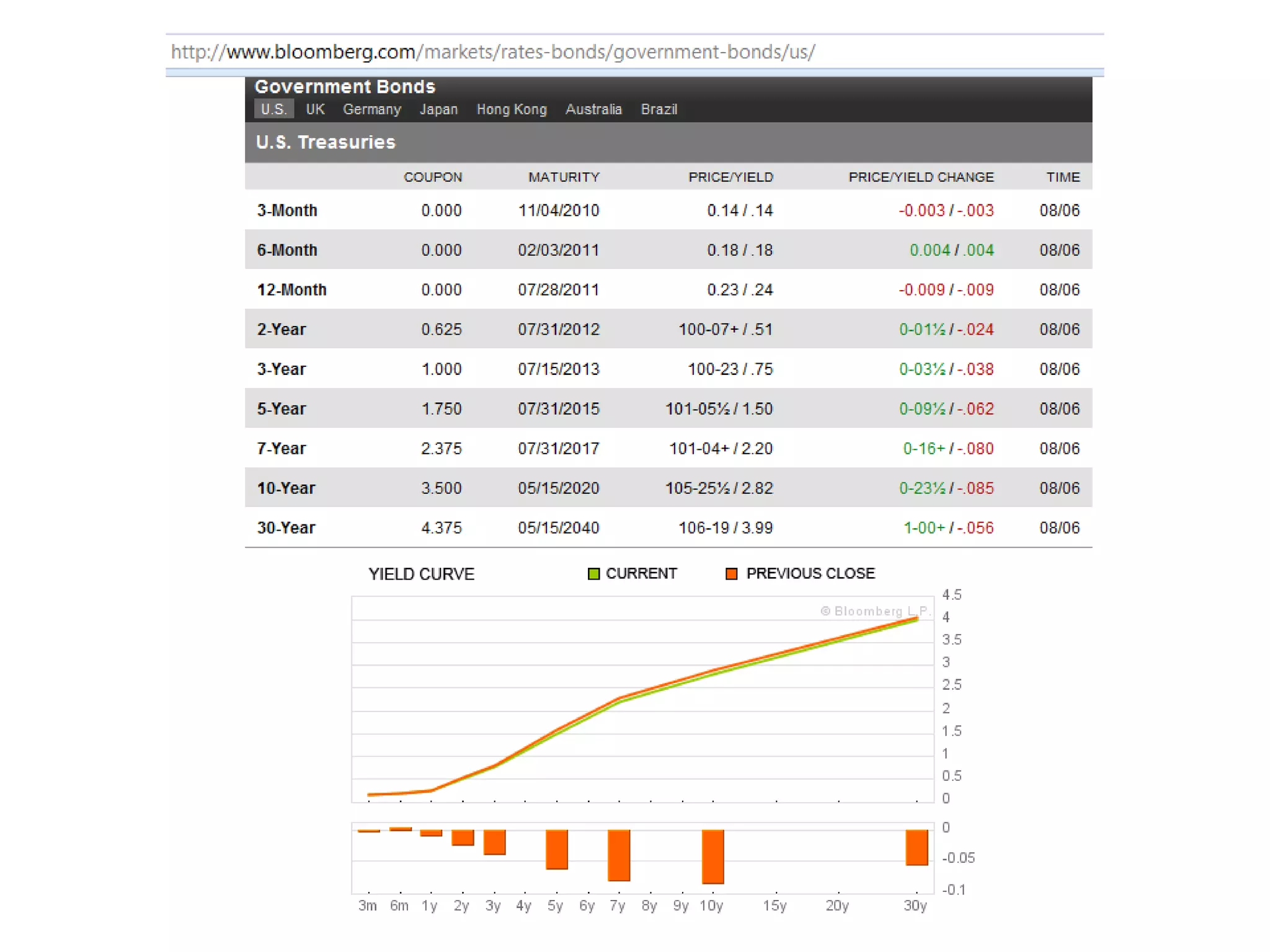

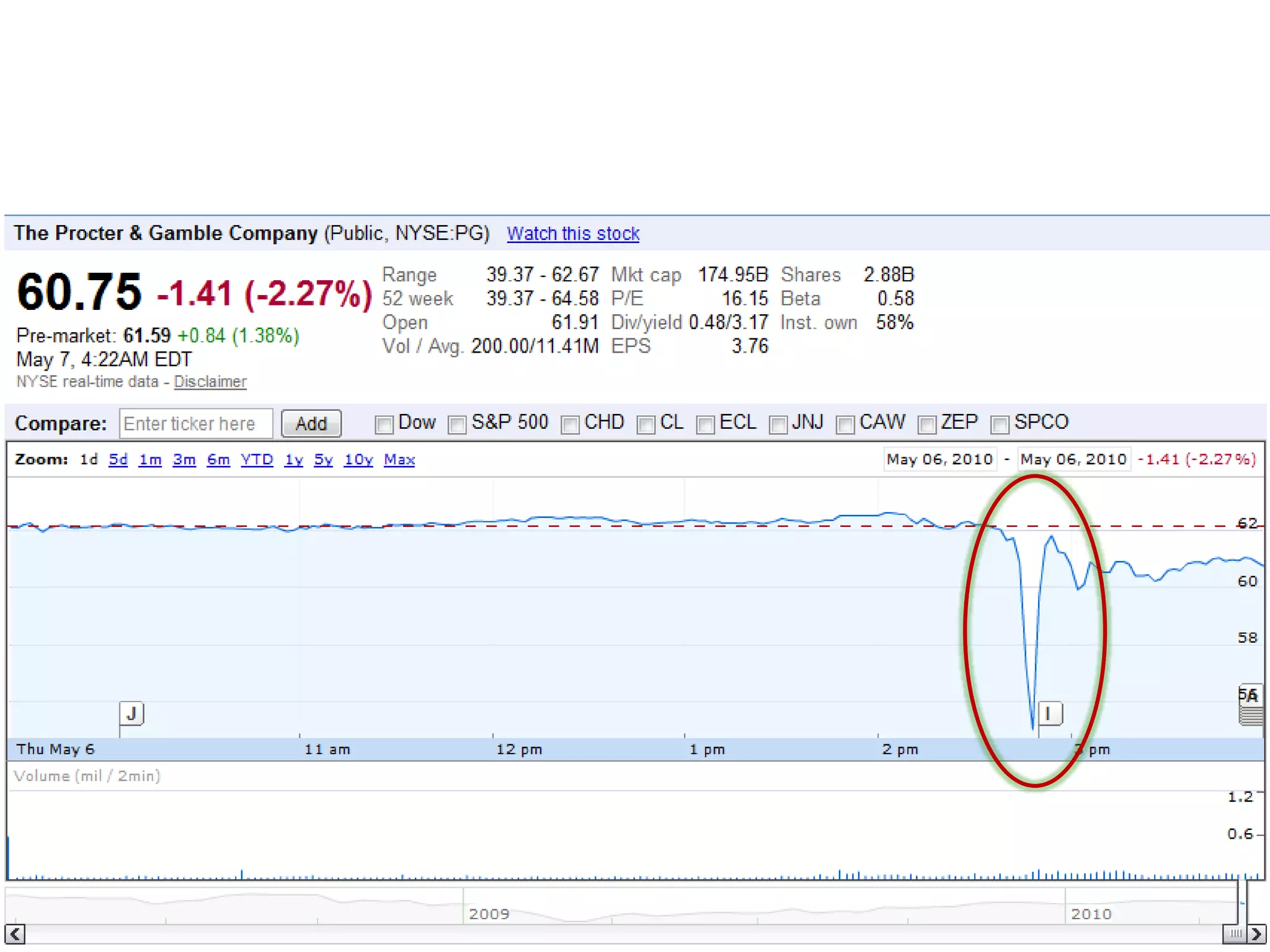

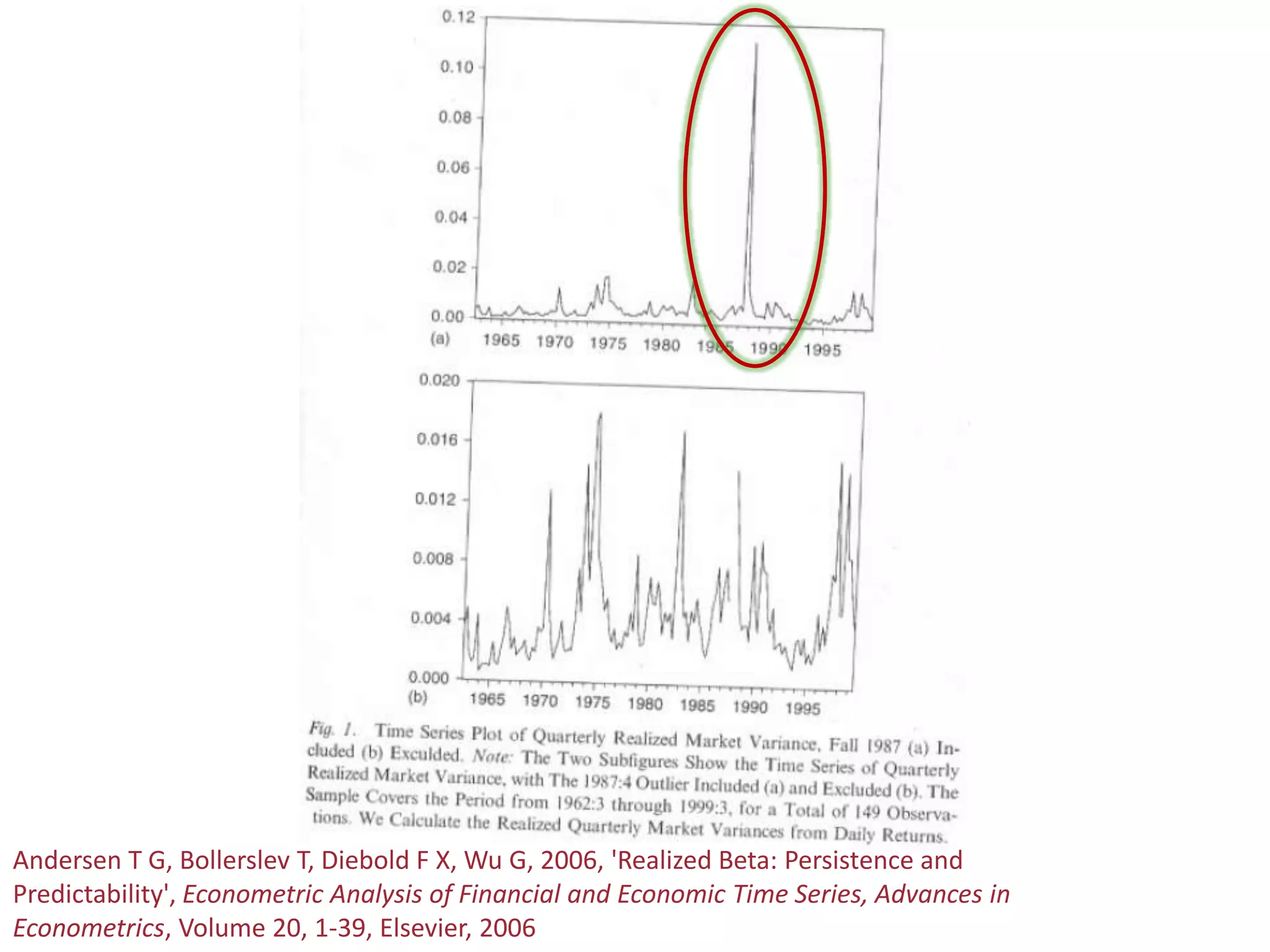

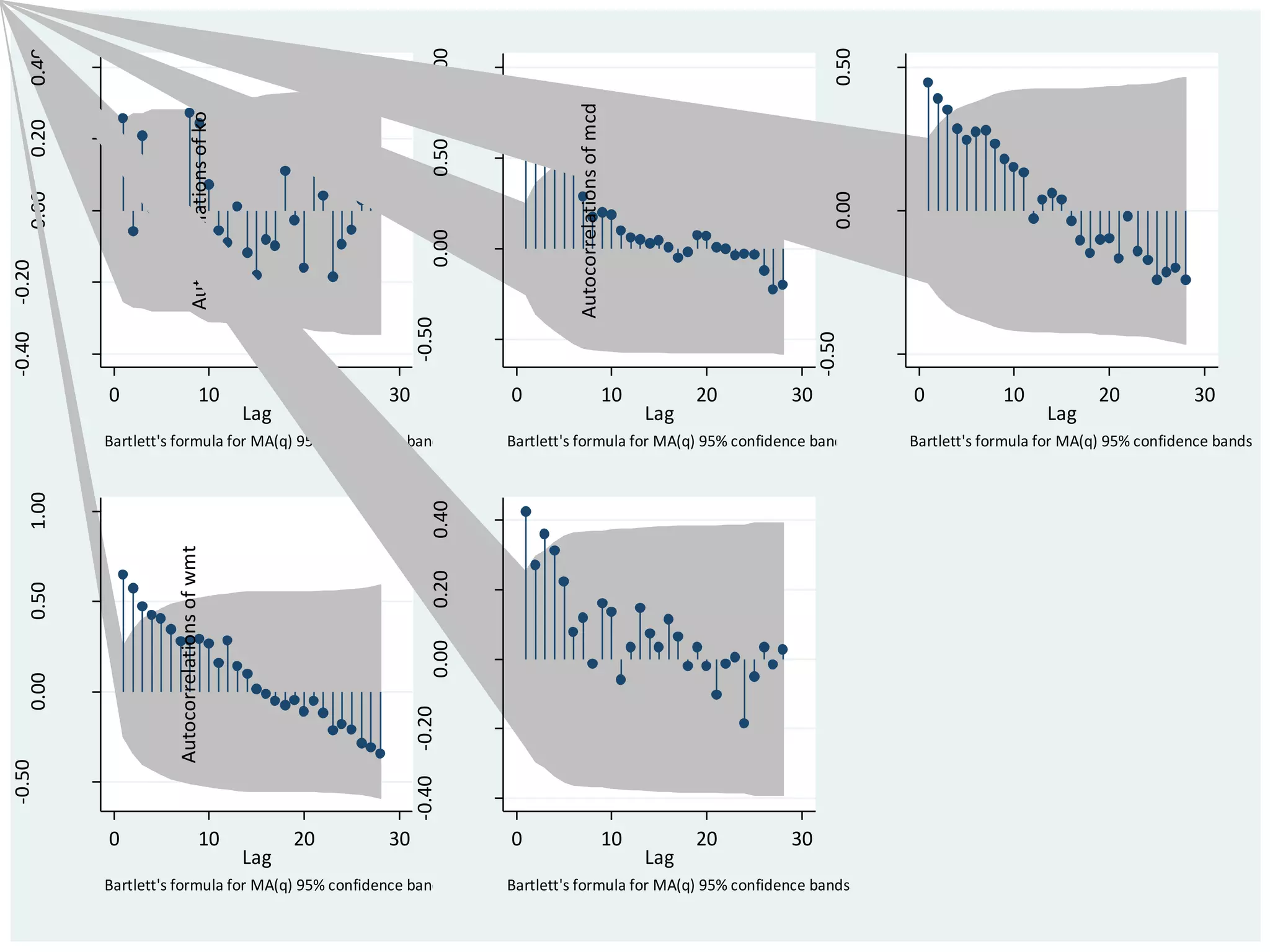

This document provides an introduction to using Stata for financial modeling. It discusses various multivariate models including the CAPM, Fama-French 3-factor model, 4-factor model, and 5-factor model. It also covers topics like data management, statistical testing, and addressing issues like multicollinearity, outliers, autocorrelation, and heteroskedasticity. Suggested readings on multivariate models and factors like momentum, asset growth, and corporate governance are also provided.