This document summarizes a master's thesis on integrating market views into quantitative portfolio allocation. It introduces the concepts of optimal asset allocation, mean-variance optimization, and dimension reduction using linear factor models. It then discusses incorporating investor views through information sets and the efficient market hypothesis. The Black-Litterman model uses a Gaussian market assumption, CAPM reverse optimization, and Bayesian updating to integrate views. An alternative approach uses f-divergences to measure distortions between probability distributions and translate views into information gain. The thesis concludes by proposing directions for future research.

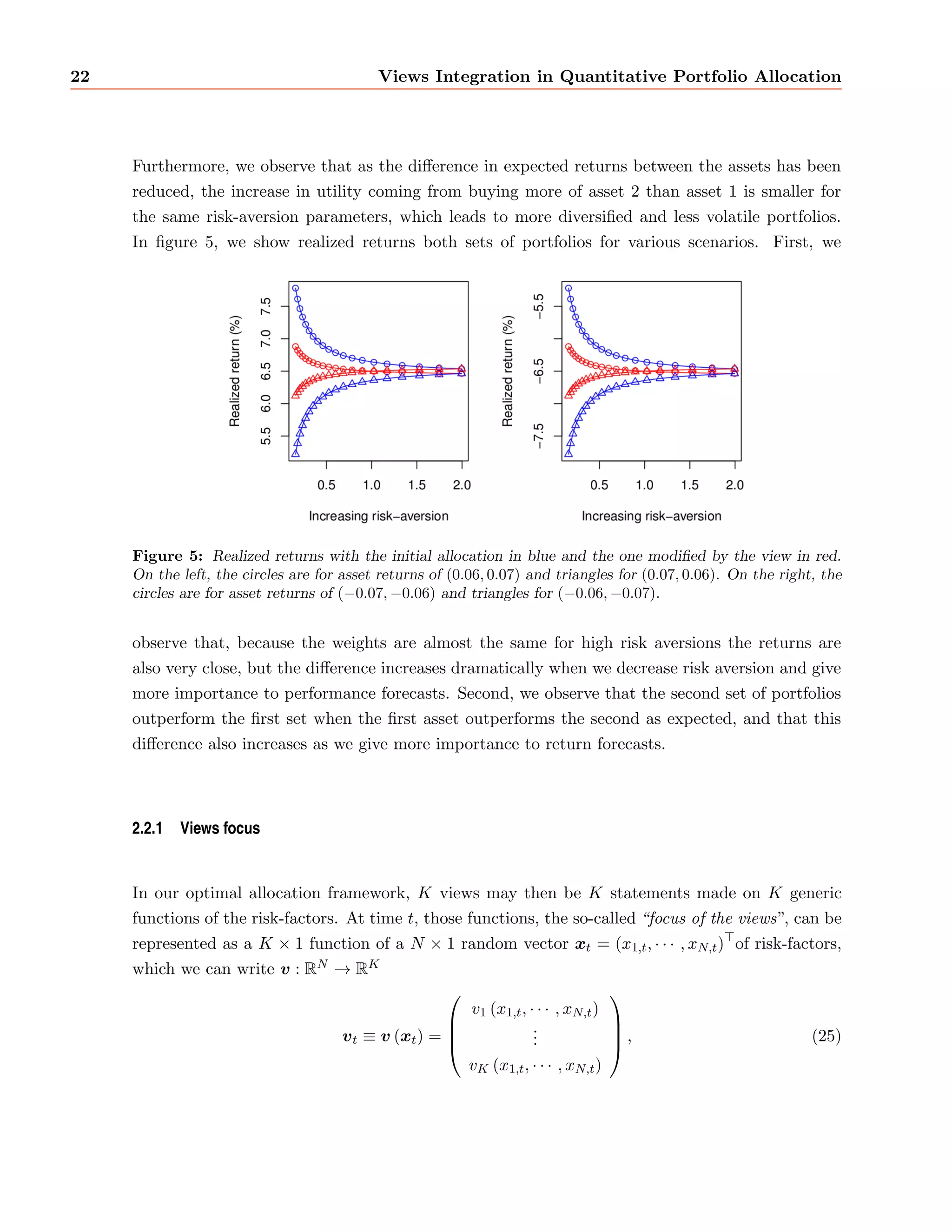

![4 Views Integration in Quantitative Portfolio Allocation

1 Introduction

To use the [expected returns-variance] rule in the selection of securities we must have proce-

dures for](https://image.slidesharecdn.com/806cd096-7d64-44de-bd0f-a7868ffd6479-141211065559-conversion-gate02/75/vatter_pdm_1-1-7-2048.jpg)

![nancing strategies (e.g. the optimal consumption/saving problem introduced

by Fisher in [31]) which need in general to be solved using dynamic programming (see [1] for an

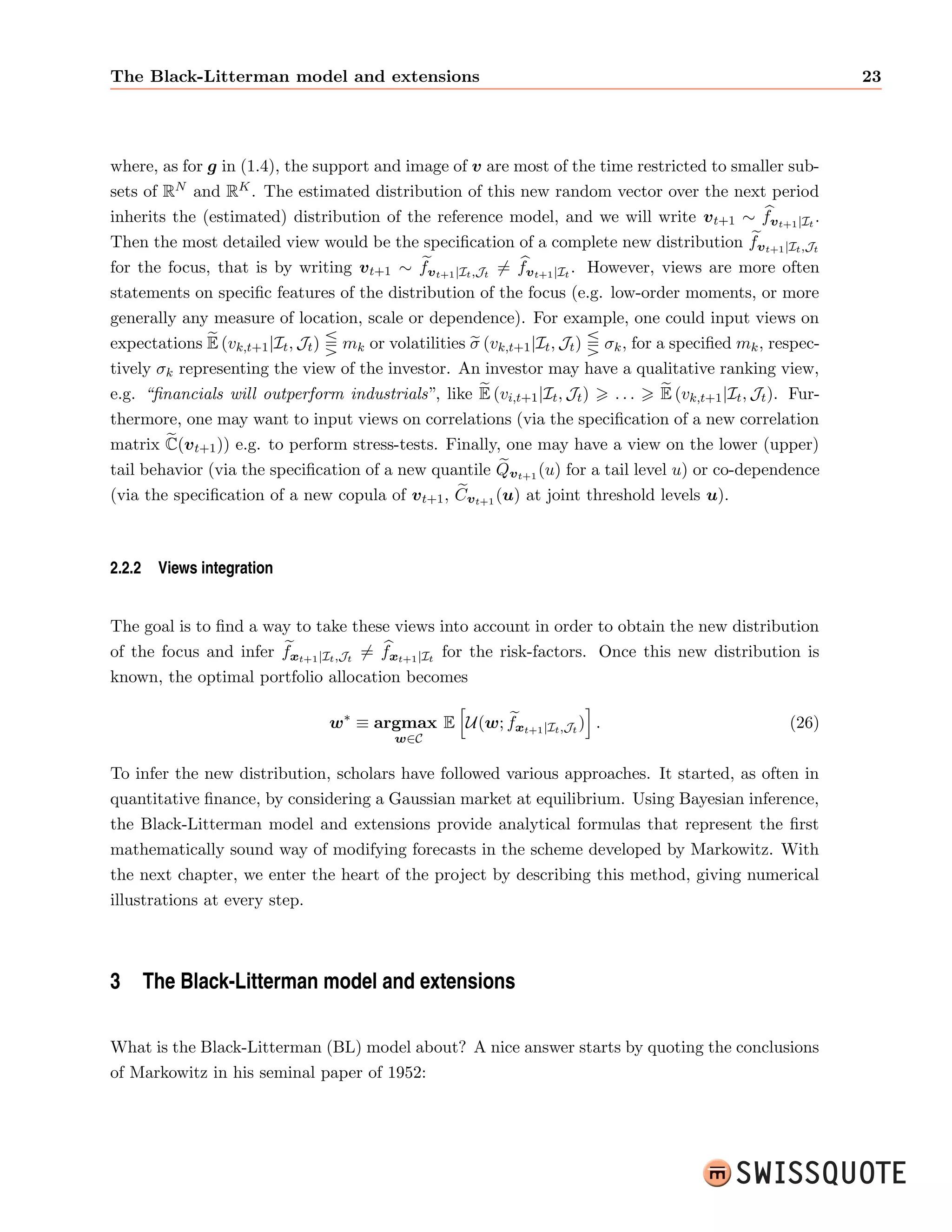

introduction on the subject in Economics). In this respect, our minimal investment constraint is

Pn

called the budget constraint and is expressed as

i=1

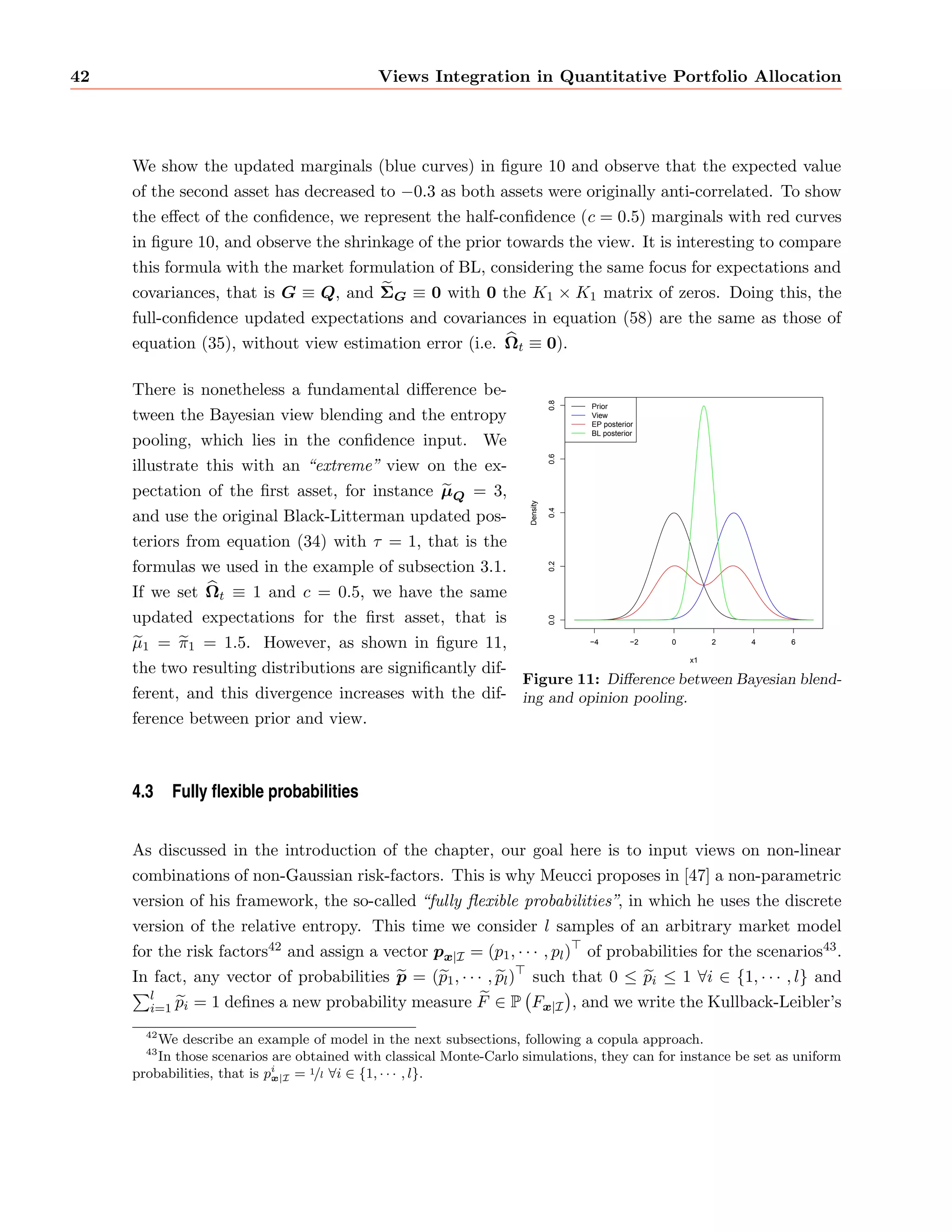

wp

i;t = 1 8t.

1.2 The mean-variance allocation scheme

Let us give an example within the mean-variance framework pioneered by Markowitz in [45].

We start by assuming that an investor has originally picked the securities in which he wanted

to invest. Indeed Markowitz's framework (as other quantitative allocation schemes) was not

developed for stock picking (i.e. the initial choice of the n securities). In fact, themean-variance

oered the](https://image.slidesharecdn.com/806cd096-7d64-44de-bd0f-a7868ffd6479-141211065559-conversion-gate02/75/vatter_pdm_1-1-27-2048.jpg)

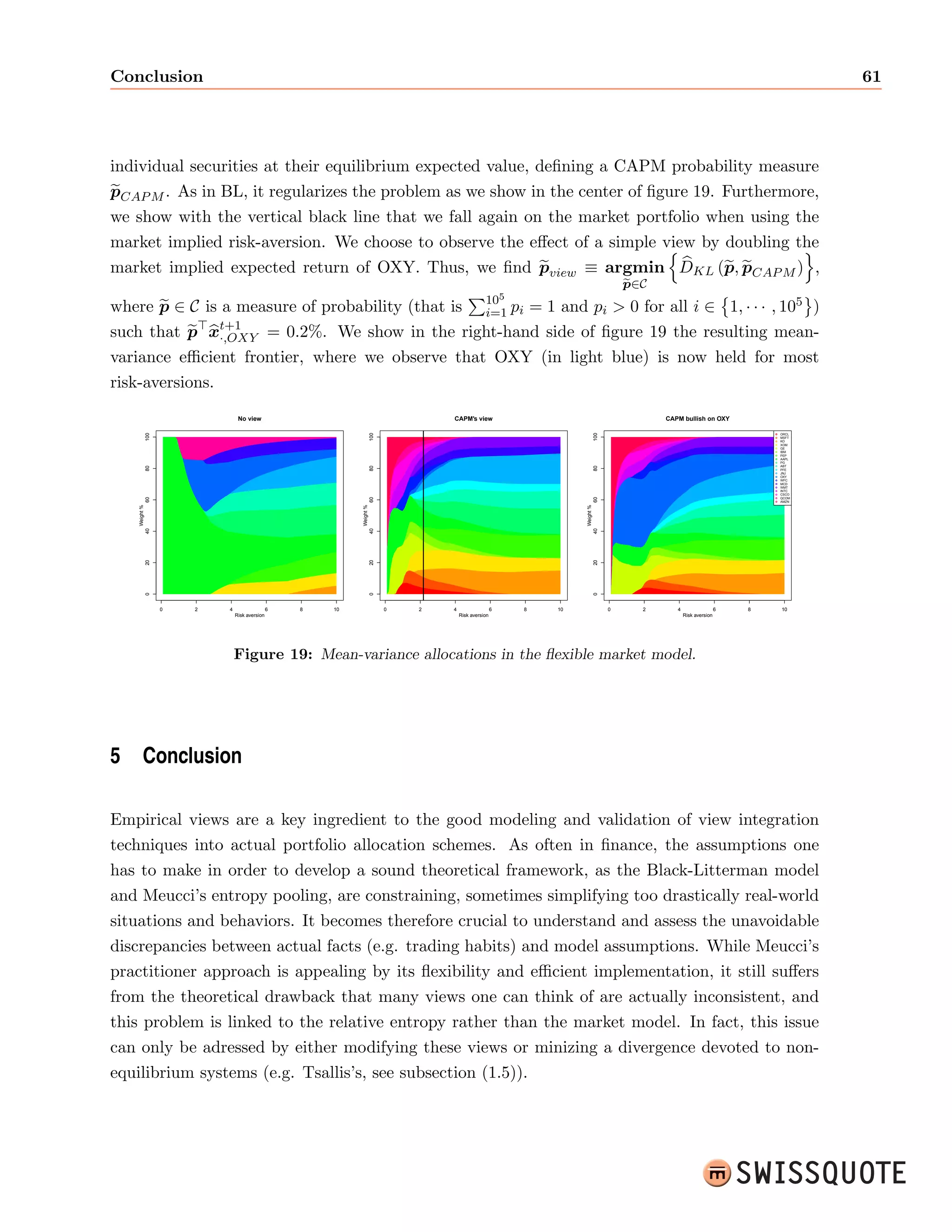

![rp=0

r2

p + O

r3

p

; (3)

with U (rp) 0. This development can indeed only be valid when considering small investment

horizons such as daily or weekly, that is horizons for which rp is (usually) close to zero. Truncating

the higher order terms, the expectation of equation (3) yields

E[U (rp)]

@U

@rp](https://image.slidesharecdn.com/806cd096-7d64-44de-bd0f-a7868ffd6479-141211065559-conversion-gate02/75/vatter_pdm_1-1-37-2048.jpg)

![rp=0

E[rp] +

@2U

@r2

p](https://image.slidesharecdn.com/806cd096-7d64-44de-bd0f-a7868ffd6479-141211065559-conversion-gate02/75/vatter_pdm_1-1-41-2048.jpg)

![rst is

straightforward in the context of rational expectations, the second has been shown empirically

for instance in [54]. Those assumptions imply that the utility is an increasing function (or

equivalently the](https://image.slidesharecdn.com/806cd096-7d64-44de-bd0f-a7868ffd6479-141211065559-conversion-gate02/75/vatter_pdm_1-1-50-2048.jpg)

![ne the vector

of conditional expectations t = (E[r1;t+1jFt] ; ;E[rn;t+1jFt]) and covariance matrix t

with ij;t = Cov [ri;t+1; rj;t+1jFt]7 for the individual securities at time t, where Ft denotes all

information available at that time, and jFt means conditional on the information set Ft8. Then

we have the portfolio conditional expected return

E[rp;t+1jFt] =

Xn

i=1

wp

i;t1E[ri;t+1jFt] = w

p;tt; (5)

which is the weighted average over the portfolio positions of the security conditional expected

returns, likewise the portfolio variance

V ar [rp;t+1jFt] = Cov

h

w

p;trt+1;w

p;trt+1jFt

i

=

Xn

i=1

wp

i;t

2

V ar [ri;t+1jFt] +

Xn

i;j=1;i6=j

wp

i;twp

j;tCov [ri;t+1; rj;t+1jFt]

= w

p;ttwp;t (6)

and the volatility [rp;t+1jFt] =

p

V ar [rp;t+1jFt] of the portfolio, with respect to the all infor-mation

available at time t. Finally the mean-variance expected utility, equivalently9 to (4), with

5If it was not the case, the investor would not bother optimizing.

6We de](https://image.slidesharecdn.com/806cd096-7d64-44de-bd0f-a7868ffd6479-141211065559-conversion-gate02/75/vatter_pdm_1-1-52-2048.jpg)

![ne the conditional covariance between two random variables ri and rj as

Cov [ri;t+1; rj;t+1jFt]= E [(ri;t+1 E [ri;t+1jFt]) (rj;t+1 E

[rj;t+1jFt]) jFt]. If ri = rj , we de](https://image.slidesharecdn.com/806cd096-7d64-44de-bd0f-a7868ffd6479-141211065559-conversion-gate02/75/vatter_pdm_1-1-54-2048.jpg)

![ne the condi-

tional variance V ar [ri;t+1jFt] = Cov [ri;t+1; ri;t+1jFt]= (ri;t+1 2 E

E [ri;t+1jFt])jFt

and conditional standard

deviation (also called volatility in our context) [ri;t+1jFt] =

p

V ar [ri;t+1jFt].

8We will give later a formal de](https://image.slidesharecdn.com/806cd096-7d64-44de-bd0f-a7868ffd6479-141211065559-conversion-gate02/75/vatter_pdm_1-1-55-2048.jpg)

![ltered probability space.

9The dierence comes from assuming that E [rp;t+1jFt]2 E

r2

p;t+1jFt

, or equivalently V ar [rp;t+1jFt]

E

r2

p;t+1jFt

.](https://image.slidesharecdn.com/806cd096-7d64-44de-bd0f-a7868ffd6479-141211065559-conversion-gate02/75/vatter_pdm_1-1-57-2048.jpg)

![8 Views Integration in Quantitative Portfolio Allocation

risk-aversion parameter

reads

E[U (wp;t;t;t)] = E[rp;t+1jFt]

2

V ar [rp;t+1jFt]

= w

p;tt

2

w

p;ttwp;t: (7)

The risk-aversion parameter

=

1

2

@2U

@r2

p](https://image.slidesharecdn.com/806cd096-7d64-44de-bd0f-a7868ffd6479-141211065559-conversion-gate02/75/vatter_pdm_1-1-58-2048.jpg)

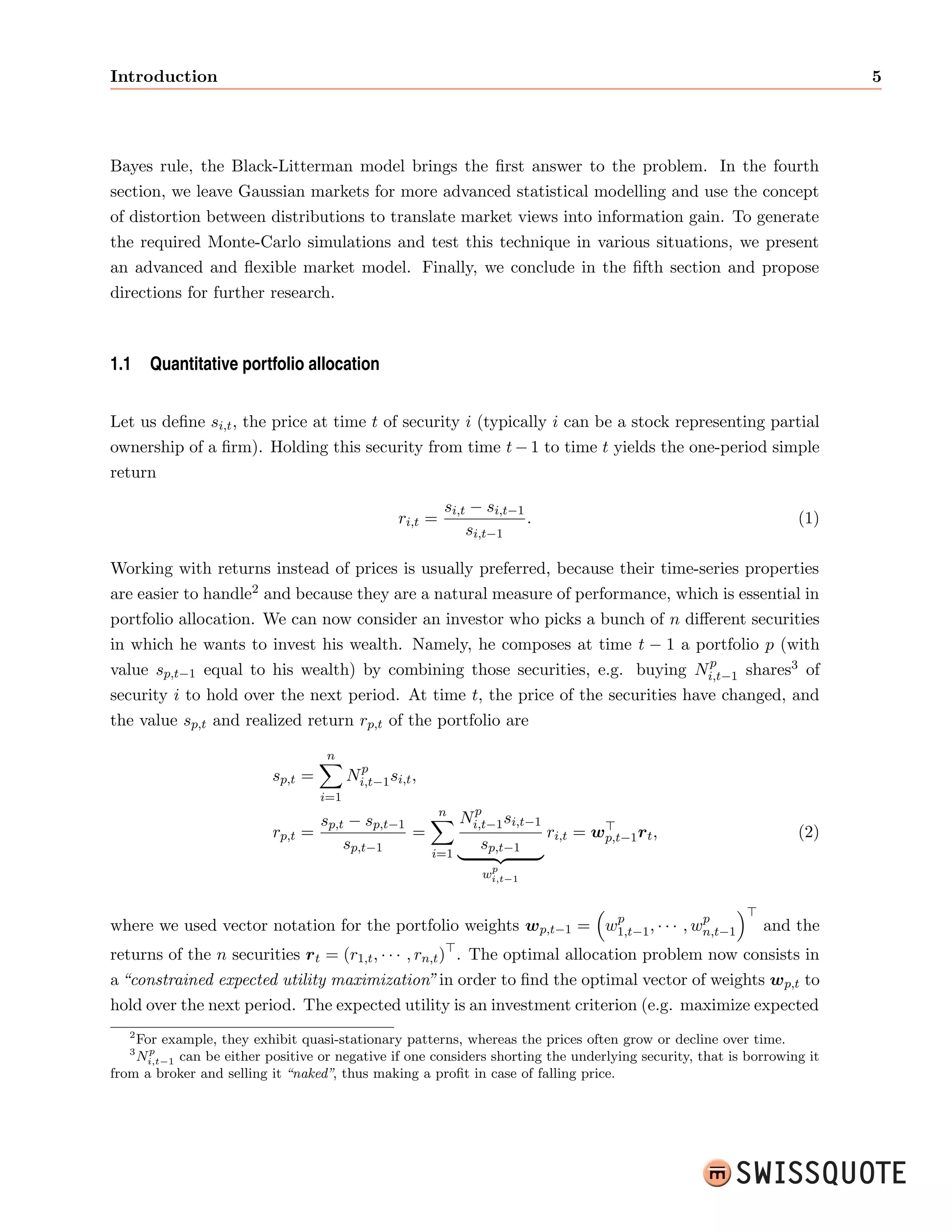

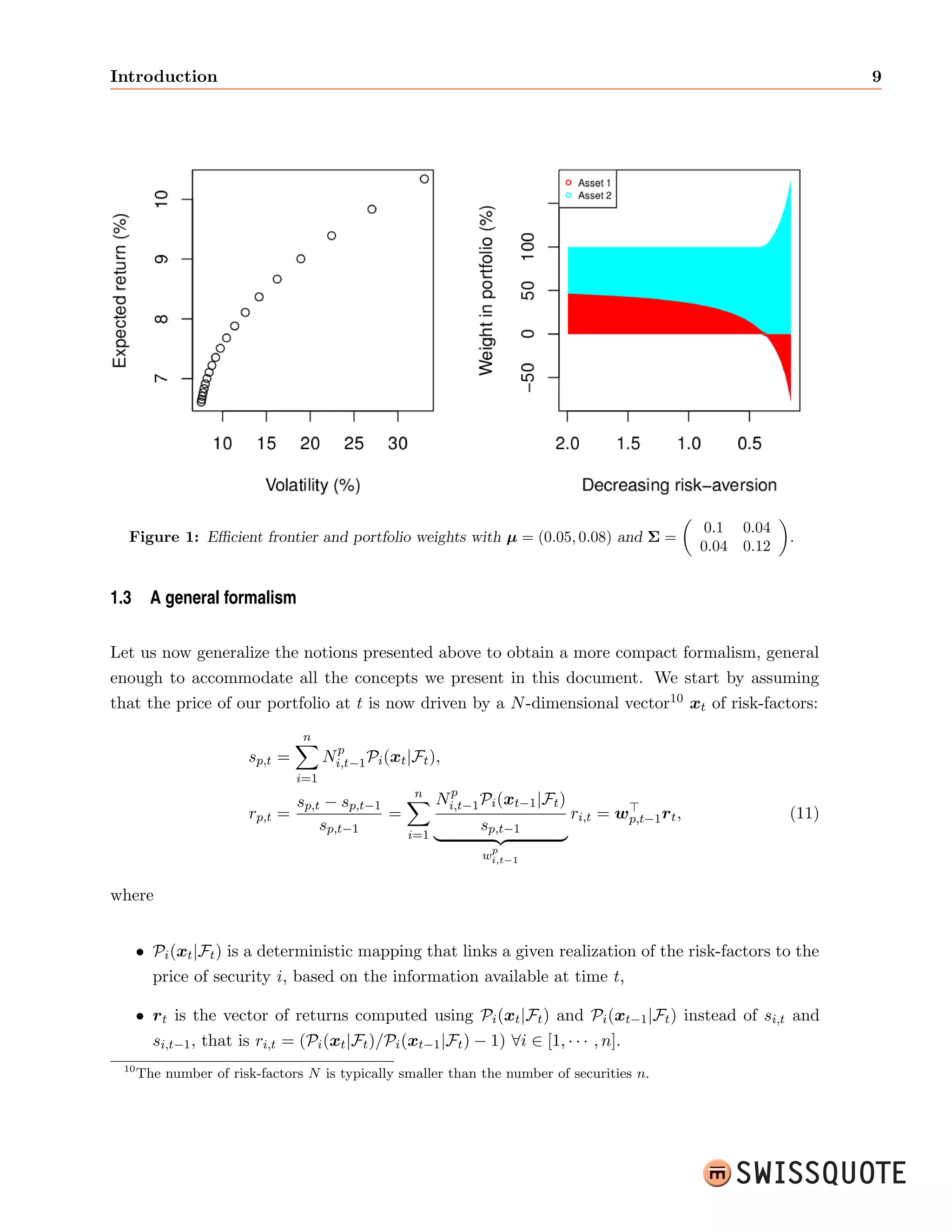

![Introduction 9

Figure 1: Ecient frontier and portfolio weights with = (0:05; 0:08) and =

0:1 0:04

0:04 0:12

.

1.3 A general formalism

Let us now generalize the notions presented above to obtain a more compact formalism, general

enough to accommodate all the concepts we present in this document. We start by assuming

that the price of our portfolio at t is now driven by a N-dimensional vector10 xt of risk-factors:

sp;t =

Xn

i=1

Np

i;t1Pi(xtjFt);

rp;t =

sp;t sp;t1

sp;t1

=

Xn

i=1

Np

i;t1Pi(xt1jFt)

| sp{;tz1 }

wp

i;t1

ri;t = w

p;t1rt; (11)

where

Pi(xtjFt) is a deterministic mapping that links a given realization of the risk-factors to the

price of security i, based on the information available at time t,

rt is the vector of returns computed using Pi(xtjFt) and Pi(xt1jFt) instead of si;t and

si;t1, that is ri;t = (Pi(xtjFt)=Pi(xt1jFt) 1) 8i 2 [1; ; n].

10The number of risk-factors N is typically smaller than the number of securities n.](https://image.slidesharecdn.com/806cd096-7d64-44de-bd0f-a7868ffd6479-141211065559-conversion-gate02/75/vatter_pdm_1-1-70-2048.jpg)