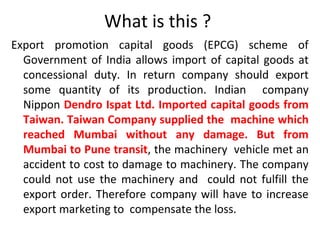

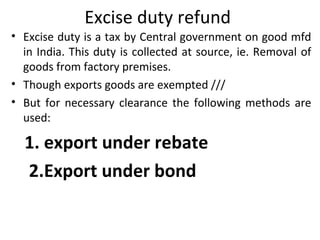

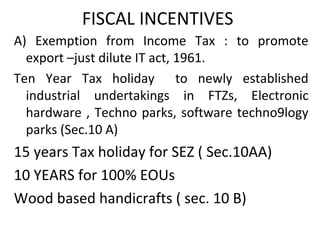

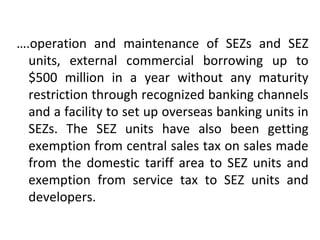

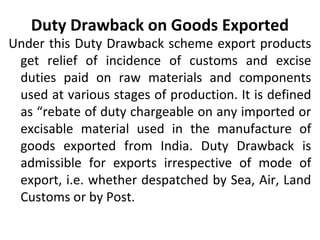

The document discusses various export promotion schemes and fiscal incentives in India. It outlines schemes that provide duty exemptions or remissions on imports of inputs for export production, including Advance Authorizations, Duty Free Import Authorizations, and Duty Entitlement Passbook schemes. It also discusses duty drawback schemes that provide refunds of import duties on raw materials. Other topics covered include Export Promotion Capital Goods scheme, excise duty refunds, income tax exemptions, and marketing assistance available to exporters in India.

![The 1992 -97 Mantra in India

• India’s external Trade policy

[laid down the foundation of

globalization of Indian economy].

• Initiating liberalization and making

Indian industries to face

competition from foreign MNCs](https://image.slidesharecdn.com/unitvexportincentives-150108023815-conversion-gate01/85/Unit-v-export-incentives-3-320.jpg)

![Support which Indian exporters GET

• JUST see your FTP [2009-14]

EPCG[ Export Promotion Capital Goods

Scheme]

Introduced in 1992-97 EXIM policy.

To enable exporter to import capital goods.

Export obligation !! i.e EXPORTER required

to guarantee exports of certain minimum

value, which is multiple of the value of

capital goods imported.](https://image.slidesharecdn.com/unitvexportincentives-150108023815-conversion-gate01/85/Unit-v-export-incentives-5-320.jpg)

![Duty free import authorization[DFIA]

• DFIA is issued to allow duty free

imports of inputs, fuel, oil,

energy sources, catalyst which

are required in export

production.

• This is given based on the SION

-Standard INPUT OUTPUT norms]](https://image.slidesharecdn.com/unitvexportincentives-150108023815-conversion-gate01/85/Unit-v-export-incentives-7-320.jpg)

![DUTY remission Schemes

• Duty Entitlement Passbook [ BEPB] : is to

neutralize the incidence of customs duty on

import contents of export product.

• Here Exporter may apply for credit as a specified

percentage of FOB value of exports.

• Such credit may be utilized for payment of

customs duty on freely importable items/ or

restricted items and also on imports under EPCG

Scheme.](https://image.slidesharecdn.com/unitvexportincentives-150108023815-conversion-gate01/85/Unit-v-export-incentives-8-320.jpg)

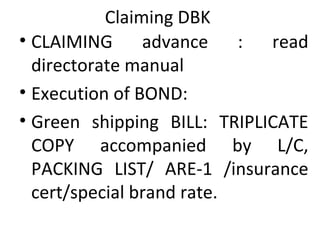

![DBK[ Duty Drawback Scheme]

• Administered by the Directorate of Drawback,

Dept. of Revenue, Ministry of Finance, Govt. of

India, Jeevan Deep, Parliament Street, New Delhi -

110 001.

• Under this scheme: Exporters are entitled to

claim: 1. Customs duty paid on the import of raw

materials, components, and consumables.

• 2. Central excise duty paid on indigenous raw

materials, components and consumables utilized

in the manufacture if exportable goods.](https://image.slidesharecdn.com/unitvexportincentives-150108023815-conversion-gate01/85/Unit-v-export-incentives-10-320.jpg)

![Classification of DBK

• All Industry rates:

• Brand rates

• Special brand rates [ Performa

I,II and III]

• ElGILIBILITY :](https://image.slidesharecdn.com/unitvexportincentives-150108023815-conversion-gate01/85/Unit-v-export-incentives-11-320.jpg)

![NO TAX PAYABLENo tax is payable under this Act on –

Any transaction of sale in the course of export out of the territory of India. [Section 5(1)].

Sale in the course of import or sale effected by transfer of document of title to the goods

before it crosses the custom frontier of India popularly known as "High Seas Sale".

[Section 5(2)]

Sale of goods to the exporter for the purpose of complying with pre-existing export order

or agreement against Form H. [Section 5(3)]

Any subsequent sale, during inter-state movement of goods, effected by transfer of

documents is exempted if the sale is made to a registered dealer, provided the

prescribed declarations are obtained from the supplier and the purchaser of such goods.

[Section 6(2)]

Inter-State sale of goods to any foreign diplomats/mission/consulates/United Nations, etc.

against Form J. [Section 6(3)]

Inter-State stock transfer against Form F. [Section 6A]

Sale of goods to:

(a) Developer of SEZ; (b) Unit situated in SEZ against Form I [Section 8(6)]

Sale of goods to notified persons against Form "J" [Section 8(4)]](https://image.slidesharecdn.com/unitvexportincentives-150108023815-conversion-gate01/85/Unit-v-export-incentives-19-320.jpg)

![Octroi Exemption

EXEMPTION FROM OCTROI [EXPORT ROMOTION] RULES 1976.

Every claim for exemption from Octroi under these Rules

must be supported by an application for exemption in

triplicate in form 'EP, ' annexed to these Rules and duly

filled in and signed by a Registered Exporter or by a

Custom House Agent who may be Authorised to sign

such 'EP' From under the condition of the Bond or by a

person holding power of attorney from under the

condition of the Bond or by a person holding power of

attorney from a registered exporter, and no such

application shall be entertained unless it fulfills the

following conditions.](https://image.slidesharecdn.com/unitvexportincentives-150108023815-conversion-gate01/85/Unit-v-export-incentives-21-320.jpg)

![Forms to be used by tax-payers.

FormRemarksADeclaration-cum-application to pay Octroi, to be filled in by the importer

at the time of import.

( Rules 4, 6, 8 & 12 of Levy of Octroi Rules. )BImport Octroi Bill - Receipt showing

Octroi Collected.

( Rules 4, 6, 8 &12 of Levy of Octroi Rules. )C (Front)

C (Back)Octroi Export Note for use in case of export by Sea.

(Rule 4, Refund of Octroi Rules). Also in case of export by Air.CCOctroi Export Note

for use in case of export by Road.

( Rule, 29(g), Refund of Octroi Rules. )D (Front)

D (Back)Application for refund on account of export.

( Rule, II (a) Refund of Octroi Rules.)ERefund Receipt.

[ Rule, 11 ( c ), Refund of Octroi Rules. ]EP (Front)

EP (back)Application for exemption in respect of

articles imported for export to Foreign Countries.

(Rule, 5-A, Export Promotion Rules. )](https://image.slidesharecdn.com/unitvexportincentives-150108023815-conversion-gate01/85/Unit-v-export-incentives-22-320.jpg)

![Marketing Assistance

• MDA- Market development Assistance [ EPCs,

commodity boards, FIEO

• MAI- market Access initiative [ survey/ field

study]

Supply of Raw Materials:

Indian Raw material assistance centre

Back to back inland L/C](https://image.slidesharecdn.com/unitvexportincentives-150108023815-conversion-gate01/85/Unit-v-export-incentives-24-320.jpg)

![DFIA [ duty free import authorization]

• EOUs

• Software Techno Parks

• Electronic Hardware TECHNO parks[ EHTPS]

• Bio- Tech parks

• Supply of goods

• Supply of Infrastructure

• Supply of projects

• What not ??](https://image.slidesharecdn.com/unitvexportincentives-150108023815-conversion-gate01/85/Unit-v-export-incentives-35-320.jpg)