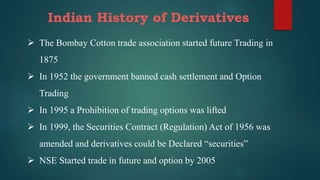

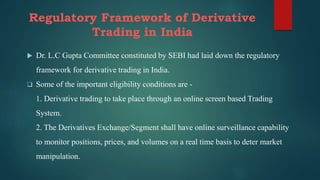

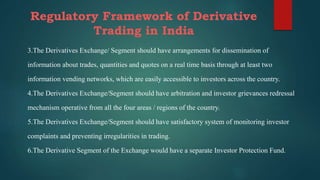

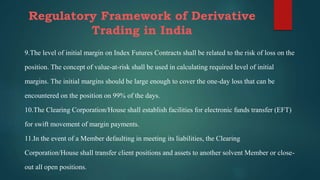

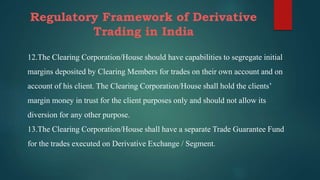

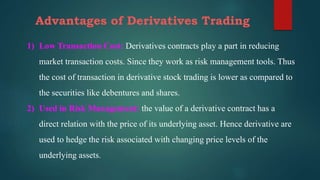

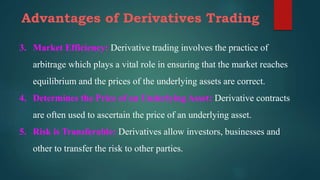

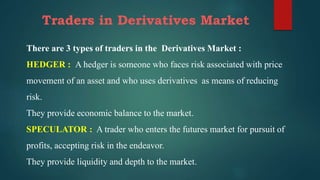

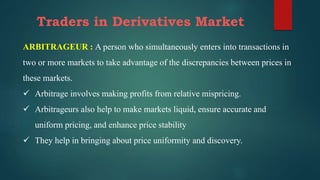

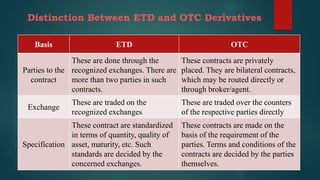

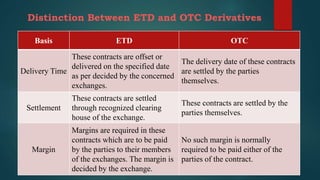

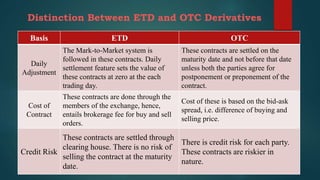

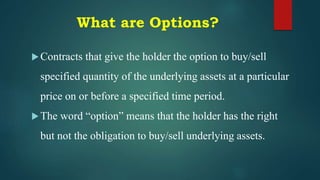

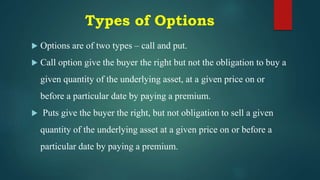

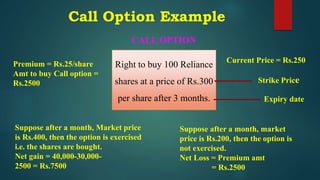

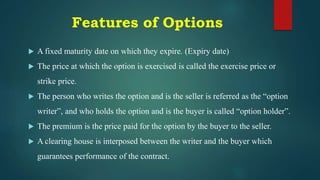

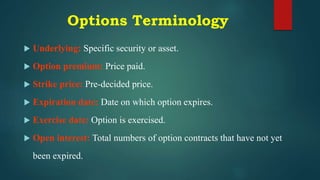

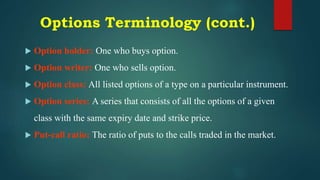

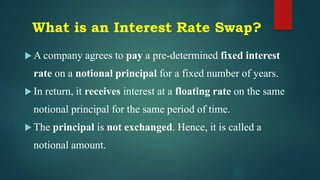

The document outlines a comprehensive syllabus for a course on financial derivatives, covering essential topics such as types of derivatives, options markets, hedging techniques, and regulatory frameworks, particularly in India. It discusses the advantages and disadvantages of derivatives trading, types of traders involved, and the differences between OTC and exchange-traded derivatives. Key concepts such as forward and futures contracts, options, and their valuation models are also included, providing a foundational understanding of the derivatives market.