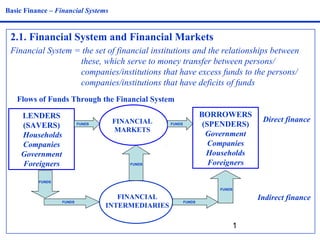

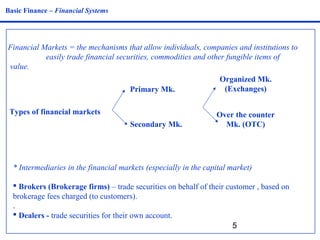

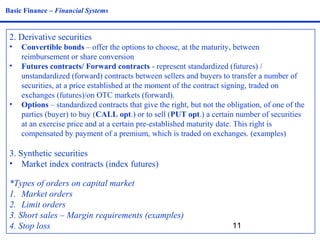

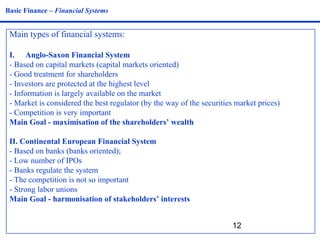

The document defines and describes key components of a financial system. It explains that a financial system consists of financial institutions and markets that facilitate the transfer of funds between entities with excess capital and those with deficits. It outlines the main participants in financial systems as households, companies, governments, and foreigners. It also describes various financial intermediaries like banks, investment funds, pension funds, and insurance companies. Finally, it provides examples of different types of financial markets and securities.