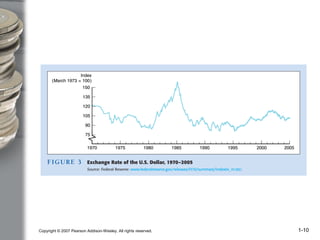

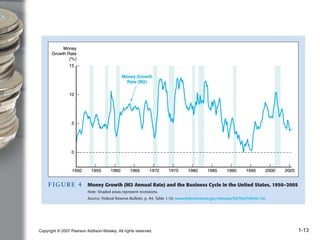

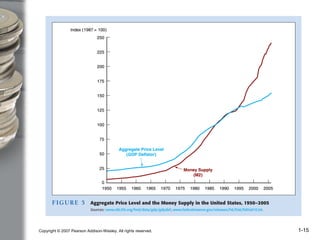

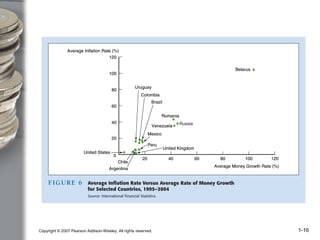

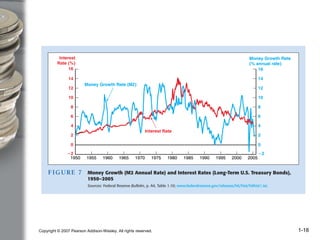

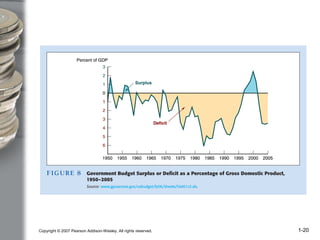

The document introduces the topics of money, banking, and financial markets. It will examine how financial markets like bonds, stocks, and foreign exchange work, as well as how financial institutions like banks and insurance companies operate. It will also explore the role of money in the economy, and how monetary and fiscal policy can impact inflation, interest rates, and business cycles. The document aims to study these topics through a simplified analysis of asset demand, supply and demand equilibrium, and aggregate supply and demand.