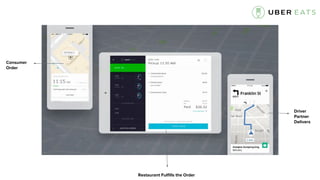

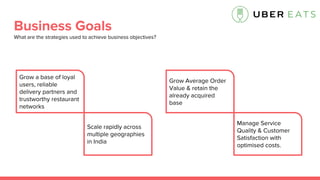

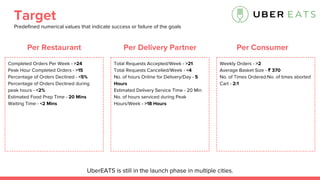

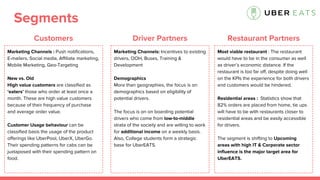

UberEATS aims to make eating well effortless for everyone by seamlessly integrating food delivery with the Uber app. It helps restaurants reach more customers and build their business by connecting them to delivery partners. The business objectives are to capitalize on Uber's expertise in moving people and products, and to plug gaps in the food ordering and delivery industry. Key strategies include growing a base of loyal users, reliable delivery partners, and trustworthy restaurant networks while rapidly scaling across geographies. Performance is measured through KPIs like completed orders, customer satisfaction, and time metrics. Targets indicate success like over 24 completed orders per restaurant weekly and over 2 orders per consumer weekly. The business focuses on segments like high value customers, residential areas