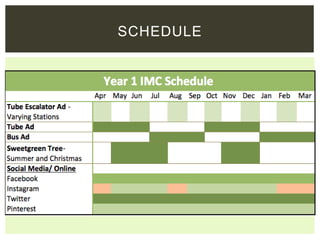

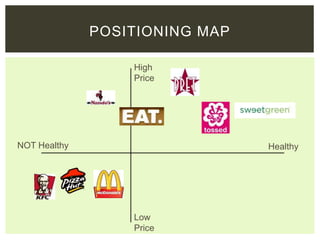

Sweetgreen is a fast casual salad restaurant founded in 2007 in Washington D.C. that is expanding to London. The summary outlines Sweetgreen's background, target audience, promotional strategy, and schedule. The target audience is working professionals in London ages 25-45 who value health, sustainability and convenience. The promotional strategy utilizes social media, mobile apps, ads on buses and the tube to increase brand awareness and loyalty. The schedule runs promotions from March to September 2016 to achieve objectives of social media followers and mobile app downloads.

![OVERVIEW

MICRO ENVIRONMENT

Bargaining power of

buyers - Moderate

• Large number of them

but little “financial

muscle”

• Industry is not

essential to

consumers a

leisure activity that can

be lost in tough

financial times

• Driving customer

loyalty through low

pricing, heavy brand

building

Threat of substitutes- Strong

• Consumers can eat in (cheaper) or

spend money on another leisure

activity

• Increase in snacking/ eating on the

go

Threat of new entrants- Strong

• Low initial costs but industry is run by

major corporations (McDonalds, Yum!)

• Low-margin markets have the threat of

increasing minimum wage

Rivalry- Strong

[small number of multi national

corporations and med. sized brands]

Bargaining power of

suppliers- Moderate

• Quality and on time

delivery of produce is

essential

• Switching costs and

disruption to the

supply chain would

cause issue

• Suppliers have

significant negotiating

power- one supplier

for many restaurants](https://image.slidesharecdn.com/7da299fb-5145-4079-a98d-dde596bacca2-160412215912/85/Sweetgreen-PPT-4-320.jpg)

![Integrated

Communications Mix

[pull strategy]](https://image.slidesharecdn.com/7da299fb-5145-4079-a98d-dde596bacca2-160412215912/85/Sweetgreen-PPT-21-320.jpg)