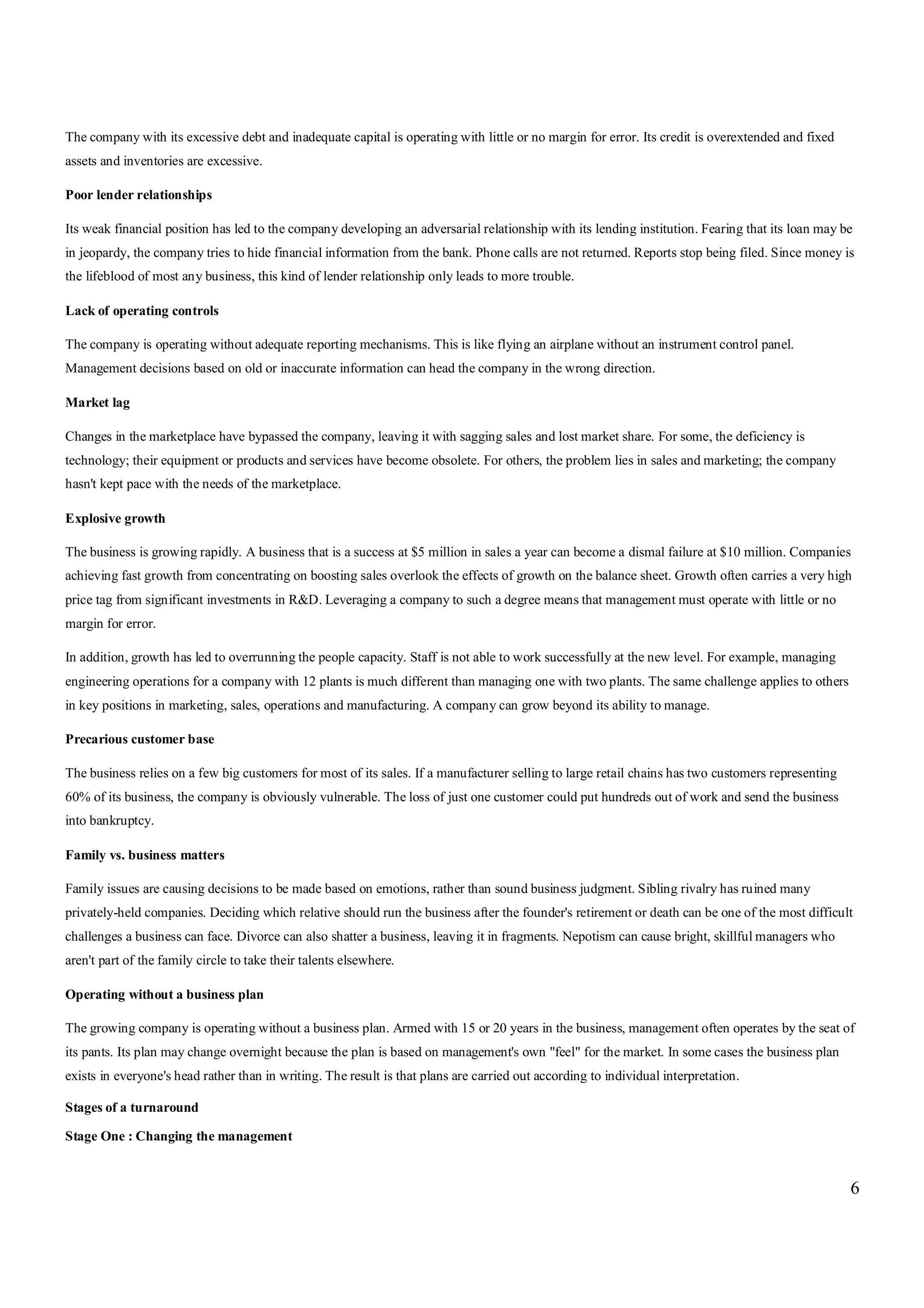

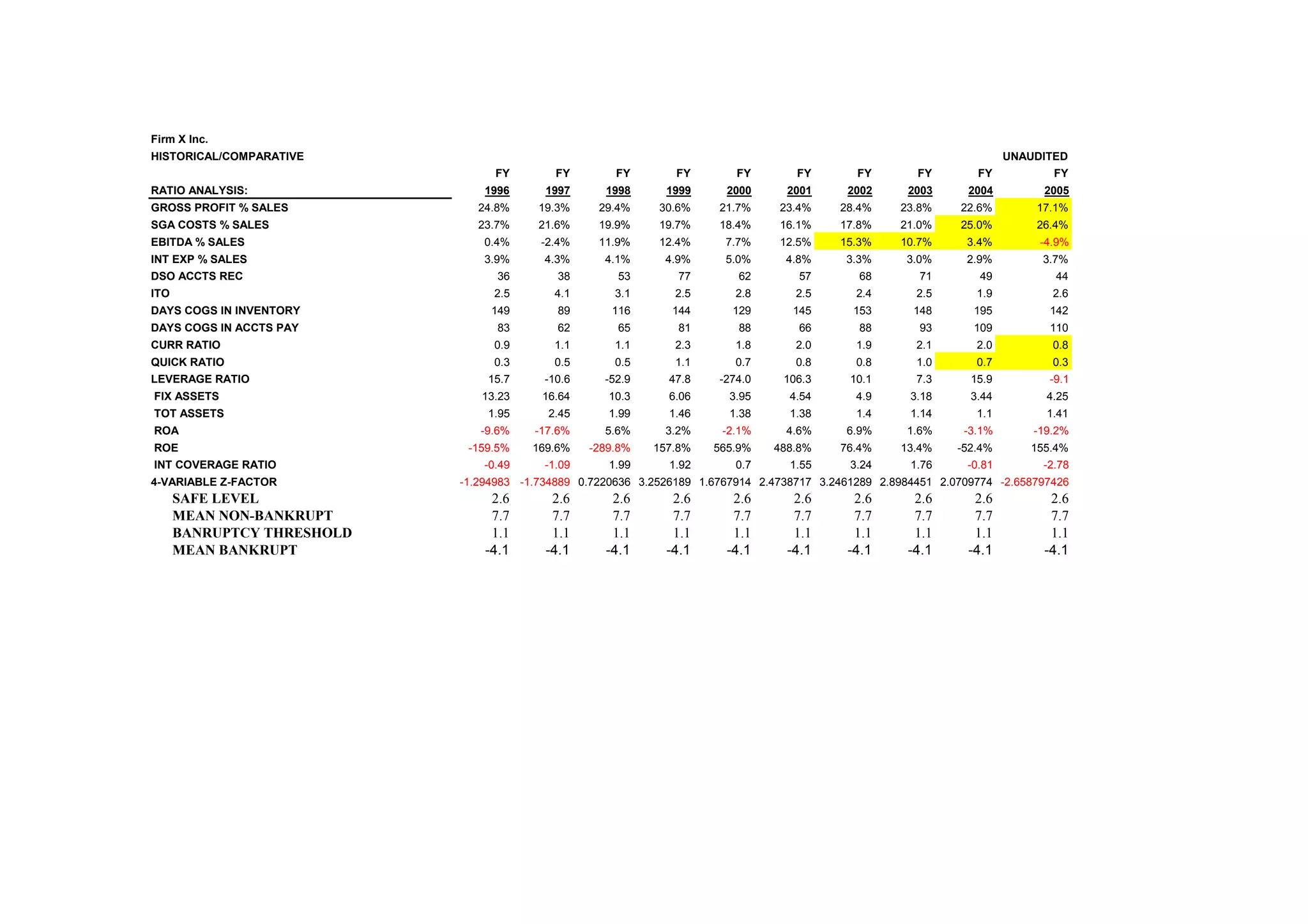

This document provides background on a financially distressed manufacturing firm. The firm expanded significantly in recent years through acquisitions and new business lines, taking on substantial debt. Rising costs and underperformance of new ventures have led to declining profits and cash flow issues. The firm is technically insolvent, with over $24 million in senior debt, $9.5 million in unpaid trade debt, and equipment collateral worth $5 million against $7.5 million in loans. The chief lender wants to exit its credit within 120 days. As CRO, the author must develop a turnaround plan within 30 days to address the firm's financial crisis and multiple creditors.