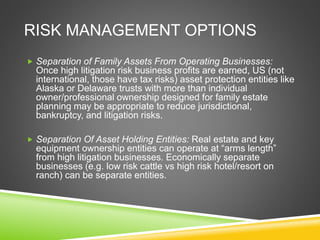

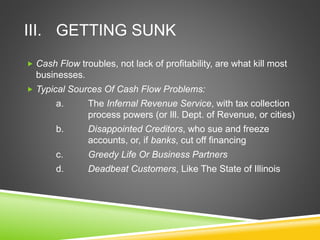

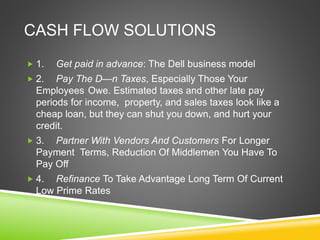

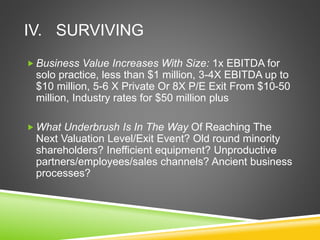

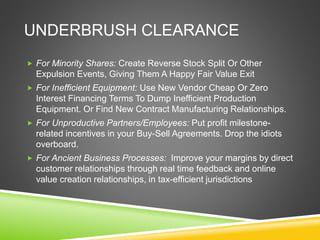

The document discusses challenges businesses face due to Obamacare, litigation, and cash flow issues, along with strategies for risk management and growth. It emphasizes the importance of self-insurance, separating assets from high-risk operations, and improving cash flow through various financial strategies. Additionally, it highlights the value of businesses as they scale and the necessity of addressing inefficiencies to enhance valuation.