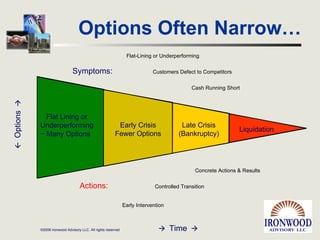

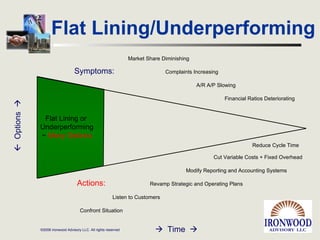

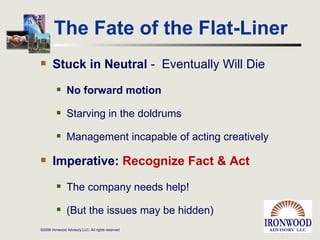

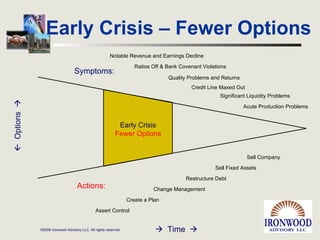

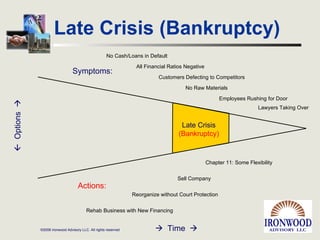

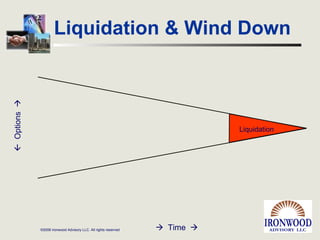

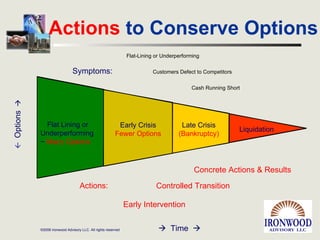

Ironwood Advisory provides transition management services to both distressed and healthy companies. They have over 500 years of combined experience in senior leadership roles. Their services include turnaround and crisis management, strategic planning, operations and financial restructuring, and interim management. They help companies address underperformance, financial difficulties, and other issues to preserve options and create positive outcomes during times of transition and change.