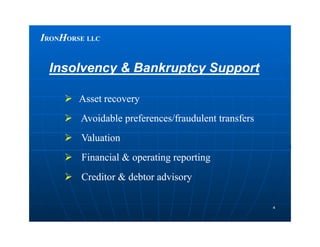

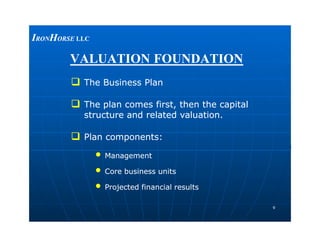

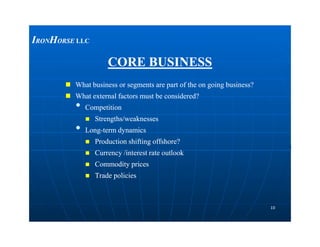

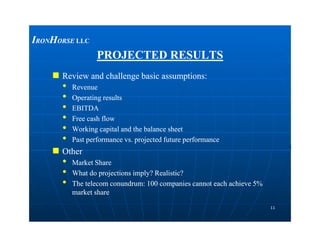

This document provides information on Ironhorse LLC, a business valuation and appraisal firm. It lists the services Ironhorse provides, including business valuation, litigation support, mergers and acquisitions advisory, and insolvency and bankruptcy support. It also provides biographies of the executive team members and describes Ironhorse's competitive advantages. Finally, it discusses valuation methods and considerations.

![VALUATIONVALUATION

Theories Behind Premiums and DiscountsTheories Behind Premiums and Discounts

Maximum value

attributable to a

strategic buyer

Sale value

MBO

LBO

Premium for strategic

value / synergies

Controlling interest

value

($ in millions, except share price)

Fully Diluted Shares 100.0

Share price $20.00

Market Value of Equity $2,000.0Controlling

Interest

Investment Value

IIRONRONHHORSEORSE LLCLLC

1414

MBO

LBO

IPO

Public trading

Non-public stock

Premium for

control

Minority interest

discount

Discount for lack of

marketability

Minority interest

value

plus: Total Debt (book) 1,500.0

less: Converted Debt 0.0

plus: Preferred Stock 200.0

less: Converted Preferred 0.0

less: Cash & Cash Equivalents 100.0

plus: Minority Interest in Subs 0.0

Enterprise Value $3,600.0

Discount for lack of marketability / liquidity

[NYSE vs. OTC:BB]

Non-Marketable

Minority

Value

Marketable

Minority

Value

Interest

Value](https://image.slidesharecdn.com/5f3560ef-e2b2-4b52-bb1e-408552d5d211-161209202018/85/IronHorse-Business-valuation-presentation-14-320.jpg)

![VALUATIONVALUATION

DriversDrivers (cont.)(cont.)

Qualitative characteristicsQualitative characteristics

•• Quality and depth of managementQuality and depth of management

•• Customer and vendor concentrationCustomer and vendor concentration

•• Industry dynamics [Market share, competition, rawIndustry dynamics [Market share, competition, raw

materials/commodities]materials/commodities]

IIRONRONHHORSEORSE LLCLLC

1717

•• Company’s position / reputation in the industryCompany’s position / reputation in the industry

•• DiversificationDiversification

Product offeringProduct offering

GeographyGeography

•• Vendor relationshipsVendor relationships

•• Seasonality / cyclicalitySeasonality / cyclicality

•• Power over vendors / customersPower over vendors / customers

•• Ability to expandAbility to expand

•• Emergence / intensification of foreign competitionEmergence / intensification of foreign competition](https://image.slidesharecdn.com/5f3560ef-e2b2-4b52-bb1e-408552d5d211-161209202018/85/IronHorse-Business-valuation-presentation-17-320.jpg)