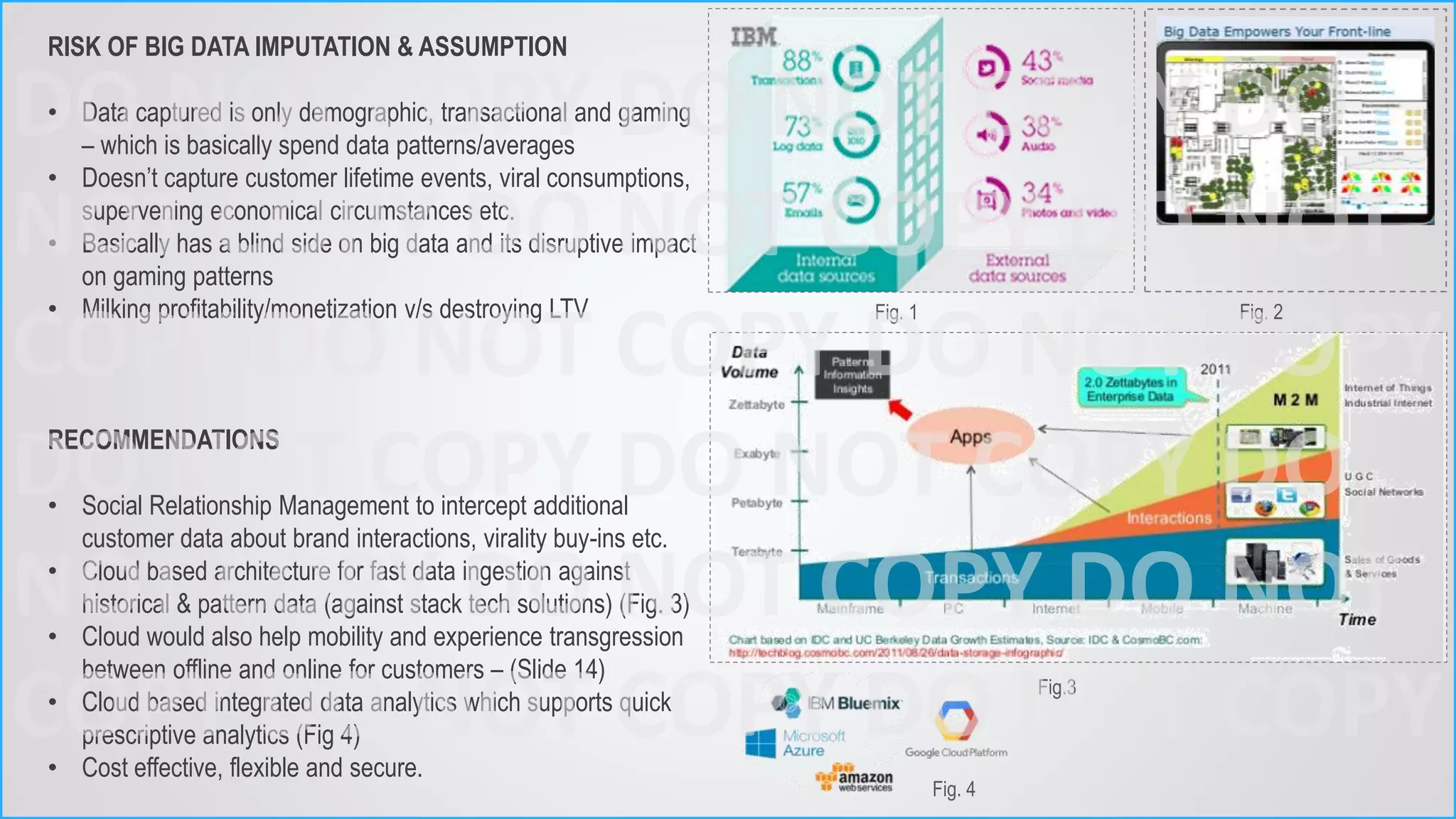

The document analyzes Harrah's Entertainment Inc.'s use of real-time CRM in enhancing service within its casino supply chain, detailing strengths such as strong brand identity and a comprehensive rewards program, while addressing weaknesses like outdated technology and potential data security issues. It explores customer segmentation and strategies for engagement, emphasizing the importance of data-driven decision-making and personalized customer experiences. Additionally, the text discusses risks associated with CRM, including data accuracy and impulsive decision-making, alongside recommendations for improvement.