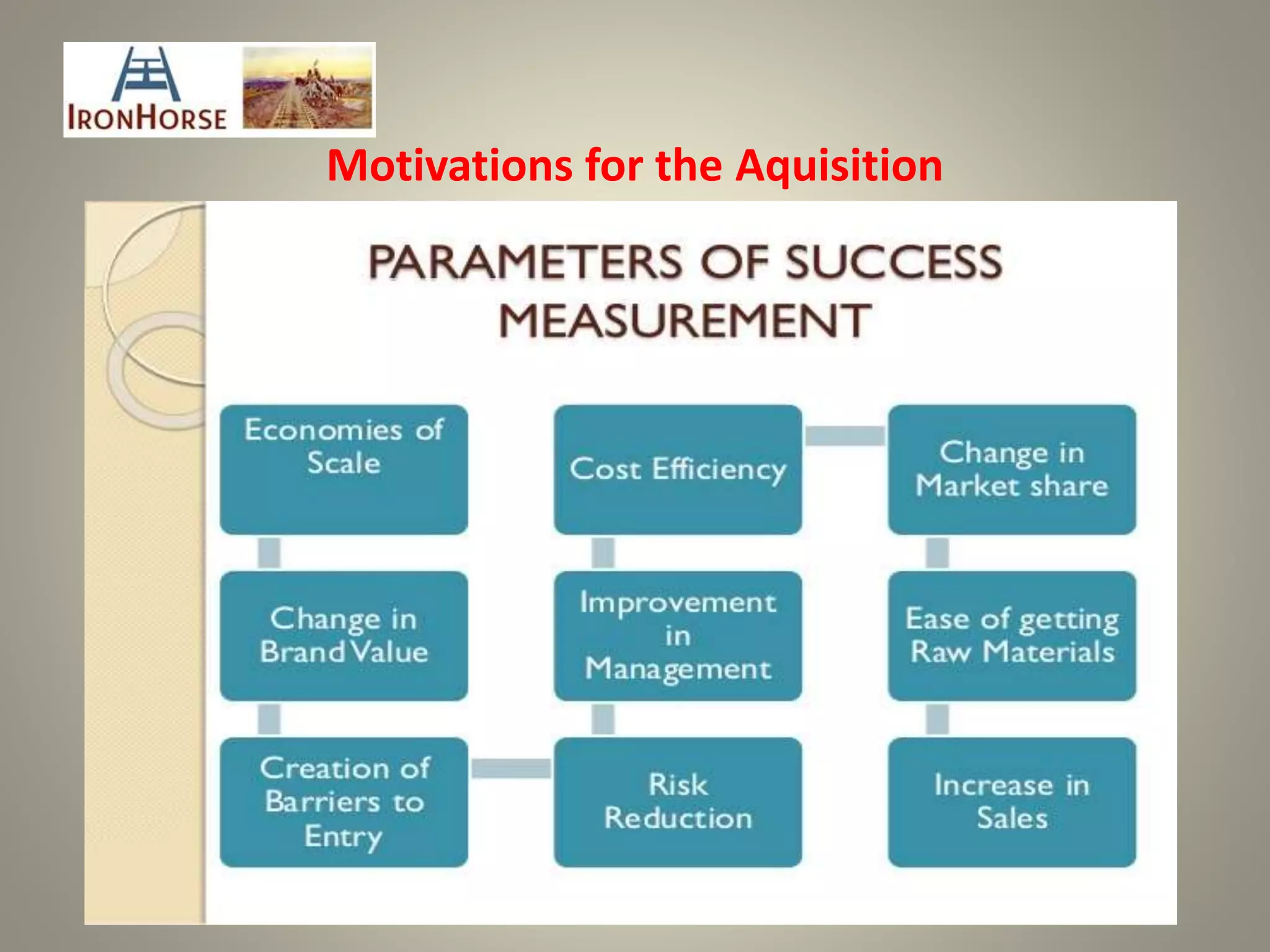

- The document discusses top mistakes made during acquisitions and how to avoid them. It focuses on two main mistakes - getting the deal structure, price, or leverage wrong which can lead to overpayment, and misreading the culture of the acquired company which can result in a poor integration.

- To prevent overpaying, companies should conduct thorough due diligence, stress test financial projections, and perform sanity checks on valuations. They should also formalize acquisition policies and procedures.

- To prevent culture clashes, acquirers need to carefully assess the entrepreneurial culture of privately-held targets, especially family businesses. The role and expectations of the founder must be clearly understood to facilitate integration.