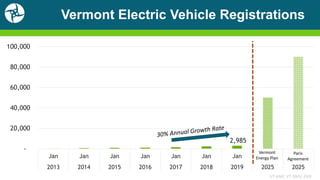

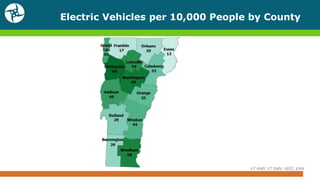

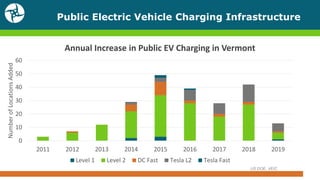

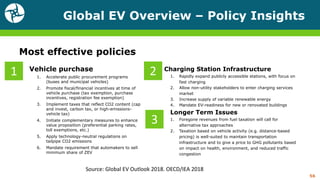

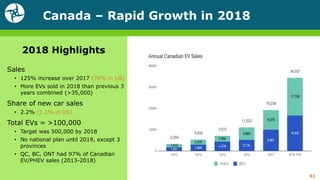

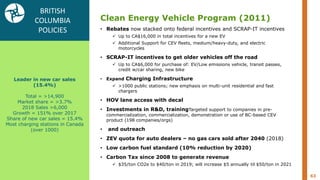

This document discusses transportation electrification in Vermont. It provides an overview of electric vehicle (EV) market status and economics, outlines opportunities and case studies to accelerate EV adoption, and examines policies and programs to promote electrification. Key points include:

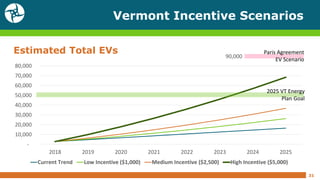

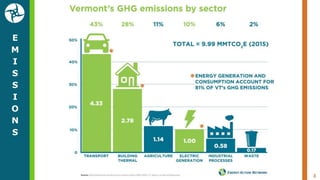

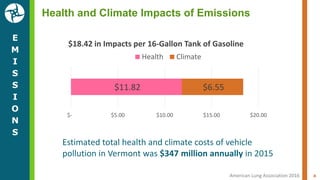

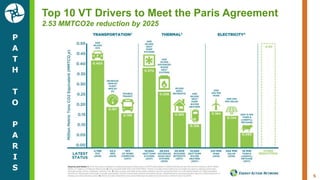

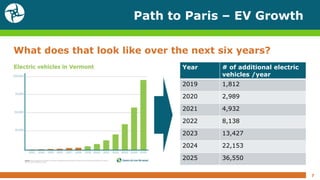

- Transportation is a major source of emissions in Vermont, and increased EV adoption is part of the state's plan to meet climate goals.

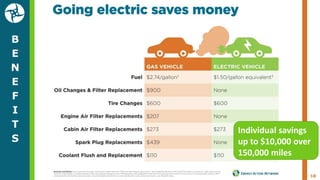

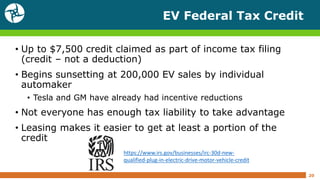

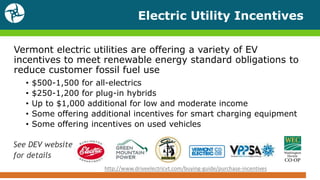

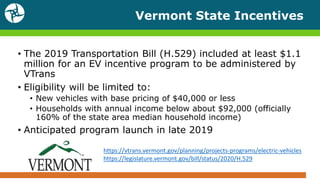

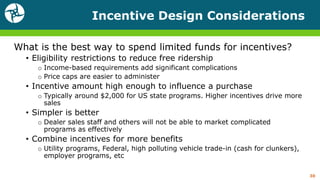

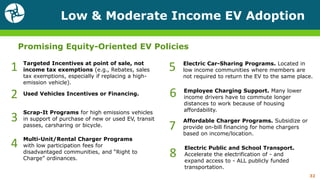

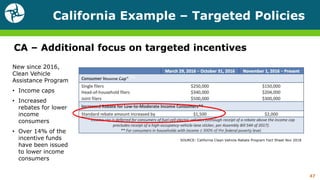

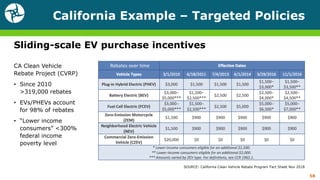

- Incentive programs aim to reduce the cost of EVs and charging infrastructure to encourage purchases. Combined incentives can lower EV costs by over $10,000.

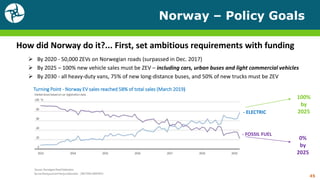

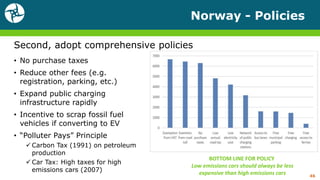

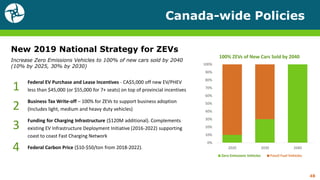

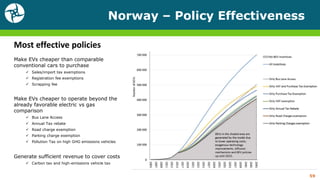

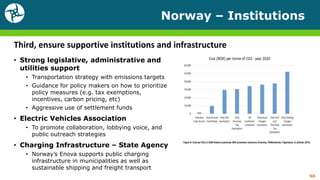

- Case studies from Norway show that setting ambitious EV requirements and adopting comprehensive policies like fees on gas vehicles can lead to over 50% of new car sales being electric.

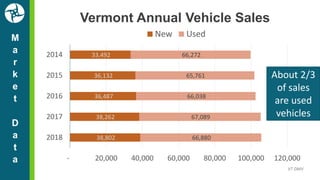

![Vermont Annual New Vehicle Sales

VT VADA

[CELLRANGE] [CELLRANGE] [CELLRANGE] [CELLRANGE]

-

5,000

10,000

15,000

20,000

25,000

30,000

35,000

40,000

45,000

2015 2016 2017 2018

Passenger Cars SUVs / Light Trucks](https://image.slidesharecdn.com/eanvt-energyfutureinitiativeevpresentationupdated08292019-190829184216/85/Transportation-Electrification-in-Vermont-12-320.jpg)