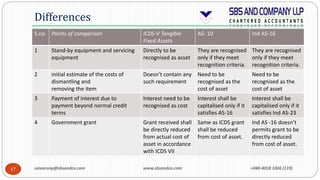

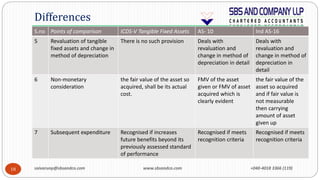

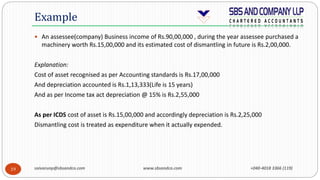

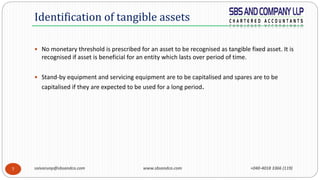

The document provides an overview of Income Computation and Disclosure Standards (ICDS) related to tangible fixed assets, detailing their applicability, scope, and specific components of actual costs. It highlights various aspects such as identification of tangible assets, inclusions and exclusions, and special cases relevant to accounting treatment. Additionally, it compares ICDS V with AS-10 and IND AS-16, emphasizing differences in asset recognition and depreciation methods.

![saivarunp@sbsandco.com www.sbsandco.com +040-4018 3366 (119)11

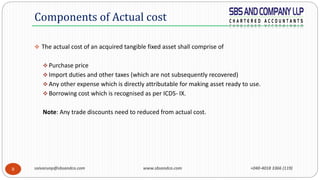

If an asset is acquired from country outside India then exchange fluctuation araised while

payment to concerned party is to be increased or decreased from actual cost of the asset in

accordance with ICDS-VI Effects of changes in foreign exchange rates.

Administrative and general overhead are need to be included in the cost of asset if such

expenditure is directly attributable to asset or bringing it to its working condition.

Expenditure on test runs, experimental production and any other expenditure related to such

asset till the asset has been ready for commercial production or captive consumption need to

be capitalised.

If asset used in business after it ceases to be used for scientific research, the amount deduction

claimed under section 35 (1)(iv) of the Act [i.e. 100% deduction in respect of capital expenditure

for scientific research] need to be decreased from Actual cost i.e. Nil .

Inclusions and Exclusions](https://image.slidesharecdn.com/icds-v-tangible-fixed-assets-181120013524/85/Icds-v-tangible-fixed-assets-11-320.jpg)