The document discusses various transition provisions under the GST law relating to carry forward of input tax credit from previous tax regimes. It summarizes the Supreme Court orders regarding filing of Form GST TRAN-1 and TRAN-2 for transition of credit before the deadline of February 2022. It also discusses key sections of the CGST Act such as 140, 141 and 142 governing transition of credits for input tax, capital goods, inputs in stock, etc. and the forms and timelines for claiming such credits. Issues related to eligibility of certain duties and taxes for transition credit and discrepancies observed are also highlighted.

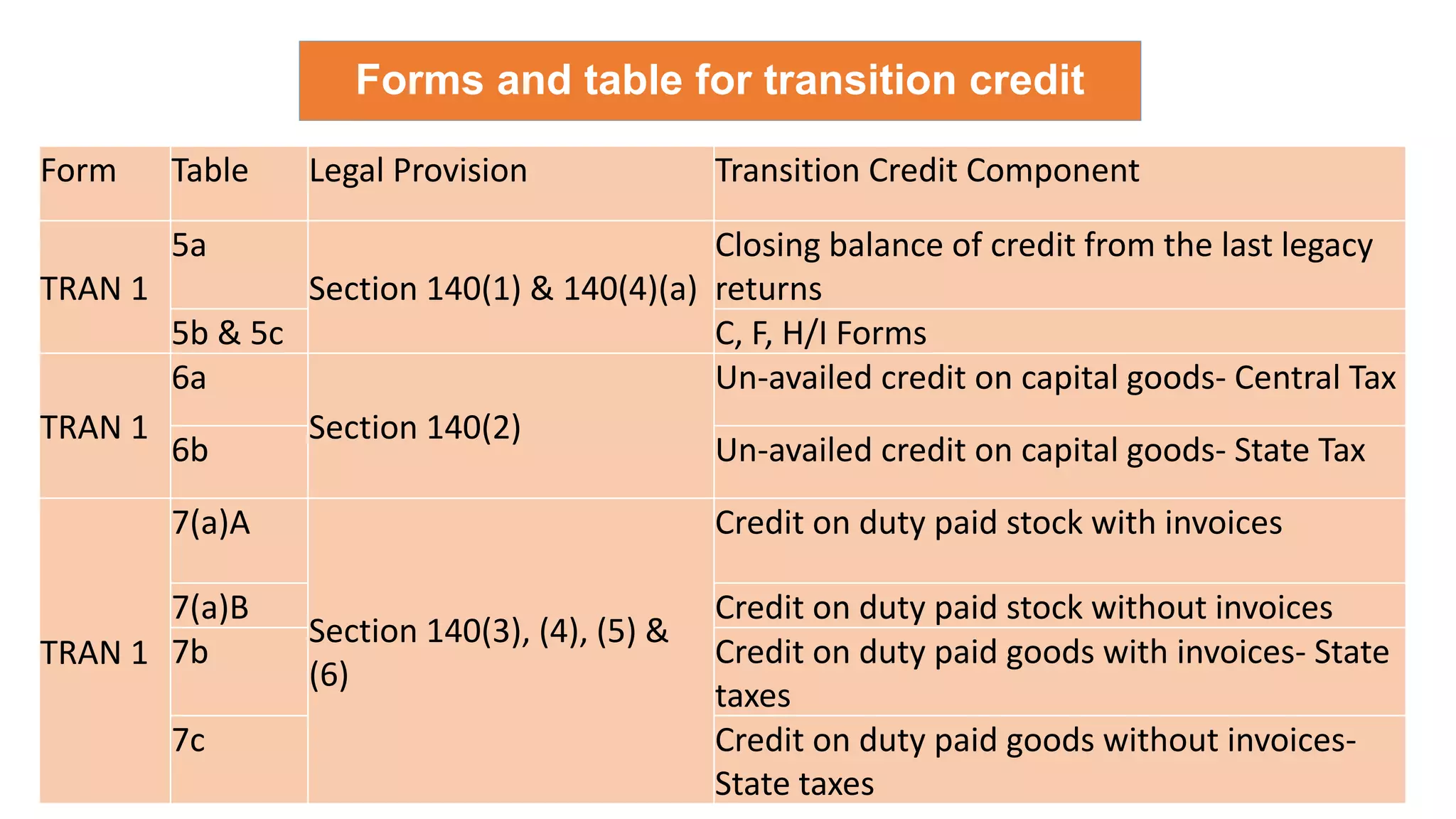

![Explanation 1 : Eligible Duties [For sub-sections (1), (3), (4) and (6)]

(In respect of inputs held in stock and inputs contained in semi-finished or finished goods held in stock on appointed day)

Sr. Type of Duty Leviable Under Remarks

(i) Additional Duty of Excise

Section 3 of Additional Duties of Excise (Goods of Special

Importance Act) 1957

AED (GSI)

(ii) Additional Duty Section 3(1) of Customs Tariff Act , 1975 CVD (CE)

(iii) Additional Duty Section 3(5) of Customs Tariff Act , 1975 CVD (VAT) 4%

(iv) Omitted --- ---

(v) Duty of Excise First Schedule of Central Excise Tariff Act, 1985 BED

(vi) Duty of Excise Second Schedule of Central Excise Tariff Act, 1985 SED

(vii) National Calamity Contingent Duty Section 136 of Finance Act 2001 NCCD](https://image.slidesharecdn.com/ppt-1transitionprovisions-230321143103-10fe6d78/75/PPT-1TransitionProvisions-pptx-10-2048.jpg)

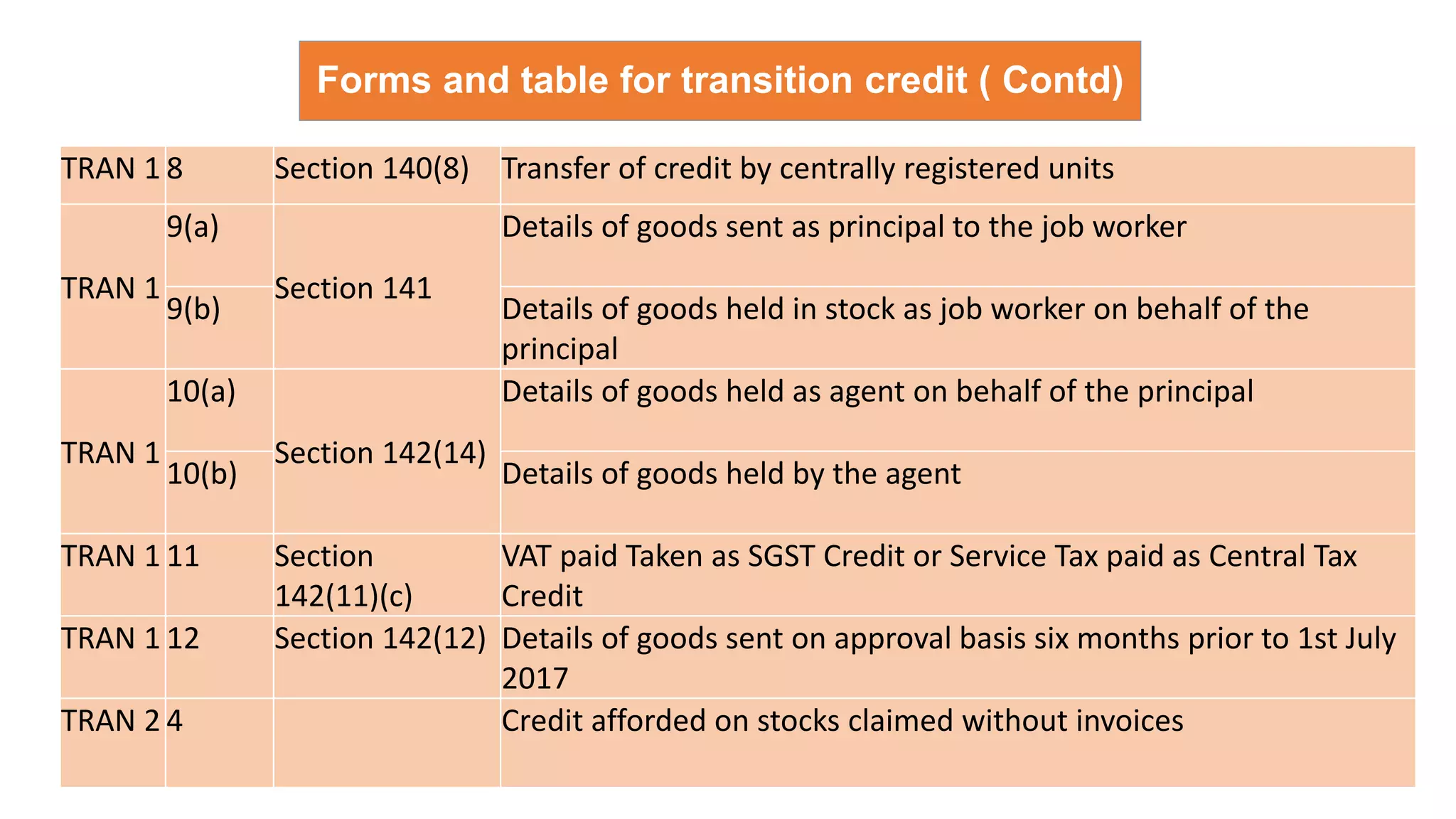

![Explanation 2 : Eligible Duties and Taxes [For sub-section (1) and (5)]

(in respect of inputs and input services received on or after appointed day)

Sr. Type of Duty Leviable Under Remarks

(i) Additional Duty of Excise

Section 3 of Additional Duties of Excise (Goods of Special

Importance Act) 1957

AED (GSI)

(ii) Additional Duty Section 3(1) of Customs Tariff Act , 1975 CVD (CE)

(iii) Additional Duty Section 3(5) of Customs Tariff Act , 1975 CVD (VAT) 4%

(iv) Omitted --- ---

(v) Duty of Excise First Schedule of Central Excise Tariff Act, 1985 BED

(vi) Duty of Excise Second Schedule of Central Excise Tariff Act, 1985 SED

(vii) National Calamity Contingent Duty Section 136 of Finance Act 2001 NCCD

(viii

)

Service Tax Section 66B of the Finance Act 1994 ST](https://image.slidesharecdn.com/ppt-1transitionprovisions-230321143103-10fe6d78/75/PPT-1TransitionProvisions-pptx-11-2048.jpg)