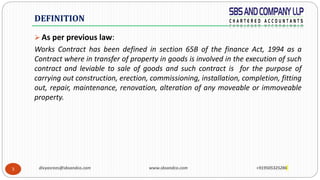

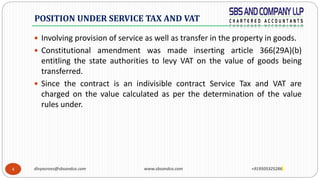

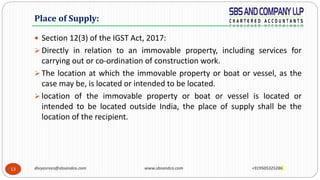

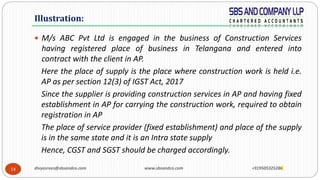

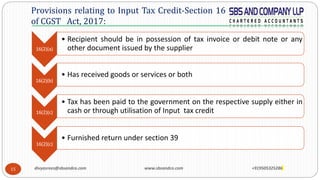

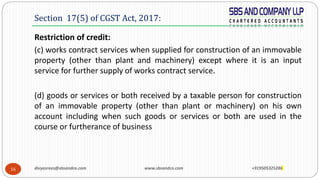

The document discusses the definition and tax implications of works contracts under GST, detailing changes from previous tax systems like service tax and VAT. It explains the classification of works contracts, including composite and mixed supplies, and outlines taxability, place of supply, and input tax credit provisions. Additionally, it provides examples to illustrate the application of these concepts in practice.