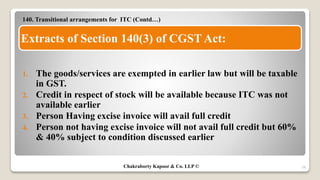

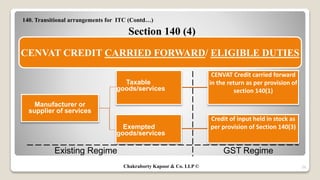

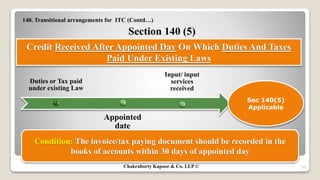

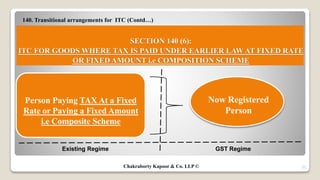

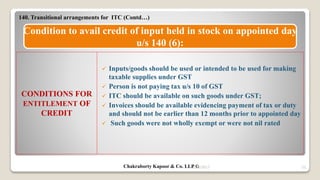

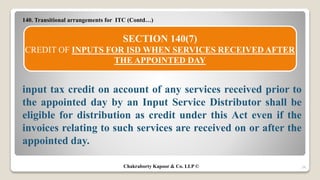

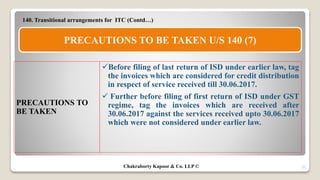

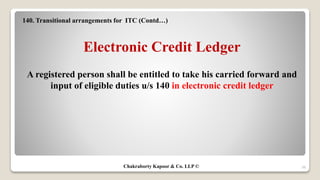

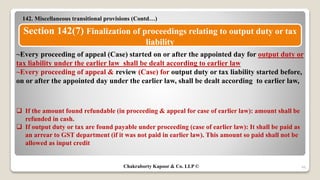

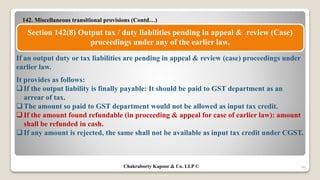

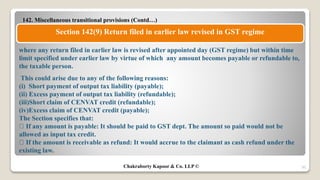

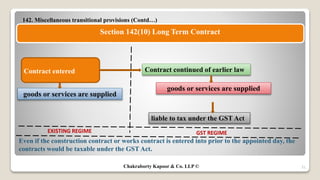

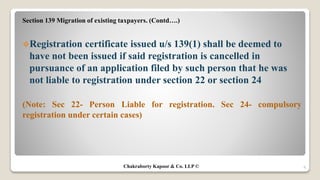

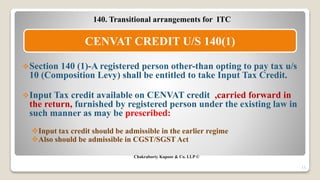

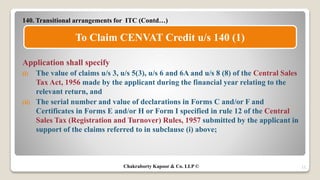

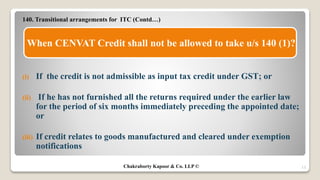

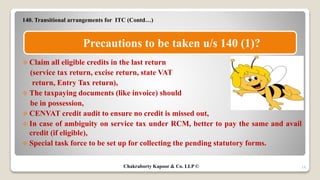

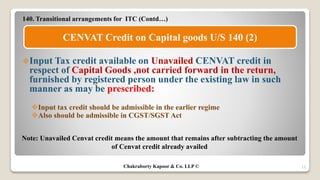

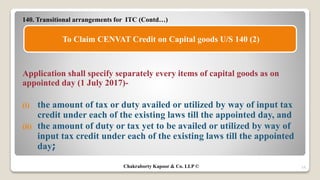

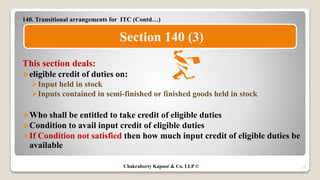

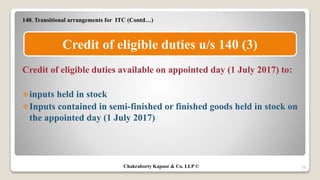

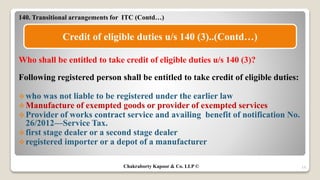

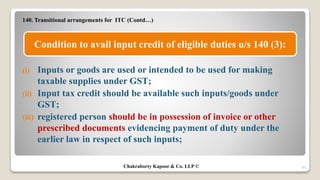

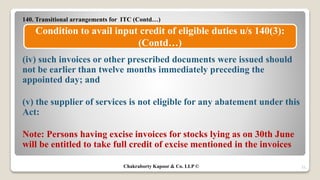

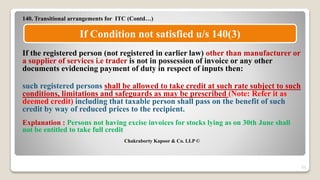

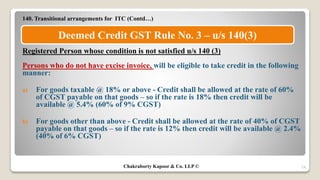

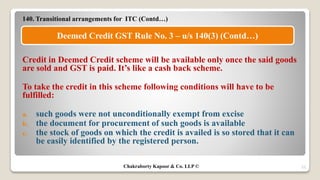

The document discusses various transitional provisions under GST relating to input tax credit (ITC). Section 140 provides for ITC on taxes paid under previous laws including CENVAT credit carried forward and unavailed credit on capital goods. It also allows credit of eligible duties on inputs held in stock or contained in final products on the appointed GST date. Certain conditions must be satisfied for claiming this ITC. If conditions are not met, deemed credit will be allowed at a prescribed rate subject to specified limitations and safeguards. Precautions for availing ITC and deemed credit provisions are also summarized.

![27

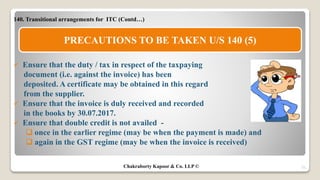

Prepare Stock Statement Summary as on 30.06.2017 (determining the

quantity, value, involvement of eligible duties, taxes and state VAT)

Make sure whether the Taxpaying Documents are available before

claiming any credit,

Such taxpaying documents should not have been issued earlier than

twelve months [Stock Level may be maintained at minimum level],

Pricing policy – Such stock used / intended to be used for making

taxable supplies must lead to reduction in prices to the extent of

availment of benefit of ITC.

140. Transitional arrangements for ITC (Contd…)

PRECAUTIONS TO BE TAKEN U/S 140 (3)

Chakraborty Kapoor & Co. LLP ©](https://image.slidesharecdn.com/transitionprovisional-170914171045/85/GST-Transitional-provision-Sec-139-140-141-and-142-27-320.jpg)