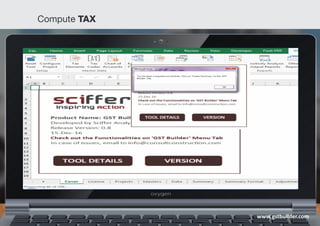

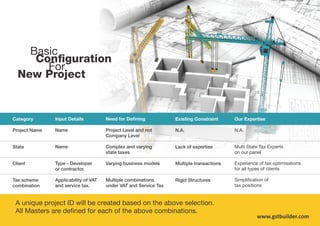

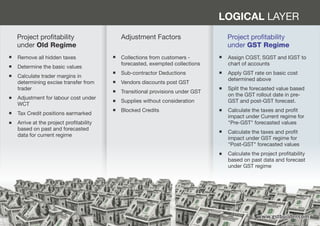

The document outlines the GST Builder tool designed for builders, real estate developers, and contractors to assess the impact of GST on ongoing projects. It emphasizes the importance of analyzing historical data, project completions, and tax implications to strategize and optimize financial outcomes post-GST implementation. Key features include profit analysis, tax credit comparisons, and detailed reporting to manage complexities around GST and other indirect taxes.

![Reports

And

Simulations

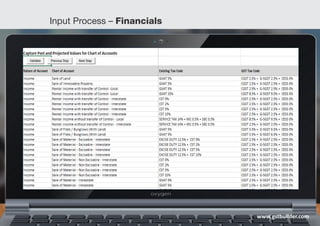

Data Level Reports:

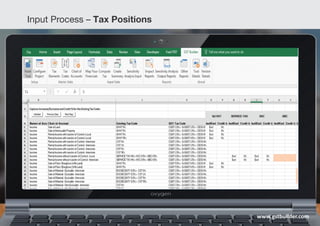

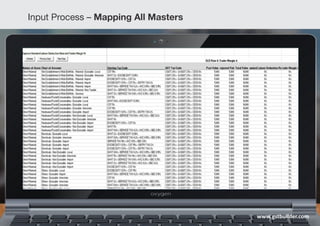

Chart of accounts with basic price with taxes

calculated under both regimes

Summary of Tax Credits under both regimes

Summary of Tax Liabilities under both regimes

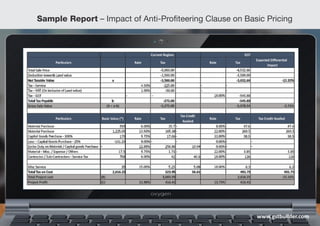

Transitionary provisions impact

Analytical Reports:

Project profitability comparison

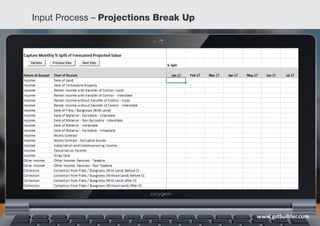

Monthly cash flow comparison

Tax code level comparison

[Old tax code and GST]

Simulations:

Determination of sales price by maintaining the same profit

GST impact with change in GST roll out date

Changes to Discounts of vendors/ contractors

Change in timing of projections

www.gstbuilder.com](https://image.slidesharecdn.com/gst-realestate-170116094520/85/GST-Tool-for-Builders-and-Contractors-16-320.jpg)