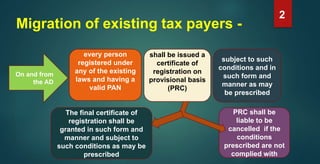

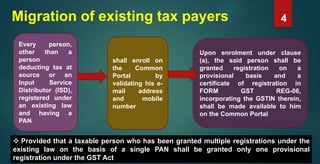

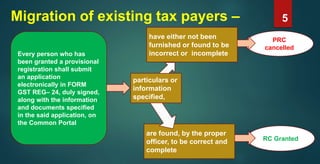

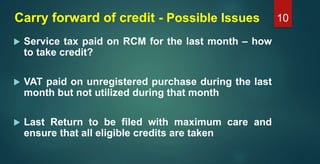

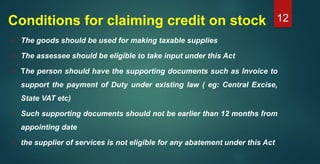

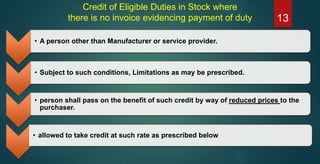

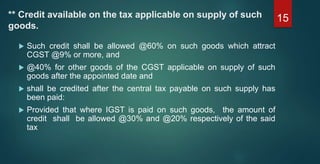

This document discusses provisions around migrating existing taxpayers to the GST regime and carrying forward credits from prior tax systems. It states that persons registered under existing laws and with a PAN will be issued a provisional GST registration certificate. It also allows the carrying forward of credits for taxes like central excise duty, VAT, and service tax held in electronic ledgers to the GST system. It provides conditions for claiming credits on stocks held and specifies eligible credits that can be carried forward. It also discusses provisions for availing unutilized capital goods credits under GST.