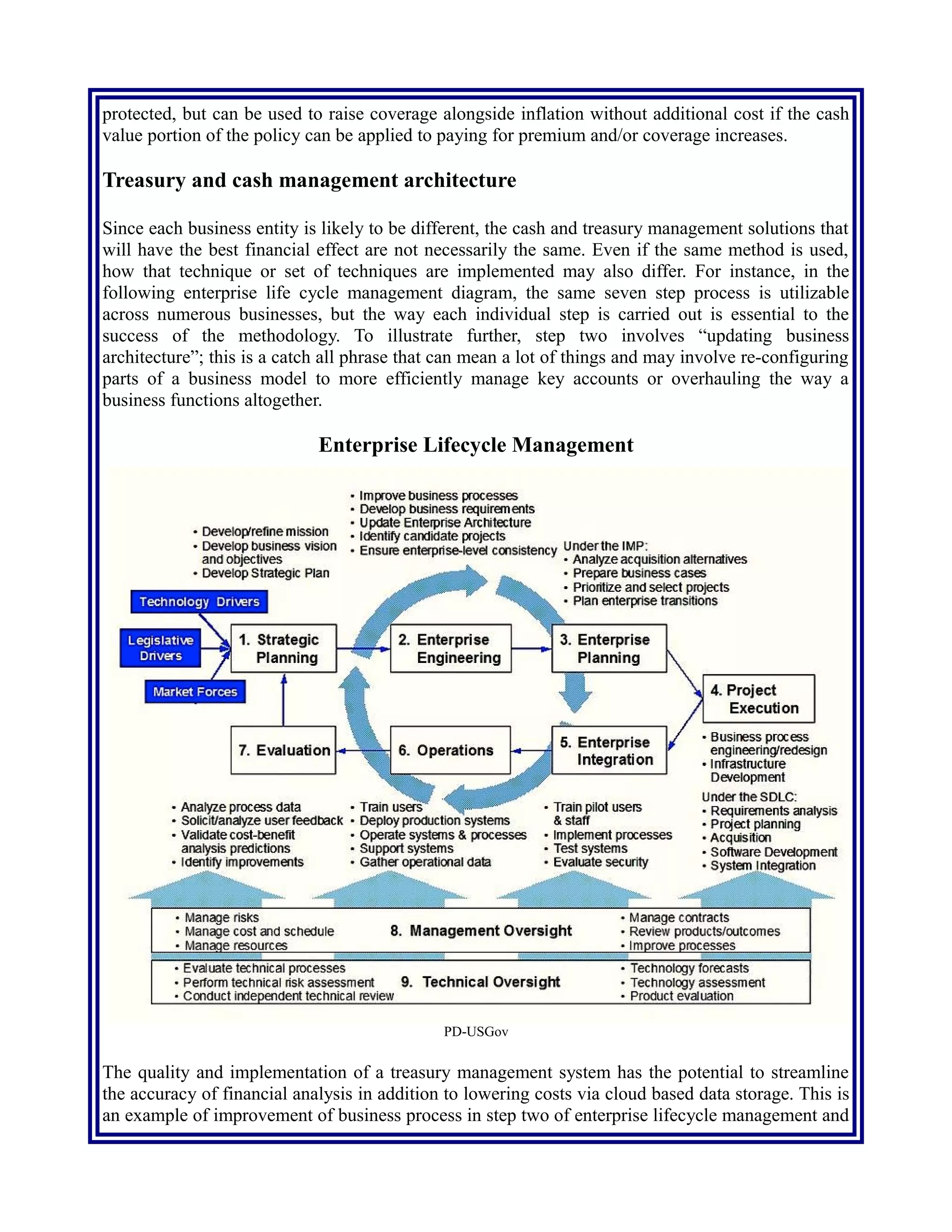

The document discusses corporate cash and treasury management solutions, emphasizing their importance for businesses in optimizing capital access and improving financial operations. It distinguishes between cash management, which deals with operational cash flow, and treasury management, focused on financing and investment activities, while exploring various strategies for effective cash flow management, tax strategies, and accounting practices. Additionally, it highlights the significance of risk management and thoughtful financial decision-making in enhancing overall business performance and shareholder value.