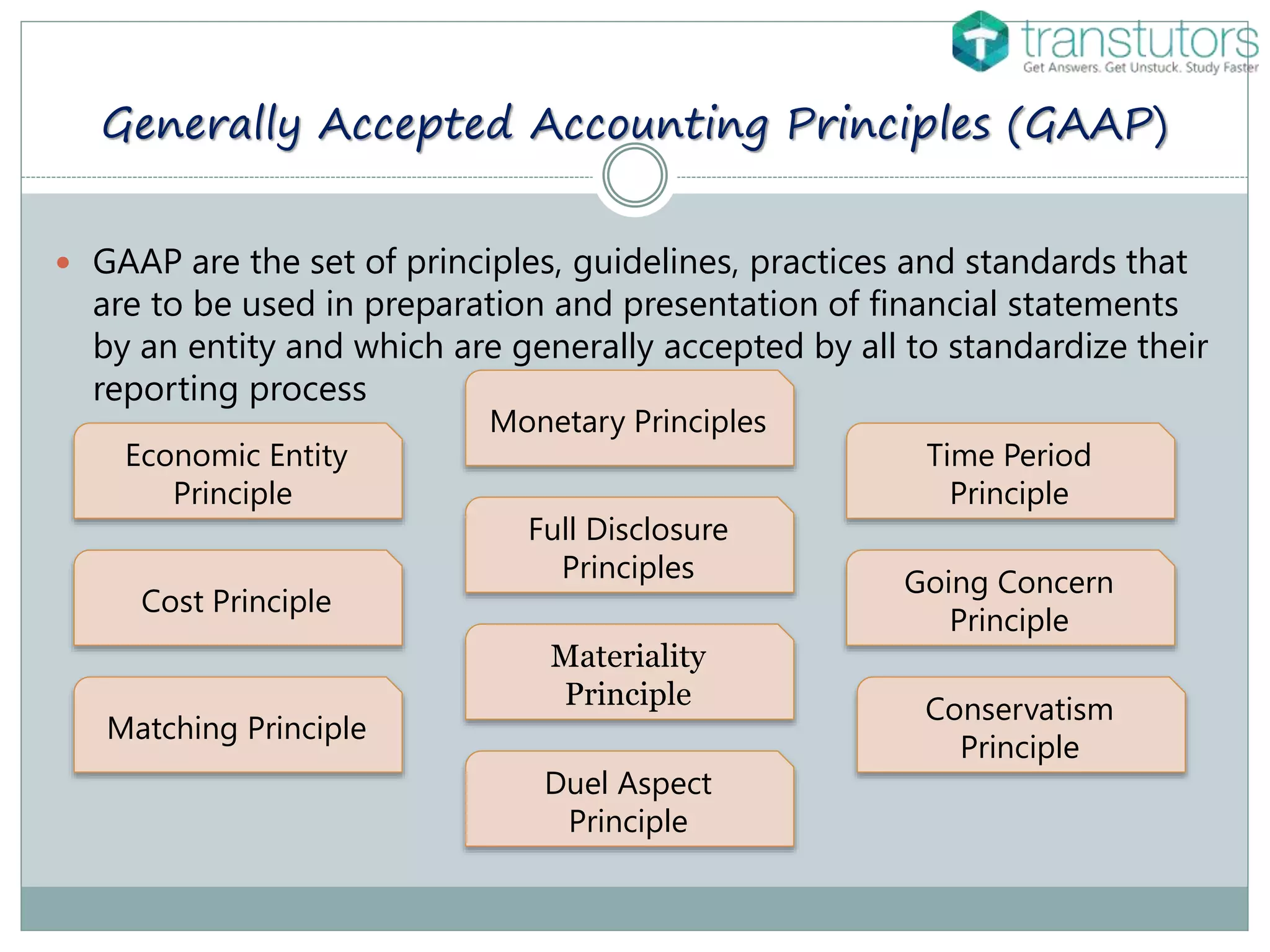

Accounting involves recording, classifying, summarizing, and interpreting business transactions with economic value. Accounting theory encompasses logical principles that enhance the understanding and evaluation of accounting practices, guiding the development of new methods. Key standard-setting organizations include the FASB, which follows GAAP, and the IASB, which develops IFRS to promote transparency and efficiency in financial markets.