This document provides an overview of financial accounting. It defines accounting and outlines its key objectives, features, scope and importance. It discusses accounting concepts and principles, conventions and standards. The document is part of a course on financial accounting for B.Com/BBA students in the II semester at the University of Calicut School of Distance Education. It covers topics such as the meaning and definition of accounting, the objectives and features of accounting, accounting concepts, principles and conventions, and the role of the Accounting Standards Board of India.

![School of Distance Education

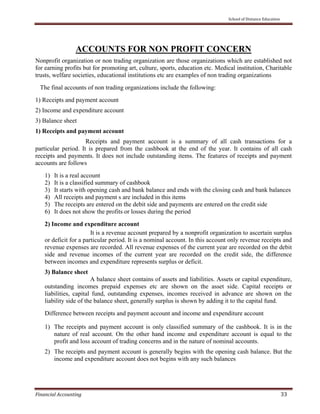

Financial Accounting 76

Interest account

2000 Dec31

2000 Dec 31

2000 Dec 31

2000 Dec 31

2000 Dec 31

To B Ltd.

To B Ltd.

]

To B Ltd.

To B Ltd.

To B Ltd.

16250

13310

10230

6990

3220

31st

Dec

31st

Dec

31st

Dec

31st

Dec

31st

Dec

By P&L a/c

By P&L a/c

By P&L a/c

By P&L a/c

By P&L a/c

16250

13310

10230

6990

3220

CALCULATION OF INTEREST

1. Calculation of interest when cash price and rate of interest and amount of installment are

given – total interest is the difference between hire purchase price and cash price. Interest

for each year is calculated on the amount of outstanding cash price

2. Calculation of interest when cash price and amount of installment are given. In the case ,

total interest apportioned to each year on the ratio of installment price outstanding

3. When rate of interest and installment are given but total cash price is not given. In this

method, interest is calculated from the last year firstly and then previous year and at last

fist year. For this purpose. Rate of interest must be converted on cash to on installment.

Illustration 2

X purchased a radiogram on HP system. He is required to pay Rs 800/- down, Rs. 400/-

at the end of first year and Rs. 300/- at the end of second year and Rs.700/- at the end of third year.

Interest is charged at 5% p. a. calculate cash price and interest of each installment

year installment Interest paid Cash price

1st

year down payment 800 No interest 800

First year end

400 400+254+667*5/105=63 337

Second year

300 330+667*5/105=46 254

Third year end 700 700*5/105=33

667

2058

Default and re possession

When hire purchaser is not able to make the payment in time, then default is committed by

him and the owner takes back the possession of goods. There are two possibilities:](https://image.slidesharecdn.com/corecoursefinancialaccounting-130618052231-phpapp02/85/Core-coursefinancialaccounting-76-320.jpg)